What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

How much does Medicare Part C plan cost?

The cost of a Medicare Part C (also commonly called “Medicare Advantage”) plan can be quite low relative to the cost of other types of health insurance. The Centers for Medicare and Medicaid Services (CMS) estimates that the average premium for a Medicare Part C plan in 2021 is just $21 per month.

What is the best Medicare supplement plan?

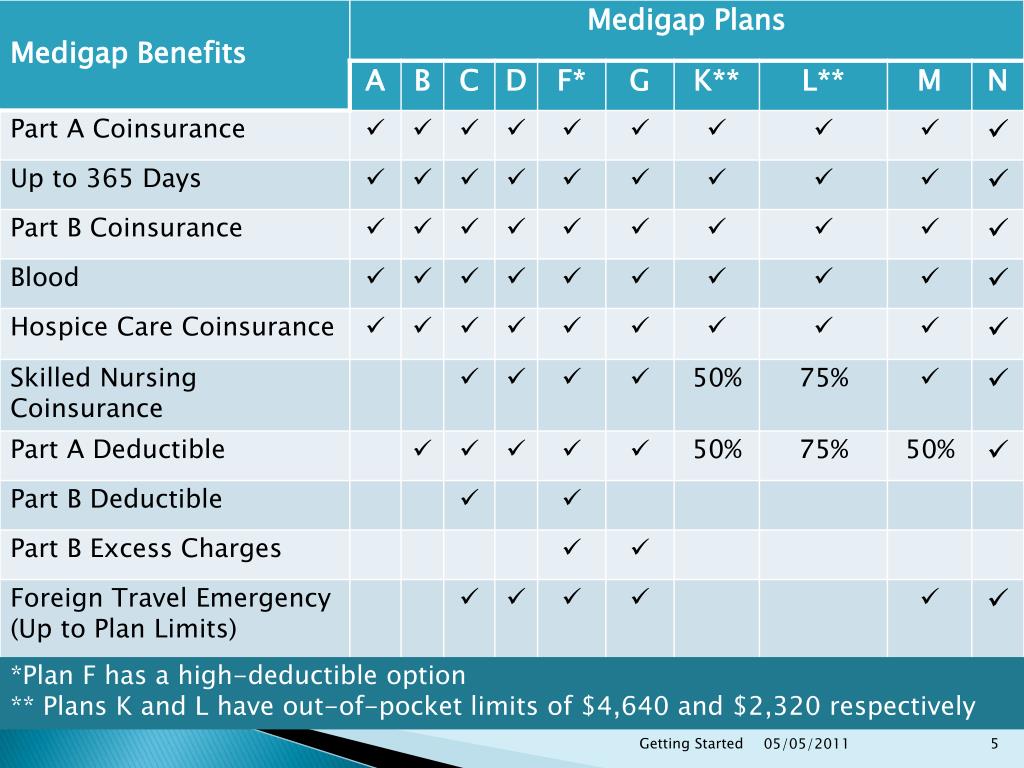

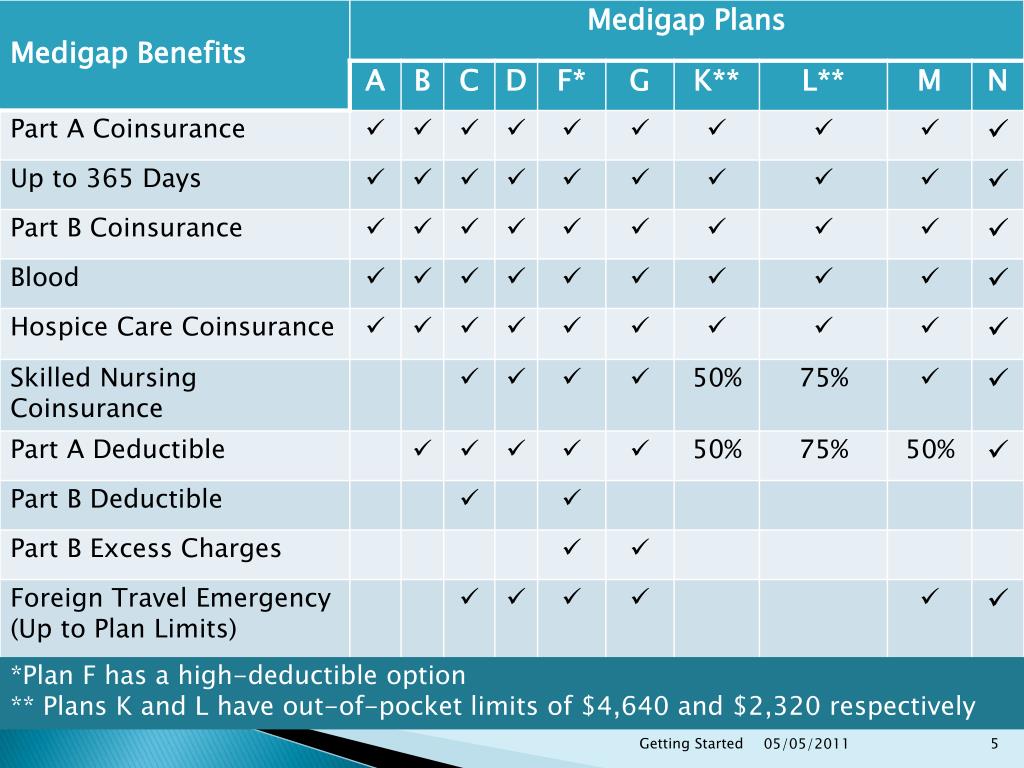

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

What are the benefits of Medicare plan?

Who Plan A is Ideal For

- Those looking for a lower monthly premium

- People who aren’t concerned about out of pocket hospital costs

- Those who do not travel outside the United States

What is plan C and F?

Plan F and Plan C are both referred to as “first-dollar” coverage plans because they cover the annual Medicare Part B deductible. This benefit allows policyholders to get non-emergency medical care without having to pay an annual deductible. The Part B deductible is $233 per year in 2022.

Is plan C better than plan F?

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

What is Medicare Plan F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What does F plan mean?

Medicare Supplement Plan F is one of the most popular Medicare Supplement Insurance plans because it offers the most comprehensive coverage of the currently available Medicare Supplement insurance plans. Medicare Supplement Plan F covers the most amount of benefits compared to the other Medicare Gap plans.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Who qualifies plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare Plan F cover cataract surgery?

Also good: Plan A, B, D, G, M and N pay 100% of Part B coinsurance, which is your portion of cataract procedure costs. Best plans if you're eligible: Plan C and Plan F pay 100% of the Medicare Part B coinsurance and the Part B deductible.

Does plan F pay Medicare deductible?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is High Deductible Plan F?

The coverage for a high-deductible Plan F is nearly the same as Medicare Supplement Plan F, but you’re required to satisfy an annual deductible bef...

What is High Deductible Plan G?

A high-deductible Plan G requires you to pay an annual deductible before the plan begins to pay. Once you reach the deductible, you will receive th...

Is Medigap Plan C and Medicare Part C the same?

No. Even though Medigap Plan C and Medicare Part C sound similar, they are very different. Medigap is Medicare Supplement Insurance that helps cove...

How can I enroll in a Medicare Supplement plan?

To be eligible for a Medicare Supplement plan, you must enroll in Original Medicare (Parts A and B). The Medigap open enrollment period lasts six m...

Are there other options rather than enrolling in a Medigap plan?

Yes. Consider enrolling in a Medicare Advantage (Part C) plan, an alternative to Original Medicare that comes with additional benefits and features...

What does Plan F cover?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.

When will Plan C and F be available?

Plan C and Plan F will no longer be options for new enrollees as of January 1, 2020. That may seem like quite a distance away, but consider the Medicare enrollment window. You have seven months in which to make a decision about your coverage. Knowing what options are in front of you is important.

What is the deductible for Medicare Part B?

The Medicare Part B deductible in 2018 was $183. 2 It’s easy to understand the appeal of folding that cost into a plan that covers more of your out-of-pocket expenses. Plan C has no out-of-pocket limit, and covers: Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

How many states have Medicare Supplement Plans?

There are currently 10 types of Medicare Supplement Insurance plans in 47 states. (Massachusetts, Minnesota and Wisconsin have their own plans.) Like Medicare Advantage and Medicare Part D plans, Medicare Supplement plans are provided by private insurance companies. You have to be enrolled in Medicare Part A and Part B to purchase ...

When will Medicare Supplement Insurance change?

If you’re eligible for Medicare after January 1, 2020, ...

Is Medicare Supplement Plan F or C an option?

If you’re eligible for or enrolling in Medicare after January 1, 2020, neither Medicare Supplement Plan F or Plan C will be an option for you . But don’t worry! There are several other Medicare plans available that can help support your health care needs.

Can you have both Medicare Advantage and Supplement?

Medicare Advantage and Medicare Supplement insurance are mutually exclusive. You can’t have both. So if you opt for a Medicare Advantage plan, there’s no need to stress over the loss of these Supplement plans.

What is the Medicare deductible?

The Medicare deductibles, coinsurance and copays listed are based on the 2019 numbers approved by the Centers for Medicare and Medicaid Services. You can go to any hospital, doctor or other health care provider in the U.S. or its territories that accepts Medicare.

Does Blue Cross Blue Shield of Michigan cover Medicare Supplement?

Blue Cross Blue Shield of Michigan administers Blue Cross Medicare Supplement plans. Where you live, your age, gender and whether you use tobacco may affect what you pay for your plan. Your health status may also affect what you pay. This is a solicitation of insurance. We may contact you about buying insurance.

Is Blue Cross Medicare endorsed by the government?

This is a solicitation of insurance. We may contact you about buying insurance. Blue Cross Medicare Supplement plans aren't connected with or endorsed by the U.S. government or the federal Medicare program. If you're currently enrolled in Plan A or Plan C, you can stay with your plan as long as you pay your premium.

Does Medicare cover Part B?

The new MACRA law doesn’t allow Medicare supplement plans to cover the Part B deductible for people who are eligible for Medicare on or after Jan. 1, 2020. Because Plans C, F and high-deductible F cover the Part B deductible, they will no longer be available for beneficiaries who become eligible for Medicare on or after Jan. 1, 2020.

What is the first dollar Medicare Supplement?

First-Dollar Medicare Supplement Insurance plans. Plan F and Plan C are both referred to as “first-dollar” coverage plans because they cover the annual Medicare Part B deductible. This benefit allows policyholders to get non-emergency medical care without having to pay an annual deductible. The Part B deductible is $198 per year in 2020.

How many Medicare plans are there in 2020?

Unless new plans are added, most newly eligible Medicare beneficiaries in 2020 will only have 8 Medigap plan options to choose from: Plans A, B, D, G, K, L, M, and N. If you're a new Medicare beneficiary starting in 2020, you will not be able to enroll in Plan F or Plan C and will not have coverage for the Medicare Part B deductible benefit.

When will Medicare stop allowing you to buy Medigap?

If you became eligible for Medicare on or after January 1, 2020, a federal law will prevent you from purchasing Medigap Plan C and Plan F.

Can you keep Medigap Plan C?

Current Medigap policyholders. If you are currently enrolled in Medigap Plan C or Plan F, you can keep your plan. However, you may still want to explore your options. “Plan F holders may want to make sure Plan F is the right plan for them and make changes while they are healthy and still able to qualify for a new plan,” he said.

Does lower rated insurance increase premiums?

Lower-rated carriers or new insurance carriers may offer lower premiums at first, but they might increase premiums drastically from year to year, or after the introductory rates are over. “If you are uncertain about plan F or the future of Plan F, give us a call,” Esposito said.

Will Medicare Part B deductible increase in 2020?

If you use Medicare Part B services, you must pay the $198 annual deductible in 2020. The Part B deductible may increase in future years. Esposito thinks that it's possible that the Part B deductible will increase at a higher rate than we are used to seeing especially due to the recent increase.

What are the different parts of Medicare?

This is true for other parts and plans as well. In all, there are four parts that make up Medicare coverage: Part A, Part B , Part C and Part D.

What is Medicare Part B?

Medicare Part B helps to pay for outpatient services, like primary care. This includes your doctor office visits, lab tests, preventative care, dialogistic imaging and so on. As you can see, many of these things may take place during a hospital stay, which is why both Part A and Part B are always recommended.

How much does Medicare pay for Part B?

It’s important to note that you pay a premium each month for Part B. Also, after your deductible is met, you typically pay 20% of the Medicare-approved amount for Part B services.

Does Medicare Part F exist?

Medicare Part F actually doesn’t exist. When people begin talking about “Part F” or “Part G,” they have likely confused Medigap Plans with the parts of the Medicare program itself. This is simply due to similar wording, with Medicare supplement insurance (Medigap) policies offering Plan A, B, C, D, F, G, K, L, M and N.

Do you have to enroll in Medicare Advantage before signing up?

So, before signing up, be sure that you compare a Medicare supplement insurance policy to a Medicare Advantage plan. Also, keep in mind that you don’t have to enroll in either.

Does Medicare Part A cover hospital services?

Of course, while Medicare Part A is responsible for hospital related coverage, it won’t necessarily cover all of the services that you may receive while in the hospital. For that reason, it’s still suggested that you sign up for both Part A and Part B coverage to stay protected.

Is Part D required for a prescription?

Part D is not required, although many people opt for it because the relatively low monthly premium typically covers a lot of out-of-pocket prescription drug costs. Keep in mind that there are rules regarding when you can enroll or remove yourself from a Part D plan.

Medicare Plan F

Historically, Medicare Plan F provided the most benefits of all the supplemental Medicare plans, says Price. It addresses some of the coverage gaps in Medicare parts A and B, which is why many people thought it was worth the extra premium, he notes.

Who Is Still Eligible for Medicare Plan F?

Those who were eligible for Medicare on or before January 1, 2020 can still sign up for Medicare Plan F. People who already had or were covered by Medicare Plan F before January 1, 2020 are also able to keep their plan.

What Other Medicare Supplement Plans Are Similar to Plan F?

People newly eligible for Medicare can’t sign up for Plan F, but they still have options when it comes to other Medigap plans. Here’s a look at what some experts say are the two best alternatives to Plan F.

How to Choose a Medicare Supplement Plan

Now that Medicare Plan F is only available to a certain subset of the population, those who are just signing up may struggle with their coverage decisions. Is a Medigap Supplement Plan necessary? And is Plan G the best option?

Sources

Meyers DJ, Trivedi AN, Mor V. Limited medigap consumer protections are associated with higher reenrollment in medicare advantage plans. Health Aff (Millwood). 2019;38 (5):782-787.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.