Medicare Part B supplemental insurance is the cornerstone of your health care plan, covering regular doctors' visits, outpatient hospital care, emergency room visits and preventative care. Your Part B insurance is part of original Medicare along with Part A, which covers inpatient hospital visits and long-term care.

Full Answer

Which Medicare Part B plan is best?

- Part A (Hospital Insurance): covers a portion of hospitalization expenses and hospice care.

- Part B (Medical Insurance): applies to doctor bills and other medical expenses, such as lab tests and some preventive screenings.

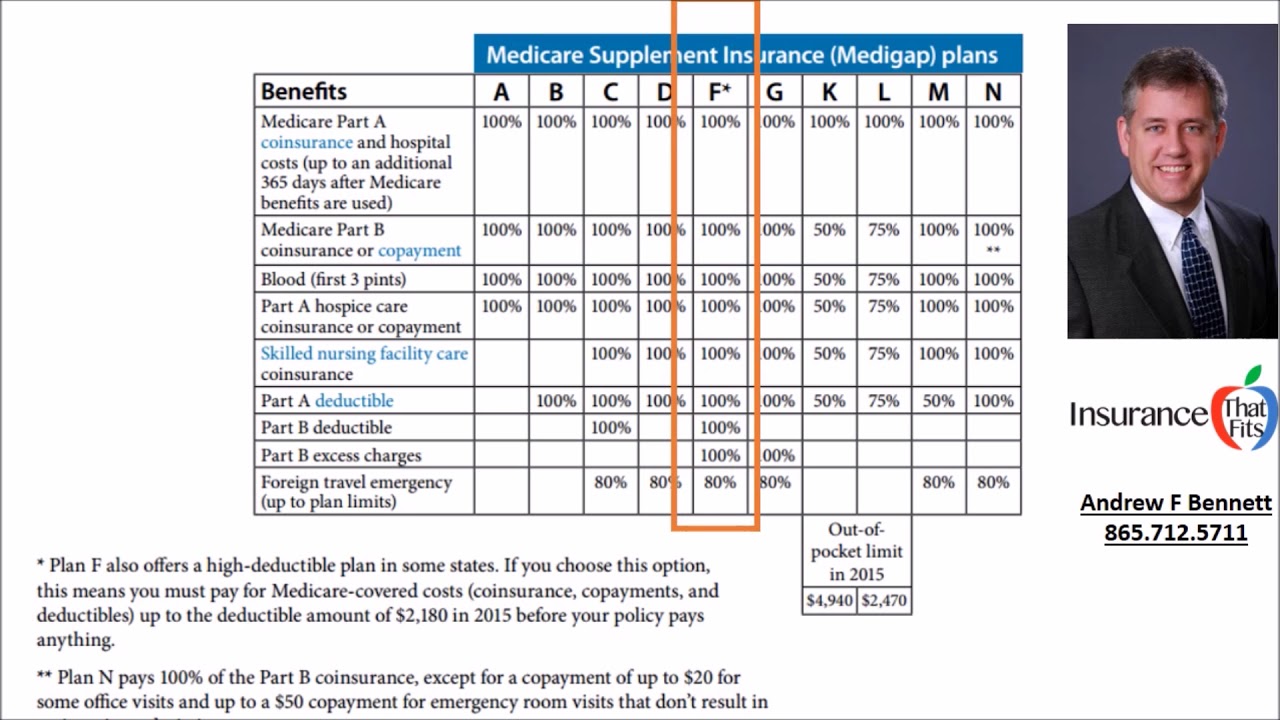

- Medicare Supplement (Medigap) Insurance: can cover copayments, coinsurance and deductibles - gaps in your insurance.

What is the best alternative to Medicare Part B?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

What are Medicare Part B benefits?

and especially how or if “original Medicare” (Medicare Part A and Part B) interacts with a Medicare Advantage plan. If you now have a Medicare Advantage plan, it is the private insurer who provides your plan that administers all of your healthcare ...

Should you buy Medicare Part B?

Medicare Part B typically requires supplemental premiums to be paid by the beneficiary. You can enroll in Medicare Part B by paying a monthly premium, although this premium is typically quite low ...

What is Medicare Supplement?

A Medicare Supplement plan, sometimes called “Medigap,” is a private insurance policy that can help pay for some of the health care costs that Medicare doesn't cover. This can include out-of-pocket expenses such as copayments, coinsurance and deductibles.

How do I know if I have Medicare Parts A and B?

How do I know if I have Part A or Part B? If you're not sure if you have Part A or Part B, look on your red, white, and blue Medicare card. If you have Part A, “Hospital (Part A)” is printed on the lower left corner of your card. If you have Part B, “Medical (Part B)” is printed on the lower left corner of your card.

Is Medicare Part B the same as Medicare Supplement?

Part B is part of what's called Original Medicare, along with Part A. Plan B refers to Medicare supplement insurance commonly called Medigap. Part A covers hospital bills and Part B, for which a standard premium is paid, covers outpatient care, medical equipment, and other services.

What is the difference between Medicare and Medicare Supplement?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is Part B on Medicare?

Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

How do you get Medicare Part C?

To be eligible for a Medicare Part C (Medicare Advantage) plan:You must be enrolled in original Medicare (Medicare parts A and B).You must live in the service area of a Medicare Advantage insurance provider that's offering the coverage/price you want and that's accepting new users during your enrollment period.

Are you automatically enrolled in Medicare Part A when you turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

How do I check my Medicare status?

How to Check Medicare Application StatusLogging into one's “My Social Security” account via the Social Security website.Visiting a local Social Security office. ... Contact Social Security Administration by calling 1-800-772-1213 (TTY 1-800-325-0778) anytime Monday through Friday, 7 a.m. to 7 p.m.More items...•

Who is eligible for Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Who is eligible for Medicare Part B?

Be age 65 or older; Be a U.S. resident; AND. Be either a U.S. citizen, OR. Be an alien who has been lawfully admitted for permanent residence and has been residing in the United States for 5 continuous years prior to the month of filing an application for Medicare.

What is Medicare Part B?

It covers physician care and outpatient medical services, as well as durable medical equipment (DME). The medical care services listed above are only part of all of the health insurance benefits offered by Medicare Part B.

What does Part B cover?

Part B covers the other 80%. If you don’t want to pay for deductibles or coinsurance, some Medicare Supplement insurance (also called Medigap) plans can help cover these and other out-of-pocket Medicare costs.

How much is Medicare Part B deductible?

Deductibles, Copayments and Coinsurance. Medicare Part B comes with a $198 annual deductible in 2020. Part B won’t pay for anything until you pay that amount each year that you use the coverage. After you pay the deductible, you still pay for a portion of the services covered by Part B. This is usually 20% of the Medicare-approved amount for ...

What is the late enrollment penalty for Medicare?

The late enrollment penalty is 10% of the Part B premium for each full 12-month period that you were eligible for Part B but did not sign up. You will have to pay the late enrollment penalty for as long as you are enrolled in Part B. One exception to this rule is if you or your spouse are working and have employer-provided group health insurance ...

Is Medicare Part B optional?

Medicare Part B is optional. If you're automatically enrolled, you can opt out of it. You may be able to enroll in Part B online.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What does Medicare Part B cover?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, ...

What is Part B insurance?

Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

What is Medicare Supplement Plan B?

government website on Medicare, Medicare Supplement Plan B coverage includes: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part B coinsurance and copayment. The first three pints of transfused blood. Part A hospice care coinsurance or copayment.

When is the best time to buy a plan B?

The best time to buy a Plan B health policy without worrying about being rejected for coverage is during the six-month open-enrollment period starting with your Medicare Part B effective date. Your coverage can’t be canceled as long as you keep up your premium payments. This is true of all Medigap policies.

How long does Medicare pay for skilled nursing?

Original Medicare pays for up to 100 days in such a facility for each benefit period, according to the U.S. government website for Medicare. For the first 20 days you pay no money; for days 21-100, you pay coinsurance of $176 a day. Medigap policies with skilled nursing facility coverage would pay that coinsurance, but Plan B policies will not.

How many different types of Medigap policies are there?

There are 10 different kinds of Medigap policies, all of them lettered A, B, C, D, F, G, K, L, M, or N. Two of them – the ones providing the most coverage, C and F – no longer are available to people who became eligible for Medicare starting January 1, 2020. Only people who were eligible before January 1, 2020, can buy one of these policies.

Which states have Medigap coverage?

An important note for residents of Massachusetts, Minnesota and Wisconsin: These states have their own ways of organizing Medigap coverage, so be sure to check their websites separately if you live in one of them. In Massachusetts, 5 for example, three standard Medigap policies are available.

Is Medigap more expensive than other insurances?

Coverage in some states is more expensive than in others. Even within a state, Medigap premiums can vary depending on the region. Some companies offer discounts for women, non-smokers or married couples; for those who pay yearly discounts, for using electronic funds transfer or discounts for multiple policies.

Is Medicare Supplement Plan B the right fit for me?

Medicare Supplement Plan B may or may not be the right fit for you. Perhaps you travel overseas often and want emergency coverage. Or you might feel that fuller skilled nursing coverage would be a prudent thing to have for the future. Or you could pick Medicare Supplement Plan A, which has less comprehensive coverage.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

Does Medigap replace Part B?

Medigap plans do not replace Part B. They pay secondary to Part B. Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement.

Do you have to be enrolled in Part B for Medicaid?

When you are 65 or older and enrolled in Medicaid. All of these scenarios require you to be enrolled in Part B. Without it, you would be responsible for the first 80% of all outpatient charges. Even worse, your secondary coverage may not pay at all if you are not actively enrolled in Part B as your primary coverage.

Do you need Part B before you can enroll in Medigap?

Conclusion. To recap the important points in this article, most people need Part B at some point. When you enroll will depend on what other coverage you currently have when you turn 65. Also, Part B is not a supplement. You need Part B before you can enroll in Medigap or a Medicare Advantage plan.

What does Medicare Part B cover?

What Medicare Part B Covers. Medicare Part B provides coverage for a variety of doctor and outpatient visits and services including routine doctor visits, some preventative items such as flu shots or screenings, diagnostic tests such as X-rays, emergency room services and more.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50. However, your Part B premium cost will depend on your modified adjusted gross income as reported on your IRS tax return from 2 years prior (for 2021, ...

What are the parts of Medicare?

Parts of Medicare Basics – Part B. The best place to start learning about Medicare is with the basics – with Parts A, B, C and D. The second in a four-part series, this “Medicare Basics” article will focus on Medicare Part B. Medicare Part B is one part of what is known as Original Medicare, which is administered by the federal government ...

What is part time skilled nursing?

Part-time, intermittent skilled nursing care and health aid services for the homebound. Mental health care when you’re an outpatient. You can always talk to your health care provider about what services you may need, or medical supplies, and whether Medicare will cover them.

What is Medicare Supplement Insurance?

Medicare supplement insurance plans, otherwise known as Medigap policies, are designed to help with some of the cost exposure inherent in Original Medicare, such as copayments, coinsurance and deductibles. Some of these policies cover deductibles as well.

What is Plan B coverage?

Plan B Coverage. Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits have been exhausted.

How long is the Medicare Supplement enrollment period?

When you are 65 years of age and enrolled in Medicare Part B, you enter your Medicare Supplement Initial Enrollment Period. This is a 6-month period when you have a guaranteed issue right to purchase any Medicare Supplement plan sold in your state.

Do private insurance companies have to include Medigap?

These regulations require that if a private insurance company elects to offer Medigap policies, they must include plan A in their offering because it is the standard plan for basic coverage. Plan B Coverage.

Does Medicare Advantage include Part D?

Additionally, unlike some Medicare Advantage plans, supplement plans do not include Part D. Therefore, a premium would also be due to the insurance company carrying your drug coverage. It is possible that the company in which you are enrolled for supplement insurance also offers Part D.

Does Plan B cover deductible?

Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care coinsurance. Where Plan B becomes advantageous is that it also covers the Part A deductible, which, in 2020, is projected to rise to $1,420.

What is Medicare Part B?

Medicare Part B is offered by the U.S. government to help cover the costs of doctor visits and outpatient services. Medicare Part C is offered by private companies. It includes Medicare Part B along with Part A and often Part D. Medicare Part C can also include services not offered by Medicare, such as vision and dental.

What percentage of Medicare does Part B cover?

For other costs like copays and coinsurance, you’ll pay 20 percent of the Medicare-approved rate until you reach your deductible. Part B only covers services approved by Medicare and does not include extras like vision, hearing, or dental coverage.

What are the different parts of Medicare?

The four parts of Medicare are: Part A: hospital services. Part B: outpatient services. Part C: Medicare Advantage. Part D: prescription drugs. Part B is a portion of your healthcare ...

Does Medicare Advantage have a deductible?

Your Medicare Advantage plan’s premiums, deductibles, and services can change annually. A Part C plan will bundle all of your part A and part B coverage, along with several extra services, into an all-in-one plan.

How to learn more about Medicare?

How to Learn More About Your Medicare Options. Primary insurance isn't too hard to understand; it's just knowing which insurance pays the claim first. Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast.

Is Medicare primary insurance in 2021?

Updated on July 13, 2021. Many beneficiaries wonder if Medicare is primary insurance. But, the answer depends on several factors. While there are times when Medicare becomes secondary insurance, for the most part, it’s primary. Let’s go into further detail about what “primary” means, and when it applies.

Is Medicare a primary or secondary insurance?

Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

Does Medicare pay your claims?

Since the Advantage company pays the claims, that plan is primary. Please note that Medicare WON’T pay your claims when you have an Advantage plan. Medicare doesn’t become secondary to an Advantage plan. So, you’ll rely on the Advantage plan for claim approvals.

Can you use Medicare at a VA hospital?

Medicare and Veterans benefits don’t work together; both are primary. When you go to a VA hospital, Veteran benefits are primary. Then, if you go to a civilian doctor or hospital, Medicare is primary. But, you CAN’T use Veterans benefits at a civilian doctor. Also, you can’t use Medicare benefits at the VA.

Is Medicare a part of tricare?

Medicare is primary to TRICARE. If you have Part A, you need Part B to remain eligible for TRICARE. But, Part D isn’t a requirement. Also, TRICARE covers your prescriptions. Your TRICARE will be similar to a Medigap plan; it covers deductibles and coinsurances.