Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

Full Answer

Is Medicare better than insurance?

When comparing coverages between Original Medicare and private health Insurance, private insurance wins. You can build a product with Medicare that is as good if not better than private insurance by adding options such as Medicare Advantage or Medicare Supplement products.

Is Medicare the same as health insurance?

You've probably noticed that Medicare is somewhat different from health insurance plans you've had before. Before Medicare, your plan likely included medical and prescription coverage. And if you had health insurance through work, you probably had dental and vision coverage, too.

Which is better Medicare or Medicaid?

Medicaid can potentially pay for a nursing home and cover certain services pending financial eligibility and whether the service is deemed medically necessary. Unlike Medicare, Medicaid can pay for long-term stays at a nursing home facility and provide room and board for older adults.

Does Medicare count as health insurance?

Medicare is Health Insurance but it does not cover all the bills. In addition to Medicare you will need a Part D - prescription plan. If you are bout to go on Medicare now is the time to look at Medicare Supplements and Medicare Advantage Plans.

What is the difference between health insurance and Medicare?

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents.

What are the 3 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the two types of Medicare?

There are two types of Medicare: Original Medicare and Medicare Advantage. Here's how they differ. Original Medicare provides more choices of plans. You choose the doctors, hospitals, and healthcare providers and pay your own deductibles and coinsurance (the amount you pay after meeting your deductible).

Is Medicare only individual?

You might not know that Medicare only offers individual coverage. Unlike health insurance plans before age 65, there is no family coverage plan with Medicare. That means your spouse or partner won't be covered by your Medicare coverage; they have to enroll on their own when they become eligible for Medicare.

What kind of insurance is Medicare?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What is considered Medicare insurance?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Does everyone get Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What are the disadvantages of Medicare?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Do I have to pay for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare and Medicaid the same?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

What is the difference between Medicare and private insurance?

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents. Not only does Medicare provide many coverage combinations to choose from, ...

How much higher is Medicare compared to private insurance?

However, according to a 2020 KFF study, private insurance payment rates were 1.6-2.5 times higher than Medicare rates for inpatient hospital services. 5.

What is Medicare Supplement?

Medicare Supplement plans are designed to cover the out-of-pocket costs left over from Original Medicare. For example, these plans can cover coinsurance amounts, copays, or deductibles. Original Medicare + Medicare Supplement + Prescription Drug.

What happens if you delay Medicare for four years?

For example, if you delayed enrolling in Medicare for four years, you’ll have to pay a higher premium for eight years. Medicare Part B. The Part B penalty is a lifelong consequence to delaying your Medicare coverage. This late-enrollment penalty can increase your premiums by 10% for each year you delayed coverage. 10.

How much is Medicare Part A deductible?

The Medicare Part A deductible is $1,484. The Medicare Part B deductible is $203. 4. On average, an employer insurance plan will have an annual deductible of $1,400. 6. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

How much is the deductible for bronze health insurance?

It is best to use your plan information to make comparisons. On average, a bronze-level health insurance plan will have an annual medical deductible of $1,730. 7. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

Which is better: Medicare or Original?

Medicare is the front-runner when it comes to networks. If you don’t want to stick to a limited number of doctors or hospitals, Original Medicare is likely your best option. With Original Medicare , you can go to any provider who accepts the national program.

What are the different types of healthcare insurance?

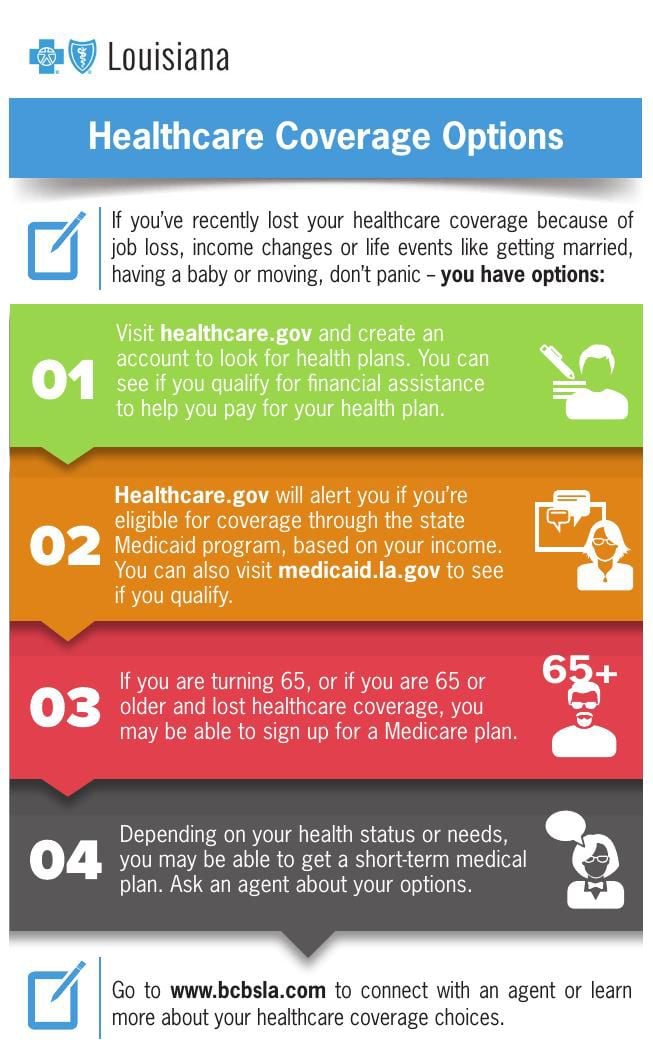

If you purchase individual insurance, you can also access the federal Healthcare Marketplace. There are four tiers of coverage within the Healthcare Marketplace: 1 Bronze Plans: Cover 60% of healthcare costs. 2 Silver Plans: Cover 70% of costs. 3 Gold Plans: Cover 80% of costs. 4 Platinum Plans: latcosts.

What is private insurance?

Private insurance is offered by health insurance companies. You can access private insurance through individual or group plans. Many employers offer health coverage as part of their benefit. When health insurance is offered through an employer, the employer will generally pay a portion or all of the premium.

What is Medicare Supplemental Insurance?

Medigap: These are Medicare supplement policies offered by private insurance companies to cover gaps in coverage and out-of-pocket costs. Medicare Supplemental insurance is not part of Original Medicare, but isregulated by Medicare. Medicare Parts A and B do not have a max on out-of-pocket costs. This is something to consider as you evaluate ...

How much is Medicare deductible for 2021?

Medicare has a sizable deductible anytime you are admitted into the hospital. In 2021, the deductible is $1,484. This tends to increase each year. Hospital stays can be expensive over time. For days 1-60, there is $0 coinsurance. You will pay the deductible. For days 61-90, there is a $371 co-insurance per day.

What happens if you apply for Medicare at any time?

If you apply at any time outside the window, there may be a lapse in coverage and penalties. If you are concerned about potential gaps in coverage between Medicare and private plans, Medicare has established options: Medicare Supplement plans and Medicare Advantage plans.

How much is Part B insurance in 2021?

You can defer signing up for Part B if you are still working and have insurance through your job or spouse’s health plan. The monthly Part B premium in 2021 is $148.50, but can be higher if your income is over $87,000. You are also subject to an annual deductible, which is $203 for 2021.

What is Plan A?

Plan A is the most basic plan. All other plans build off this coverage. Plan A covers Part A Medicare co-insurance, including an extra 365 days of hospital costs.Part B 20% co-insurance is covered, along with three pints of blood and Part A hospice care.

What age does Medicare cover?

Original Medicare is a federally funded health program that can cover any adult over the age of 65 as well as some adults with disabilities, such as end-stage renal disease.

How much will Medicare Part B premium increase?

If you’re choosing between enrolling in Medicare Part B versus private insurance, remember that delaying your Part B enrollment can leave you with up to a 10% increase in your premium when you do decide to enroll.

Can I stay on my spouse's insurance?

The fact is, it depends on how good your spouse’s insurance is . However, if you do qualify for Medicare, Part A (the part that covers hospital costs) has a $0 premium for anyone who has worked and paid Medicare taxes for at least ten years. If you haven’t worked that long but your spouse has, you might still qualify. If that’s the case, there’s no reason not to go ahead and enroll in Medicare Part A as soon as you become eligible.

Is it hard to compare Medicare vs employer?

It’s hard to even compare Medicare vs. employer health plans because the only thing they have in common is that they provide health insurance. If you’re turning 65 or otherwise preparing to make the switch from your employer plan to Medicare, you should know the pros and cons of each option.

Can I get medicaid if I have low income?

Each state has slightly different rules and each state has its own funding. The program can cover any person of any age with low income (according to the Federal Poverty Level and with some adjustments in each state). Most Medicaid beneficiaries will have either no or very small premiums. If you have a low monthly income AND are over 65, you may qualify for both Medicaid and Medicare! In that case, you can get what is called a “ Dual-Eligible Special Needs Plan ,” which is low-cost and tailored to your needs.

Can I get health insurance through my employer?

You can purchase health insurance through your employer, as long as it meets the coverage limits set by the federal government. If you’re retiring but aren’t eligible for Medicare yet, you can use COBRA to hold you over. COBRA allows you to continue receiving your employer coverage for a short period of time (but your employer likely won’t help you pay for it except for in some unique cases).

Is Medicare good for spouse?

The good news about Medicare is that as long as you or your spouse have worked and paid Medicare taxes for a certain number of years, your Part A Medicare costs will be low.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What are the factors that affect the cost of private insurance?

Other factors affecting the cost of private insurance include: the age of the person. where they live. the benefits of the plan. the out-of-pocket expenses. Generally, private insurance costs more than Medicare. Most people qualify for a $0 premium on Medicare Part A.

What is Medicare insurance?

Medicare insurance is a program provided by the federal government to seniors age 65 and older. Qualified individuals who are disabled or have end-stage renal disease (ESRD) may also obtain Medicare coverage. There are four parts to Medicare: Part A, Part B, Part C, and Part D:

How does group health insurance work?

This is made possible through an agreement between your employer and an insurance company that handles group plans. Because the group plan provides insurance for a group of individuals, a discount is usually granted. Employers that provide group insurance usually pay a portion of or all of the premiums. Employees are responsible for paying the remainder of their premium and the premium amount due is usually taken off the top of their payroll check each pay period.

Is Medicaid a federal program?

Medicaid insurance is provided through a federal-state program with each state having its own rules concerning covered expenses and eligibility. Medicaid is available to those with a limited income, pregnant women and their newborn child, and to those who are blind or disabled. Children may also be covered based on certain terms even if the parent does not qualify. You can check with your state's Medicaid office to find out the requirements.

What is an individual health plan?

Individual Plan: Individual health plans must charge the same premium to all beneficiaries throughout a given region / area. Employer Group Waiver Plan: CMS waives the uniform premium requirement for EGWPs, meaning that Group MAOs can vary premium amounts by class of retiree.

What is failure to pay Medicare?

Failure to Pay. Individual Plan: If the individual is paying the premium directly, you must follow the traditional rules for Medicare non-payment. Employer Group Waiver Plan: If the employer group is paying the premium, there are no particular disenrollment criteria.

What is EGWP in Medicare?

Group Medicare Advantage, or Employer Group Waiver Plans (EGWP), is one of the most challenging markets within Medicare, igniting interest and questions from health plan executives as this market grows. In 2018, there were 4.1 million retirees in EGWPs out of nearly 20 million Medicare Advantage beneficiaries making this a highly valuable business ...

Is an employer self-insured?

The employer is self-insured and assumes most of the risk. Advantages: Employers can provide group medical, drug, and supplemental coverage to their retiree population at a reduced cost and / or increased benefits because of the prospective payment and management opportunities found in high performing MA plans.

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

What is private insurance?

Private insurance plans are responsible for covering at least your preventative healthcare visits. If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans.

What is deductible insurance?

Deductible. A deductible is the amount that you must pay out of pocket before your insurance company begins paying its share. Generally, as your deductible goes down, your premium goes up. Plans with lower deductibles tend to pay out much faster than plans with high deductibles.

What is the difference between silver and gold?

Silver plans cover 70 percent of your healthcare costs. Silver plans generally have a lower deductible than bronze plans but with a moderate monthly premium. Gold plans cover 80 percent of your healthcare costs. Gold plans have a much lower deductible than bronze or silver plans but with a high monthly premium.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

How many tiers of private insurance are there?

There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying. Bronze plans cover 60 percent of your healthcare costs. Bronze plans have the highest deductible of all the plans but the lowest monthly premium.

Is Medicare a government or private insurance?

Medicare is government-funded health insurance that may help you save on your monthly medical costs but does not have a limit on how much you might pay out of pocket each year.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).