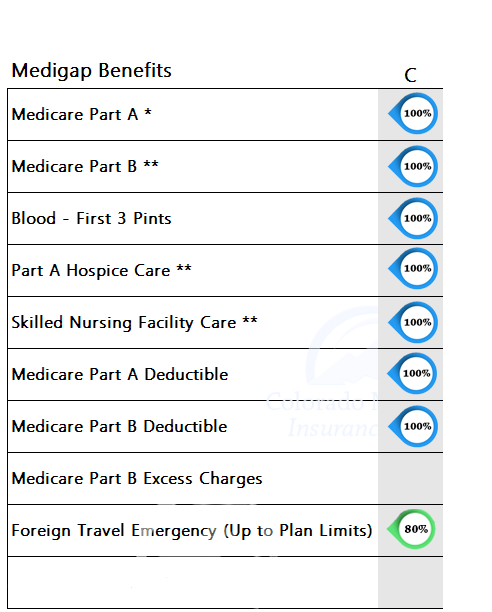

Medicare Supplement insurance Plan C typically covers the following:

- Medicare Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits are exhausted

- Medicare Part A hospice care coinsurance or copayments

- Medicare Part B copayments and coinsurance

- First three pints of blood for a medical procedure

- Skilled Nursing Facility care coinsurance

- Medicare Part A deductible

Full Answer

What does Medicare supplement plan C cover?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

How much does Medicare Part C plan cost?

Apr 18, 2022 · What Is Medicare Part C - Part C might be one of the most confusing parts of Medicare. But, don't let that deter you from learning about it because it's a great fit for many Medicare beneficiaries. As long as you understand how Part C works and take care to read your plan's summar ...

What is the best Medicare plan?

Sep 15, 2021 · Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great...

What does Part C cover in Medicare?

Apr 15, 2020 · Medicare Part C is an alternative way to get your Original Medicare benefits. It is also referred to as a Medicare Advantage plan. In addition to your Original Medicare coverage, a Medicare Part C plan might offer additional benefits like vision and dental care.

What is Medicare Part C and how does it work?

Medicare Advantage, or Medicare Part C, is a type of Medicare plan that uses private health insurance to cover all the services you'd receive under Medicare Parts A and B. Anyone who is eligible for original Medicare Parts A and B is eligible for the Medicare Advantage programs in their area.

What is the point of Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is Medicare C the same as Medicare Advantage?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is Type C Medicare?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

What is the difference between Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.Oct 1, 2021

Does Medicare Part C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What is Medicare Part C?

Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

When is open enrollment for Medicare Part C?

If you miss the initial enrollment period, open enrollment runs from October 15 through December 7 every year. You can sign up for original Medicare online through the Social Security Administration website. You can compare and shop for Medicare Part C plans online through Medicare’s plan finder tool.

What is an HMO plan?

Health Maintenance Organization (HMO) plans are a popular option for those who want additional coverage not offered by original Medicare. In a Medicare Advantage HMO plan, you can receive care from your plan’s in-network healthcare professionals, but you will need to get a referral to see a specialist.

Does Medicare Part C cover out of pocket costs?

There are a variety of costs associated with a Medicare Part C plan, which means your out-of-pocket costs may vary, depending on the plan you choose. Some Medicare Part C plans will cover a portion of your Part B monthly premium. However, some of these plans also have their own premium and deductible. In addition to these costs, you may also owe ...

Is Medicare Part C a good plan?

These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you. If you’re happy with your current Medicare coverage and are only interested in receiving prescription drug coverage, a stand-alone Medicare Part D plan may be the best option.

Does Medicare Supplemental Insurance work?

If you have Medicare coverage but only need additional help with costs, a Medicare supplemental insurance (Medigap) policy might work for you. For some people, Medicare Part C is an additional cost that they just can’t afford — in this case, shopping around for Part D and Medigap coverage may help save money.

Does Medicare offer Part C?

If you already receive coverage through a major insurance company, it may offer Medicare Part C plans. Some of the major insurance companies that offer Medicare Part C are: There are two main types of Medicare Advantage plans offered, which we’ll go over in detail next.

What is Medicare Advantage Part C?

Find Plans. Find Plans. Summary: Medicare Part C, also known as Medicare Advantage, is an alternative way to get your Original Medicare benefits. These plans often offer additional coverage for services like prescription drugs, vision and dental care. Plans vary in terms of both cost and benefits.

What are the parts of Medicare?

There are four basic parts to Medicare. Part A and Part B make up Original Medicare. Part A covers care you receive while you are in the hospital. Part B helps pay for expenses, like doctor visits and some medical equipment. Medicare Part C is an alternative way to get your Original Medicare coverage.

When do you enroll in Medicare?

This is the period when you first become eligible for Medicare. This enrollment period begins three months before the month you turn 65. It includes your birthday month and the three months following.

When can I switch Medicare Advantage plans?

This period runs annually from January 1 to March 31. During this time, you can switch from one Medicare Advantage plan to another.

What is a Silversneaker?

Wellness programs called SilverSneakers. Prescription medications. Medicare Part C plans can also offer additional benefits today, such as over-the-counter medications, transportation to and from doctor appointments, and adult daycare services.

Is Medicare Part D a stand alone plan?

Medicare Part D is prescription drug coverage. You can have a stand-alone prescription drug plan with Original Medicare, or you might have a Medicare Advantage plan that includes prescription medication benefits.

What is Medicare Supplement Insurance Plan C?

Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive Medicare Supplement Insurance plans you can buy . If you only choose to see doctors who accept assignment, it provides the same amount of coverage as the most extensive plan, Medigap Plan F. Without Medigap Plan C, your costs under Medicare Part A in 2021 include:

What is the difference between Medicare and Medicare Part B?

The difference between what Medicare pays for a certain medical service, and what your doctor or provider charges for it, is the Medicare Part B excess charge, which you’re responsible for paying out-of-pocket. In some cases, you may be charged up to 15% more than the Medicare-approved amount for a service.

How much is Medicare Part B deductible in 2021?

Without Medigap Plan C, your costs under Medicare Part B include: A $203 annual deductible in 2021. 20% coinsurance for most Medicare-approved services after the deductible is met. Up to 15% additional excess charges if your doctor does not accept assignment. All costs for foreign travel emergency coverage.

How much is Medicare Part B coinsurance?

With Medigap Plan C, your costs under Medicare Part B include: $0 for the Medicare Part B deductible. $0 in coinsurance for Medicare-approved services. Up to 15% additional excess charges if your doctor does not accept assignment. 20% of your medically necessary emergency care outside of the U.S. after you meet a $250 deductible.

What is the deductible for Medicare Supplement 2020?

Effective Jan. 1, 2020, Section 401 of the Medicare Access and CHIP Reauthorization Act (MACRA) stipulates that newly eligible Medicare beneficiaries are unable to sign up for a Medicare Supplement Insurance plan that covers the Medicare Part B deductible (which is $203 in 2021 ).

How much is Medicare Part A 2021?

Without Medigap Plan C, your costs under Medicare Part A in 2021 include: $1,484 deductible during inpatient hospital stays (per benefit period) $371 coinsurance per day after day 60 in the hospital. $742 coinsurance per day for up to 60 “lifetime reserve days” after day 90 in the hospital. All costs for inpatient hospital care after day 150.

Is Medicare Part C the same as Medigap?

Please note that Medigap Plan C is not the same as Medicare Part C ( Medicare Advantage), despite their names that sound somewhat alike. Medicare Supplement insurance Plan C typically covers the following: Medicare Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits are exhausted.

Is Medicare Supplement Plan C phased out?

Medigap Plan C covers most Medicare-approved out-of-pocket expenses. However, Medicare Supplement Plan C is being phased out, along with Plan F. Be aware that if you become eligible for Medicare on or after January 1, 2020, you won’t be able to buy Plan C.

What is Medigap Plan C?

Medigap Plan C is designed to provide enrollees with fewer out-of-pocket expenses because it covers a portion of the remaining balance of hospital or doctor bills not covered by Original Medicare (Parts A and B), such as Medicare deductibles, copayments, and coinsurance.

What is Medicare Part A deductible?

At its most basic level, this plan specifically covers the following costs and benefits: Medicare Part A deductible. Part A hospital and coinsurance costs (up to an additional 365 days after Medicare benefits are exhausted) Part A hospice care copayment or coinsurance. Part B deductible. Part B copayments and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is a policy designed to help pay some of the health care costs that Original Medicare doesn’t cover. Medigap Plan C is one such option, and (considering it covers all but one of the available Medicare Supplement benefits) it happens to be one of the most comprehensive.

Is Charlie on Medicare?

Charlie has been eligible for Medicare for a few years, but he's just now retiring at age 71 and enrolling in Medicare for the first time. He plans to spend much of his free time traveling the world, so coverage while abroad is at the top of his needs list.

Is Medigap Plan C still available?

Medigap Plan C policies are still available to Medicare beneficiaries who were eligible for Medicare before January 1, 2020. If you frequently need medical attention, travel outside the United States, or are interested in lowering your out-of-pocket costs, then Medigap Plan C could be the ideal solution.

What is excess charge in Medicare?

If you have Original Medicare, and the amount a health care provider is legally allowed to charge is greater than the Medicare-approved amount, the difference is called an excess charge. With Plan F, excess charges will be taken care of, while with Plan C they become the beneficiary’s responsibility.

Does Medicare cover medical expenses?

Typically, Medicare doesn’t cover health care outside of the United States, which means a medical emergency while on vacation can leave you with 100% of the costs incurred. Plan C pays 80%of approved costs up to plan limits in foreign countries.

How much is Medicare Part B in 2021?

The Medicare Part B premium is typically $148.50 a month in 2021, but it may be higher if you earn a higher income. Beyond that, prices can vary greatly by plan. Medicare Advantage premiums average $33 in 2020, according to data from the CMS compiled by Policygenius. At the same time, premiums can reach up to $481.

What is Medicare for older people?

Medicare is a federal health insurance program that primarily serves Americans age 65 and older. It’s also available to younger individuals with certain disabilities or health conditions. Medicare consists of multiple parts, which each cover different types of health services.

How many parts does Medicare have?

Unlike traditional health insurance plans, Medicare is divided into four parts that each cover different services. If you’re already claiming Social Security benefits, then you will be automatically enrolled in Medicare Part A and Medicare Part B once you turn 65. These two parts are known as Original Medicare .

When is the open enrollment period for Medicare?

Outside of initial enrollment, these are the times you can purchase or make changes to a Medicare Advantage plan: Open enrollment for Medicare Part C and Medicare Part D, which runs from Oct. 15 to Dec. 7 each year. This is also called the annual election period (AEP).

Who runs Medicare Advantage?

The Medicare program is run by the Centers for Medicare & Medicaid Services (CMS), a federal agency, but Medicare Advantage plans are run by private insurers. For that reason, Medicare Advantage plans often look similar to traditional health insurance plans.

What is MSA in Medicare?

MSAs are a bit different from the types of plans above. An MSA works very similarly to a high-deductible health plan (HDHP) paired with a health savings account (HSA). With an MSA plan, Medicare will deposit money into an account that you can then use to pay for your health care services. Your insurance will not start to pay for your medical expenses until you spend enough to hit your deductible.

Is Medicare Advantage a private insurance?

Medicare Advantage is run by private insurance companies, and even though prices may be lower than traditional private health insurance, a lot of the complexities from private plans exist in Medicare Part C. Medicare Advantage plans (sometimes called MA plans) also require you to use a local network of providers.