One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

What is the difference between wages and Medicare wages?

You can expect to be taxed at the 1.45% rate if you fall under the following categories:

- For Single Taxpayers: The first $200,000 of your wages

- For Married Taxpayers Filing Jointly: The first $250,000 of your wages

- For Married Taxpayers Filing Separately: The first $125,00 of your wages

Why are Medicare wages higher than wages?

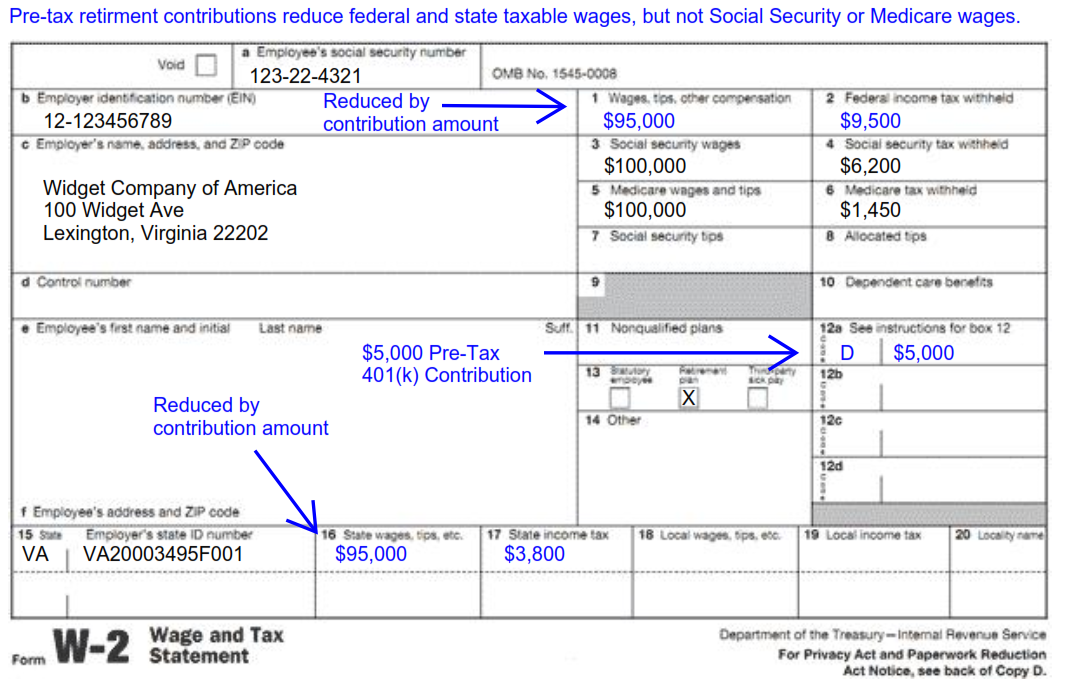

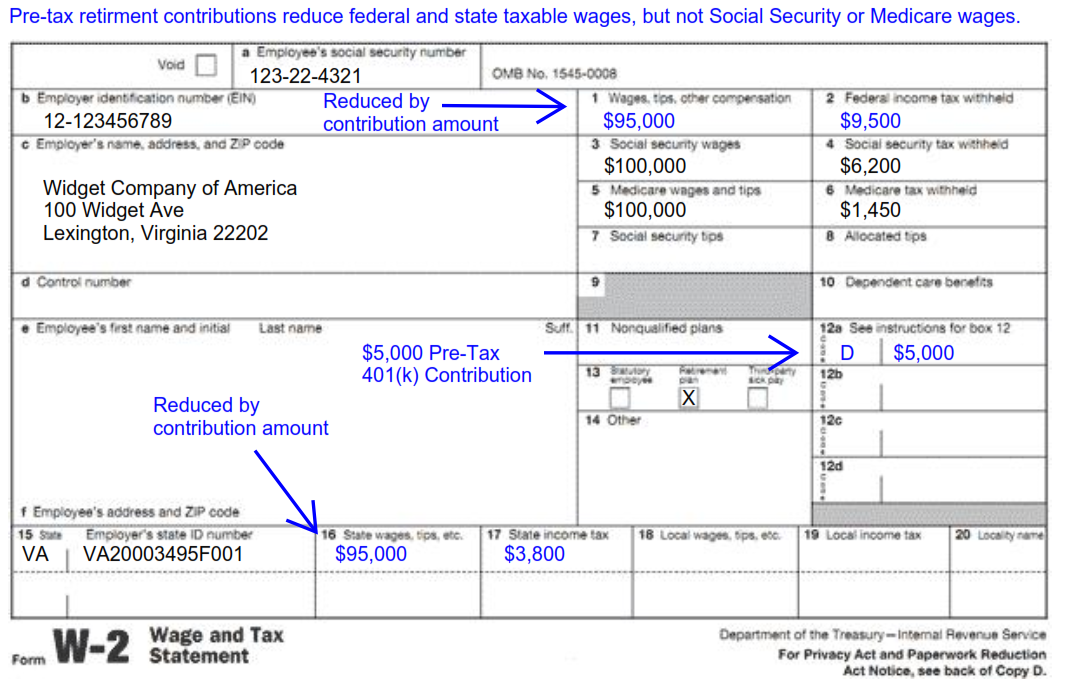

The most common reason why medicare wages are higher is due to 401(k) contributions (W2, Box 12, Code D) or other pre-tax retirement plan contributions. They are subject to medicare tax but not to federal or state income tax.

Can Medicare garnish wages from Social Security?

Under the law, Social Security funds are exempt, or protected, from garnishment and other actions taken by debt collectors. However, if your Social Security funds are not direct deposited into your bank account, or if you transfer the funds into another account after they are received, the protection is not automatic.

How to calculate Social Security wages?

Social Security calculators provided by other companies or non-profits ... Social Security benefit rate as long as you still paid Social Security taxes on your earnings. Employers withhold and pay Social Security taxes for covered wage earners, so workers ...

See more

Are Medicare and Social Security wages the same?

Social Security and Medicare taxes are very similar and use the same wage definition. Social Security is capped at $7,886.40 for 2017. There is no Medicare cap, and employers are required to withhold an additional Medicare Tax of 0.9% for wages over $200,000.

Why are Social Security wages higher than gross wages?

Your social security wages can be higher than your wages if you are making contributions to a 401k plan or have other items taken out of your check "pre-tax". You are paying social security tax on these items but not income tax.

Why are my Medicare wages higher than my salary?

How is that possible? Certain amounts that are taken out of your pay are not subject to federal income tax, so they are not included in box 1, but they are subject to Social Security and Medicare taxes, so they are included in boxes 3 and 5. A common example is contributions to a 401(k) plan.

Why are my Medicare wages lower than my regular wages?

Medicare wages are reduced by pre-tax deductions such as health/dental/vision insurances, parking and flex spending but not reduced by your contributions to a retirement plan (403b or 457.)

Are Medicare wages the same as gross wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

What makes up Social Security wages?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

What is the difference between Social Security wages and gross wages?

Gross income is the total of all compensation from which the amount of taxes and other withholdings are calculated. Social Security wages are based on the gross income and have specific inclusions (as listed above) and exclusions (as listed below).

Why are my wages different on my W-2?

Why is My W-2 Different from My Salary? The compensation may be different on a W-2 vs a final pay stub, but here's why. Your salary is a gross dollar amount earned before taxes and deductions. Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions.

Why is box 1 and 3 different on my W-2?

Some pre-tax deductions reduce your taxable income (box 1) and your social security income (box 3). Other pre-tax deductions only reduce your taxable income (box 1). If you have a deduction that only reduces your taxable income then the amounts in box 1 and box 3 will be different.

Do Social Security and Medicare tax count as federal withholding?

Social Security taxes will not reduce the amount of federal income taxes that you owe since they are separate. However, if you end up with excess Social Security taxes withheld, you'd get a refund on your tax return that you could put toward paying any federal income taxes due.

Why does my W-2 not have Social Security wages?

Social Security wages should be in box 3 and the Social Security Taxes withheld should be in box 4 of the W-2. Contact your employer for either an explanation of why there are no SS wages or taxes withheld or to get a corrected W-2.

Why is Box 1 and Box 16 different on my W-2?

If retirement contributions are exempt from state income tax, Boxes 1 and 16 may be the same. If contributions are subject to state income tax, Box 16 may be higher than Box 1. For example, Pennsylvania requires employees to pay state income tax on retirement contributions.