What do you pay in a Medicare Advantage plan?

Aug 03, 2021 · Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or …

What are the advantages and disadvantages of Medicare Advantage plans?

government pays for Medicare benefits when you get them. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. Medicare pays these companies to cover your Medicare benefits. If you join a Medicare Advantage Plan, the plan will provide all of your Medicare

When to choose Original Medicare vs. Medicare Advantage?

Medicare Advantage plans (Medicare Part C) are a form of private health insurance that provide the same coverage as Medicare Part A and Part B (Original Medicare) and may include additional benefits such as dental, vision and prescription drug coverage. Medicare Advantage plans are widely used in the United States.

Why Advantage plans are bad?

Jun 12, 2020 · Medicare Advantage plans, also known as Medicare Part C, combine Original Medicare (Parts A & B) into one plan and include additional benefits. Instead of receiving the Part A & B benefits through Medicare, Medicare Advantage plans are offered through Medicare-approved private insurers, like UnitedHealthcare. What do Medicare Advantage (Part C) plans …

:max_bytes(150000):strip_icc()/medicare-part-d-overview-4589766-ec01f6e5f22546d8b45249a54d466e53.png)

Is Medicare Advantage and Medicare Part C the same thing?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

What is Medicare Part C responsible for?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Does Medicare Part C cover prescriptions?

What is Medicare Part C coverage for extra benefits? Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

Is Medicare Part C necessary?

Do you need Medicare Part C? These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you.

What is the difference between Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is there a deductible for Medicare Part C?

Most Medicare Part C plans have both a plan deductible and a drug deductible. Many (but not all) of the free Medicare Advantage plans offer a $0 plan deductible. Copayments and coinsurance. Copayments are amounts you'll owe for every doctor's visit or prescription drug refill.

What is the average cost for Medicare Part C?

What's the average cost of Medicare Part C?Medicare Part C plan type# of plans offeredAverage monthly costHMO-POS202$47Cost plan13$53PFFS19$77Regional PPO29$802 more rows•Jan 24, 2022

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is a TAB plan?

#TAB#Medical Savings Account (MSA) plans—These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan. For more information about MSAs, visit Medicare.gov/publications to view the booklet “Your Guide to Medicare Medical Savings Account Plans.”

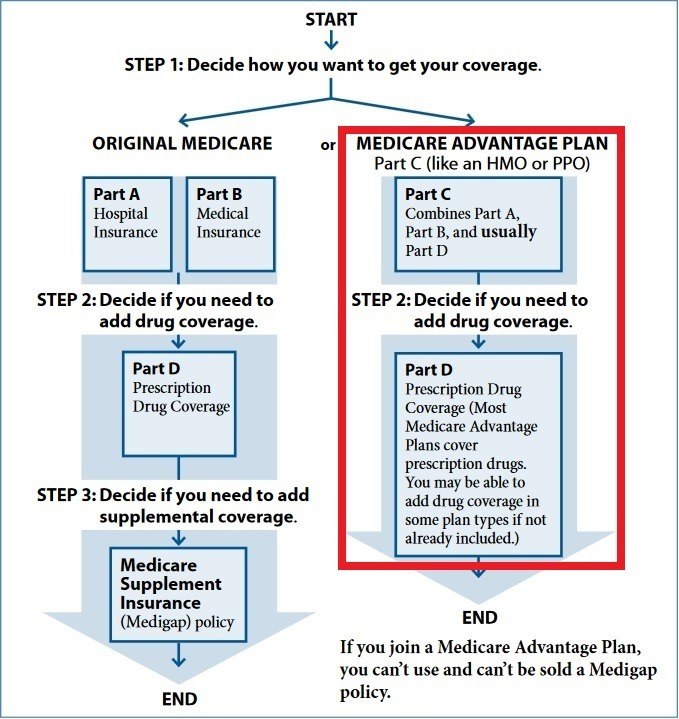

Can you sell a Medigap policy if you already have a Medicare Advantage Plan?

If you already have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re disenrolling from your Medicare Advantage Plan to go back to Original Medicare.

Can I go to a doctor for a HMO?

#TAB#Health Maintenance Organization (HMO) plans—In most HMOs, you can only go to doctors, other health care providers, or hospitals in the plan’s network, except in an urgent or emergency situation. You may also need to get a referral from your primary care doctor for tests or to see other doctors or specialists.

What is Medicare Advantage Plan?

Medicare Advantage plans (Medicare Part C) are a form of private health insurance that provide the same coverage as Medicare Part A and Part B (Original Medicare) and may include additional benefits such as dental, vision and prescription drug coverage. Medicare Advantage plans are widely used in the United States.

What is Medicare Part C?

2. They are an alternative way to get Medicare coverage through private insurance companies instead of the federal government. 3. They provide the same benefits as Original Medicare and may include additional benefits such as dental, vision, prescription drug and wellness programs coverage. ...

What are the requirements to qualify for Medicare Part C?

There are 3 general eligibility requirements to qualify for Medicare Part C: You must be enrolled in Original Medicare (Part A and Part B) There must be a Medicare Advantage plan offered in your area. You do not have End Stage Renal Disease (ESRD) You enroll in a Medicare Advantage plan through a private insurance company, not the government. ...

How much did Medicare premiums drop in 2020?

In the video below, Medicare expert John Barkett explains that Medicare Advantage premiums dropped by around 14 percent in 2020. If playback doesn't begin shortly, try restarting your device. Videos you watch may be added to the TV's watch history and influence TV recommendations.

What is a HMO plan?

Health Maintenance Organizations (HMOs) These plans feature a network of participating health care providers. With a Medicare HMO, you typically select a primary care physician (PCP). Your PCP coordinates your care and makes referrals to specialists within your plan network when you need additional care.

How many people will be in Medicare Advantage in 2021?

Medicare Advantage plans are widely used in the United States. In 2021, more than 24 million people are enrolled in Medicare Advantage plans, according to the Kaiser Family Foundation (KFF).1.

What is a SNP in medical?

You can typically visit any health care provider who accepts Medicare and the terms and conditions of your plan. Special Needs Plans (SNPs) A Special Needs Plan is a certain type of Part C plan that is designed for people with a specific health condition or those who are dual-eligible for Medicare and Medicaid.

What does Medicare Advantage cover?

What do Medicare Advantage (Part C) plans cover? Medicare Advantage plans are required to offer all the benefits included in Original Medicare (except hospice care which continues to be covered by Part A). These plans combine coverage for hospital (Part A) and doctor (Part B) visits all in one plan. Many Medicare Advantage plans also include ...

What are the benefits of UnitedHealthcare?

What are the benefits of Medicare Advantage plans from UnitedHealthcare? All UnitedHealthcare Medicare Advantage plans offer ways to help members to connect to the care they need. Plan benefits and features may include help finding a doctor, getting a ride to appointments , or talking to a nurse 24/7. Find a Medicare Advantage plan that may be right ...

Does Medicare Advantage include prescriptions?

Many Medicare Advantage plans also include prescription drug coverage (Part D). You may also find plans that offer additional benefits like routine eye and dental care coverage not offered by Original Medicare.

What Does Medicare Part C Cover?

Medicare Advantage (Part C) has more coverage for routine healthcare that you use every day.

What Does Medicare Part C Cover Compared To Original Medicare?

Medicare Part C plans cover Part A and Part B, and many also include prescription drug coverage (Part D) and other benefits not available with Original Medicare. That’s why, of the approximately 64 million people who applied for Medicare, nearly 22 million of them opted for Medicare Advantage plans. 1

What Are Medicare Part C (Medicare Advantage) Costs?

It’s pretty easy to find a Medicare Advantage plan that fits your budget. Medicare Part C premiums, deductibles, and copays vary from plan to plan and state to state. Anthem has many options, and there are money-saving programs for those with low incomes.

Should I Enroll In A Medicare Advantage Plan?

Review your coverage needs when you apply for Medicare. If Original Medicare isn’t enough, you may want to consider Medicare Part C — just know all the pros and cons.

How To Enroll In A Medicare Part C Plan?

If you are applying for Medicare for the first time, you can choose a Medicare Advantage plan during the Initial Enrollment Period (IEP). This is the seven-month period that includes:

What Is The Difference Between Medicare Part C And Part D?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined.

How to change Medicare plan?

The Medicare Open Enrollment Period provides an annual opportunity to review, and if necessary, change your Medicare coverage options. Coverage becomes effective on January 1. During Open Enrollment, some examples of changes that you can make include: 1 Join a Medicare Advantage (Part C) plan. 2 Discontinue your Medicare Advantage plan and return to Original Medicare (Part A and Part B). 3 Change from one Medicare Advantage plan to another. 4 Add or Change your Prescription Drug Coverage (Part D) plan if you are in Original Medicare.

What is the initial enrollment period for Medicare?

The Initial Enrollment Period is a limited window of time when you can enroll in Original Medicare (Part A and/or Part B) when you are first eligible. After you are enrolled in Medicare Part A and Part B, you can select other coverage options like a Medicare Advantage plan from approved private insurers.

What is a copayment in Medicare?

Copays. A copayment may apply to specific services, such as doctor office visits. Coinsurance. Cost sharing amounts may apply to specific services. Out-of-Pocket Expenses. All Medicare Advantage plans have an annual limit on your out-of-pocket expenses, which is a feature not available through Original Medicare.

Do you have to enroll in Medicare before joining a Medicare Advantage plan?

You must first enroll in Medicare Part A and Part B before joining a Medicare Advantage plan. Contact your local Blue Cross Blue Shield company for help choosing a Medicare Advantage plan and getting enrolled.

Does Medicare Advantage have copayments?

Medicare Advantage plans may have copayments or cost sharing amounts on Medicare covered services that differ from the cost sharing amounts in Original Medicare. Medicare Advantage plans may change their monthly premiums and benefits each year. This also occurs in Original Medicare, as Part B premiums, standard deductibles ...

Does Medicare Advantage have geographic service areas?

Limits. Medicare Advantage plans have defined geographic service areas and most have networks of physicians and hospitals where you can receive care. Ask your physicians if they participate in your health insurance plan’s Medicare Advantage network.

What is Medicare Advantage Plan?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

What happens if you don't get a referral?

If you don't get a referral first, the plan may not pay for the services. to see a specialist. If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care. These rules can change each year.

Can't offer drug coverage?

Can’t offer drug coverage (like Medicare Medical Savings Account plans) Choose not to offer drug coverage (like some Private Fee-for-Service plans) You’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply: You’re in a Medicare Advantage HMO or PPO.

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...