The coinsurance varies among Medicare plans. Medicare Part A is insurance that covers inpatient care in a hospital or nursing home. It also includes hospice

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

Full Answer

What services are covered by Medicare Part?

Nov 29, 2021 · Coinsurance is the percentage of a medical bill that you (the Medicare beneficiary) may be responsible for paying after reaching your deductible. Coinsurance is a form of cost-sharing; it's a way for the cost of care to be split between you and your provider.

What is covered by Medicare Part?

Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount. With coinsurance, you pay a fixed percentage of the …

What is deductible for Medicare Part?

Apr 16, 2021 · Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the U.S. without a break for at least five years. You’re eligible if you’re 65 and older or …

What is Medicare Part an and what does it cover?

Mar 02, 2022 · Medicare coinsurance kicks in after you’ve paid your Medicare deductible for the year. The amount for Medicare Part A hospital insurance is a set dollar amount while coinsurance for other Medicare parts are a percentage of the cost of the medical or hospital service you receive. When Medicare Coinsurance Begins.

Does Medicare Part A have a coinsurance?

Coinsurance refers to a percentage of the Medicare-approved cost of your health care services that you're expected to pay after you've paid your plan deductibles. For Medicare Part A (inpatient coverage), there's no coinsurance until you've been hospitalized for more than 60 days in a benefit period.

What is the Medicare Part A coinsurance rate for 2020?

Part A Deductible and Coinsurance Amounts for Calendar Years 2020 and 2021 by Type of Cost Sharing20202021Daily coinsurance for 61st-90th Day$352$371Daily coinsurance for lifetime reserve days$704$742Skilled Nursing Facility coinsurance$176.00$185.501 more row•Nov 6, 2020

What is the Medicare Part A coinsurance for 2022?

Daily Coinsurance Costs for Medicare Part A in 2022 You pay $0 coinsurance for first 20 days and $194.50 for days 21 to 100. You are responsible for all costs from day 101 and beyond.

What is the Medicare coinsurance rate for 2021?

$371 per dayIn 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61 st through 90 th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020).

What are the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.Sep 24, 2021

How is Medicare coinsurance calculated?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.Nov 29, 2021

What will Irmaa be in 2023?

2023 IRMAA Brackets (Projected)PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART BAbove $149,000 – $178,000Above $298,000 – $356,000Standard Premium x 2.6Above $178,000 – $500,000Above $356,000 – $750,000Standard Premium x 3.2Greater than $500,000Greater than $750,000Standard Premium x 3.45 more rows•Mar 28, 2022

What is the deductible for Medicare Part D in 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is the Part D Irmaa for 2022?

The average premium for a standalone Part D prescription drug plan in 2022 is $47.59 per month.Feb 15, 2022

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

What is Medicare coinsurance?

Takeaway. Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount.

How much is coinsurance for Medicare?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: 1 Days 1 to 60: $0 daily coinsurance 2 Days 61 to 90: $371 daily coinsurance 3 Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

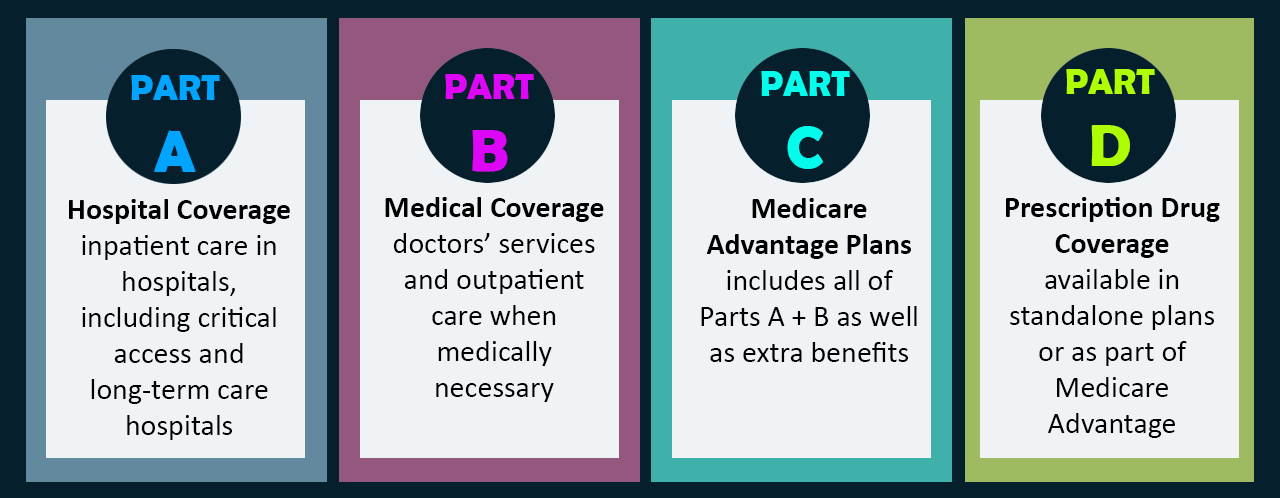

What is the Medicare Part B?

Together with Medicare Part B, it makes up what is known as Original Medicare , the federally administered health-care program.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

When do you enroll in Medicare Part A?

If you’re currently receiving retirement benefits from Social Security or the Railroad Retirement Board (RRB), you’re automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

How old do you have to be to get Medicare?

You are 65 or older and meet the citizenship or residency requirements. You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What is coinsurance in Medicare?

Medicare coinsurance is the amount of money you have to pay out of your own pocket for medical services you receive after you’ve paid your deductible. It’s a percentage of the Medicare-approved price of the services you receive.

What percentage of Medicare coinsurance is paid?

After meeting the deductible, your coinsurance will usually be 20 percent of the Medicare-approved price for certain services. Medicare Part B services for which you pay coinsurance include: Most doctor services including hospital inpatient doctor services. Outpatient therapy or treatments.

How long do you have to pay coinsurance for Medicare 2021?

But you still don’t have to pay coinsurance for the first 60 days of hospitalization even after you’ve paid your deductible.

How many states have Medigap?

There are 10 different types of standardized Medigap plans sold through private insurers in 47 states and the District of Columbia.

What is hospice coinsurance?

Hospice coinsurance for drugs and up to five days of inpatient care. Medicare Plan A hospital coinsurance. You may also choose plans that cover differing amounts of coinsurance and other out-of-pocket costs. These include skilled nursing facility coinsurance and excess physician charges — those charges beyond Medicare-approved prices for services.

How much is deductible for Part D?

There is a standard deductible of $445 for all Part D prescription drug plans, but after that, the amount of your coinsurance is set by the insurer through which you purchased your Part D coverage. You should check with your Part D insurance provider to find out what your coinsurance will be.

Does Medicare Advantage include prescriptions?

Advantage plans may also include prescription drug coverage. Your deductible will depend on the particular Medicare Advantage plan you purchased. Once it’s met, you will be responsible for the plan’s deductible until you reach its yearly out-of-pocket limit. You should check with your insurer to find out the deductible, ...

What is general nursing?

General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

What is an inpatient hospital?

Inpatient hospital care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

What is a critical access hospital?

Critical access hospitals. Inpatient rehabilitation facilities. Inpatient psychiatric facilities. Long-term care hospitals. Inpatient care as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).