What is the average cost of Medicare Part D?

Nov 13, 2021 · For 2022, beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Part D – pay a surcharge that’s added to their Part B and Part D premiums. IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are …

What are the rules of Medicare Part D?

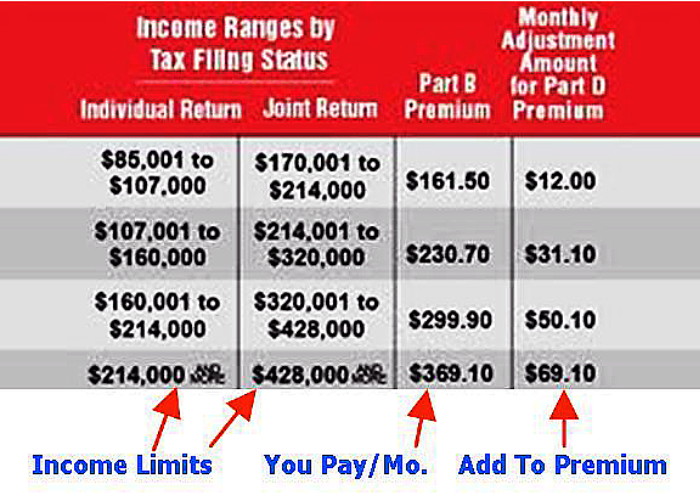

May 20, 2021 · Medicare with Melissa Income-Related Monthly Adjustment Amount or IRMAA is a surcharge that high-income people will pay in addition to their monthly premium. Social Security sets income brackets that determine your (or you and your spouse) IRMAA. Determination is based on the income you reported on your IRS tax returns two years prior.

What is the average cost of Part D?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. IRMAA payments go directly to Medicare, even if you pay monthly …

What is included in Medicare Part?

IRMAA is a consideration with two parts of Medicare — Part B and Part D. Part B of Original Medicare, commonly referred to as medical insurance, features a standard monthly premium that changes each year ($170.10 in 2022). Medicare Part D, which is drug coverage offered by private insurance companies, has a monthly premium that varies from plan to plan.

What does Medicare Part D Irmaa mean?

Medicare Income-Related Monthly Adjustment AmountThe Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may have to pay in addition to your Part B or Part D premium if your income is above a certain level.

What is the Part D Irmaa for 2021?

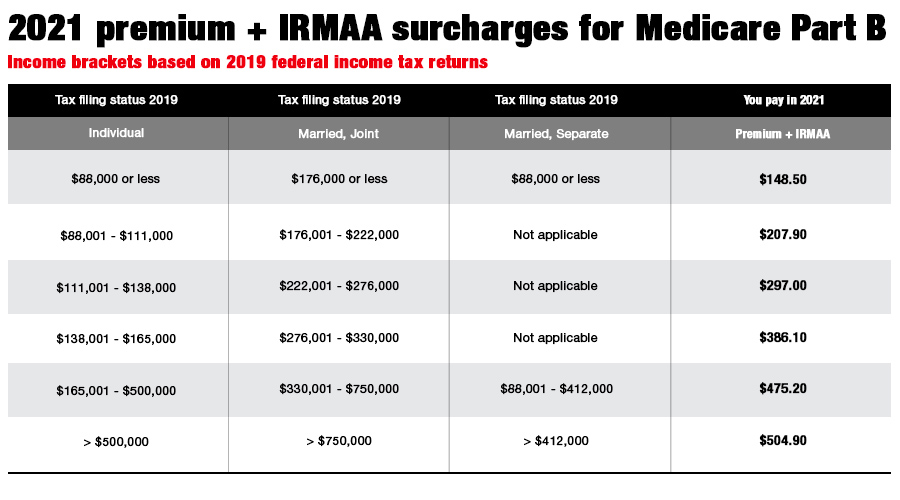

D. IRMAA tables of Part D Prescription Drug coverage premium year for three previous premium yearsIRMAA Table2021More than $165,000 but less than $500,000$70.70 + Plan premiumMore than or equal to $500,000$77.10 +Plan premiumMarried filing jointlyMore than $176,000 but less than or equal to $222,000$12.30 + Plan premium12 more rows•Dec 6, 2021

Do I have to pay Part D Irmaa?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

What is the Medicare Part D Irmaa for 2022?

The standard premium for Medicare Part B in 2022 is $170.10 per month. Part D premiums are sold by private insurers so there is no “standard” premium. The average premium for a standalone Part D prescription drug plan in 2022 is $47.59 per month.Feb 15, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Do I have to pay Irmaa Part D if I don't have Part D Medicare?

No. You should not pay an Income-Related Monthly Adjustment Amount (IRMAA) for Medicare Part D if you are not enrolled in a Medicare Part D drug plan.

What is the income limit for Part D Irmaa?

What are the income brackets for IRMAA Part D and Part B?SingleMarried Filing JointlyPart D IRMAA$88,000 or less$176,000 or less$0 + your plan premium$165,001 and under $500,000$330,001 and under $750,000$70.70 + your plan premium$500,000 or above$750,000 and above$77.10 + your plan premium3 more rows

Does Social Security count towards Irmaa?

The tax-exempt Social Security isn't included in the MAGI calculation for the IRMAA.Dec 18, 2018

Is Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

WHAT IS THE MAGI for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

How do I stop paying Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).Dec 21, 2021

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

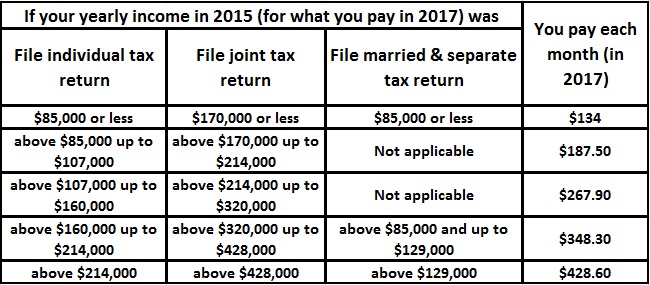

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What are the income brackets for IRMAA Part D and Part B?

The income brackets for both IRMAA for Medicare Part B and Medicare Part D are the same in 2021. They’re based on your 2019 tax returns.

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

Does IRMAA affect Part A?

It covers inpatient stays at locations such as hospitals, skilled nursing facilities, and mental health facilities. IRMAA doesn’t affect Part A. In fact, most people who have Part A don’t even pay a monthly premium for it.

Does Medicare pay monthly premiums?

Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income. One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, ...

What is Medicare Part D IRMAA?

Can I Avoid Medicare Part D IRMAA? Medicare Part D IRMAA stands for Income-Related Monthly Adjustment Amounts that affects higher income beneficiaries. Basically, the government is making you pay more for being successful.

Who Gets Affected by the Part D IRMAA?

After addressing the question, ‘What is Medicare Part D IRMAA?’, the next question is who gets affected or who gets to pay the Part D IRMAA.

How Do You Know if You Have Part D IRMAA?

Aside from the income bracket indicated above, policy holders who have Part D IRMAA will be notified by the Social Security Administration if they are part of this adjustment or not. This is determined every year in line with the Modified Adjusted Gross Income as indicated by your two-year income tax return report.

How Do You Pay Your Part D IRMAA?

Generally, most people have their Part D IRMAA deducted from their Social Security benefits. However, if you aren’t a recipient of Social Security benefits or the amount of your benefit is not enough to pay for Part D IRMAA, the CMS will directly bill you.

How can I avoid IRMAA?

Can I Avoid Medicare Part D IRMAA? If Medicare has your income correct then you cannot avoid IRMMA. What you CAN do is adjust your insurance plan premium to offset the extra cost you have to pay with IRMMA.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.