Under current regulations, a plan can choose to only count cost-sharing paid directly by the beneficiary toward the OOP limit, not cost-sharing paid by Medicaid. Even if a state Medicaid program has paid enough cost-sharing to reach the OOP limit for a dual-eligible member, a Medicare Advantage plan can continue to charge cost-sharing.

Full Answer

Does Medicare cost less than private insurance?

Typically, Medicare costs less than private insurance. However, if a person’s employer covers their premiums, this can offset those costs. People with dependents may prefer private insurance over Medicare. Medicare only covers an individual, whereas private insurance can include dependents and other family members on a single plan.

Does Medicaid have copay or cost sharing?

State Medicaid agencies have legal obligations to pay Medicare cost-sharing for most "dual eligibles" – Medicare beneficiaries who are also eligible for some level of Medicaid assistance. Further, most dual eligibles are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [1]

What are my Medicare cost sharing obligations?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

How are your Medicare costs calculated?

There are also options for supplemental coverage, notably:

- Medicare Supplement – Highly-regulated add-ons that pay your out-of-pocket Medicare costs

- Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C.

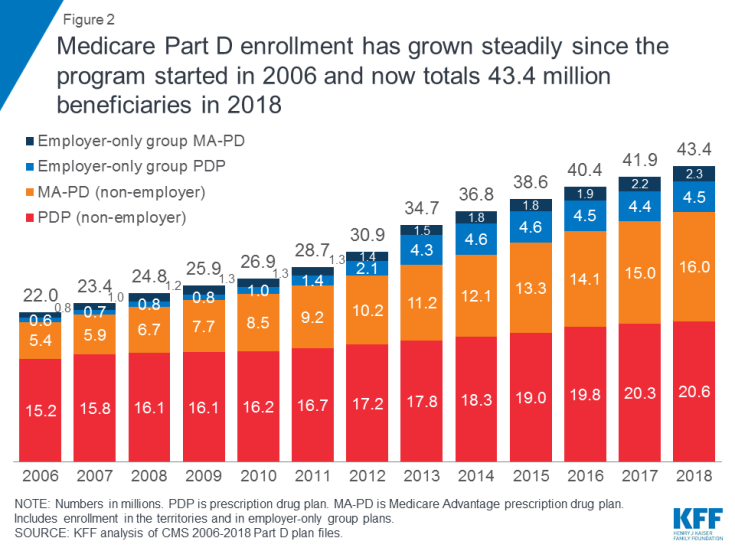

- Medicare Part D – Prescription drug coverage plans, introduced in 2006.

How Do Medicare Deductibles Work

A deductible is an out-of-pocket amount beneficiaries must pay before the policy starts to pay. Part A has a deductible per benefit period, and Part B has a deductible that changes each year. Part D also has an annual deductible you must pay before benefits kick in.

Medicare Advantage Out-Of-Pocket Costs

When you enroll in an Advantage plan, the carrier determines what the cost-sharing will be. So, instead of the 20% coinsurance, you have to pay under Medicare, it could be more.

Medigap Cost-Sharing Plans

Three Medigap plans involve cost-sharing. These plans are Plan K, Plan L, and Plan M. The cost-sharing helps keep the premiums for these plans lower.

Get Quote

Compare rates side by side with plans & carriers available in your area.

How much does Medicare pay for a physician visit?

For example, if Medicare allows $100 for a visit to a physician's office, Medicare will pay 80% of that amount, or $80. If the state Medicaid program pays only $70 for the same service, it would make no payment for that service delivered to a QMB. The authority (but not a requirement) for states to limit their QMB cost-sharing obligations ...

What is the law that states that Medicare is paid in full?

Two sections of the law require this result. The first is 42 U.S.C. § 1396a (n) (3) (A), which says that the amount paid by Medicare and the amount, if any, paid by the state shall be considered payment in full.

What is a QMB in Medicare?

Qualified Medicare Beneficiaries (QMBs) are people with Medicare who have incomes at or below 100% of the Federal Poverty Level , or a higher level set by their state, and very few resources. [1] . The QMB benefit is administered by State Medicaid programs. QMBs can be eligible for Medicare cost-sharing protections only, ...

Does Medicare have a cross-over billing agreement?

The MLN piece reminds providers that most states have "cross-over" billing agreements with Medicare whereby any Medicare claim for a person also receiving Medicaid is sent to the state for the state's share of payment.

Can you pay Medicare with QMB?

People with QMB are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [2] . All cost-sharing (premiums, deductibles, co-insurance and copayments) related to Parts A and B is excused, meaning that the individual has no liability . The state has responsibility for these payments for QMBs regardless ...

Can advocates work with states to increase the state's cost sharing payment to the full Medicare rate?

Advocates can work with their states to increase the state's cost-sharing payment to the full Medicare rate. Perhaps it is time for Congress to revisit the question of whether limited cost-sharing payments adversely impact beneficiaries.

Do states have to pay Medicare premiums?

States can, but are not required to, pay premiums for Medicare Advantage plans' basic and supplemental benefits; states do have responsibility for MA co-payments for Part A and B services. The State's responsibility, however, is limited.

What is cost sharing in Medicaid?

Cost Sharing. States have the option to charge premiums and to establish out of pocket spending (cost sharing) requirements for Medicaid enrollees. Out of pocket costs may include copayments, coinsurance, deductibles, and other similar charges.

Can you charge out of pocket for coinsurance?

Certain vulnerable groups, such as children and pregnant women, are exempt from most out of pocket costs and copayments and coinsurance cannot be charged for certain services.

Does Medicaid cover out of pocket charges?

Prescription Drugs. Medicaid rules give states the ability to use out of pocket charges to promote the most cost-effective use of prescription drugs. To encourage the use of lower-cost drugs, states may establish different copayments for generic versus brand-name drugs or for drugs included on a preferred drug list.

Can you get higher copayments for emergency services?

States have the option to impose higher copayments when people visit a hospital emergency department for non-emergency services . This copayment is limited to non-emergency services, as emergency services are exempted from all out of pocket charges. For people with incomes above 150% FPL, such copayments may be established up to the state's cost for the service, but certain conditions must be met.

Medicare Cost Sharing Definitions

Medicare cost sharing may seem more complex than other forms of insurance because Medicare has four different parts, and each one covers something different. Two of those parts are public (Parts A and B), and two are private (Parts C and D).

Medicare Part A Cost Sharing

Medicare Part A is hospital insurance and it covers inpatient procedures, hospice care, and skilled nursing facilities. Many Medicare eligibles don’t pay a monthly premium for Part A. If you don’t meet the “premium-free Part A” requirements, you may pay up to $458 per month in 2020.

Medicare Part B Cost Sharing

Medicare Part B is medical insurance, and it helps pay for outpatient medical services such as doctor’s appointments, emergency medical transportation, outpatient therapy, and durable medical equipment (DME).

Medicare Part C Cost Sharing

Medicare Advantage (MA or Part C) are private plans that can cover additional benefits such as prescription drugs, dental, hearing, vision, and fitness classes. You must be enrolled in both Part A and Part B before you can enroll in a MA plan.

Medicare Part D Cost Sharing

Medicare Part D is prescription drug coverage. You may have to pay a monthly premium, for which the average cost was $33.19 nationwide in 2019.

Medicare Supplement Cost Sharing

Medicare Supplement (Medigap) plans have a different cost sharing structure than MA plans. Medigap plans have eight standardized coverage levels*. In 2020 there are eight different coverage levels:

We Can Help You Navigate Medicare Cost Sharing

Cost sharing with Medicare may seem complicated, and a licensed agent with Medicare Plan Finder can help you determine what you need. Our agents are highly trained, and they can find the Medicare Advantage, Medicare Supplement, and/or Medicare Part D plans in your area.

Plan L Cost-Sharing

If your health is great, this option could be ideal for you. If you cover some of the costs, then, you get a lower monthly premium.

Plan K Cost-Sharing

This policy is very similar to Plan L, instead of 75 percent of coverage, you’ll get 50%. In exchange for a lower premium, of course.

Deductible Sharing with Plan M

Plan M is one of the top Medicare cost-sharing plans since Plan M only requires you to cost-share on the Part A deductible. They cover 50% and you cover the other half.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

What percentage of Medicare coinsurance is covered by Part B?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items. The Medicare-approved amount is a predetermined amount ...

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is the deductible for John's doctor appointment?

John’s doctor appointment is covered by Medicare Part B, and his doctor bills Medicare for $300. Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth ...

What is the most important thing to know about Medicare?

There are a number of words and terms related to the way Medicare works, and one of the most important ones to know is coinsurance.

Does Medicare Advantage include coinsurance?

Medicare Advantage plans typically include coinsurance. Many Medicare beneficiaries choose to get their benefits through a privately-sold Medicare Advantage plan (Medicare Part C), which provides the benefits of Original Medicare combined into one plan.