How much does Medicare Part C cost per month?

With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans. While the average cost for Medicare Part C is $25 per month, it’s possible to get a Medicare Advantage plan with a $0 monthly premium.

What is the average cost of Medicare Advantage plan?

Advantage plans, Part D drug plans, Medigap supplement policies, assistance to help pay your Medicare costs, etc., contact the State Health Insurance Assistance Program at 800-452-4800, 866-846-0139 (TDD) or online at www.medicare.in.gov. You can also find ...

How to compare Medicare Advantage plans?

What You Should Know

- In 2022, there are more than 3,800 Medicare Advantage Plans for Americans to choose from — more than any previous year.

- Choosing the right plan requires a careful comparison of costs and how often you expect to need the benefits.

- All Medicare Advantage Plans are required to have an annual limit on out-of-pocket costs. ...

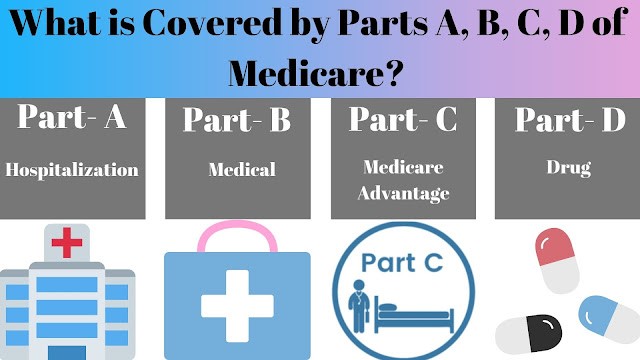

What is Medicare Part C plans?

- Routine dental care

- Vision exams and coverage for eyeglasses

- Routine hearing care and coverage for hearing aids

- Fitness memberships

- Home modifications to aid with aging in place, such as bathroom grab bars

- Non-emergency medical transportation, such as rides to the doctor’s office

What are Part C premiums?

Part C premium. The Part C monthly. premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What does Medicare Part C pay for?

Medicare Part C covers the inpatient care typically covered by Medicare Part A. If you are a Medicare Part C subscriber and are admitted to the hospital, your Medicare Advantage plan must cover a semi-private room, general nursing care, meals, hospital supplies, and medications administered as part of inpatient care.

Is Medicare Advantage the same as Part C?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What does Medicare Part C handle?

Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

Do you have to pay for Medicare Part C?

Medicare Part C premiums vary, typically ranging from $0 to $200 for different coverage. You still pay for your Part B premium, though some Medicare Part C plans will help with that cost.

Do I qualify for Medicare Part C?

You must be at least age 65 or older and a U.S. citizen or legal permanent resident for a minimum of 5 contiguous years. Disability. If you've received monthly Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months, you're eligible for Original Medicare.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare Part C part of Medicare?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

What common feature is shared by all Medicare Advantage plans offered under Medicare Part C?

What three common features are shared by all Medicare Advantage plans offered under Medicare Part C? - They are all guaranteed issue. - Medicare pays the company offering the plan a fixed amount each month to provide the Medicare beneficiary with health care.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What are some items that Medicare Part C offers that are not covered in Original Medicare?

does not cover:Routine dental exams, most dental care or dentures.Routine eye exams, eyeglasses or contacts.Hearing aids or related exams or services.Most care while traveling outside the United States.Help with bathing, dressing, eating, etc. ... Comfort items such as a hospital phone, TV or private room.Long-term care.More items...

How do I apply for Medicare Part C?

Once you understand the plan's rules and costs, here's how to join:Use Medicare's Plan Finder.Visit the plan's website to see if you can join online.Fill out a paper enrollment form. ... Call the plan you want to join. ... Call us at 1-800-MEDICARE (1-800-633-4227).

How Medicare Advantage Premiums Work

Medicare Advantage, known as Medicare Part C, includes both Medicare Parts A and B (Original Medicare) coverage. When you enroll in a Medicare Adva...

Medicare Part C Cost: How Much Is The Premium?

Medicare Advantage premiums vary depending on the type of plan and the state you live in. Monthly premiums range from $0 to the high $300s. But ove...

How Does Obamacare Affect Medicare Advantage Costs?

Obamacare (Affordable Care Act) made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industr...

Can I Get Help Paying For Medicare Advantage?

You can get help with paying for your Medicare Part C plan through Medicare Savings Programs (MSPs) made available by the Centers for Medicare and...

How Do I Choose A Medicare Advantage Plan?

The first step in choosing a Medicare Advantage plan is to compare quotes from different insurance companies. HealthMarkets provides access to Medi...

What is Medicare Part C premium?

The premium you may pay is used to cover the wider range of services available with Medicare Part C . The Medicare-approved private insurance companies that offer Medicare Part C coverage decide what services the plans will cover, so monthly premiums vary from plan to plan and state to state. Insurance companies are only allowed to make changes ...

What is Medicare Advantage?

A Medicare Advantage plan is health insurance offered by Medicare-approved private insurance companies. It’s a single plan that includes all Original Medicare (Part A and Part B) ...

How is Medicare Part B billed?

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Here’s how you pay Medicare and your private insurance company. Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, ...

What is the Medicare Advantage premium for 2020?

What Is the Premium for Medicare Advantage? In 2020, the average monthly premium for plans that include Medicare Part D prescription drug (MA-PD) benefits is $25, according to the Kaiser Family Foundation. (The average monthly premium is weighted by enrollment.)

How much is Medicare Part B 2021?

Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate. Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums.

When are Medicare premiums due?

Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made. Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

Do you pay for Medicare Part C?

Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums. In addition to covering medically necessary procedures, Part C plans typically provide prescription drug coverage (Medicare Part D) and other types of benefits such as dental and vision. The premium you may pay is used ...

How Medicare Advantage Plans Work

Medicare Advantage, or Part C, is an all-in-one alternative to Original Medicare . These plans are offered by government-approved private insurance companies Medicare later reimburses.

Medicare Advantage Plans Include Out

A Medicare Advantage plan out-of-pocket spending limit represents an annual cap on your out-of-pocket spending for covered Part A and Part B health care costs.

Types Of Medicare Part C Plans

Medicare Part C comes in several types, much like non-Medicare health insurance, with different requirements for finding care providers. In a health maintenance organization, or HMO plan, for instance, you need to see in-network health care providers unless its an emergency, and you need a referral to see a specialist.

Eligibility For Part C

You must have Both Part A and Part B to be eligible for Part C. The one health question that can disqualify you for a Medicare Advantage plan is, do you have End-Stage Renal Disease? Unless you develop End-Stage Renal Disease when youre already on a Medicare Advantage plan, you wont be able to select this coverage.

Compare Medicare Part C Plan Costs In Your Area

Plan pricing is not always made readily available on an insurance companys website. But a licensed insurance agent can help you gather up the costs for the various Medicare Part C plans available in your area and help you better understand the terms and conditions of each.

S For Using The Plan Finder Tool

To check which plans are in your area, you can use the Medicare Health Plan Finder. If you wish, you can create an account, log in, and return to saved plan searches later if youre not able to make your selection in one day.

What Medicare Part C Covers

Medicare Part C plans offer all the benefits of Medicare Part A and Part B, with a few exceptions:

What is Medicare Advantage?

Medicare Advantage, or Medicare Part C, is a type of Medicare plan that uses private health insurance to cover all the services you’d receive under Medicare Parts A and B. Anyone who is eligible for original Medicare Parts A and B is eligible for the Medicare Advantage programs in their area.

What benefits can I expect on Medicare Advantage?

Medicare Advantage covers everything that original Medicare covers. However, Advantage plans also cover hearing, vision, and dental care — which aren’t covered under original Medicare. Depending on the plan, Medicare Advantage may also cover things like gym memberships, transportation, and adult day-care.

How do I enroll in a Medicare Advantage Plan?

Even if you’re happy with your current health care coverage, you should review your plan during open enrollment to see if you’re overpaying or if your benefits will be changing in the coming year.

Get started now

Interested in learning more about Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare (Parts A & B). These are all-in-one plans and are only provided by Medicare-approved private insurance companies.

What to know about Medicare Advantage Plans?

Key Things to Remember About Medicare Advantage Plans. Medicare Advantage plans are diverse and unique, so here are some key things to remember. Medicare Advantage plans are provided by private insurers only. You must be enrolled in Medicare Part A and Part B before you can enroll in Part C.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is the purple text on Medicare?

Purple text appears on the bottom half. ON SCREEN TEXT: 3 Additional health benefits you can get with a Medicare Advantage plan may include... The bottom half of the screen divides in half. The purple text remains on the green left-hand side. Light blue text appears on a darker blue background on the right side.

Does Medicare have a yearly limit?

All Medicare Advantage plans have a yearly limit on the out-of-pocket costs you must pay for covered medical services. This limit may vary for different plans, and can change each year; however, it’s something that only Medicare Advantage plans offer to help keep costs in check. It’s important to know that even with a Medicare Advantage plan, ...

Do you have to be enrolled in Medicare Part A and B?

You must be enrolled in Medicare Part A and Part B before you can enroll in Part C. Medicare Advantage plans include coverage for items under Medicare Part A and B and may include coverage for other health care benefits such as prescriptions drugs, dental and vison. Costs, plan benefits and plan availability vary by plan provider ...

Does Medicare Advantage have a deductible?

However, there is a unique benefit to Medicare Advantage plans that other Medicare plans don’t have.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

What is copayment in medical terms?

copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).