Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender.

Full Answer

What is covered by Medicare Part F?

52 rows · · The average premium for Medicare Supplement Plan F was $169.14 per month in 2018. 2. Learn more about the average cost of Medigap Plan F in each state in 2018, and find out if the benefits of Plan F work for your health coverage needs.

How much is the deductible for Medicare Part?

· This will be in addition to your Medicare Part B monthly premium. Here are a few examples of Medigap Plan F premiums in different cities across the country: City. Plan option. Monthly premium. Los ...

What are the benefits of Medicare Part F?

· Medicare Supplement Plan F is great because it provides the most coverage of the 10 currently available MedSup plans. That coverage comes at a cost, however; specifically, Plan F is the most expensive of all the MedSup policies on the market today. Before you decide to pass on Plan F, though, do your due diligence and see how much the insurance ...

Do I have to pay for Medicare Part?

You’ll pay $233, before Original Medicare starts to pay. You pay this deductible once each year. Costs for services (coinsurance) You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

Is Medicare Plan F expensive?

Since Medicare Plan F is the most comprehensive Medigap policy, the premium can be costly. Typically, the cost ranges from $161 to $410 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, age and gender.

What is the average cost for Medicare Plan F?

How much does it cost for Medigap Plan F? The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

What is the monthly cost of a Plan F?

The average cost of Medicare Supplement Plan F is around $173.00 per month. However, there are many factors that impact the premium price. Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $250.00 per month or more.

What is Part F of Medicare coverage?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What is the difference between Plan F and Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Why should I keep Plan F?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover. This means zero out-of-pocket for you at the doctor's office.

What is the deductible for Plan F in 2022?

What is the Deductible for High Deductible Plan F in 2022? In 2022, the deductible is $2,490.

Is Plan F going away in 2020?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

How much is Medicare G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.

Can I switch from Plan F to Plan G?

If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance. However, every state has different rules worth considering before making the switch.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

What is the deductible for Plan F in 2022?

What is the Deductible for High Deductible Plan F in 2022? In 2022, the deductible is $2,490.

Is Medicare Plan F going away 2020?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Does AARP still offer Plan F?

According to AARP, Medicare Supplement Plan F provides the most coverage, and as a result, it's the most popular plan among those eligible for Medicare. But with recent changes, Plan F is no longer available to everyone as of January 1, 2020.

What does Medicare Supplement Plan F cover?

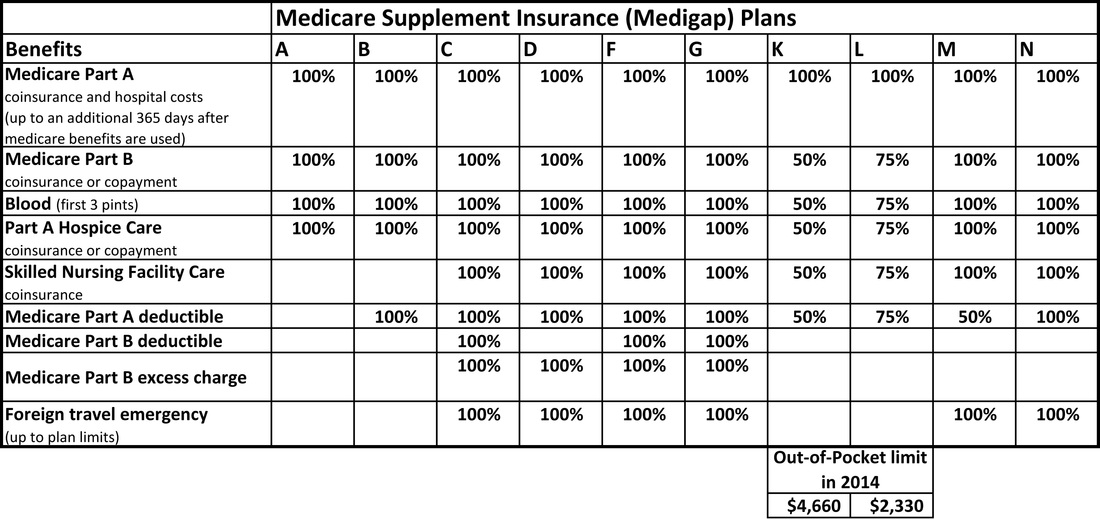

MedSup Plan F pays for 100% of the following: Medicare Part A deductible. Medicare Part B deductible. Part A coinsurance and hospital costs up to a...

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if the...

How does Medicare Part F compare to other MedSup plans?

The only way MedSup Plan F differs from Plan G is that Plan F pays your Medicare Part B deductible while Plan G does not. All other benefits are th...

Is Medicare Part A or Part B covered by Medigap Plan F?

It covers almost all your Medicare Part A and Part B costs so that you owe very little money out-of-pocket for healthcare services. Medigap Plan F may a good option if you: require frequent medical care and visit the doctor often. require financial assistance with nursing care or hospice care.

What is Medicare Supplement Plan F?

Medigap Plan F, sometimes called Medicare Supplement Plan F, is the most comprehensive Medigap plan offered. It covers almost all your Medicare Part A and Part B costs so that you owe very little money out-of-pocket for healthcare services. Medigap Plan F may a good option if you:

What are the different Medicare options?

The different Medicare options to cover your basic healthcare needs include Part A, Part B, Part C, and Part D.

Does Medigap Plan F cover deductibles?

However, unlike some of the other options offered, Medigap Plan F covers 100 percent of the Part A and Part B deductibles. Copayments and coinsurance. With Medigap Plan F, all your Part A and Part B copayments and coinsurance are completely covered, resulting in an almost $0 out-of-pocket costs for medical or hospital services.

Is Medigap Plan F still available?

However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020. If you were already enrolled in Medigap Plan F, you can keep the plan and the benefits.

What is a Medigap Plan F?

Medigap Plan F is a comprehensive Medigap plan that helps cover your Medicare Part A and Part B deductibles, copayments, and coinsurance. Medigap Plan F is beneficial for low-income beneficiaries who require frequent medical care, or for anyone looking to pay as little out-of-pocket as possible for medical services.

Does Medigap have a yearly deductible?

Each Medigap plan has its own monthly premium. This cost will vary depending on the plan you choose and company you purchase your plan through. Yearly deductible. While Medigap Plan F itself does not have a yearly deductible, both Medicare Part A and Part B do. However, unlike some of the other options offered, ...

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage. Beyond that, Part F is the most comprehensive of all the MedSup plans on the market today.

How to figure out how much you have to pay for Plan F?

To figure out how much you may have to pay for Plan F coverage, contact a number of insurance companies that sell the policies in your ZIP code. Compare the prices they quote you and then make your decision based on that.

What is the most popular Medicare supplement plan?

Medicare Part F is the most popular Medicare supplement plan around. Here’s why, plus what it covers and costs. The good news for Americans who aren’t entirely happy with the health coverage Original Medicare provides them is that they have options. In particular, they have options when it comes to finding supplemental insurance ...

Is Plan F the best Medicare Supplement?

If you would like to deal with as few out-of-pocket healthcare costs as possible while enrolled in Original Medicare, Plan F probably is the Medicare Supplement policy for you. Plan F also may be the best MedSup policy for you if you’re the kind of person who likes covering all the bases, so to speak.

What does Plan F mean?

It means it helps the people who buy it with all of the payment gaps left open by Medicare Part A and Part B. To put that another way, it often means that those who enroll in Plan F rarely, if ever, have to worry about out-of-pocket costs when they visit a doctor or otherwise seek medical assistance.

Is MedSup Plan G the same as Plan F?

MedSup Plan G offers nearly the same benefits as Plan F, though, so consider enrolling in it instead if Plan F isn’t available to you.

Can you switch to Medicare Advantage if you have Original Medicare?

If you have Original Medicare plus a MedSup plan and you’d like to switch to a Medicare Advantage plan that offers the same or similar coverage, you can do that. Drop the MedSup plan before you do so, though, as it won't pay out after you enroll in Medicare Advantage.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Supplement Insurance Plan F?

Medicare Supplement Insurance Plan F is standardized by the federal government. This means that the 9 basic benefits of Plan F will be the same, no matter where you live or what Medicare Supplement Insurance company you buy it from.

What are the different pricing models for Medicare Supplement?

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan. Community-rated.

Why are Medicare premiums so high?

Medicare Supplement Insurance plan premiums could be more expensive for older beneficiaries for a few reasons, such as: 1 If you wait until after your Medigap Open Enrollment Period to sign up for a Medigap plan, insurance companies can charge you a higher premium based on your health.#N#Your Medigap Open Enrollment Period (OEP) is a 6-month period that starts as soon as you are at least 65 years old and enrolled in Medicare Part B.#N#During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs. 2 There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan.#N#Community-rated#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.#N#Issue-age-rated#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age.#N#Attained-age-rate#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Can Medicare Supplement Insurance determine my Medigap plan?

During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs. There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates.

Is Medigap Plan J still available?

Medigap Plan J is no longer available for sale. If you bought Plan J before June 1, 2010, you may keep the plan. Here is how the average cost of Plan F compared with that of other Medicare Supplement Insurance plans in 2018. Plan. Monthly Premium. Annual Premium.

What factors affect the cost of a Medigap plan?

Location is another factor that can affect the cost of a Medigap plan, as market competition and the local cost-of-living can affect Medigap premiums. The chart below shows the average cost of Medicare Supplement Insurance Plan F by state in 2018. State.

Do Medigap premiums increase based on age?

You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. Attained-age-rate.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Does Medicare Plan F pay for doctor copays?

Never Pay a Doctor Copay Again. The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

Is Medicare Supplement Plan F the #1 seller?

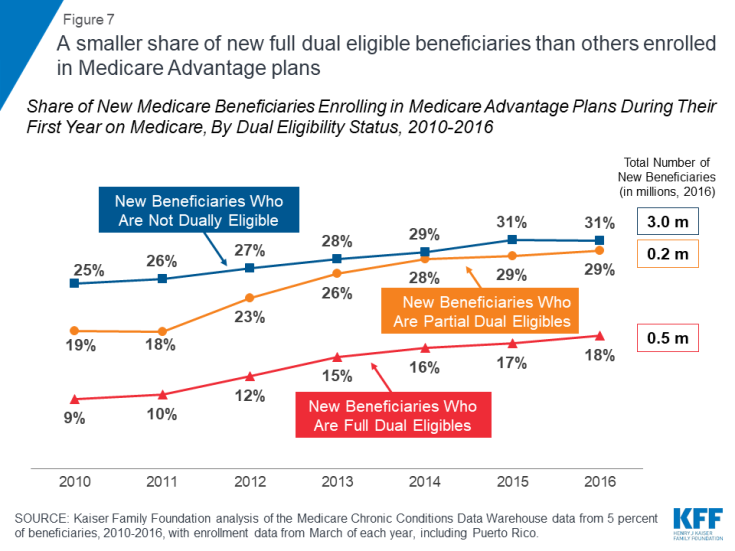

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

Does Medicare Supplement Plan F replace Part B?

Medigap plans do not replace your Medicare Part B. You must be enrolled in both Part A and Part B first, then you are eligible to enroll in Medicare Supplement Plan F.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

Does Medicare Part B cover 20%?

It even pays the 20% that Medicare Part B does not cover. This means zero out-of-pocket for you at the doctor’s office. So when you are asking which Medicare plan is best, it’s pretty easy to see why so many people think Plan F is the best Medicare Supplement plan. Learn Medicare for Free: Enroll in 6-Day Mini Course.

How much does Medicare Supplement Plan F cover?

Medicare Supplement Plan F covers up to 80% of the health care expenses incurred abroad. It should be noted that Original Medicare does not offer coverage for these costs. With Plan F, you need to pay just 20% of the healthcare expenses, when out of the country.

What is Plan F for Medicare?

Plan F also covers expenses related to Medicare Part A including coinsurance during hospitalization, hospice care, and a skilled nursing facility. It also covers the first three pints of a blood transfusion and Medicare takes care of the rest.

How long does hospice care cost after Medicare has exhausted?

Part A hospice care co-insurance or co-payment. Part A co-insurance and hospital costs up to an additional 356 days after original Medicare benefits have exhausted. Part B deductible and excess charges. Part B co-insurance for Preventative Care. Part B co-payment or co-insurance.

Does Medicare cover blood transfusions?

It also covers the first three pints of a blood transfusion and Medicare takes care of the rest. It covers Part A deductible that resets after each new period of benefit, typically when you are admitted in a hospital the next time. Medicare Supplement Plan F covers up to 80% of the health care expenses incurred abroad.

Does Original Medicare cover Plan F?

It should be not ed that Original Medicare does not offer coverage for these costs. With Plan F, you need to pay just 20% of the healthcare expenses, when out of the country.

Will Medicare Part B be sold after 2020?

It might not be sold after 2020. These modifications will be a part of the MACRA (Medicare Access and CHIP Reauthorization Act) of 2015, which states the plans that pay for the Medicare Part B deductible would no longer be sold to the newly eligible. According to the MACRA signed in 2015, some changes were scheduled to be made to Medicare ...

What is the Medicare Part B deductible?

The Medicare Part B deductible that refers to the deductible amount involved in the MACRA legislation, changes every year. In 2019, it was $185. This is the amount you need to pay before Part B pays for the services that are covered. However, once MACRA legislation is implemented in 2020, the coverage for this deductible by Medicare plan F would no ...

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender. For this reason, it is vital to compare rates for ...

What is Medicare Plan F?

Medicare Plan F provides the most benefits out of all the supplemental Medicare plans available and can help reduce your out-of-pocket expenses. The policy is designed to address most of the coverage gaps in Medicare parts A and B. For this reason, many people covered by the standard Medicare policies are willing to pay ...

Does Medicare Plan F cover out of pocket?

Those who have Medicare Plan F won' t pay out-of-pocket costs for Medicare parts A and B. Policyholders would only pay the premiums, which start at $0 for Part A and $135.50 for Part B. Additionally, individuals would not have to pay the deductible, which is $1,364 for Part A and $185 for Part B. Supplemental Medicare Plan F will cover:

Does Medicare cover injectables?

Medicare Plan F does provide coverage for injectable or infusion drugs given in a clinical setting but does not pay for other prescription drugs. The ideal coverage package would include Medicare parts A and B, along with the Part D prescription drug plan and a supplemental Medigap policy such as Plan F.

What is a high deductible Medicare plan?

What is a high-deductible Medicare Plan F? The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits.

Is Medicare Plan F deductible?

When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out-of-pocket can also be deducted on your taxes. You would need to itemize these medical expenses, but the tax deductions could provide valuable additional returns.

Is Plan F the best Medicare supplement?

Furthermore, Plan F is still one of the best Medicare Supplement plans available on the market. The change is due to legislation in Congress focused on giving doctor better pay when they provide services to a Medicare patient.

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

Does Medicare Supplement Plan F have a high deductible?

Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan. Medicare Supplement Plan F also has a high-deductible version.

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

Which states have standardized Medicare Supplement Plans?

Please note that Massachusetts, Minnesota, and Wisconsin have their own standardized Medicare Supplement plans. Medicare Supplement Plan F isn’t available in those states. Here’s an overview of what Medicare ...