The Conversion Factor (CF) is the number of dollars assigned to an RVU. It is calculated by use of a complex formula (Fig 1) that takes into account the overall state of the economy of the United States, the number of Medicare beneficiaries, the amount of money spent in prior years, and changes in the regulations governing covered services.

How do you calculate Medicare conversion factor?

Apr 10, 2013 · The Conversion Factor (CF) is the number of dollars assigned to an RVU. It is calculated by use of a complex formula (Fig 1) that takes into account the overall state of the economy of the United States, the number of Medicare beneficiaries, the amount of money spent in prior years, and changes in the regulations governing covered services. Medicare fees are …

What is the conversion factor?

Dec 23, 2021 · The new conversion factor will be $34.6062, a decrease of approximately $0.29 or 0.83% from the 2021 conversion factor of $34.8931. The AAPM&R website has been updated to include this new information. Additionally, we have updated the chart of final RVUs and national payment rates for services effective January 1, 2022.

What is the Medicare physician fee conversion factor for 2022?

Initially, the Medicare Physician Payment Schedule included distinct conversion factors for various categories of services. In 1998, a single conversion factor was implemented. The reduction in the 1999 conversion factor was offset by elimination of the work adjustor from the first Five-Year Review and increases in the practice expense and PLI RVUs.

What is the new conversion factor for AAPM&R?

Dec 17, 2011 · The following graph shows the value required by law without the 2 month extension signed into law 12/23/2011. If that conversion factor ($24.67) had gone into effect 3/1/2012, it would have caused a 27.39% reduction from 2011, which was 20.4% below the 1992 rate. Try running a business with numbers like these.

What is the Medicare conversion factor for 2021?

$34.8931This represents a 0.82% cut from the 2021 conversion factor of $34.8931. However, it also reflects an increase from the initial 2022 conversion factor of $33.5983 announced in the 2022 Medicare physician fee schedule final rule.Feb 7, 2022

What is the 2021 conversion factor?

$34.891, 2021. This changes the CY2021 conversion factor from $32.36 to $34.89 and is accomplished by: An increase in the payment schedule of 3.75 percent.

How is the conversion factor for the fee schedule determined?

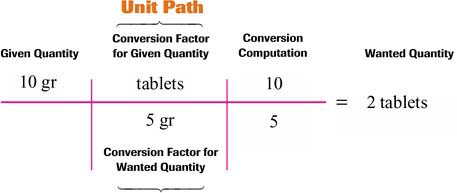

For our purposes here, the conversion factor is a per牛unit value that is multiplied by the relative value units (RVU) to convert it into a fee (or charge) for a particular medical service or procedure.

What factors are used to calculate Medicare reimbursement?

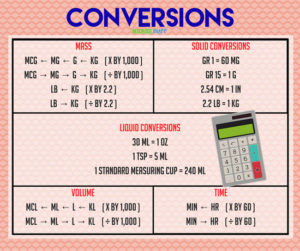

Payment rates for an individual service are based on the following three components: Relative Value Units (RVU); Conversion Factor (CF); and. Geographic Practice Cost Indices (GPCI).

What is the Medicare fee for 2021?

That is slightly less than the 2021 conversion factor of $34.8931, but more than the $33.59 that CMS planned to implement before S. 610 passed. The new conversion factor is included in updated spreadsheets on the CMS website. With the new conversion factor and other changes in S.Jan 3, 2022

Did Medicare reimbursement go up in 2021?

In January 2021, CMS increased Medicare payments for outpatient E/M services an average of 8 percent for new patients and 35 percent for established patients.Jul 8, 2021

Which of the following expenses would be paid by Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services.Sep 11, 2014

What is the limiting charge for Medicare?

15%In Original Medicare, the highest amount of money you can be charged for a covered service by doctors and other health care suppliers who don't accept assignment. The limiting charge is 15% over Medicare's approved amount.

Is there an allowable fee schedule for Medicare?

Medicare will accept 80% of the allowable amount of the Medicare Physician Fee Schedule (MPFS) and the patient will pay a 20 % co-insurance at the time services are rendered or ask you to bill their Medicare supplemental policy.

What are the three main components to the reimbursement formula?

To understand this more fully, the calculations can be broken into three components – RVUs, the geographical adjustment and the conversion factor.

How are Medicare payments calculated?

Calculating 95 percent of 115 percent of an amount is equivalent to multiplying the amount by a factor of 1.0925 (or 109.25 percent). Therefore, to calculate the Medicare limiting charge for a physician service for a locality, multiply the fee schedule amount by a factor of 1.0925.

How is Medicare outpatient reimbursement calculated?

The payments are calculated by multiplying the APCs relative weight by the OPPS conversion factor and then there is a minor adjustment for geographic location. The payment is divided into Medicare's portion and patient co-pay. Co-pays vary between 20 and 40% of the APC payment rate.

What Is the CF?

The monetary CF is 1 of 3 key elements that determine physician payment under the Medicare Physician Fee Schedule, along with the Resource-Based Relative Value Scale and Geographic Practice Cost Indices (GPCIs) (GPCI W = physician work, GPCI PE = practice expense).

How Is the CF Calculated? Why Is the Calculation So Complex?

The CF is updated annually according to a complex formula set by statute. Every year, by use of the formula, the Centers for Medicare and Medicaid Services (CMS) must publish an estimated SGR and estimated CF applicable to Medicare payments for physician services for the following year, as well as the data underlying these estimates.

If the Formula Were Followed, What Would the CF Be for Next Year?

Under current law, the CF for 2014 would be similar to 2013, reduced by approximately 26.5% to $25.0069 (compared with the current $34.0230). This reduction would be effective January 1, 2014, unless Congress passes a legislative fix.

What Happens Next?

Annually, the Sustainable Growth Rate–mandated cuts in the CF have been overridden by Congress, usually through last-minute negotiations that cover numerous contentious issues. Many interested in health policy recognize the need for a reform of this process to improve clarity and remove uncertainty from the annual determination of the CF.

When will Medicare update the PFS?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2019.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will Medicare update payment policies?

This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022. This proposed rule proposes potentially misvalued codes and other policies affecting the calculation of payment rates. It also proposes to make certain revisions ...

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When is the 2021 Medicare PFS final rule?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

When will CMS accept comments?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: https://www.federalregister.gov/public-inspection.