What is the current rate of Medicare?

The Medicare tax rate for 2021 is 2.9%. In most cases, you are responsible for half of the entire Medicare tax amount (1.45%), and your employer is responsible for the remaining 1.45%. Your Medicare tax is a part of your paycheck automatically.

What percentage of your paycheck is Medicare?

Mar 15, 2022 · Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or ...

What is the current Medicare tax rate?

2021 Maximum Taxable Earnings: OASDI–$142,800; Hospital Insurance (HI, also called Medicare Part A)–No limit Federal Tax Rate: Max OASDI Max HI Employee 7.65% (6.2% - OASDI, 1.45% - HI) $8,853.60 No limit

What is the FICA limit?

Jun 21, 2021 · In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare...

How do you calculate Medicare tax 2021?

Those sums are:12.4% for Social Security on the first $142,800 of net income (6.2% each for being both an employer and an employee)2.9% for Medicare (1.45% for employers plus 1.45% for employees)Mar 23, 2021

What are Social Security and Medicare taxes for 2021?

For 2021, the Social Security tax rate is 6.2% each for the employer and employee (12.4% total) on the first $142,800 of employee wages. The tax rate for Medicare is 1.45% each for the employee and employer (2.9% total). There's no wage base limit for Medicare tax so all covered wages are subject to Medicare tax.Oct 19, 2020

What percentage is Medicare tax?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How is Medicare calculated?

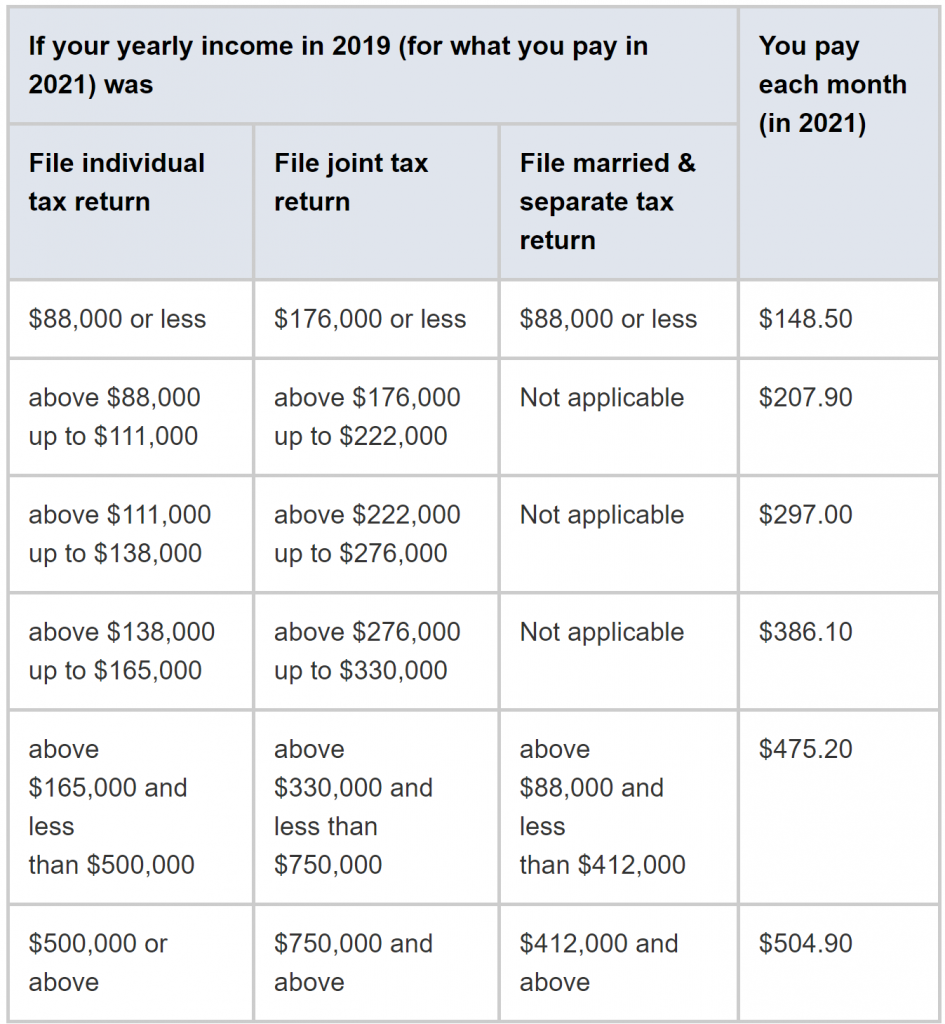

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What percentage of Medicare beneficiaries are in 2021?

The share of Medicare Advantage enrollees varies across the country: in 26 states and Puerto Rico, at least 40 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans in 2021, and at least 50 percent in Florida, Minnesota and Puerto Rico. In a growing number of counties, more than half of all Medicare beneficiaries are in ...

How many people will be in Medicare Advantage in 2021?

Over the last decade, the role of Medicare Advantage, the private plan alternative to traditional Medicare, has grown. In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).

What states have Medicare Advantage plans?

At least 50 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans in two states (MN, FL) and Puerto Rico. Puerto Rico has the highest Medicare Advantage penetration, with 80 percent of Medicare beneficiaries enrolled in a Medicare Advantage plan.

How many people will be enrolled in Medicare in 2021?

In 2021, more than four in ten (42%) Medicare beneficiaries – 26.4 million people out of 62.7 million Medicare beneficiaries overall – are enrolled in Medicare Advantage plans; this share has steadily increased over time since the early 2000s. Between 2020 and 2021, total Medicare Advantage enrollment grew by about 2.4 million beneficiaries, or 10 percent – nearly the same growth rate as the prior year. The Congressional Budget Office (CBO) projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to about 51 percent by 2030 (Figure 2)

Is Minnesota a Medicare Advantage state?

Historically, the majority of Medicare private health plan enrollment in Minnesota has been in cost plans, which are not Medicare Advantage plans, but are a type of Medicare health coverage that has some of the same rules as Medicare Advantage plans, and are offered in limited areas of the country.

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

Should Medicare beneficiaries review HCPCS codes?

It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the maximum amount of Social Security income in 2021?

In 2021, the upper limit -- commonly known as the Social Security wage base -- is $142,800. (Note: This is the only income threshold in this article that is adjusted for inflation each year.) It's important to note that Social Security tax only applies ...

How much taxes do self employed people pay in 2021?

This means they pay a Social Security tax rate of 12.4% on earned income up to $142,800 in 2021, Medicare tax of 2.9% on all income, and the 0.9% additional Medicare tax on income in excess of $200,000 (or $250,000 if filing jointly). In all, here's how the self-employment tax breaks down for a single individual who gets all of their income from self-employment in 2021:

What is payroll tax?

Payroll taxes are types of tax that are applied to earned income, meaning wages, salaries, bonuses, and income from a business you actively participate in. There are two components to the payroll tax in the United States -- Social Security and Medicare.

What is the first component of payroll tax?

The first component of the U.S. payroll tax is known as OASDI (Old Age, Survivors, and Disability Insurance) tax, but it is more commonly referred to as Social Security tax.

What is the Medicare tax rate?

Medicare tax. The second component of the payroll tax is Medicare, which is taxed at a rate of 1.45% each for the employee and employer. Unlike the Social Security tax, there is no upper income limit to the Medicare tax. Even if your earned income is in the millions, you'll pay Medicare tax on all of it.

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

Will payroll taxes increase in the future?

fund some pretty important programs. And as a final thought, it's entirely possible that one (or both) parts of the payroll tax could increase in the not-too-distant future, as both Social Security and Medicare face long-term funding shortfalls.