Does Medicare have copay for doctor visits?

Mar 02, 2022 · A Medicare copayment is a fixed, out-of-pocket expense that you have to pay for each medical service or item — such as a prescription you receive if you have a Medicare Advantage plan or a Medicare prescription drug plan. Your Medicare plan pays the rest of the cost for the service. Copayments are different from coinsurance. If you have Original Medicare, …

How do Medicare copays and deductibles work?

Jan 20, 2022 · Even though it's called coinsurance, it operates like a copay. For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 61 to 90 require a coinsurance of $389 per day. Days 91 and beyond come with a $778 per day coinsurance for a total of 60 “lifetime reserve" days.

Does Medicare have copayments?

Jul 07, 2021 · A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and …

Does Medicaid pay primary insurance copays?

Nov 17, 2021 · Medicare copay. Many Medicare Advantage plans require that you pay a copay when you see a doctor. This is a fixed cost — and an alternative to Original Medicare’s 20 percent coinsurance. Premiums. As noted above, the average monthly premium for Medicare Advantage plans with drug coverage is $33.57 per month in 2021.

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Does Medicare cover out of pocket costs?

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs. Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay ...

What is a copay in Medicare?

A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in ...

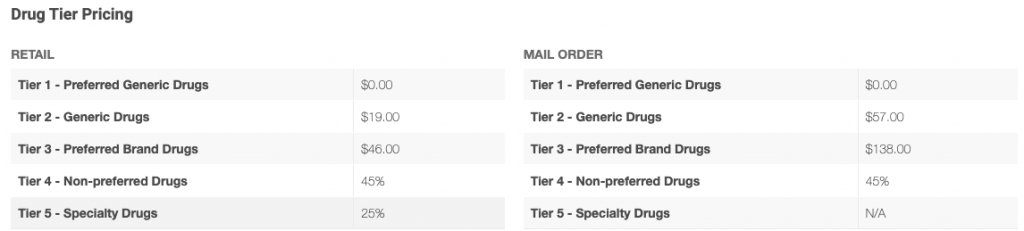

What is a Part D copay?

prescription drug copay or coinsurance. Part D plans use a formulary structure with different tiers for the medications they cover. The copay or coinsurance amount for your medication depends entirely on what tier it is in within your plan’s formulary.

What is Medicare for 65?

Cost. Eligibility. Enrollment. Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions. Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

How much is Medicare Part A 2021?

You’ll have the following costs for your Part A services in 2021: monthly premium, which varies from $0 up to $471. per benefits period deductible, which is $1,484. coinsurance for inpatient visits, which starts at $0 and increases with the length of the stay.

When is Medicare enrollment period?

If you miss your initial enrollment period or want to change or enroll in a different Medicare plan, here are the additional enrollment periods: General and Medicare Advantage enrollment: from January 1 to March 31.

How much is coinsurance for Medicare?

These coinsurance amounts generally take the place of copays you might otherwise owe for services under original Medicare and include: $0 to $742+ daily coinsurance for Part A, depending on the length of your hospital stay. 20 percent coinsurance of the Medicare-approved amount for services for Part B.

When is Medicare open enrollment?

General and Medicare Advantage enrollment: from January 1 to March 31. Open enrollment: from October 15 to December 7. Special enrollment: a number of months depending on your circumstances. The initial enrollment period is the time in which you can enroll into Medicare parts A and B.

What are the benefits of Medicare Advantage?

Many are likely drawn to the unique benefits of Medicare Advantage, as compared with Original Medicare: 1 Medicare Advantage plans may often include additional benefits for prescription drugs, dental care, and vision care. 2 The average premium for a Medicare Advantage plan that offers prescription drug coverage is $33.57 per month in 2021. 2 Some plans may not have a monthly premium, and some may even help pay you back for your Medicare Part B premium. 3 Medicare Advantage, unlike Original Medicare, comes with an out-of-pocket limit, which means your out-of-pocket spending will be capped. 4 While plans are offered by private insurers, you are still guaranteed the benefits of Original Medicare.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay . (if the plan has one). You pay your share and your plan pays its share for covered drugs. If you pay. coinsurance. An amount you may be required to pay as your share ...

What is coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). , these amounts may vary throughout the year due to changes in the drug’s total cost. The amount you pay will also depend on the. Groups of drugs that have a different cost for each group.

What is a copay?

A copayment, which people sometimes refer to as a copay, is a specific dollar amount that a person must pay directly to a healthcare provider at the time of receiving a service.

What is copayment for medical?

A copayment is a fixed cost that a person pays toward eligible healthcare claims once they have paid their deductible in full. If a person is eligible, they may receive help paying their out-of-pocket costs, and benefits are available through state or federal programs to help with medical expenses.

What is a deductible for Medicare?

A deductible is a set amount that a person must pay before their plan starts to cover expenses. A person must pay the plan deductible in full before coinsurance and copayments apply to eligible costs. Medicare Part A and Part B have deductibles. Other Medicare plan options may also have a deductible, but these can vary depending on ...

What is the maximum out of pocket limit for Medicare 2021?

The maximum out-of-pocket limit in 2021 is $7,550. After a person has paid this much in deductibles, copayments, and coinsurance, the plan pays 100% of the costs. Original Medicare has no out-of-pocket maximum.

What is Medicare Part A 2021?

Part A. Medicare Part A provides coverage for care at inpatient hospitals, skilled nursing facilities, and hospices. It also helps with some home healthcare services. In 2021, Part A has the following costs: Premium: Most people will not pay a premium for Part A. For those who do, this ranges from $259 to $471.

How much is the Part B premium for 2021?

The standard premium is $148.50 per month, but this amount could be higher depending on a person’s income.

What is the cost of Part D?

A person can expect to pay a copayment of no more than $3.70 for generic drugs and $9.20 for brand name drugs in 2021 , once they enter the catastrophic coverage stage of their plan.