Like Part A, Medicare Part B has no maximum out-of-pocket limit. All Medicare beneficiaries pay an annual deductible ($203) and monthly premium for Part B. The monthly premium can increase based on your income, but the starting rate is $148.50.

Is there a limit on Medicare Part B out-of-pocket?

Medicare Part B is the part of Original Medicare that covers outpatient services, such as doctor’s appointments and preventive care. Unlike Part A, your Part B costs are not encapsulated into benefit periods. Most people have to pay the standard Part B …

What's the Medicare Advantage maximum out of pocket?

May 16, 2020 · For 2020, the largest out-of-pocket maximum that a plan can have is $8,150 for an individual plan and $16,300 for a family. These numbers are up from $7,900 and $15,600 in 2019. In general, if you select a plan with a lower monthly premium, it is associated with a higher out-of-pocket maximum amount. The opposite is also true, as lower out-of ...

What are the Medicare Part B out-of-pocket costs in 2022?

May 26, 2021 · It has two parts. Part A is hospital coverage. Part B is medical coverage. has no out-of-pocket limits. The 20-percent Medicare beneficiary A person who has health care insurance through the Medicare or Medicaid programs. cost-sharing that’s built into Medicare Part A Medicare Part A is hospital coverage for Medicare beneficiaries. It covers inpatient care …

What are Medicare out-of-pocket costs?

Jul 20, 2021 · There is no limit on out-of-pocket costs in original Medicare (Part A and Part B). Medicare supplement insurance, or Medigap plans, can help reduce the burden of out-of-pocket costs for original Medicare. Medicare Advantage plans have out-of-pocket limits that vary based on the company selling the plan. Medical care can be expensive, even when ...

Is there a max out-of-pocket for Medicare Part B?

Medicare Part B out-of-pocket costs There is no out-of-pocket maximum when it comes to how much you may pay for services you receive through Part B. Here is an overview at the different out-of-pocket costs with Part B: Monthly premium. Premiums start at $148.50 per month in 2021 and increase with your income level.

What is the maximum out-of-pocket for Medicare in 2020?

The maximum limits will increase to $7,550 for in-network and $11,300 for in- and out-of-network combined. Once the limit is reached, the plan covers any costs for the remainder of the year.Jul 14, 2020

How much do Medicare patients pay out-of-pocket?

A: According to a Kaiser Family Foundation (KFF) analysis of Medicare Current Beneficiary Survey (MCBS), the average Medicare beneficiary paid $5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed.

What is the Medicare out-of-pocket for 2021?

$7,550Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B. In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined.Jun 21, 2021

What is not included in out-of-pocket maximum?

The out-of-pocket limit doesn't include: Your monthly premiums. Anything you spend for services your plan doesn't cover. Out-of-network care and services.

What counts towards out-of-pocket maximum?

The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums. It typically includes your deductible, coinsurance and copays, but this can vary by plan.

How much is healthcare out-of-pocket?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.Jan 21, 2022

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much is deducted from Social Security for Medicare?

Medicare Part B If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.Feb 24, 2022

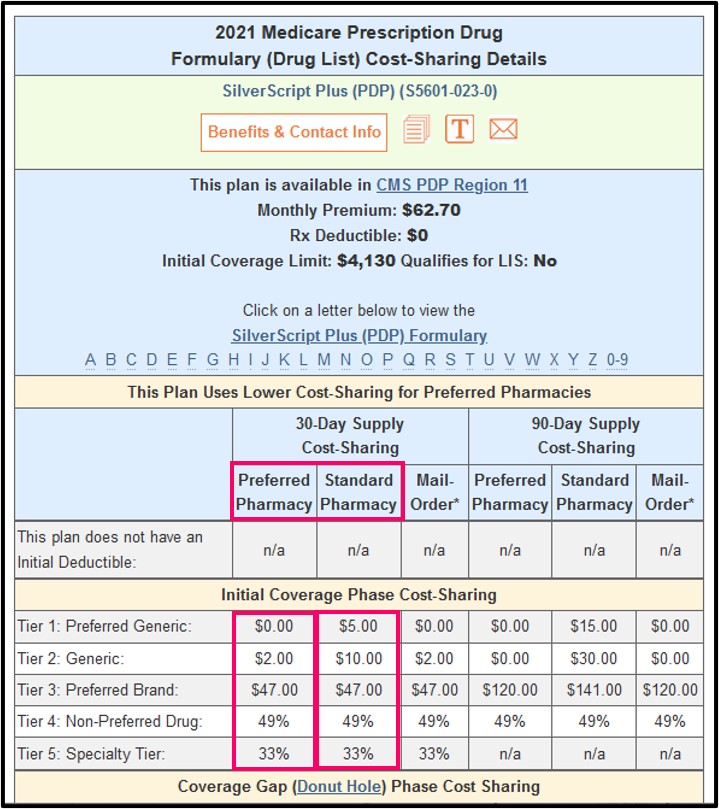

Do Part D plans have an out-of-pocket maximum?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides catastrophic coverage for high out-of-pocket drug costs, but there is no limit on the total amount that beneficiaries have to pay out of pocket each year.Jul 23, 2021

What is the maximum out-of-pocket for Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.Dec 12, 2019

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What is the maximum out of pocket amount for health insurance?

For 2020, the largest out-of-pocket maximum that a plan can have is $8,150 for an individual plan and $16,300 for a family. These numbers are up from $7,900 and $15,600 in 2019.

How much is the out of pocket maximum for 2019?

These numbers are up from $7,900 and $15,600 in 2019. In general, if you select a plan with a lower monthly premium, it is associated with a higher out-of-pocket maximum amount. The opposite is also true, as lower out-of-pocket maximums often carry higher premium payments. Some people may qualify for reduced out-of-pocket maximum payments ...

What is copayment in healthcare?

Copayments are set dollar amounts that are associated with specific visits or treatments, and coinsurance costs are a percentage of care that you are responsible for paying. You will continue to be responsible for paying all coinsurance and copayment amounts until they total an additional $1,500 in payments.

What is Medicare Advantage?

Once a person meets their maximum, your Medicare Advantage provider is responsible for paying 100 percent of the total medical expenses. Having an out-of-pocket maximum offers protection for both the policy holder and the health insurance company. For the recipient, a maximum provides a cap for their share of the healthcare costs.

Does Medicare cover annual checkups?

This care can include annual checkups, routine screenings, flu shots, other vaccinations, and more. The good news is that many of these expenses are covered in full by Medicare to begin with, but you are not able to add these fees towards your maximum .

Does preventative care count towards the maximum?

Insurance companies can also restrict the services that they will cover. For example, certain cosmetic procedures, weight loss surgeries, or alternative medicine therapies may not be covered and will not count towards the maximum. Most preventative care does not contribute towards the maximum either.

Do health insurance premiums count towards out of pocket?

This means that you may end up paying more than your maximum amount each year. If you have a monthly premium payment, this amount does not contribute towards your out-of-pocket maximum.

What is the maximum out of pocket limit for Medicare Part B 2021?

And, unlike Medicare Advantage coverage, there is no maximum out-of-pocket limit. Fortunately, you can get a Medigap plan to cover some or all of the Part B coinsurance.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... , high out-of-pocket costs, or even unlimited out-of-pocket expenses.

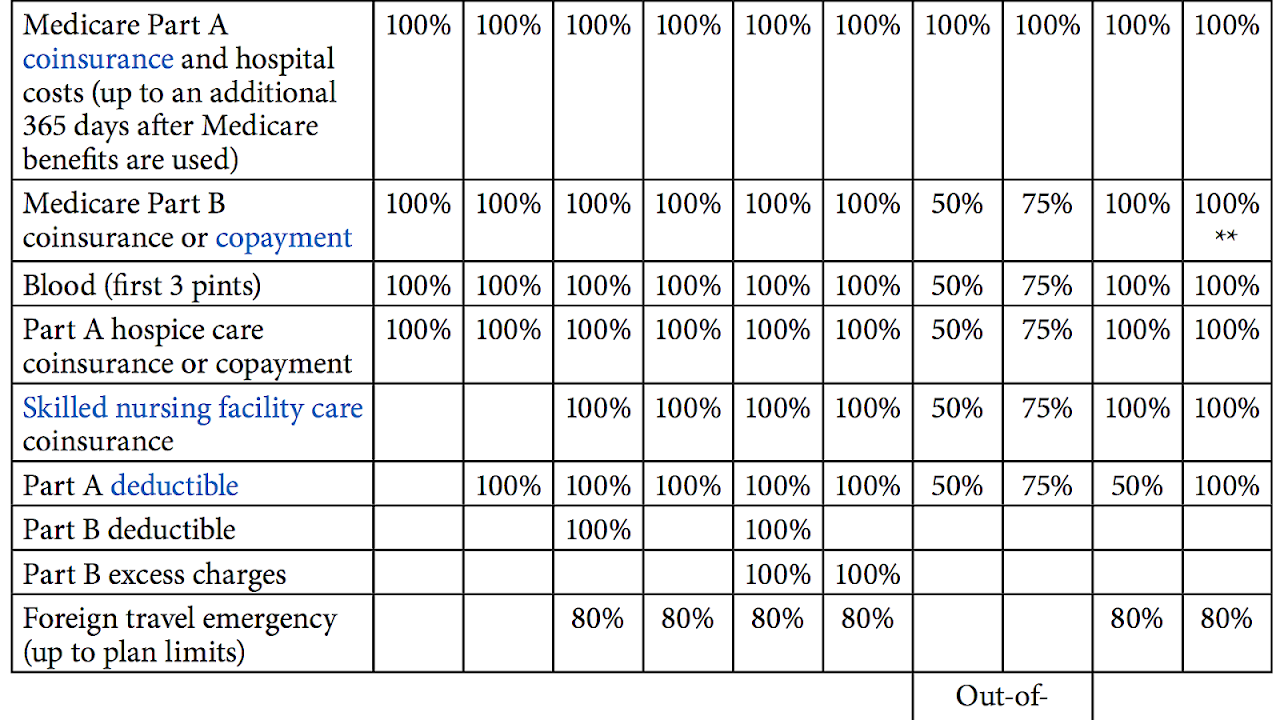

What is Medicare Supplement Plan C?

Medicare Supplement Plan C, also called Medigap Plan C, is one of the most comprehensive of the 10 standardized supplemental Medicare plans available in most states.

What is coinsurance in Medicare?

Coinsurance is a percentage of the total you are required to pay for a medical service. ... costs for all Medicare-approved healthcare services. Medicare Advantage plans (Medicare Part C) have an annual maximum out-of-pocket limit (MOOP) on health care services only. Plan members pay copayments when they get medical care.

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

How long does Medicare cover skilled nursing?

Medicare Part A covers 100 percent of the cost of skilled nursing facility care for the first 20 days so long as you had at least a three-night inpatient hospital stay prior to the skilled nursing facility stay. Supplemental Medicare coverage helps pay some or all of your Part A coinsurance.

How much does Medicare pay if you don't work 10 years?

How much you pay depends on the number of quarters you paid the Medicare tax. $263/month for beneficiaries who paid into Medicare for 7.5 to 10 years.

What happens if a doctor doesn't accept my insurance?

And, if the doctor doesn’t accept the policy, you don’t have coverage. Any expense you incur that doesn’t have coverage won’t apply to your maximum out of pocket. Further, that service will be 100% your bill. Some choose PPO plans to have some coverage outside the plan.

Does Medigap have a maximum out of pocket?

Medigap plans don’t have a maximum out of pocket because they don’t need one. The coverage is so good you’ll never spend $5,000 a year on medical bills. Sure, the premium is a little higher, but the benefits are more significant. If high medical bills are your concern, consider choosing Medigap.

Is there a limit on Medicare 2021?

Updated on July 13, 2021. There isn’t a maximum out of pocket on Medicare. Because of this, there is no limit to the amount you can pay in medical bills. You can contribute 20% of any number of costs after meeting the deductible. Don’t worry, though; we have a few solutions to help you.

Can you pay Medicare out of pocket?

No, with Medicare you can pay any amount out of pocket on medical bills. So, those with chronic health conditions can expect to pay endlessly on coinsurances with Medicare. There is no Part A or Part B maximum out of pocket.

Does Medicare cover surgery?

Medicare doesn’t have a limit on the amount you can spend on healthcare. But, they do cover a portion of most medical bills. Yes, there is some help, but 20% of $100,000+ surgery or accident could be bank-breaking. But, there are options to supplement your Medicare. Some options have a maximum limit. Yet, some options don’t.

What is Medicare out of pocket?

Medicare out-of-pocket costs are the amount you are responsible to pay after Medicare pays its share of your medical benefits. In Medicare Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

How much of Medicare is spent on out of pocket?

More than a quarter of all Medicare recipients spend about 20 percent of their annual income on out-of-pocket costs after Medicare reimbursements. People lower income or complex health conditions are likely to pay the most.

What percentage of Medicare deductible do you pay?

After you meet your deductible, you will pay 20 percent of the Medicare-approved amount for most of your medical costs. Some services, like preventive care, are supplied without a coinsurance cost. Out-of-pocket maximum. There is no out-of-pocket maximum for your share of Medicare Part B costs.

What is the Medicare Part A deductible for 2021?

Medicare Part A costs include your share of expenses for any inpatient treatments or care. In 2021, the Part A deductible is $1,484. Once you’ve paid this amount, your coverage will kick in and you’ll only pay a portion of your daily costs, based on how long you’ve been in the hospital.

What is Medicare Supplemental Insurance?

There are a number of private insurance products that can help cover the out-of-pocket costs of your Medicare coverage. These Medicare supplemental insurance plans are called Medigap, and they are regulated by both federal and state guidelines. Each plan is different, and out-of-pocket costs may vary by plan.

What is Medicare Part C?

Medicare Part C is a private insurance product that replaces your original Medicare coverage. These plans may also include Medicare Part D, which covers prescription drug costs.

What is the Medicare Advantage out of pocket limit for 2021?

In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket. Out-of-pocket limit levels.