Medicare Choice Group is a supporter for the American Heart Association, the nation’s oldest and largest voluntary health organization dedicated to fighting heart disease and stroke. Medicare Choice Group has joined the American Heart Association to inspire consumers to honor their reasons to live healthier, longer lives.

Full Answer

What choices do you have to make about Medicare?

Medicare+ Choice. An expanded set of options for delivering healthcare under Medicare (US), which was established by the 1997 Balanced Budget Act, under which most Medicare beneficiaries can choose to receive benefits through the original fee-for-service program or through one of three M+C plans. Medicare+ Choice.

Which Medicare plan should I Choose?

With Medicare, you have options in how you get your coverage. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage. There are 2 main ways: Original Medicare. Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). You pay for services as you get them.

How to choose the right Medicare plan for You?

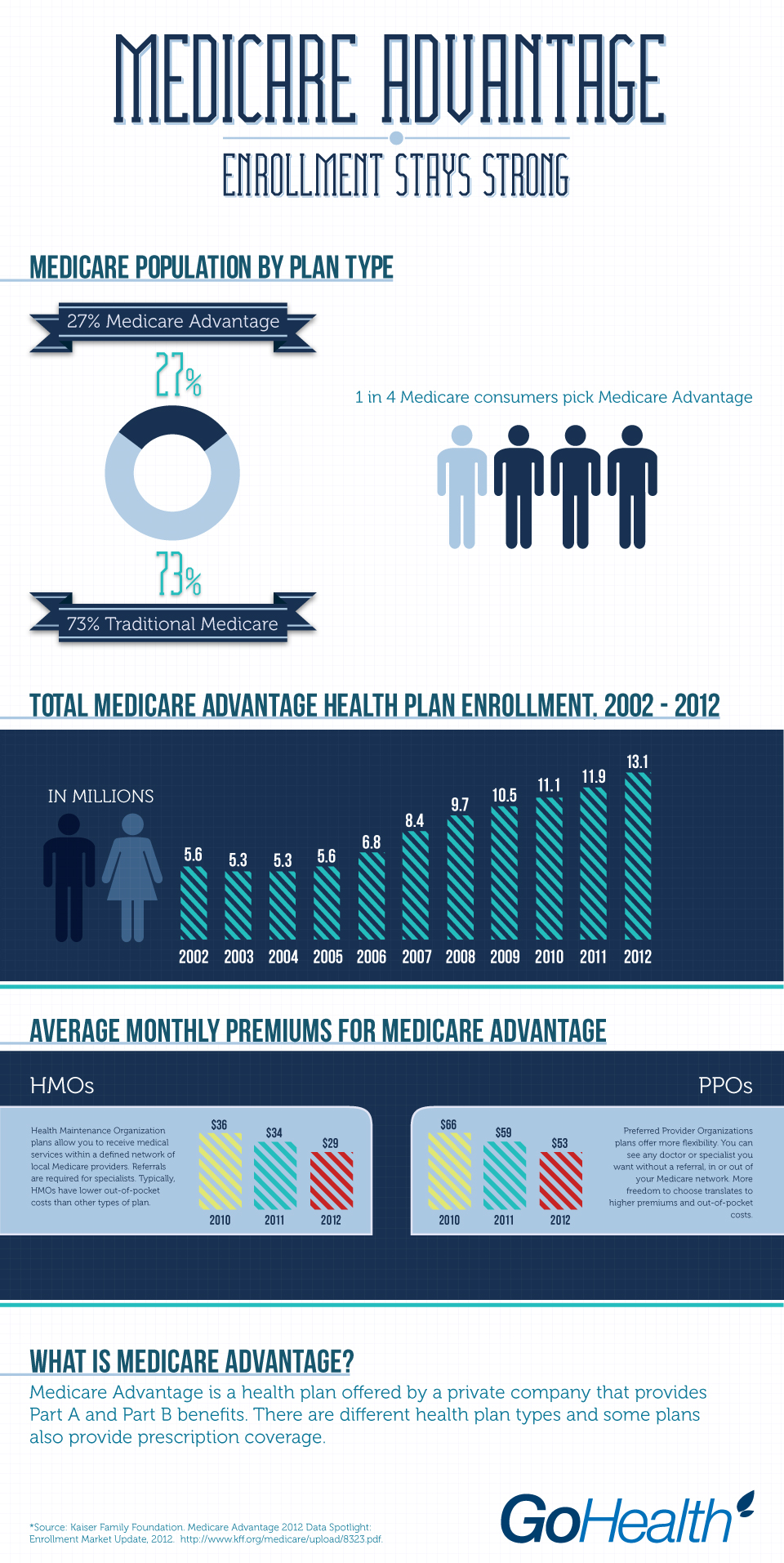

Medicare Advantage. Medicare Advantage Plan (Part C) A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D). Refer to Medicare glossary for more details.

What is the best Medicare plan?

Jan 17, 2022 · CDPHP Choice HMO and CDPHP Choice Rx HMO. Monthly Premium*. With Part D: $131.00. Without Part D: $39.90. Medical Deductible. No deductible. Primary Care Physician Office Visit Copayment. $0. Doctor On Demand.

What is used as Medicare Choice plans?

What is a Medicare Choice organization?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

What are the 2 types of Medicare plans?

What are the 4 phases of Medicare Part D coverage?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What are Medicare Parts A & B?

Why do doctors not like Medicare Advantage plans?

What is the best Medicare program?

Does Medicare cover dental?

What is the average cost of supplemental insurance for Medicare?

What type of insurance is AARP?

What is Medicare for?

Medicare is the federal health insurance program for: 1 People who are 65 or older 2 Certain younger people with disabilities 3 People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare Advantage?

Medicare covers medical services and supplies in hospitals, doctors’ offices, and other health care settings. Services are either covered under Part A or Part B. Coverage in Medicare Advantage. Plans must cover all of the services that Original Medicare covers.

Does Medicare Advantage include prescription drugs?

Most Medicare Advantage Plans include drug coverage. If yours doesn't, you may be able to join a separate Part D plan. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Doctor and hospital choice.

Does Medicare cover hearing?

Some plans offer benefits that Original Medicare doesn’t cover like vision, hearing, or dental. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Your other coverage.

Background

Recent MedPAC reports indicate that fewer than half of eligible Medicare beneficiaries use hospice care and most only for a short period of time. Currently, Medicare beneficiaries are required to forgo Medicare payment for care related to their terminal condition in order to receive access to hospice services.

Target Population

The target population for the Medicare Care Choices Model is Medicare beneficiaries and Medicaid beneficiaries with Medicare coverage (‘dually eligible beneficiaries’), who are eligible for either the Medicare or Medicaid hospice benefit.

Model Details

Under the model, participating hospices will provide services that are currently available under the Medicare hospice benefit for routine home care and respite levels of care, but cannot be separately billed under Medicare Parts A, B, and D. Model services are available around the clock, 365 calendar days per year.

Where Health Care Innovation is Happening

See who's working with CMS to implement new payment and service delivery models.

Medicare Advantage (Part C)

You pay for services as you get them. When you get a covered service, Medicare pays part of the cost and you pay your share.

You can add

You join a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage.

Most plans include

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services)

Medicare drug coverage (Part D)

If you chose Original Medicare and want to add drug coverage, you can join a separate Medicare drug plan. Medicare drug coverage is optional. It’s available to everyone with Medicare.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

How many hospices are there in the MCCM?

MCCM will consist of up to 141 participating hospices with up to 71 participating since the first year of the Model (2016) and up to 70 additional hospices entering the Model in Year 3 (2018). The number may decrease as hospices choose to withdraw or are otherwise terminated from the Model.

What is a MCCM?

The MCCM is designed to evaluate whether eligible Medicare and dually eligible beneficiaries would elect to receive supportive care services typically provided by hospice if they could also continue to receive treatment for their terminal condition, and how this flexibility impacts quality of care and patient, family and caregiver satisfaction. Under the Model, participating hospices will provide designated services that are currently available under the Medicare hospice benefit for routine home care and respite levels of care, but cannot be separately billed under Medicare Parts A, B, and D. These services include nursing, social work, hospice aide, hospice homemaker, volunteer, chaplain, bereavement, nutritional support and respite care services. Please make certain your staff is aware of the changes under the MCCM.

Background

Target Population

- The target population for the Medicare Care Choices Model is Medicare beneficiaries and Medicaid beneficiaries with Medicare coverage (‘dually eligible beneficiaries’), who are eligible for either the Medicare or Medicaid hospice benefit. Also, to be eligible, beneficiaries must not have elected the Medicare (or Medicaid) hospice benefit within the...

Model Details

- Under the model, participating hospices will provide services that are currently available under the Medicare hospice benefit for routine home care and respite levels of care, but cannot be separately billed under Medicare Parts A, B, and D. Model services are available around the clock, 365 calendar days per year. CMS pays a per-beneficiary per-month (PBPM) fee ranging from $20…

Evaluations

- Latest Evaluation Reports

1. Two Pager: At-A-Glance Report (PDF) 1.1. Medicare Care Choices Model - Third Annual Report (PDF) 1.2. Medicare Care Choices Model - Third Annual Report Technical Appendices (PDF) 1.3. Medicare Care Choices Model - Third Annual Perspective Report (PDF) - Prior Evaluation Reports

1. Two Pager: At-A-Glance - First Annual Report (PDF) 1.1. Medicare Care Choices Model - First Annual Report (PDF) 2. Two Pager: At-A-Glance - Second Annual Report (PDF) 2.1. Medicare Care Choices Model - Second Annual Report (PDF) 2.2. Medicare Care Choices Model - Second Annu…

Additional Information