What does Medicare Part D include?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is Type D Medicare?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

Is Medicare Part D for everyone?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

What happens if I don't want Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

What does Medicare D cost?

The national base beneficiary premium for Part D plans is $33.37 per month for 2022, according to the Centers for Medicare & Medicaid Services, which calculates this number in part by using the national average monthly bid amount submitted by private insurers.

Which Medicare Part D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Which medication would not be covered under Medicare Part D?

For example, vaccines, cancer drugs, and other medications you can't give yourself (such as infusion or injectable prescription drugs) aren't covered under Medicare Part D, so a stand-alone Medicare Prescription Drug Plan will not pay for the costs for these medications.

When did Part D become mandatory?

January 1, 2006The benefit went into effect on January 1, 2006. A decade later nearly forty-two million people are enrolled in Part D, and the program pays for almost two billion prescriptions annually, representing nearly $90 billion in spending. Part D is the largest federal program that pays for prescription drugs.Aug 10, 2017

When did Medicare Part D become mandatory?

January 1, 2006Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the “Medicare Prescription Drug, Improvement, and Modernization Act of 2003.”[1] This Act is generally known as the “MMA.”

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.What help is available?Medicare is the federal health insurance program...

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 to the Social Secur...

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.EligibilityPrescript...

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:Log into your MyMedicare.gov account and reque...

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.Original Medica...

What is the Medicare coinsurance rate?

Medicare is gradually phasing in subsidies in the coverage gap for brand-name drugs and generic drugs, reducing the beneficiary coinsurance rate from 100 percent in 2010 to 25 percent in 2020.

What is the coverage gap?

The coverage gap, also known as the “doughnut hole,” is gradually closing by 2020 due to a provision of the ACA. In 2015, Part D beneficiaries pay 45 percent of their brand-name drug costs, and 65 percent of their generic drug costs in the coverage gap.

Medicare Eligibility, Applications and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

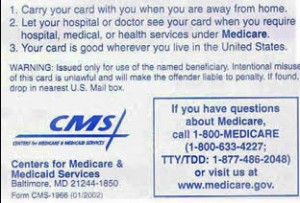

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

What are the parts of Medicare?

You choose the ones that best meet your healthcare needs. Let’s look at the first two parts: Part A pays for hospital stays. Plus, some home health and hospice care. Part B pays for doctor visits and care.

What is Medicare Advantage Plan?

These plans, known as Medicare Advantage plans, are offered by private insurance companies and are approved by the government. Part C (Medicare Advantage plan) provides all the benefits of Part A (Hospital Insurance) and Part B (Medical Insurance), and often includes extra benefits they do not cover, such as dental and vision.

Does Medicare cover prescription drugs?

They’re not covered in Original Medicare, so you’ll need to add a separate plan, known as a Medicare prescription drug plan (Part D). These plans are offered by private insurance companies and are approved by the government. Part D covers medications prescribed by doctors.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for?

Medicare is the federal health insurance program for: 1 People who are 65 or older 2 Certain younger people with disabilities 3 People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

When is Medicare enrollment period?

The Initial Enrollment Period (IEP) for Medicare is a 7-month period beginning 3 months before you turn 65, the month in which you turn 65, and 3 months after you turn 65. For example, if you turn 65 on June 14, your IEP is from March 1st through September 30.

How much is Medicare Part B premium for 2020?

Nearly everyone pays a monthly premium for Medicare Part B. The standard amount for 2020 is $144.60. However, if your gross income on your tax return is high enough, you’ll be required to pay both the standard monthly premium and an Income Related Monthly Adjustment Amount (IRMAA).

What is Medicare for people over 65?

Medicare is a health insurance program provided by the federal government for qualifying individuals, including people over the age of 65, those with certain disabilities, and individuals with end-stage kidney disease. Some people may confuse Medicaid and Medicare programs — the primary difference between the two is that Medicaid is ...

Who is Ron Elledge?

Ron Elledge. Medicare Consultant and Author. Ron Elledge is a seasoned Medicare consultant and author of “Medicare Made Easy.”. As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies.

What is the difference between Medicare and Medicaid?

Some people may confuse Medicaid and Medicare programs — the primary difference between the two is that Medicaid is a needs-based insurance program, while Medicare is not. Your income is not a determining factor for Medicare qualification. Although Medicare is a federal insurance program, there are monthly premiums for certain parts of Medicare. ...

How long do you have to be on Medicare to get a Social Security card?

You will be enrolled automatically in Medicare if you: Are already receiving Social Security benefits (at least four months prior to start) Receive Railroad Retirement Board benefits (at least four months prior to start) Are under the age of 65, but have a social security disability for 24 months.

When does Medicare start?

If you enroll in Medicare during the three months before you turn 65, Medicare coverage begins the first day of the month you turn 65. If you enroll in Medicare the month you turn 65, your Medicare coverage will start the first day of the month after you turn 65.

Does Medicare Advantage have network restrictions?

On the other hand, Medicare Advantage Plans typically have network restrictions, meaning that you will likely be more limited in your choice of doctors and hospitals.

Do you have to pay coinsurance for Medicare?

You typically pay a coinsurance for each service you receive. There are limits on the amounts that doctors and hospitals can charge for your care. If you want prescription drug coverage with Original Medicare, in most cases you will need to actively choose and join a stand-alone Medicare private drug plan (PDP).

What is an RRE?

Define who must report, a responsible reporting entity (RRE), as “an applicable plan”: "... [T]he term 'applicable plan' means the following laws, plans, or other arrangements, including the fiduciary or administrator for such law, plan, or arrangement: (i) Liability insurance (including self-insurance). (ii) No fault insurance.

What is a NGHP RRE?

An organization that must report under Section 111 is referred to as a responsible reporting entity (RRE). In general terms, NGHP RREs include liability insurers, no-fault insurers, and workers’ compensation plans and insurers. RREs may also be organizations that are self-insured with respect to liability insurance, no-fault insurance, ...

What is the purpose of 111?

The purpose of Section 111 reporting is to enable CMS to pay appropriately for Medicare-covered items and services furnished to Medicare beneficiaries. Section 111 NGHP reporting of applicable liability insurance (including self-insurance), no-fault insurance, and workers’ compensation claim information helps CMS determine when other insurance coverage is primary to Medicare, meaning that it should pay for the items and services first before Medicare considers its payment responsibilities.