What is Medicare Secondary Payer?

The Medicare Secondary Payer (MSP) provisions protect the Medicare Trust Fund from making payments when another entity has the responsibility of paying first. Any entity providing items and services to Medicare patients must determine if Medicare is the primary payer. This booklet gives an overview of the MSP provisions and explains your responsibilities in detail.

Why does Medicare make a conditional payment?

Medicare may make pending case conditional payments to avoid imposing a financial hardship on you and the patient while awaiting a contested case decision.

Can Medicare deny a claim?

Medicare may mistakenly pay a claim as primary if it meets all billing requirements, including coverage and medical necessity guidelines . However, if the patient’s CWF MSP record shows another insurer should pay primary to Medicare, we deny the claim.

What is a COB in health insurance?

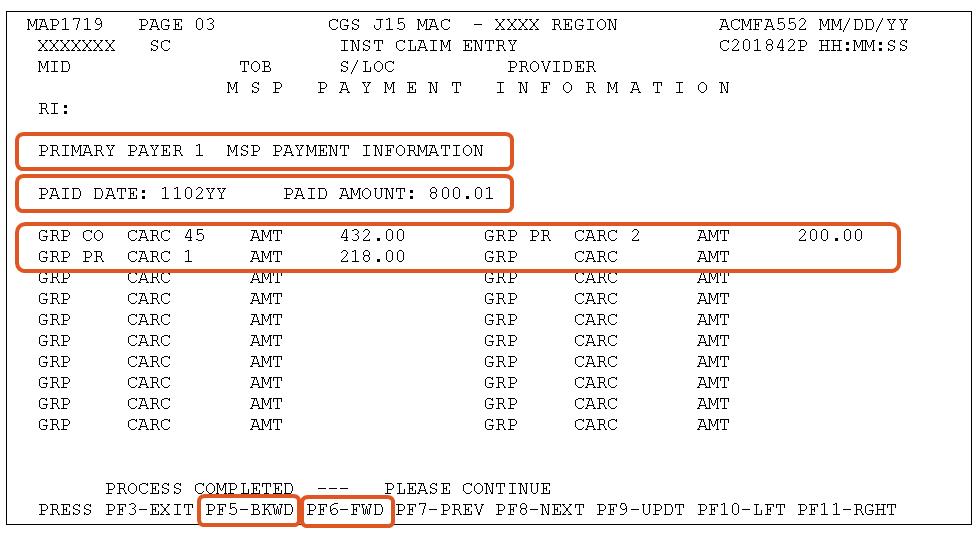

Coordination of Benefits (COB) allows plans to determine their payment responsibilities. The BCRC collects, manages, and uploads information to the Common Working File (CWF) about patients’ other health insurance coverage. Providers, physicians, and other suppliers must collect accurate MSP patient information to ensure that claims are filed properly.

How long does it take to pay a no fault claim?

For no-fault insurance and WC claims, “paid promptly” means payment within 120 days after the no-fault insurance or WC carrier got the claim for specific items and services. Without contradicting information, you must treat the service date for specific items and services as the claim date when determining the paid promptly period; for inpatient services, you must treat the discharge date as the service date.

What happens if you don't file a claim with the primary payer?

File proper and timely claims with the primary payer. Not filing proper and timely claims with the primary payer may result in claim denial. Policies vary depending on the payer; check with the payer to learn its specific policies.

Can Medicare make a payment?

Medicare can’t make payment when payment “has been made or can reasonably be expected to be made” under liability insurance (including self-insurance), no-fault insurance, or a WC law or plan of the United States, called a primary plan.

What is BCRC in Medicare?

The Benefits Coordination & Recovery Center (BCRC) is responsible for ensuring that Medicare gets repaid by the beneficiary for any conditional payments it makes. The “Beneficiary NGHP Recovery Process Flowchart” provides the typical steps involved in recovering conditional payments from the Medicare beneficiary. This document can be accessed by

What is the presentation of POR vs CTR?

For purposes of this presentation, we will be focusing on the documentation required if you are an attorney representing a beneficiary, including if you are using an agent to assist you in resolving any potential Medicare claim recovery. However, you should take the time to review the full “POR vs. CTR” presentation for other issues.