What is the monthly premium for Medicare Part B?

Nov 17, 2017 · The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement.

Is Medicare Part B premiums tax-deductible?

Income thresholds will change in 2018. For people who earn above $85,000, the categories for higher Part B IRMAA surcharges will change in the middle tiers as follows: Up to $85,000 for single filers; up to $170,000 for joint filers. $85,001 to $107,000 for single; $170,001 to …

What is Plan B deductible?

14 rows · 2018 Medicare Part B (Medical) Monthly Premium & Deductible. 2018 Medicare Part B ...

What is part B deductible?

In 2022, you pay $233 for your Part B deductible [glossary]. After you meet your deductible for the year, you typically pay 20% of the Medicare-Approved Amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy; Durable Medical Equipment (Dme) [Glossary]

What is the yearly Medicare Part B deductible?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What was Medicare deductible for 2018?

What is the Medicare Part B deductible for 2021?

What are the annual premiums for Part B coverage in 2019 and 2020?

What is the Medicare Part B deductible for 2017?

What was the Medicare Part B deductible in 2019?

How does the Medicare Part B deductible work?

What is the 2020 Part B deductible?

How much is deducted from Social Security for Medicare?

Are Medicare Part B premiums going up in 2021?

Does Medicare have a deductible every year?

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

What is the Medicare Part B deductible for 2018?

2018 Medicare Part B Deductible. CMS announced that the annual deductible for all Part B beneficiaries once again be $183, the same as in 2017.

How much is the 2018 Medicare Part D deductible?

The 2018 standard Part D plan deductible is $405, however the actual plan deductible can be anywhere from $0 to $405 . Use our 2018 Part D Plan Finder to see plan premiums, deductibles, and features in your state. use our 2017/2018 Part D plan comparison to see annual changes for each Medicare Part D plan.

How long can you get Medicare Part A if you are disabled?

(If you’re under 65 and disabled, you can continue to get premium-free Part A for up to 8 1/2 years after you return to work.) The chart below shows the annual Medicare Part A deductible and the Medicare Part A monthly premium for people who do not ...

How much is Medicare Part B premium?

The Social Security Administration announced a 2.2 percent cost-of-living adjustment (COLA) for 2018 Social Security benefits - which translates into about a $28 increase for the average Medicare Part B beneficiary.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the "hold harmless" provision are: those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2018, dual eligible beneficiaries who have their premiums paid by Medicaid, and.

Who will enroll in Medicare Part B for the first time in 2018?

those who will enroll in Part B for the first time in 2018, dual eligible beneficiaries who have their premiums paid by Medicaid, and. beneficiaries who pay an additional income-related premium. These groups account for about 30 percent of the 52 million Americans expected to be enrolled in Medicare Part B in 2018.

What is dual eligible Medicare?

dual eligible beneficiaries who have their premiums paid by Medicaid, and. beneficiaries who pay an additional income-related premium. These groups account for about 30 percent of the 52 million Americans expected to be enrolled in Medicare Part B in 2018.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is the Part B premium for 2021?

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

How much is the 2021 Medicare premium?

The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is the Part B tax deductible?

The Part B deductible increased again for 2017, to $183, and remained unchanged for 2018. For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203.

How much does Medicare Part B cover?

After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

Will Medicare Part B increase in 2021?

Q: Did the Medicare Part B deductible increase for 2021? A: Yes. The Part B deductible increased by $5 for 2021, to $203. (Note that the monthly premium for Part B also increased for most enrollees for 2020, to $148.50/month.

How much is Medicare Part B deductible for 2021?

These enrollees have to pay the full Part B deductible if and when they need services that are covered under Medicare Part B. For 2021, that deductible is $203. After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

What is the Medicare deductible for 2021?

For 2021, that deductible is $203. After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%.

Do you have to pay Part B deductible?

Enrollees who have Medicaid or retiree health benefits from an employer generally don’t have to pay the Part B deductible, as the other coverage picks up the tab. Some Medicare Advantage plans have no deductibles and low copays (Medicare Advantage enrollees pay the Part B premium plus the Medicare Advantage premium, ...

Is Part B deductible indexed annually?

Part B deductible by year. These amounts are indexed annually, after being set by the Medicare Modernization Act in 2005: Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much coinsurance do you pay for Medicare?

Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% ...

What is the coinsurance amount for Medicare?

The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example. Say your treatment cost you $80.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

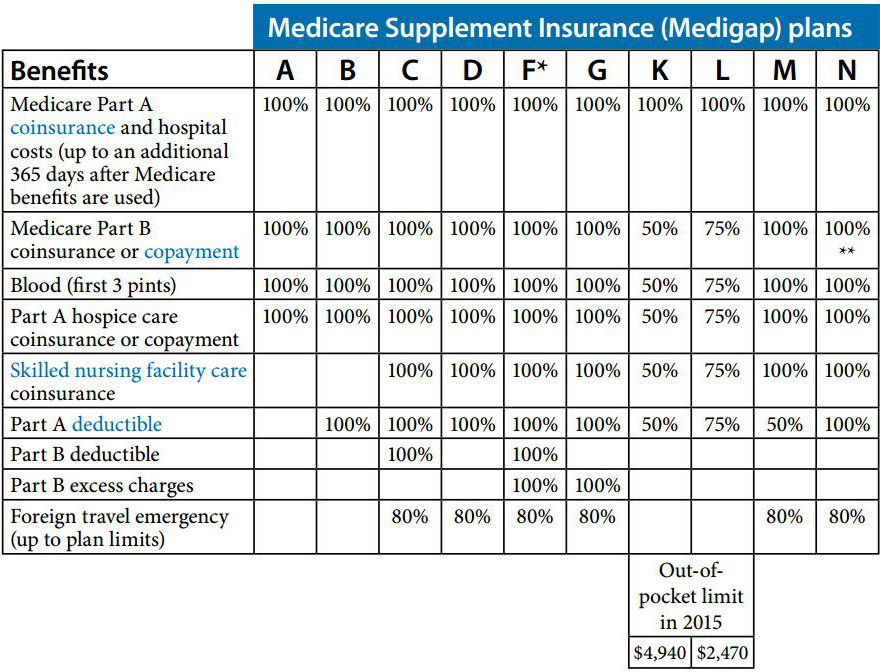

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.