Why are Medicare Advantage plans bad?

What is the giveback benefit? The giveback benefit is officially the Part B premium reduction. This benefit is making a big splash this year, but it first appeared in 2003. A Federal regulation...

What is Medicare Advantage plan?

Sep 20, 2021 · Updated on January 27, 2022. The Medicare Part B give back is a benefit specific to some Medicare Advantage Plans. This benefit covers up to the entire Medicare Part B premium amount for the policyholder. The give back benefit can be a great way for beneficiaries to save, as the premium is deducted from their Social Security checks each month.

What is Medicare Advantage?

Sep 16, 2021 · The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost ($148.50 in 2021).

What is the Medicare Part B premium Giveback?

The Medicare give back benefit is a way to save money on your Medicare Part B monthly premium. Here are a few facts about accessing these savings. If …

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Is the Medicare giveback rebate legitimate?

This benefit is not an official Medicare program, but rather a colloquial name for a Medicare Part B premium reduction included in some Medicare Advantage plans. Whether you receive this reduction depends on the conditions of the plan that you choose and a few other factors.

What is the Medicare Part B giveback benefit?

Medicare Part B Give Back plans are health plans offered by private insurance companies rather than Medicare. Like other Medicare Advantage plans, beneficiaries enjoy Original Medicare Part A and Part B coverage benefits and usually some extra perks.Jan 20, 2022

What is the Social Security giveback benefit?

The giveback rebate can be used by people in either scenario: If you're receiving Social Security retirement benefits and you enroll in an Advantage plan with a giveback rebate, the amount that's deducted from your check to cover the cost of Part B will be lower.Dec 1, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise?

In order for a 5.9% increase to result in an extra $200 per month in benefits, you would have needed to have received at least $3,389 per month in 2021. The maximum benefit for someone who'd retired at age 70 in 2021 was $3,895.Jan 6, 2022

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.Jan 20, 2022

Who qualifies for Medicare premium refund?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What is a Part B giveback?

What is the Medicare Part B Giveback Benefit? The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium.Sep 16, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Medicare pay for Part B?

Do Medigap plans offer a Part B premium reduction? No, Medigap plans don’t cover Part B premiums because you need Part B to pay its portion of the claim.

You Need to Be Enrolled in a Medicare Advantage Plan

According to the official U.S. government website for Medicare, some Medicare Advantage plans cover part or all of your Medicare Part B monthly premium. In order to enroll in a Medicare Advantage plan, you need to be enrolled in or eligible for both Medicare Part A and B.

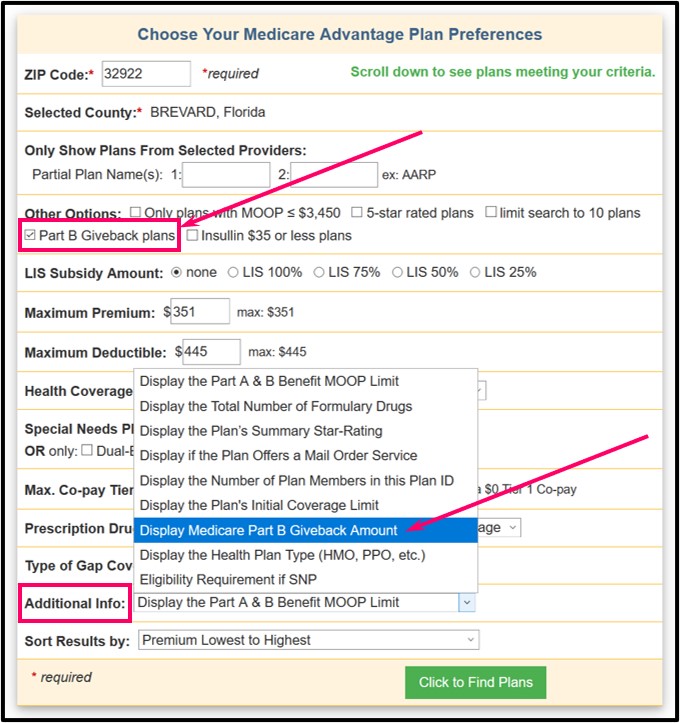

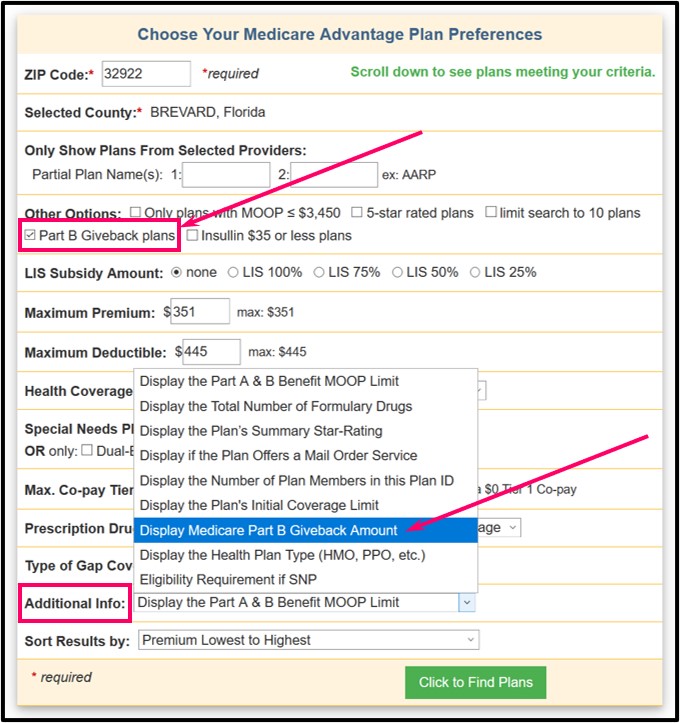

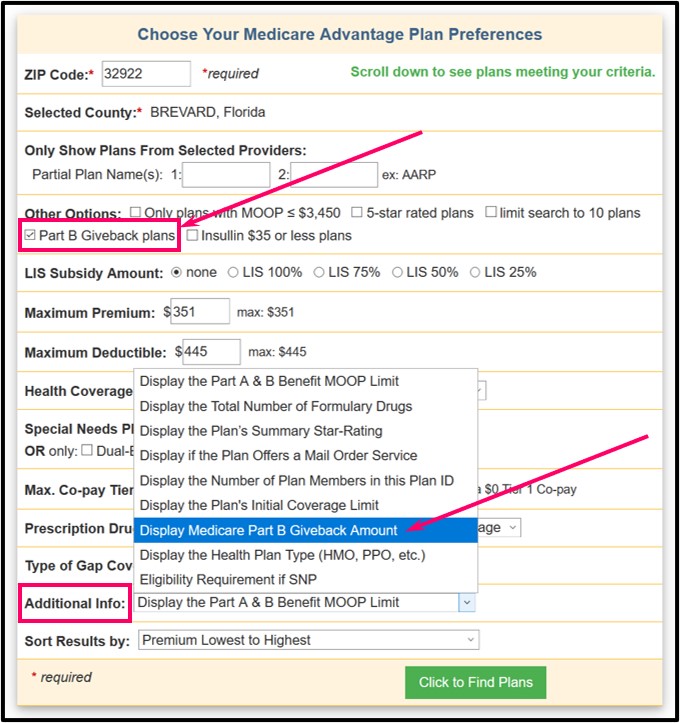

Location Is Key

According to the official U.S. government website for Medicare, the Medicare Advantage plans that are available to you differ according to your zip code. This is because Medicare Advantage plans are offered by private insurance companies who determine the specific service areas of their plans.

Your Plan Could Change Its Premiums

The official U.S. government website for Medicare reports that, even though private insurers must follow Medicare's rules for coverage in their Medicare Advantage plans, they each individually set the fees they charge for premiums, deductibles, and services.

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

How much is Medicare giveback?

In some cases, the giveback may be as low as $10, while in others it may be the entire premium. Generally, it falls somewhere between $20 and $100. You will occasionally see above $100.

How much is Medicare Part B 2021?

In 2021, the standard monthly Part B premium cost is $148.50. Most people have this premium taken directly out of their Social Security check each month. The carrier that offers ...

Does Medicare Advantage cover Part B?

The carrier that offers the Medicare Advantage plan has notified CMS and the SSA that they’ll be covering all or a portion of the Part B premium.

Does Medicare Part B give back?

This makes the Medicare Part B Premium Giveback yet another way that Medicare can help make your health care available and affordable! Just like you, your health is one of a kind. What works for one person may not for another, so the information in these articles should not take the place of an expert opinion.

How long does it take for Social Security to kick in?

It can take a few months for the benefit to kick in once you’ve enrolled in a plan with the giveback, but this will be credited to you. If it takes two months for the benefit to begin, you’ll receive two months of giveback on your first Social Security check with the benefit.

Is Medicare Part B affordable?

Medicare prides itself on being one of the best, affordable health care options for seniors. What’s even better is that depending on the type of Medicare plan you choose, there’s a way you may be able to save even more. What we’re referencing is the Medicare Part B Premium Giveback, and it’s making certain Medicare Advantage plans are even more ...

What Is the Medicare Part B Premium Giveback?

A Part B Premium Giveback is the carrier’s coverage of a designated portion of an enrollee’s Part B premium. The carrier notifies the Centers for Medicare & Medicaid Services (CMS) and Social Security Administration of this agreement to take on the cost of the specified amount.

Who Is Eligible for the Giveback?

Beneficiaries who pay their own Part B premium are eligible for the Giveback. Meaning, beneficiaries cannot receive Medicaid or any other assistance from a health program that could potentially pay their Part B premium.

How Do Beneficiaries Receive the Funds?

The Part B Giveback is credited monthly on the beneficiaries’ Social Security check.