Medigap Plan M covers the following costs and benefits:

- Part A hospital coinsurance and expenses up to an additional 365 days after someone exhausts their original Medicare benefits

- Part A deductible to 50%

- Part A hospice care copays and coinsurance

- Part B copays and coinsurance

- First 3 pints of blood for a medical procedure

- Skilled nursing facility (SNF) care coinsurance

What is Medicare supplement plan m?

Medicare Supplement Plan M is one of the new Supplements created by the Medicare Modernization Act. It first hit the Medicare insurance market in the summer of 2010. (Sometimes we hear people call it Medicare Part M or Medigap Part M, but the correct term is Plan M.) Medicare Plan M provides the same basic benefits as other Supplements.

What is Medigap plan m?

Medigap Plan M: the Deductible-sharing Plan. Medicare Supplement Plan M is one of the new supplements created by the Medicare Modernization Act. It first hit the Medicare insurance market in the summer of 2010.

What is Medicare Part M (part m)?

(Sometimes we hear people call it Medicare Part M or Medigap Part M, but the correct term is Plan M.) Medicare Plan M provides the same basic benefits as other Supplements.

When did Medicare Part M come out?

It first hit the Medicare insurance market in the summer of 2010. (Sometimes we hear people call it Medicare Part M or Medigap Part M, but the correct term is Plan M.) Medicare Plan M provides the same basic benefits as other Supplements.

Is there a plan M?

Medicare Supplement Plan M provides coverage for many seniors in the United States. A low-premium policy, Plan M is great for those who are prepared to cover out-of-pocket health care expenses.

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the 2 types of Medicare plans?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

What are 3 plans for Medicare?

Different types of Medicare health plansMedicare Advantage Plans. ... Medicare Medical Savings Account (MSA) Plans. ... Medicare health plans (other than MA & MSA) ... Rules for Medicare health plans.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is the best supplemental insurance for Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is Medicare Plan F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is Medicare Plan G?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is the eligibility for Medicare Supplement Plan M?

To be eligible for Medicare Supplement Plan M, you must be enrolled in original Medicare Part A and Part B. You must also live within an area where this plan is sold by an insurance company.

What is a Medigap plan?

Enrollment. Takeaway. Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance . Medicare Supplement Plan M (Medigap Plan M) is one option you can choose for additional coverage. To be eligible for Medicare Supplement Plan M, you must be ...

What to do before committing to Medigap Plan M?

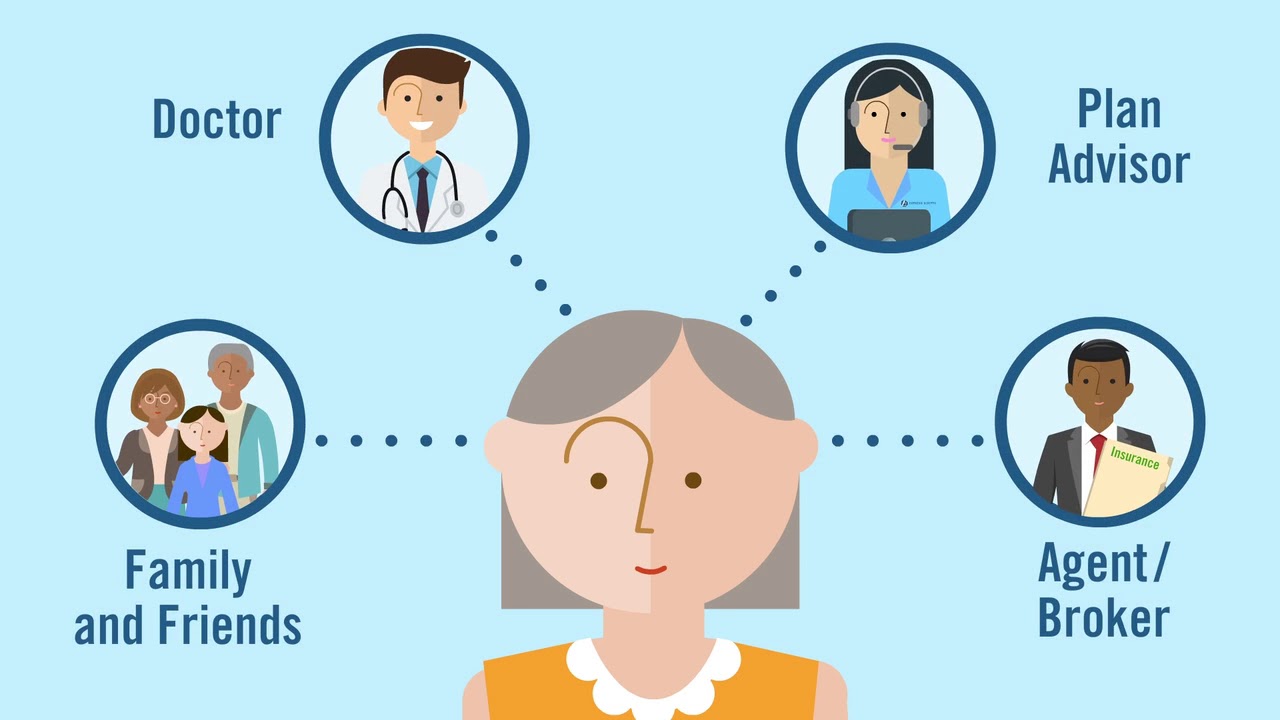

Before committing to Medigap Plan M or any other Medigap plan, review your needs with a licensed agent who specializes in Medicare supplements to help you. You can also contact your state’s State Health Insurance Assistance Program (SHIP) for free help in understanding available policies.

Why do private health insurance companies sell Medicare Supplement Plans?

Private health insurance companies sell Medicare supplement plans to help reduce out-of-pocket expenses and sometimes pay for services that Medicare doesn’t cover. People also call these Medigap plans.

What letters are used to name plans?

Most companies name the plans by uppercase letters A, B, C, D, F, G, K, L, M, and N.

Is Medicare Supplement Plan M a good plan?

If you don’t expect frequent hospital visits and are comfortable with cost-sharing, Medicare Supplement Plan M may be a good choice for you.

Does Medigap pay its share of charges?

Your Medigap policy pays its share of the charges.

What is Medigap Plan M?

Medigap Plan M is one of the offerings created by the Medicare Modernization Act, which was signed into law in 2003. Plan M was designed for people who are comfortable with cost-sharing and don’t expect frequent hospital visits. Read on to learn what’s covered and not covered under Medicare Supplement Plan M.

What are not covered by Plan M?

The following benefits are not covered under Plan M: Part B deductible. Part B excess charges. If your doctor charges a fee above the Medicare assigned rate, this is called a Part B excess charge. With Medigap Plan M, you’re responsible for paying these Part B excess charges. In addition to these exceptions, there are a few other things ...

How many Medigap plans are there?

In most states, you can choose from among 10 different standardized Medigap plans (A, B, C, D, F, G, K, L, M, and N). Each plan has a different premium and features different coverage options. This gives you the flexibility to choose your coverage based on your budget and your healthcare needs.

What percentage of Medicare pays for outpatient care?

After you’ve met the deductible, Medicare pays for 80 percent of your outpatient care. Then, Medicare Supplement Plan M pays for the other 20 percent. If your surgeon doesn’t accept Medicare’s assigned rates, you’ll have to pay the overage, which is known as the Part B excess charge. You can check with your doctor before receiving care.

How many people does Medigap cover?

Medigap plans cover only one person . If you and your spouse are both enrolled in original Medicare, you’ll each need your own Medigap policy.

Does Medicare Supplement Plan M cover dental?

Medicare Plan M can help you pay for medical expenses not covered under original Medicare (parts A and B). Like all Medigap plans, Medicare Supplement Plan M doesn’t cover prescription drugs or extra benefits, such as dental, vision, or hearing.

Does Medigap cover dental?

Medigap plans also do not cover vision, dental, or hearing care. If that coverage is important to you, you might want to consider Medicare Advantage (Part C), as these plans often include such benefits. As with Medicare Part D, you purchase a Medicare Advantage plan from a private insurance company. It’s important to know that you can’t have both ...

What does Medicare Supplement Plan M cost?

The average premium cost for Medicare Supplement Insurance Plan M in 2018 was $218.75 per month . 1

What is a Medigap Plan M?

Medigap Plan M is one of the 10 Medigap plans available in most states, which include Plan A, B, C, D, F, G, K, L, M and N. Each type of Medigap plan offers a different combination of standardized benefits. Let’s take a look at what Medicare Supplement Insurance Plan M covers and review the average cost of Medigap Plan M.

What percentage of Medicare Part A deductible is covered by Medigap Plan M?

Medigap Plan M covers 50 percent of the Medicare Part A deductible.

What is the cost of Medicare Part B?

After you meet your Medicare Part B deductible (which is $203 per year in 2021), you are typically responsible for a coinsurance or copay of 20 percent of the Medicare-approved amount for covered services.

What is the deductible for Medicare 2022?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,490 in 2022. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

How much does Medicare Part A cover in 2021?

If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital costs once you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021. For the first 60 days of your hospital stay, you aren’t required to pay any Part A coinsurance.

What are the benefits of Medicare Advantage?

Medicare Advantage plans provide all the same benefits as Original Medicare. Many Medicare Advantage plans also offer benefits that Original Medicare doesn’t cover , such as coverage for prescription drugs, dental, vision, hearing and more.

How Much Does Medicare Plan M Cost?

The average cost for Medicare Plan M is around $120-$200 per month. Due to the cost-sharing, the premium is lower compared to other Medigap plans. However, your monthly premium rates depend on various factors, including your location.

What is Medicare Supplement Plan M?

Medicare Supplement Plan M provides coverage for many seniors in the United States. A low-premium policy, Plan M is great for those who are prepared to cover out-of-pocket health care expenses.

What is a plan M?

Plan M is a cost-sharing Medigap plan. When you enroll in this plan, you’re responsible for 50% of your Part A deductible. Yet, the premiums for Plan M are lower than those of some other Medigap plans, so many enrollees are able to justify the out-of-pocket costs.

Which is better, Plan M or Plan K?

Of the three cost-sharing Medigap plan options, Plan M offers the most comprehensive coverage. The only cost-sharing involved in Plan M is 50% of your Part A deductible, whereas Plan K and Plan L require more. Certainly, you’ll also have better coverage with Plan M than with Original Medicare alone.

Does Medicare Supplement include vision?

Neither Original Medicare nor any Medicare Supplement plan includes vision coverage. However, you can pair your coverage with a stand-alone vision plan.

Is Plan M deductible or excess?

Plan M’s only expenses for which the beneficiary is fully responsible are the Part B deductible and Part B excess charges. However, not every state allows excess charges, and even in the ones that do, they are rare. The best course of action is to make sure your providers accept Medicare assignment before making appointments.

Is Plan M still available?

Yes, Plan M still exists and is available for eligible beneficiaries to enroll.

What is Medicare Supplement Plan M?

That’s why many people call them “Medigap” plans—they fill in the gaps of Medicare. Plan M covers coinsurance and copayments generously. However, it is less generous when it comes to deductibles and excess charges, so you’ll be responsible for those costs if you select Plan M. Medicare Supplement Plan M is most similar to Medigap Plan D.

How much does Medicare Part A pay for Plan M?

People who don’t expect to visit the hospital often: Plan M pays for just half (50%) of the $1,408 Medicare Part A (hospital) deductible. Most other Medigap plans pay more.

How long do you have to sign up for Medicare Supplement?

You may want to sign up for a Medicare Supplement plan during your guaranteed issue window. After you sign up for Medicare Part A and Part B, you have six months to sign up for Medigap plans when you will be accepted, no matter your health status. If you wait until later, you may be denied coverage or charged more.

How long does a hospital benefit last?

A benefit period starts when you first go into a hospital or inpatient facility and ends when you’ve been out of the facility for 60 days straight. There are no limits to the number of benefit periods you can have in a given year, and they can carry over between calendar years.

How many deductibles are there on a Plan M?

People who understand how deductibles work: There are three deductibles that people on Plan M must pay before their coverage kicks in.

What is excess charge for Medicare?

When you see a provider who isn’t contracted with Medicare (also referred to as not accepting Medicare assignment), that provider may bill you up to 15% above what Medicare pays them. This fee is called the excess charge, and Plan M doesn’t cover it. You’ll want to confirm that each provider you see accepts Medicare assignment before you receive care.

Why did Susan decide to buy Medigap Plan M?

Susan decides to purchase Medigap Plan M, because it will provide her with 50% coverage of the Part A hospital deductible and emergency medical coverage for an upcoming trip to Mexico for a family wedding.

How it works

When Medicare pays for services, you’re responsible for certain out-of-pocket costs unless you have Medicare Supplement Insurance, or Medigap, to help cover them. Medigap plans are only for Original Medicare members — they’re not compatible with Medicare Advantage.

How much does Medigap Plan M cost?

Medigap plans are standardized and regulated by the government but sold by private companies. Those companies set premiums according to factors including age, location and tobacco use. In a representative North Carolina ZIP code (27406) in 2022, monthly Medigap Plan M premiums for a 65-year-old nonsmoker range from $72 to $260.

Compare alternative plans

About the author: Alex Rosenberg is a NerdWallet writer focusing on Medicare and information technology. He has written about health, tech, and public policy for over 10 years. Read more

What is Medicare Supplement Plan M?

Medicare Supplement Insurance Plan M. Medigap Plan M is one of 10 standardized Medicare Supplement Insurance plan options available in most states. Medicare Supplement Plan M helps cover a number of costs your Original Medicare (Part A and Part B) coverage doesn’t pay for. Learn more about Plan M benefits, and find out if it may be ...

What does Medigap Plan M pay for?

Medigap Plan M pays for 80% of the costs for qualified emergency medical care you receive when traveling abroad.

How Do I Sign up for Plan M?

If Medigap Plan M seems like a good fit, you can request a free Medigap plan quote online today. Plan M options may be available where you live.

What is Medicare Part A and Part B?

Medicare Part A and Part B include things like deductibles, copayments and coinsurance, which must be paid entirely out of your own pocket. With Medigap Plan M, you pay a monthly premium in exchange for having some of those out-of-pocket costs covered for you. There are nine benefit areas that can be covered by a Medicare Supplement Insurance plan, ...

How many benefits are covered by Medicare Supplement?

There are nine benefit areas that can be covered by a Medicare Supplement Insurance plan, and each type of plan offers its own combination of coverage for those benefits. Medigap plans are standardized, which means that the benefits covered by Plan M in one state are exactly the same as Plan M in another state, no matter where or by whom it is sold.

What does Plan M pay for?

Plan M pays for the entire Part A skilled nursing facility coinsurance cost.

How many Medigap benefits does Plan M offer?

Plan M offers full or partial coverage for 7 out of 9 possible Medigap benefits.