Why do I have to pay additional Medicare tax?

The Additional Medicare Tax helps to fund some elements of the Affordable Care Act. This includes the premium tax credit and other features. Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans.

What is Medicare employee addl tax in Quickbooks?

The Medicare Employee Addl Tax payroll item is programmed to begin withholding the additional 0.9% once an employee's Medicare wages (Medicare Employee payroll item) for the calendar year are over $200,000.Apr 28, 2021

What is the Medicare withholding tax?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.Jan 13, 2022

What is a Medicare surcharge?

Medicare surcharges are also called "Income-Related Monthly Adjustment Amounts" (IRMAA). The Social Security Administration determines your Medicare surcharges based on your modified adjusted gross income (MAGI) from two years ago.

How do I set up a Medicare employee additional tax in QuickBooks?

From the Employees menu in QuickBooks, choose Get Payroll Updates. 2. Open Payroll Setup and then close it in order to automatically set up the new Medicare Employee Addl Tax payroll tax item. From the Employees menu, select Payroll Setup.Oct 4, 2013

Do I have Medicare if I pay Medicare tax?

According to the Internal Revenue Service (IRS), taxes withheld from your pay help pay for Medicare and Social Security benefits. If you're self-employed, you generally still need to pay Medicare and Social Security taxes. Payroll taxes cover most of the Medicare program's costs, according to Social Security.

How do I know if Medicare is taxable?

What Are Medicare Taxes? The current Medicare tax rate is 1.45 percent of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45 percent. If you are self-employed, you have to pay the full 2.9 percent of your net income as the Medicare portion of your FICA taxes.

What is the Medicare tax limit for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax....2020 Social Security and Medicare Tax Withholding Rates and Limits.Tax2019 Limit2020 LimitMedicare liabilityNo limitNo limit3 more rows

What is the Medicare surcharge tax for 2021?

The additional Medicare tax rate is 0.9%. However, the additional 0.9% only applies to the income above the taxpayer's threshold limit. 9 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45%, and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

Does employer pay additional Medicare tax?

Employers are responsible for withholding and reporting the 0.9 percent Additional Medicare Tax, which became effective in 2013. If an employer fails to withhold the correct amount from wages it pays to an employee, the employer may be liable for the amount not withheld and subject to applicable penalties.Dec 13, 2013

How is Medicare surcharge calculated?

For most taxpayers the Medicare levy is 2% of their taxable income. The Medicare levy surcharge (MLS) is a separate levy from Medicare levy. It applies to taxpayers on a higher income who don't have private health cover.Jul 1, 2021

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

What happens if an employee's withholding is miscalculated?

If an employee's withholding is miscalculated and they are owed a refund, the employee must request the refund directly from the IRS. Don't attempt to give the employee a refund or adjust the employee's withholding on a miscalculation of federal income tax or FICA tax.

Is fringe benefit taxable?

Some wages and fringe benefits are taxable to the employee for income tax purposes , but some wages may not be taxable to the employee for Social Security and Medicare taxes, including the Additional Medicare Tax. You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to ...

Is there regular withholding for self employment?

There is no regular withholding for self-employment tax, so if you expect that your income might be above the levels above, you may need to increase your estimated tax payments to account for the additional Medicare tax. 2.

Do you have to exclude wages from Medicare?

You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to the Additional Medicare Tax as you work on payroll. IRS Publication 15-B Employer's Tax Guide to Fringe Benefits has a list of wages that are exempt from Social Security and Medicare taxes.

Does Medicare tax self employed?

The new Medicare tax also affects self-employed individuals who earn over a specific amount. If you are both an employee and self-employed, all sources of earned income (as opposed to investment income) are combined to reach the levels where the Additional Medicare Tax is applicable.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

How much did M receive in 2013?

M received $180,000 in wages through Nov. 30, 2013. On Dec. 1, 2013, M’s employer paid her a bonus of $50,000. M’s employer is required to withhold Additional Medicare Tax on $30,000 of the $50,000 bonus and may not withhold Additional Medicare Tax on the other $20,000.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

What is the income of A and B?

A and B live in a community property state and are married filing separate. A has $200,000 in wages and B has $100,000 in self employment income. A is liable for Additional Medicare Tax on $75,000, the amount by which A’s wages exceed the $125,000 threshold for married filing separate.

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

What is the responsibility of an employer for Medicare?

Employer Responsibilities. An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status. An employer must begin withholding Additional Medicare Tax in the pay period in which ...

What form do you need to request an additional amount of income tax withholding?

Some taxpayers may need to request that their employer withhold an additional amount of income tax withholding on Form W-4, Employee’s Withholding Certificate, or make estimated tax payments to account for their Additional Medicare Tax liability.

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

Is railroad retirement subject to Medicare?

All Medicare wages, railroad retirement (RRTA) compensation, and self-employment income subject to Medicare Tax are subject to Additional Medicare Tax, if paid in excess of the applicable threshold for the taxpayer's filing status. For more information on ...

What is Medicare tax?

The standard Medicare tax applies to all earned income, with no minimum income limit.

How much Medicare tax do self employed people pay?

A person who is self-employed will pay 2.9% standard Medicare tax, and an additional Medicare tax of 0.9%, for a total of 3.8%. Employers do not have to contribute any amounts through the additional Medicare tax. A person is liable for the additional Medicare tax after their total income goes above the threshold for their filing status.

How much Medicare tax is on 80,000?

They would be liable for the additional Medicare tax only on $80,000, which is the amount in excess of $250,000. The total Medicare tax payment would be 1.45% or $3,625 on the $250,000, plus 2.35% or $1,880 on the $80,000, totalling $5,505 in Medicare taxes for the year.

What is the threshold for Medicare 2020?

The 2020 tax year thresholds are as follows: Status. Tax threshold. single , head of household, or a qualifying widow (er) $200,000. married tax filers, filing jointly.

How much is Medicare for married couples?

The limit is $250,000 for married couples. This article explains the Medicare standard tax and the Medicare additional tax. It also looks at who pays the additional tax, how the IRS calculates it, and how the government uses the money.

What is the donut hole in Medicare?

With the Affordable Care Act, a person enrolled in Medicare no longer had to worry about the Medicare Part D coverage gap, also known as the donut hole. The Affordable Care Act also expanded Medicare Part B preventive services to include: abdominal aortic aneurysm and cardiovascular disease screenings.

Do higher earners have to pay more for Medicare?

In 2013, the IRS announced that some higher-earning taxpayers would have to pay more money into Medicare through the additional Medicare tax, as part of the Affordable Care Act.

What is Medicare additional tax?

The Additional Medicare Tax is one of the U.S. government's payroll withholding taxes that is paid solely by employees and the self-employed. In other words, the employer does not match the Additional Medicare Tax.

How much is Sam's Medicare tax?

In Sam's case, the Additional Medicare Tax is 0.9% of $100,000 (Sam's gross pay of $300,000 minus $200,000) which amounts to $900. The $900 is withheld from Sam's gross pay and is remitted by Jones Corporation to the U.S. Treasury.

Does Jones Corporation pay Medicare taxes?

Treasury. The Additional Medicare Tax is paid only by Sam through payroll withholding. Jones Corporation does not match the Additional Medicare Tax and remits the $900 that was withheld ...

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

How to calculate Medicare tax?

Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What is Medicare surtax?

The Net Investment Income Tax, also referred to as the "Unearned Income Medicare Contribution Tax," is another surtax that's imposed at 3.8% when investment income, combined with other income, surpasses the same thresholds that apply to the Additional Medicare Tax. 6

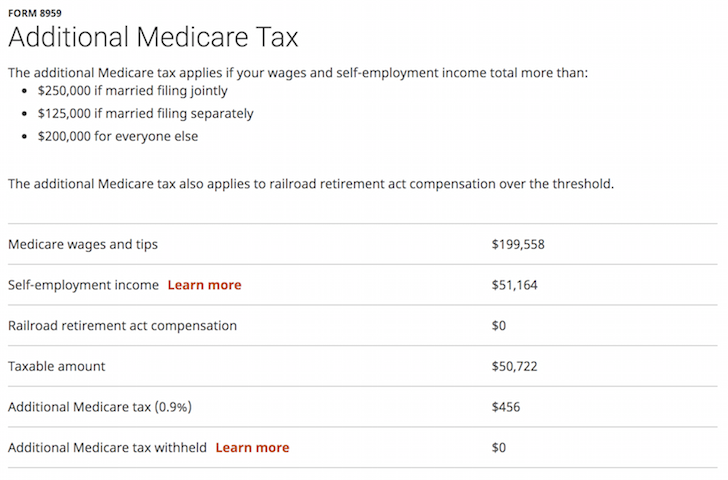

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

How much does Barney and Betty owe in Medicare?

Barney earned $75,000 in Medicare wages, and Betty earned $200,000 in Medicare wages, so their combined total wages are $275,000. Barney and Betty will owe the Additional Medicare Tax on the amount by which their combined wages exceed $250,000, the threshold amount for married couples filing jointly.

What is the Medicare tax threshold?

The Additional Medicare Tax applies when a taxpayer's wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

How much Medicare does Albert owe?

His excess amount is $25,000, or $225,000 less $200,000. Albert's Additional Medicare Tax is therefore $225, or 0.9% of $25,000.

Is the Additional Medicare Tax still in effect?

Yes. The Additional Medicare Tax remains in place for the upcoming calendar year.

What steps should I take once I have the Payroll Update?

Once you have the latest payroll update, QuickBooks will automatically have the item entered for your employees affected.

Where can I get more information from the IRS about the Additional Medicare Tax requirements?

Go to the IRS Questions and Answers for the Additional Medicare Tax web site. The IRS provides Basic FAQs, Individual FAQs, and Employer and Payroll Service Provider FAQs.

Will employees have to report Additional Medicare Tax when they file their personal federal income tax return?

Yes. Individuals will report Additional Medicare Tax on a new form developed by the IRS. Form 8959, Additional Medicare Tax, will need to be completed and attached to their income tax return.

When you use payroll setup wizard to add or edit employees, do you mark as subject to Medicare?

When you use the Payroll Setup wizard to add or edit employees, employees you mark as Subject to Medicare are automatically marked as subject to the Medicare Employee Addl Tax on the federal tax information page.

What is the Medicare tax rate for 2013?

Beginning in tax year 2013, a new Additional Medicare Tax (a provision of the Affordable Care Act) of 0.9 percent applies to individuals’ Medicare taxable wages, compensation, or self-employment income that exceeds certain threshold amounts based on their filing

Does QuickBooks have Medicare payroll tax?

For QuickBooks to properly handle the Additional Medicare Tax calculations, withholding, and payroll tax form reporting, you must first set up the Medicare Employee Addl Tax payroll tax item for your company.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

/gettyimages-1168998676-2048x2048-1f19c25d2aea4be782970eafc4d1e71c.jpg)