Full Answer

What are the four Medicare savings programs?

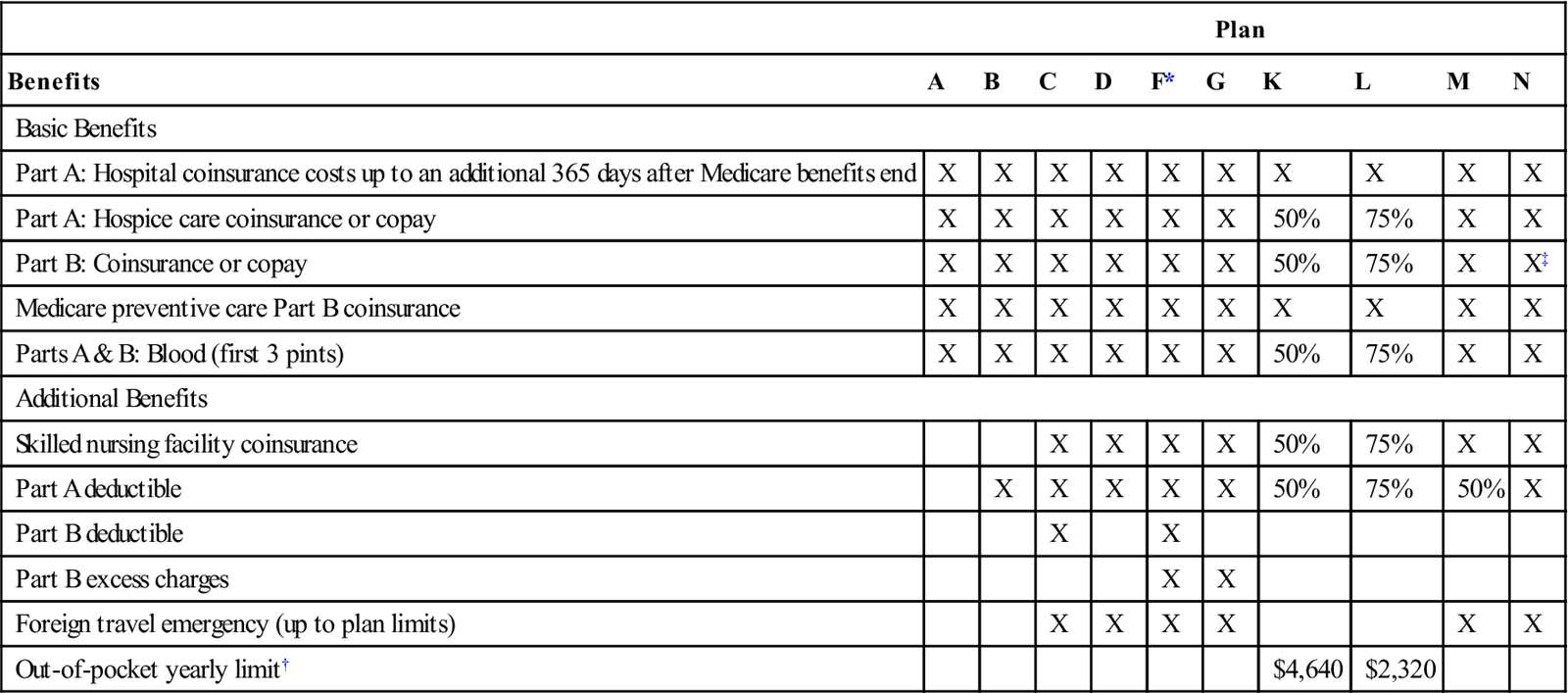

- Most MSPs pay Medicare Part B premiums and some help with additional Part A and B costs

- MSPs don’t cover costs from Medicare Part C plans (Medicare Advantage)

- Medicare beneficiaries who qualify for an MSP also receive Medicare Extra Help to help pay for prescription drugs

What are the benefits of Medicare savings program?

Types of Medicare Savings Programs

- Qualified Medicare Beneficiary (QMB) Programs pay most out-of-pocket costs for Medicare, protecting beneficiaries from cost-sharing. ...

- Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium. ...

- Qualifying Individual (QI) Programs are also known as Additional Low-Income Medicare Beneficiary (ALMB) programs. ...

How do you qualify for Medicare savings program?

What to Know About Medicare Savings Programs

- Medicare savings programs can help you pay Part A and Part B premiums, deductibles, copays, and coinsurance.

- Your income must be at or below specified limits each month.

- Your household resources must also be at or below certain limits.

What does Medicaid qi1 cover?

With QI-1, Medicaid pays your Medicare Part B premiums. As of 2010, Medicare Part B premiums are $96.40 to $110.50 monthly. Individuals enrolled in a Medicare Saving Program are automatically eligible to enroll in the Extra Help program. Extra Help offers assistance with part of your prescription costs.

What does Qi pay for?

The Qualifying Individual (QI) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part B premiums only.

What is the difference between Qi and SLMB?

Specified Low-income Medicare Beneficiary (SLMB): Pays for Medicare Part B premium. Qualifying Individual (QI) Program: Pays for Medicare Part B premium.

What does QL 1 mean?

Medicare Savings Programs (MSP) help people with limited income and resources pay for some or all of their Medicare premiums and may also pay their Medicare deductibles and co-insurance.

How much money can you have in the bank if your on Medicare?

4. How to Qualify. To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member.

Does SLMB pay deductible?

The SLMB and QI programs pay all or part of the Medicare Part B monthly premium, but do not pay any Medicare deductibles or coinsurance amounts. Nonetheless, this means potential savings of more than a thousand dollars per year.

What does QMB mean in Medicare?

Qualified Medicare BeneficiarySPOTLIGHT & RELEASES. The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.

What is a Qi recipient?

The Medicare Qualifying Individuals (QI) program helps Medicare beneficiaries cover their Part B premium. Your premium is the monthly fee you pay for your Part B medical coverage. The QI program is one of four Medicare savings programs. These programs help individuals with limited incomes cover their healthcare costs.

What is QMB stand for?

State of California—Health and Human Services Agency. QUALIFIED MEDICARE BENEFICIARY (QMB), SPECIFIED LOW-INCOME MEDICARE BENEFICIARY (SLMB), AND QUALIFYING INDIVIDUALS (QI) APPLICATION.

What is QMB?

Qualified Medicare Beneficiary (QMB) is a Medicaid program for people who are already receiving Medicare benefits. The purpose of the program is to reduce the cost of medications and copays for doctors, hospitals, and medical procedures. Important Note: The QMB program may differ by state.

Does Medicare look into your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is the QI program for Medicare?

As of 2021, there are four Medicare savings programs: The QI program is for people who have Medicare Part A (hospital insurance) and Part B (medical insurance). Together, these two parts make up original Medicare. The program covers the cost of the Part B premium for people who qualify.

What is Medicare QI?

The Medicare QI program is one of four Medicare savings programs. It helps Medicare beneficiaries with limited incomes pay their Part B premiums. You’ll need to apply through your state and meet the income requirements to qualify.

What is QI premium?

Your premium is the monthly fee you pay for your Part B medical coverage . The QI program is one of four Medicare savings programs. These programs help individuals with limited incomes cover their healthcare costs.

What is QI insurance?

The QI program is for people who have Medicare Part A (hospital insurance) and Part B (medical insurance). Together, these two parts make up original Medicare. The program covers the cost of the Part B premium for people who qualify.

What is the income limit for Medicare QI 2021?

In 2021, the income limits for the QI program are $1,469 per month for individuals or $1,980 for married couples. The income limits are slightly higher in Alaska and Hawaii.

Does Medicare consider high value items?

Medicare doesn’t consider high-value items like your car or home to be resources. The income limits can change each year and are based on the federal poverty level (FPL). The FPL is calculated using data like the cost of living and the average salary in each state.

Do I need to reenroll in the QI program each year?

Reenroll each year. You’ll need to reenroll in the QI program each year. Applications for the QI program are approved on a first-come, first-served basis, so you’ll want to apply as early as possible. Priority is given to people who were enrolled in the QI program the previous year.

What is a QI program?

The Qualifying Individual (QI) Program is one of the four Medicare Savings Programs. that allows you to get help from your state to pay your Medicare premiums. This. Program helps pay for Part B premiums only.

How often do you have to apply for QI?

You must apply every year for QI benefits. QI applications are granted on a first-come, first-served basis, with priority given to people who received QI benefits the previous year.

How to contact Medicare by phone?

For more information, please visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227) . TTY users can call 1-877-486-2048. Visit the Medicare.gov Helpful Contacts page to locate a contact near you. 1-800-633-4227. Receive an email when this benefit page is updated: Subscribe to this Benefit.

Can I get QI if I qualify for medicaid?

You can't get QI benefits if you qualify for Medicaid. In order to qualify for QI benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,426. Married couple monthly income limit $1,923. Individual resource limit $7,730.

What is QI Medicare?

The QI Medicare savings program helps those on a low income to pay for their Medicare Part B monthly premiums. The Qualifying Individual or QI program is a Medicare savings program (MSP). Medicare provides four savings programs with different income and resource limits. To receive the program benefits, a person must meet financial criteria ...

What is the eligibility for QI?

To receive QI benefits, people must have Part A or be eligible and have income and resources below a specified limit. The eligibility requirements can differ between states and from year to year. When the Medicaid agency looks at someone’s application for a QI program, they consider the following resources:

What is automatic extra help?

Automatic Extra Help. When someone qualifies for the QI Medicare savings program, they can receive the Medicare Part D low-income subsidy. Also known as Extra Help, the program provides financial assistance for prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is the maximum income for Medicaid?

For a person to be eligible for Medicaid, the total monthly income limit is $895.

How much income do you need to qualify for QI?

In most states, this includes a $20 general income disregard. For a single person, the limit is $1,456 per month. For a married couple, the combined income must be less than $1,960 per month.

Can you have Medicaid and QI?

Medicaid and QI together. An individual cannot have Medicaid and a QI plan at the same time. Although the Medicaid agency administers both types of programs, there are differences between them. Medicaid pays for a range of healthcare services for those with low income and resources, not just the monthly premium.

What is the Qualified Individual (S06) medical program?

S06 medical is a Medicare Savings Program that pays client’s Medicare Part B premiums. For more information about this program, see Apple Health eligibility manual - WAC 182-517-0300 Federal Medicare savings and state-funded Medicare buy-in programs.

Who is eligible to receive Qualified Individual (S06) medical?

A person meeting the following conditions is eligible to receive S06 medical:

How long is the Qualified Individual (S06) certification period?

The S06 medical program is certified from the month the Assistance Unit is opened through the end of the current calendar year. For more information, see Apple Health eligibility manual – WAC 182-504-0025 Medicare savings program certification periods.

How do I screen Qualified Individual (S06) medical?

An S06 Assistance Unit (AU) is initially screened in as a Qualified Medicare Beneficiary (S03) AU following the instructions in How do I screen Qualified Medicare Beneficiary (S03) medical?

What if the client is active on Qualified Individual (S06) medical and applies for Categorically Needy (CN) or Medically Needy (MN) medical?

A client cannot receive S06 when receiving CN or MN medical under any other program. You must close the S06 Assistance Unit (AU) for all months that the client is requesting CN or MN medical.

How do I close the Qualified Individual (S06) medical when opening Categorically Needy (CN) or Medically Needy (MN) medical?

You must manually close the S06 Assistance Unit (AU) with a 500-level reason code in all historical months where a CN or MN medical program is opened for the client. For additional information on 500-level codes, see What Reason Codes can be entered on the Assistance Unit (AU) Details page?

What is Medicare Savings Program?

Medicare Savings Programs. Medicare Savings Programs help pay some Medicare costs for eligible individuals. Each program provides benefits that help pay coinsurance or co-payments, costs of deductibles, and other costs of healthcare for seniors and certain disabled individuals that meet Medicare Savings Program qualifications.

What is dual eligible Medicare?

The Medicare Learning Booklet, presented by the Centers for Medicare and Medicaid Services (CMS) explains that “Dual Eligible Beneficiaries” is the term used for people receiving both Medicare and Medicaid benefits, both Medicare Part A and Part B benefits and full Medicaid benefits or other assistance through one of the Medicare Savings Plans.

What is a QMB?

Qualified Medicare Beneficiary (QMB) helps pay your Part A and Part B premiums, deductibles, co-payments, and coinsurance if you meet all program qualifications. You are also enrolled in Medicaid when enrolled in the QMB program.

What is the extra help benefit?

This benefit helps pay some of your Medicare prescription drug costs after Medicare pays their share of your prescription coverage.

Does Medicare cover Social Security?

Medicare Savings Programs helps cover some of the costs of Medicare, depending upon the specific program and eligibility requirements. The Official Medicare website indicates that if you have income from working, you potentially qualify for one of the programs. If you now receive Social Security Disability or are retired after working most ...

Does Medicaid pay for cost sharing?

Your state Medicaid program potentially pays at least some of these costs. Federal laws allow states to place limits on how much the state pays Medicare for cost-sharing. It is crucial that you understand whether your state pays all or some of your Medicare costs under QMB.

Can you qualify for QI Medicare?

If you qualify for Medicaid benefits, you are not eligible for the QI Medicare Savings Program. Recipients receiving Qualifying Individual program benefits are eligible for Medicare Part A and have income that does not exceed 135 percent of the federal poverty level (FPL). This is a first-come, first-serve program.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What states have QI?

If you live in any of the following states, please note the differences in program names: 1 Alaska: QI is called SLMB Plus 2 Connecticut: QI is called ALMB 3 Maryland: QI is called SLMB II 4 North Carolina: QMB, SLMB, and QI are called MQB, MQB-B, and MBQ-E, respectively 5 Nebraska: Federal QMB is replaced with full Medicaid; SLMB and QI are both referred to as QMB 6 New Hampshire: QI is called SLMB-135 7 Oregon: SLMB and QI are called SMB and SMF respectively 8 Wisconsin: QI is called SLMB Plus

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

Does QMB pay for Part A?

A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium.