What is the RAC program for Medicare?

Finally, the RAC program was created to identify improper Medicare payments. RAC auditors are private contractors paid on commission by the government. They review claims on a post-payment basis to identify and correct potential overpayments and underpayments to claims specific to Medicare Part A and Part B (hospital and physician practices).

Does CMS require RAC to review claims?

At CMS discretion, CMS may require the RAC to review claims, based on these referrals. These CMS-Required RAC reviews are conducted outside of the established ADR limits. …

What does RAC stand for?

Recovery Audit Contractor (RAC) Recovery Audit Contractors (RAC) identify improper Medicare payments made on healthcare claims. These audits may result in the identification of Medicare overpayments and/or underpayments.

Why is there an overpayment on my RAC claim?

In these cases, the RAC proprietary software has determined there is a high probability (but not certainty) that the claim contains an overpayment.

What is RAC in medical billing and coding?

Recovery Audit Contractors (RAC) audits, as physicians know, are part of the government's program to reduce fraud, waste, and errors in medical billing practices, especially Medicare and Medicaid.

What is the RAC process?

First, the RAC identifies a risk pool of claims. Second, the RAC requests medical records from the provider. Once the records are received by the RAC, they will review the claim and medical records. Based on the review, the RAC will make a determination: overpayment, underpayment or correct payment.

What is the purpose of a RAC audit?

Led by the Centers for Medicare & Medicaid Services (CMS), the goal of RAC audits is to identify and correct improper payments through the detection and collection of overpayments made on claims for healthcare services provided to Medicare beneficiaries.

What is a RAC letter?

If your practice receives a RAC audit notification letter, it's generally to investigate suspicion of an improper payment on a claim (either an overpayment or an underpayment). RAC auditors will usually request medical records to complete the audit.

What is the RAC appeal process?

There are three levels of appeal: Level I: Request for Reconsideration; Level II: Request for CMS Hearing Official Review; and Level III: Request for CMS Administrator Review. This page will assist you in understanding this process and how to file an appeal.

What is a RAC review?

RAC Review Process RACs review claims on a post-payment basis and will be able to look back three years from the date the claim was paid. There are two main types of review - automated (no medical record required) and complex (medical record required).

How far back can Medicare RAC audits go?

three yearsMedicare RACs perform audit and recovery activities on a postpayment basis, and claims are reviewable up to three years from the date the claim was filed.

Who performs RAC audits?

There are currently three firms that administer RAC audits, according to CMS' website: Performant Recovery Inc., Cotiviti LLC and HMS Federal Solutions, and the company that comes calling depends on your agency's geographic region.

How are RAC audits paid?

RACs are paid on a contingency fee basis, which means they are reimbursed based on a percentage of the improper payments they find or collect. The amount of the contingency fee is based on the amount of money from, or reimbursed to, providers.

How do I prepare for a RAC audit?

5 Ways You Can Begin Preparing for a RAC AuditPerform an Internal Audit. This action will help you to determine the likelihood of coding and billing mistakes within your company.Identify and Correct Coding/Billing Issues. ... Review Problem Areas. ... Check Documentation. ... Find Assistance.

What are the types of Medicare audits?

There are mainly three types of audits — Recovery Audit Contractor (RAC) audits, Certified Error Rate Testing (CERT) audits and Probe audits. Mistakes in medical documentation, coding and billing can rouse Medicare's suspicion during audits, which can lead to claim denials.

What does a RAC coordinator do?

RAC coordinators audit medical billing in hospitals, doctors offices and other medical facilities, ensuring these establishments provide proper documents and payments. When fraud or improper payments are identified, they notify the appropriate parties, or coordinate an appeals' processes for those who contest payments.

What is Recovery Audit Contractor (RAC) Audit?

As a combined effort to fight fraud, waste, and abuse in the Medicare program, Recovery Audit Contractor (RAC) audit was in place from January 1, 2010. The goal of the recovery audit contractor program is to identify improper payments made on claims for services provided to Medicare beneficiaries.

The goal of the Recovery Audit Contractor (RAC)

As discussed above, RAC contractors are tasked with identifying improper payments made on claims of health care services provided to Medicare beneficiaries. Under most circumstances, the RAC will request medical records from the provider to determine whether overpayment and/or underpayment have occurred. Payments will be deemed improper when:

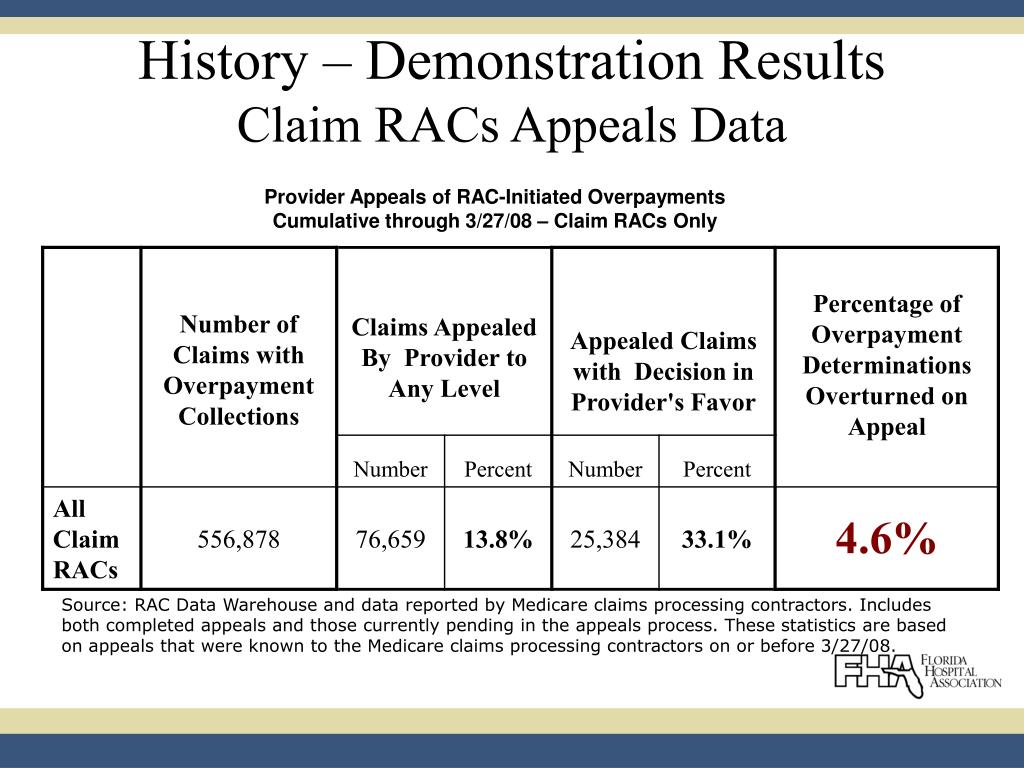

Filing an Appeal

The RAC Contractor has the ability to perform extrapolation based on improper payments identified during a review. If you receive an overpayment demand letter, and if you believe the request for overpayment is unjustified, you must file an appeal.

To summarize

Outsourcing Medical billing is complex, and your staff must be knowledgeable about many areas pertaining to billing and reimbursement. You have to establish compliance and practice standards and need to conduct internal monitoring and auditing to evaluate adherence.

Introduction: What is a RAC Audit?

Medicare Recovery Audit Contractor Audits (RACs, or RAs) were introduced beginning in 2005 to identify and recover improper payments made in Medicare and Medicaid transactions between providers and payors. They were (and are) conducted by Recovery Audit Contractors (also known as RACs).

Chapter One: History of Recovery Audits

RAC audits were introduced in 2005, peaked around 2010 and experienced a slowdown from that point on. To understand the role of RAC audits in today’s healthcare finance space, it’s important to know how they started and why they have diminished.

Chapter Two: Types of RAC Audits

Before we look at the specific types of Recovery Audit Contractor audits, let’s review where they lie in the overall audit landscape.

Chapter Three: RAC Audit FAQ

With so many levels and types, it’s clear that audits can be complex. Adding in government legislation doesn’t necessarily make the process easier. The following frequently asked questions can provide additional clarity on the why and how of RAC audits.

Chapter Four: The Audit Process

The timing of an audit is dependent entirely upon the payor. If a RAC auditor wishes to conduct an audit, the provider must comply. Once an audit begins, the initial response process is largely the same regardless of whether it was triggered by a RAC auditor, commercial payor or other audit contractors.

Chapter Five: What Can You Do To Improve Your RAC Audit Process?

Before the ADR even arrives on your doorstep, you can take steps to train your team and implement processes designed to simplify your response process.

Chapter Six: Technology as an Audit Management Solution

When RAC audits were introduced, providers received an unmanageable volume of audit requests from payors. Now, changes in Recovery Audits have led to fewer audits and less paperwork, giving hospitals the opportunity to focus more broadly on all types of payor audits.

What is RAC program?

As part of the efforts to fight fraud, waste and abuse in the Medicare program, the Tax Relief and Health Care Act of 2006, required a national Recovery Audit Contractor (RAC) program to be in place by January 1, 2010.

What is RAC contractor?

Answer. The RAC contractors are tasked with identifying improper payments made on claims of health care services provided to Medicare beneficiaries. Each RAC uses their own proprietary software and the RAC's interpretation of Medicare rules and regulations. These payments may be underpayments or overpayments.

What is recovery audit?

The goal of the recovery audit program is to identify improper payments made on claims for services provided to Medicare beneficiaries. Improper payments may be overpayments or underpayments. Overpayments can occur when health care providers submit claims that do not meet CMS coding or medical necessity policies.

How long does it take to appeal Medicare recoupment?

While you have 120 days to file the first appeal, you can only avoid a Medicare recoupment action if you do so within 30 days. The carrier's decision is usually issued within 60 days from receipt of the redetermination request. 2nd Level Appeal: You have 180 days to appeal to the 2nd level.

Can RACs review Medicare claims?

The RACs will not review a claim that has previously been reviewed by another entity.

Does Medicaid have RAC audits?

Answer. Medicaid has implemented RAC audits. The Affordable Care Act (ACA) requires Medicaid agencies to contract with Recovery Audit Contractors (RACs) to identify and recover overpayments and to identify underpayments.

Do recovery audits have to be approved by CMS?

Answer. CMS is requiring that the Recovery Audit Contractor post the list of issues that they are going to be reviewing on their website.

What is RAC audit?

RAC auditors are private contractors paid on commission by the government. They review claims on a post-payment basis to identify and correct potential overpayments and underpayments to claims specific to Medicare Part A and Part B (hospital and physician practices).

What is the role of a Medicare claim officer?

Their responsibilities also include identifying and correcting underpayments and overpayments of these claims.

What does RAC audit notification mean?

If your practice receives a RAC audit notification letter, it’s generally to investigate suspicion of an improper payment on a claim (either an overpayment or an underpayment). RAC auditors will usually request medical records to complete the audit.

How long does it take for RAC to determine if you have overpaid?

Once you submit the requested medical records, the RAC has 60 days to get a determination to you. If all goes well, this could be the end of the audit. If the RAC determines you received an overpayment, the process will continue, and you could be required to pay the money back.

How long does it take to get an overpayment letter from the RAC?

After receiving a demand letter, you are required to call the RAC within 15 days to discuss how you plan to proceed. In response to an overpayment demand letter, you essentially have three options:

How long do you have to respond to a RAC request?

If you receive a letter from a RAC contractor requesting medical records, don’t delay. You have 45 calendar days to either submit a response or file an extension. If you don’t respond at all, the RAC could simply make a determination that you were overpaid, and take their money back.

How long does it take to get a Medicare recoupment determination?

Level 1: The first appeal level is redetermination. You have 120 days to file the first appeal but if you get it in within 30 days you can avoid Medicare recoupment action. You should get a determination within 60 days of receipt of your redetermination request. Level 2: The second appeal level is reconsideration.