What drugs are covered by Part D?

Medicare prescription drug coverage isn’t automatic. Part D covers most prescription medications and some chemotherapy treatments and drugs. If Part B doesn’t cover a cancer drug, your Part D plan may cover it. It’s important to check with your plan to make sure your drugs are on the plan’s formulary (list of covered drugs) and to check ...

What does Medicare Part D really cost?

The moving parts of Medicare Part D costs. The Part D premium is certainly a major determinant of annual cost but not the only factor that can contribute to overall costs. The average monthly premium for Part D is approximately $34.00 per month. The lowest premium nationwide for 2017 is the Humana Walmart RX plan at $17.00 per month. Some Part D plans have monthly premiums well over $100.

How do you add Part D to Medicare?

Things to Consider

- Costs for Part D plans can vary, so choose a plan that meets your needs and budget.

- Part D insurance premiums may change each year. ...

- Medicare Part D has a low-income subsidy program, and Medicare beneficiaries may qualify for financial assistance with the cost of their medications based upon their income and assets.

What plans are available for Medicare Part D?

- Monthly premiums

- Annual deductible (maximum of $445 in 2021)

- Copayments (flat fee you pay for each prescription)

- Coinsurance (percentage of the actual cost of the medication)

What is Medicare Part D and how does it work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What is the difference between Part B and D Medicare?

Medicare Part B only covers certain medications for some health conditions, while Part D offers a wider range of prescription coverage. Part B drugs are often administered by a health care provider (i.e. vaccines, injections, infusions, nebulizers, etc.), or through medical equipment at home.

What does Medicare Part D include?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What's the difference between Medicare Part C and D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Is Medicare Part D deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Is it mandatory to have Part D Medicare?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Which Medicare Part D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Does Medicare Part D cover prescriptions?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

Can I use GoodRx if I have Medicare Part D?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications.

Why switch to a different Medicare Part D plan?

Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way. Part D drug plans also have changes from year to year.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

How does each drug plan work?

Each drug plan will separate its medications into tiers. Each tiers has a copy amount that you will pay. For example, a plan might assign a $7 copay for a Tier 1 generic medication. Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on.

What are Part D restrictions?

Part D plan restrictions are common with pain medications, narcotics and opiates .

When does Medicare Part D change?

Part D drug plans also have changes from year to year. Your plan’s benefits, formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance may change on January 1st of each year. Medicare gives you an Annual Election Period during which you can change your plan if you desire to do so.

Is Part D a Medicare plan?

Part D drug plans are among the most confusing Medicare topics. All too often people join a plan without checking to make sure the formulary includes their medications. Sometimes they also miss that one of their medications has step therapy rules applied.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

What is a tier in prescription drug coverage?

Tiers. To lower costs, many plans offering prescription drug coverage place drugs into different “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” on their formularies. Each plan can divide its tiers in different ways.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What are the tiers of Medicare?

Here's an example of a Medicare drug plan's tiers (your plan’s tiers may be different): Tier 1—lowest. copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug.

What is Medicare Part C?

Medicare Part C (or Medicare Advantage) and Medicare Part D (prescription drug plans) are a pair of options for Medicare beneficiaries. Learn more about what exactly these plans are, how they differ, and how you can make an informed choice about which might be the right fit for your needs.

How many parts are there in Medicare?

There are four different parts to Medicare: Part A, Part B, Part C and Part D. Current and potential Medicare beneficiaries may find these labels confusing, but with the right knowledge, you can make an informed decision about which Medicare plan might be the right fit your needs. In this article, we’ll examine Medicare Part C (also commonly known ...

How does Medicare Advantage work?

Medicare Advantage plans can work similarly to traditional health insurance plans in that you pay a premium (although some plans feature $0 monthly premiums) to belong to a plan and may then have cost-sharing responsibilities such as copays or coinsurance and a deductible. Plans typically have a provider care network.

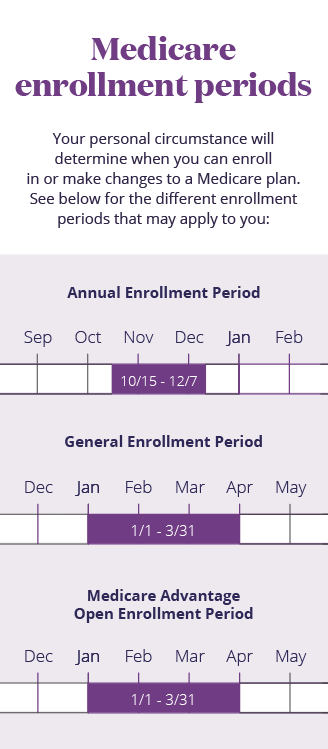

What is Medicare enrollment?

Enrollment. Enrollment is one area in which Medicare Advantage and Part D plans can be similar. Both types of plans utilize the Medicare Initial Enrollment Period (IEP) and the Annual Enrollment Period (AEP, also called the fall Open Enrollment Period), where you may join, change or drop coverage for each type of plan.

How many Medicare Advantage plans are there in 2020?

The average Medicare beneficiary will have access to 28 Part D plans in 2020. 3. There will be 3,148 Medicare Advantage plans available nationwide in 2020. A total of 948 standalone Medicare Part D plans will be available in 2020.

What is the coverage area for Medicare Advantage?

The coverage area for a Medicare Advantage plan is often based on your zip code or county of residence. Some Part D plans can encompass larger coverage areas and can even include multiple states on the same plan.

Does Medicare have an out-of-pocket limit?

When it comes to out-of-pocket expenses, there is an annual out-of-pocket limit for all Medicare Advantage plans . The out-of-pocket spending limit can vary from plan to plan. Some Medicare Advantage plans do not have a deductible.

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

What is Medicare Supplement Plan D?

Medicare Supplement Plan D. Medicare Part D. Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

How long does Medigap Plan D last?

The best time to get Medigap Plan D (or any Medicare Supplement plan) is during your Medigap Open Enrollment Period (OEP) because you won’t have to go through medical underwriting. 4. Your Medigap OEP last for six months and begins ...

How much is coinsurance for Part B?

For example, Part B charges a 20% coinsurance for covered services after you’ve met your Part B deductible ($203 in 2021). 1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged ...

How much is the cost of a Plan D in 2021?

The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $192-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida. 6.

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Does Medicare Supplement Plan D cover prescription drugs?

But these plans are not the same thing as Medicare Part D, which is for prescription drug coverage. Medicare Supplement Plan D policies do not cover prescription drugs.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.