Pennsylvania Medigap Plans by Carrier

| Insurance Carrier | Plan F | Plan G | Plan N |

| AARP | $127.65 | $108.62 | $85.91 |

| American Republic | $190.86 | N/A | N/A |

| American Retirement Life | $165.96 | $127.58 | $91.22 |

| Americo Life | $128.69 | $105.41 | $86.65 |

Full Answer

What is the best and cheapest Medicare supplement insurance?

5 rows · Sep 20, 2021 · The Pennsylvania Insurance Department oversees Medicare Advantage and Medicare Supplement ...

What is the best Medicare Advantage plan in Pennsylvania?

Jul 12, 2020 · What is the Best Medicare Supplement Plan in Pennsylvania? This article will address questions such as when do i enroll in a Medicare Supplement Plan (also called Medigap) in PA, which Medigap plan is best in PA, and how much does a Medicare Supplement Plan cost in Pennsylvania. We are a retirement planning specialist.

What Medicare supplement company is best?

37 rows · Jan 06, 2022 · This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you ...

What are the Medicare Advantage plans in Pennsylvania?

Jan 04, 2022 · If you can afford Medigap Plan F Medicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services. or G, then keep your Original Medicare and add one of these …

What is the most comprehensive Medicare Supplement plan?

Overview. Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

How much does Medicare Part G cost?

Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000. Some insurance companies offer extra perks and benefits for vision and dental care with Medicare Plan G.Sep 22, 2021

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

What is the monthly premium for plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What percent of seniors choose Medicare Advantage?

Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation.Nov 15, 2021

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Is Plan G going away?

Plan F covers the Plan B deductible, and Plan G does not, but Plan F was phased out as of Jan. 1, 2020. Plan F is now available only to those who were eligible for Medicare before that date. Plan G is a popular replacement because both offer identical benefits aside from the Plan B deductible coverage.

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

What is the plan g deductible for 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How expensive are Medicare Supplements in Pennsylvania?

It all depends. Your age, gender, zip code, use of tobacco, and the exact plan you choose all need to be factored in. You can take advantage of our...

What insurance companies offer Medigap policies in Pennsylvania?

You have many options in Pennsylvania. Here are some of the best: United Commercial TravelersThriventContinental LifeAARPMassMutual See the complet...

When should I apply for a Medigap plan in Pennsylvania?

As a general rule, you can apply for a Medigap plan anytime, there isn't a specific open enrollment period. However, if you want to protect your gu...

What is the best Medicare Advantage plan in Pennsylvania?

Medicare Advantage plans vary from County to County in Pennsylvania. This is due to the local nature of healthcare provider networks. If you enter...

Which Pennsylvania Medicare Advantage plans include Part D coverage?

One of the best features of Pennsylvania Medicare Advantage plans is the extra benefits, including prescription drug coverage. Most plans include P...

What is the downside to Medicare Advantage plans?

While not for everyone, Medicare Advantage plans have their benefits. The best way to understand these plans is to evaluate your health and financi...

Find affordable Medicare Supplement plans

Shopping for the best Pennsylvania Medicare Supplement plans should be simple. In this guide, we’ll walk you through how to compare plans and find the best value when shopping for Pennsylvania Medigap plans.

Compare Pennsylvania Medicare Supplements

It is important to know that even though the coverage for Pennsylvania Medicare Supplement Plans are the same, the rates are not. You need to compare the plan letters from company to company. For example, compare Medicare Supplement Plan G from multiple companies.

REMEDIGAP can help

Our service is free. We help Pennsylvania Medicare Insurance beneficiaries who are new to Medicare or already using Medicare.

Pennsylvania Medigap Locations

Are you wondering if I can help you lower your Medicare Supplement costs? I can! Below are the cities in Pennsylvania that I serve. Click here if you’re looking for other Medicare Supplement states.

What is the most popular Medicare Supplement Plan in Pennsylvania?

Medicare Supplement Plan F is the most popular Medigap plan available in Pennsylvania. Here are the 10 best Plan F policies available in Pennsylvania based on our reviews (click for details):

How much does Medicare cost in Pennsylvania?

Basic plans start at less than $20 per month in most places.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N is similar to Plan D, but covers Medicare Part B coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... costs differently. Due to its lower cost and good coverage, it's catching the attention of many Pennsylvania seniors.

Is dental restoration covered by Medicare?

We all need routine dental care and dental restoration work as we age, but it's not covered by Original Medicare or a Medigap plan. For coverage, you'll need a stand-alone Pennsylvania dental insurance policy.

What is Medicaid in Pennsylvania?

Medicaid is a public health insurance program that provides health care coverage to low-income families and individuals in the United States.... updates their Medicare supplement cost information annually. We show estimated monthly premiums for all Medicare supplement insurance plans in Pennsylvania.

Is there an open enrollment period for Medicare Supplement?

Unlike Medicare Advantage, there isn't an annual open enrollment period for Medicare Supplement plans. But, in many areas, you only have one chance to apply for a Pennsylvania Medigap plan without having to answer any health questions.

What is a Pennsylvania health insurance program?

The State Health Insurance Assistance Programs (SHIPs) provide free, one-on-one insurance counseling and assistance to Medicare beneficiaries, their families and caregivers. The Pennsylvania SHIP is a grant-funded project of the federal U.S. Department of Health and Human Services (HHS).

What is Medicare Supplemental Plan N?

Medicare Supplemental Plan N is one of the ten standardized Medigap plans. Although it is one of the newest plans available, Medicare Plan N is quickly becoming a favorite with Baby Boomers aging into their...

What is Medicare Part D?

If you want prescription coverage and have Original Medicare you must purchase a Medicare Part D. Medicare Part D is Medicare's prescription drug plan program. Plans are offered by private insurance companies and cover outpatient prescriptions.... plan. However, most Medicare Advantage plans include a Pennsylvania Medicare Part D plan.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... .

Does Medicare Advantage have copays?

In the Medicare Advantage program, the government allows plans to set their own copays and coinsurance for each healthcare service offered . This makes comparing plans difficult, at best. However, in the Original Medicare system deductibles.

What is Medicaid insurance?

Medicaid is a public health insurance program that provides health care coverage to low-income families and individuals in the United States. ... (dual eligible), for those with retiree healthcare benefits, and for extremely healthy, active seniors. Similarly, traditional Medicare, plus Medicare supplement insurance.

Is Medicare Advantage for everyone?

More than 20% of all Medicare beneficiaries choose enrollment in a Medicare Advantage plan. But, it's not for everyone. Before you enroll, learn the disadvantages of these plans if you are a senior in Pennsylvania.

What is Medigap Plan F?

Medigap plan F in Pennsylvania the most comprehensive suite of benefits and of course usually costs the most. Still, it has held first place for a long time as the most common choice.

Is Medicare Supplement Plan N in Pennsylvania?

Medicare Supplement plan N in Pennsylvania is also rising in popularity. You can enjoy cheaper premiums if you are will to accept more cost-sharing. You will have to pay copays for some doctors or ER visits. Medicare Part B excess charges will not be covered when you see providers who charge more than the federal Medicare program allows.

Does Medicare Part B pay for Medigap Plan G?

Medigap plan G in Pennsylvania is rising in popularity because the only thing it won’t pay for is the Medicare Part B deductible. Typically, the premium difference between this plan and Plan F more than make up the difference.

What is Medicare Supplement?

Medicare Supplement insurance plans, also known as Medigap, refer to standardized policies that address out-of-pocket costs. As its name implies, Medigap policies close certain gaps in Original Medicare benefits. They also contain select benefit provisions excluded from Original Medicare.

What is Medicare Plan F?

Best Comprehensive Coverage: Medicare Plan F. Covers your Medicare Part A and B deductibles. Comprehensive coverage includes coinsurance, copayments, excess charges, and most other out-of-pocket costs. Only open to beneficiaries with Medicare Part B eligibility and an effective date prior to January 1, 2020. 2.

How does Medigap work?

The following points sum up how Medigap policies work: Medicare beneficiaries sign up for Medigap policies and pay monthly premiums. Original Medicare pays for all eligible expenses when medical care is obtained.

When does the open enrollment period end?

That period starts the first day of the month you turn 65 and enroll in Original Medicare. It ends six months later. During the Open Enrollment Period, you have guaranteed issue rights that prevent the Medicare insurance company from denying your application or submitting you to medical underwriting.

Does Pennsylvania have Medicare Supplement?

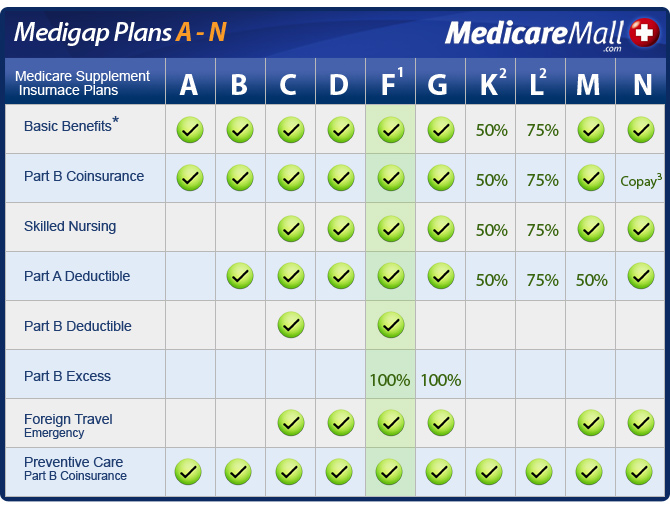

There are 10 Medicare Supplement Plans in Pennsylvania to choose from. Medicare Supplement plans do not use a network, go wherever Original Medicare is excepted. Once you are eligible for Medicare, you will discover that Original Medicare benefits do not cover everything, but Medicare Supplement plans in Pennsylvania can be your solution.

How many Medicare beneficiaries are there in Pennsylvania?

Medicare Supplement Plans in Pennsylvania. There are over 2.6 million Medicare beneficiaries in Pennsylvania. Of them all, over 660,000 are enrolled in a Medigap plan. It’s important to know the difference between all of your Medicare options. If you make the wrong choice now, it could negatively impact you for the rest of your life.

What is the difference between Plan N and Plan G?

The only other difference between Plan N and Plan G is that Plan N doesn’t cover excess charges. The good news is, Pennsylvania does not allow excess charges.

Does Pennsylvania have Medicare Advantage?

Some Medicare Advantage Plans in Pennsylvania come with prescription drug coverage. It’s also crucial to understand the total out of pocket costs with these types of drug plans. Around 41% of Pennsylvania residents that are eligible for Medicare enroll in a Medicare Advantage plan.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Medicare changing?

However, Medicare is changing because of MACRA. Any new beneficiaries won’t be eligible for Plan F. The new top plan is Plan G, followed by Plan N. Plan G covers everything minus the Part B deductible.

Does Medicare require a disclosure?

Physicians that accept Medicare must sign a disclosure that prohibits them from charging beneficiaries’ excess charges. So you don’t have to worry about which plans allow excess charges and which don’t.

Is Medicare Advantage cheaper than Medigap?

It’s essential to understand the pros & cons of these plans before you enroll. Yes, the premiums are cheaper.

What is Medicare Supplement Insurance?

Medicare supplement insurance is private insurance that fills in the gaps left by Medicare. For instance, when you have a hospital or doctor bill, Medicare pays its approved amount first, then the supplemental insurance pays other costs, such as deductibles and copays.

Does Medicare Supplement include dental insurance?

However, the premium you pay for that plan may differ from one company to another. It is important to note that most Medicare supplement plans do not include dental or vision coverage. An alternative to Original Medicare and Medicare supplement insurance is Medicare Part C, or Medicare Advantage.

What is PSERS 401(a)?

PSERS is a defined benefit plan under Section 401 (a) of the IRS code. Assets have grown to more than $50 billion, which provides public school employees a safe retirement option. Headquartered in Harrisburg, reporting units include 500 school districts, 64 technology schools, 163 charter schools, and 18 universities and community colleges.

What is Tier 1 drug?

Tier 1 generally consists of the least expensive (and often generic) drugs.

What is Part B insurance?

Part B covers medically necessary services and supplies. Outpatient care, preventative expenses, and the cost of an ambulance may be part of these benefits. If you delay the Part B enrollment, you may have to permanently pay a higher cost. This could result in thousands of dollars of out-of-pocket expenses.

How long is the OEP?

The six-month OEP (Open Enrollment Period) is provided for all eligible persons. There are state and federal laws that must be followed on every plan. Occasionally, legislative changes are introduced that can impact the price of your plan, benefits, and eligibility.

Does UnitedHealthcare have AARP?

Yes. For example, in most areas, Plans A, B, C, F, K, L, and N are available. A is one of the least expensive options, although it may not be the most cost-effective solution in many situations. UnitedHealthcare underwrites all AARP plans.