Full Answer

What is the difference between Medicare and advantage?

- Routine vision, including eye glasses, contacts, and eye exams

- Routine hearing, including hearing aids

- Routine dental care

- Prescription drugs and some over the counter medications

- Fitness classes and gym memberships

- Meal delivery to your home

- Transportation to doctor visits

- Other benefits

When to choose Original Medicare vs. Medicare Advantage?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

Does Medicare Advantage offer much advantage?

Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

What are disadvantages of Medicare Advantage?

For example, Aetna recently began requiring prior authorization for cataract surgeries across all its health plans — including Medicare Advantage. Tens of thousands of Americans covered by Aetna ...

What is the difference between basic Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

What are the negatives to a Medicare Advantage Plan?

The takeaway There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling. Whether you choose original Medicare or Medicare Advantage, it's important to review healthcare needs and Medicare options before choosing your coverage.

What is Medicare Advantage in simple terms?

Medicare Advantage is a type of Medicare health plan offered by private companies that are Medicare-approved. They are considered an alternative to Original Medicare and cover all the expenses incurred under Medicare. They include the same Part A hospital and Part B medical coverage, but not hospice care.

What is the point of Medicare Advantage?

A Medigap policy is private insurance that helps supplement Original Medicare. This means it helps pay some of the health care costs that Original Medicare doesn't cover (like copayments, coinsurance, and deductibles).

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why do I need Medicare Part C?

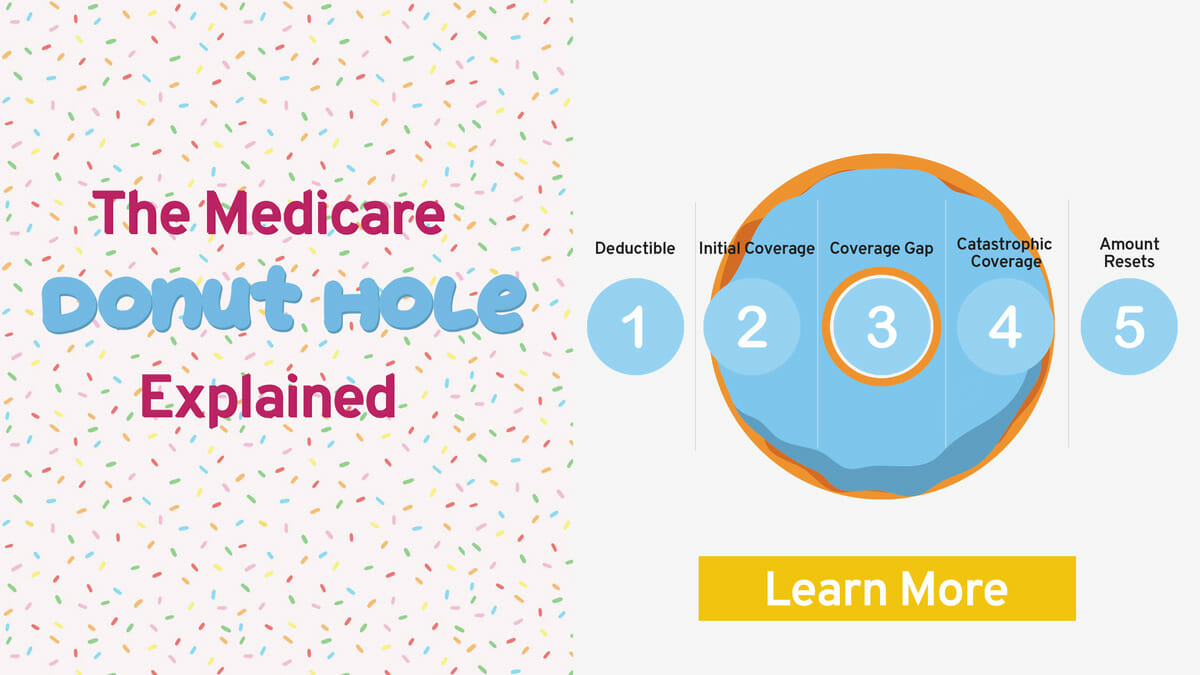

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are 4 types of Medicare Advantage Plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Why should I get an Advantage plan?

Advantage plans provide the benefits of Part A and B, and most also include Part D, or prescription drug coverage. Some offer extra benefits not available through Original Medicare, such as fitness classes or vision and dental care.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What are the top 3 Medicare Advantage Plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is offered to people ages 65 and older and disabled adults who qualify. Plans are provided by Medicare-approved private insurance companies. Coverage is the same as Part A hospital, Part B medical coverage, and, usually, Part D prescription drug coverage, with the exception of hospice care.

When can I change my Medicare Advantage plan?

People can change their Medicare Advantage plans during a specified open enrollment period in the fall that typically spans from mid-October to early December. 8 9. Like other types of health insurance, each Medicare Advantage plan has different rules about coverage for treatment, patient responsibility, costs, and more.

What is the maximum Medicare deductible for 2021?

In 2021, the annual maximum is rising to $7,550, up from $6,700, although many plans have lower out-of-pocket caps. 11 The 2021 monthly premium and annual deductible for Medicare Part B are $148.50 and $203, respectively. 12.

Is Medicare available for people over 65?

Medicare is generally available for people age 65 or older, younger people with disabilities, and people with end-stage renal disease—permanent kidney failure requiring dialysis or transplant—or amyotrophic lateral sclerosi (ALS). 3 4 Medicare Advantage is a type of Medicare health plan offered by private companies that are Medicare-approved.

Does Medicare Advantage work with Medigap?

Medicare Advantage plans don't work with Medigap, which is also called Medicare Supplement Insurance. 2. The average monthly premium for a Medicare Advantage plan in 2021 is expected to drop 11% to about $21 from an average of $23.63 in 2020. 5 Private companies receive a fixed amount each month for Medicare Advantage plan care.

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan and Medicare share the difference between the bid and the benchmark ; the plan's share of this amount is known as a "rebate," which must be used by the plan's sponsor to provide additional benefits or reduced costs to enrollees.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

How many people will be on Medicare Advantage in 2020?

Enrollment in the public Part C health plan program, including plans called Medicare Advantage since the 2005 marketing period, grew from zero in 1997 (not counting the pre-Part C demonstration projects) to over 24 million projected in 2020. That 20,000,000-plus represents about 35%-40% of the people on Medicare.

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

How much has Medicare Advantage decreased since 2017?

Since 2017, the average monthly Medicare Advantage premium has decreased by an estimated 27.9 percent. This is the lowest that the average monthly premium for a Medicare Advantage plan has been since 2007 right after the second year of the benchmark/framework/competitive-bidding process.

When did Medicare Advantage become Medicare?

In 2003, under the Medicare Prescription Drug, Improvement, and Modernization Act, Medicare Advantage became the new name for Medicare + Choice plans, and certain rules were changed to give Part C enrollees better benefits and lower costs. The law also created Part D, prescription drug coverage.

How many parts are there in Medicare Advantage?

It’s divided into four parts; Part A, Part B, Part C, and Part D. Medicare Advantage Plans (Part C) are one of several options within the Medicare program. Follow along to learn about Medicare Advantage plans and how to choose and enroll in one.

What are the protections under Medicare Part C?

Under Medicare Part C, consumers are offered several protections designed to enhance the quality of care they receive, including the right to information, the right to participate in treatment decisions, the right to get emergency services, and the right to file complaints.

When did Medicare Part C become available?

In 1997, Medicare Part C (Medicare + Choice) became available to persons who are eligible for Part A and enrolled in Part B. Under Part C, private health insurance companies can contract with the federal government to offer Medicare benefits through their own plans. Insurance companies that do so are able to offer Medicare health coverage ...

Do you have to give notice of appeal to Medicare?

If you are enrolled in a Medicare Advantage plan, the plan must give you written notification of your appeal rights; this will generally be included in your Medicare enrollment materials. Medicare beneficiaries also have the right to a fast-track appeals process.

Can you appeal a Medicare plan?

You have the right to appeal any decision about your Medicare-covered services, whether you are enrolled in Original Medicare or a Medicare Advantage plan. You can file an appeal if your plan does not pay for or provide a service or item you think should be covered or provided.

Medicare Advantage Defined

Medicare benefits come in two forms: Original Medicare and Medicare Advantage.

Types of Medicare Advantage Plans

Given that Medicare Advantage is provided by private insurance companies, there are many types from which to choose. However, most fall under one of these six categories:

Medicare Advantage Prescription Drug Coverage

While most Medicare Advantage plans offer some type of drug coverage, participants also have the option of joining separate prescription drug coverage plans (known as Part D) if their plan does not provide these types of benefits. This is often the case with MSA and some PFFS plans.

Costs Associated with Medicare Advantage Plans

The average cost of a Medicare Advantage plan in 2018 is $134 according to Medicare.gov. For individuals receiving Social Security benefits, the median premium is slightly lower at $130.

What Is Medicare Advantage?

Until 1997, the original Medicare program was the only game in town. Enrollees signed up and the government paid their health care expenses. That year, the government rolled out a second option that is now known as Medicare Advantage.

How Does Medicare Advantage Work?

Medicare Advantage works a lot like the coverage provided by a health maintenance organization ( HMO ). To maintain low costs, you need to make use of doctors and facilities that are part of the Medicare Advantage plan administrator’s network. You also typically need pre-approval for services that go beyond simple preventative care.

Medicare Advantage vs Original Medicare

A zero premium for Medicare Advantage certainly sounds enticing, but this is where Danielle Kunkle Roberts advises healthy 65-year-olds to make sure they understand key differences between Medicare Advantage vs Medicare once you actually need care.

Is It Better to Have Medicare Advantage or Medigap?

Beyond freedom of choice, there’s coinsurance to consider. Most Medicare Advantage plans require you to pay for a portion of your care. The good news is that there’s an annual out-of-pocket maximum for all your combined Medicare Part B copays and coinsurance.

Why Are Medicare Advantage Plans Bad?

If you do opt for Medicare Advantage, you’ll need some cushion against an expensive emergency calamity.

Should You Choose Medicare Advantage or Original Medicare?

From the perspective of peace-of-mind, original Medicare + Medigap + Medicare Plan D Drug plan can be a better financial investment if you get sick. But it’s definitely an investment, given the premium costs of Medigap and a Medicare Part D plan for prescription drug coverage.