The Low-Income Subsidy (LIS) in Medicare helps people with Medicare pay for medications and lowers the cost of Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Copayment

A copayment or copay is a fixed amount for a covered service, paid by a patient to the provider of service before receiving the service. It may be defined in an insurance policy and paid by an insured person each time a medical service is accessed. It is technically a form of coinsurance, but is defined differently in health insurance where a coinsurance is a percentage payment after the deductible up to a ce…

Who qualifies for Medicare subsidy?

Sep 15, 2018 · A Medicare Savings Program from the state may help subsidize your Medicare and Medicare Advantage premiums. If you meet certain conditions, a Medicare Savings Program may also pay hospital and medical insurance deductibles, copayments and coinsurance. There are four types of Medicare Savings Programs.

What are the advantages and disadvantages of Medicare?

Dec 01, 2021 · Eligibility for Low-Income Subsidy. This page contains information on eligibility for the Low-Income Subsidy (also called "Extra Help") available under the Medicare Part D prescription drug program. It includes information on how one becomes eligible for the Low-Income Subsidy as well as useful outreach material. See the link under "Related ...

Are Medicare Advantage plans subsidized?

Medicare-Subsidy.com helps beneficiaries explore Medicare options by providing information and resources related to Medicare Advantage, Medicare Supplement, and Prescription Drug plans. Medicare-Subsidy.com is not an insurance or operating company.

What is the best Medicare Advantage plan?

Jun 05, 2021 · Medicare beneficiaries receiving the low-income subsidy (LIS) get assistance in paying for their Part D monthly premium, annual deductible, coinsurance, and copayments. Also, individuals enrolled in the Extra Help program do not have a gap in prescription drug coverage, also known as the coverage gap, or the Medicare “donut hole.” The amount of subsidy depends …

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How can I avoid paying Medicare premiums?

Delaying enrollment in Medicare – when you're eligible for it – could result in a penalty that will remain in effect for the rest of your life.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

Does Medicare subsidize?

If you are eligible for both Medicare and Medicaid, you are called “dual eligible” and most of your health care costs are generally subsidized.Jul 17, 2021

Is Medicare Part D subsidized?

Part D Financing Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Higher-income Part D enrollees pay a larger share of standard Part D costs, ranging from 35% to 85%, depending on income.Oct 13, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Is Medicare deducted from your Social Security check?

Yes. In fact, Medicare can automatically deduct your Part B premium directly from your Social Security check if you are both enrolled in Part B and collecting Social Security benefits. Most Part B beneficiaries have their premiums deducted directly from their Social Security benefits.Jan 14, 2022

How is Medicare funded?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.Mar 16, 2021

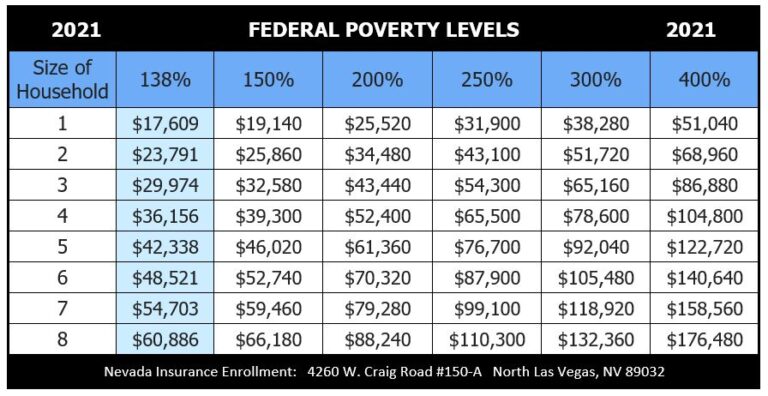

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What is the income limit for the Medicare Savings Program?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,060. Married couple monthly income limit $1,430. Individual resource limit $7,730.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What Is The Medicare Low-Income Subsidy?

Eligible beneficiaries who have limited income may qualify for a government program that helps pay for Medicare Part D prescription drug costs.Medi...

Medicare Extra Help Eligibility

You may qualify for the low-income subsidy available under Medicare Part D if: 1. Your annual income and assets are below the eligibility threshold...

How to Apply For Medicare Extra Help

To apply for the Medicare low-income subsidy, simply fill out an “Application for Extra Help with Medicare Prescription Drug Plan Costs” (SSA-1020)...

What is Medicare Extra Help Program?

If you meet certain income and resource limits, you will have low or no deductible, low or no premiums, no coverage gap, and will pay much less for your prescriptions.

Is Medicare deductible cheap?

It’s your time to save on Medicare! Medications aren’t cheap, and neither are insurance premiums or deductibles. Once you’ve turned 65 and have a low or fixed income, you may be eligible to save thousands annually off of premiums, deductibles, and copayments associated with your Medicare prescription drug costs!

What is Medicare low income subsidy?

What is the Medicare Low-Income Subsidy? Eligible beneficiaries who have limited income may qualify for a government program that helps pay for Medicare Part D prescription drug costs. Medicare beneficiaries receiving the low-income subsidy (LIS) get assistance in paying for their Part D monthly premium, annual deductible, coinsurance, ...

What assets count toward Medicare eligibility?

Assets that count toward eligibility include: Cash and bank accounts, including checking, savings, and certificates of deposit. Real estate outside of your primary residence. Stocks and bonds, including U.S. savings bonds. Mutual funds and IRAs. When calculating eligibility for the low-income subsidy, Medicare does not count resources such as your ...

How to apply for medicare?

To apply for the Medicare low-income subsidy, simply fill out an “Application for Extra Help with Medicare Prescription Drug Plan Costs” (SSA-1020) form with Social Security. You can apply and submit this form by: 1 Applying online at www.socialsecurity.gov/extrahelp. 2 Calling Social Security at 1-800-772-1213 (TTY 1-800-325-0778) and requesting an application be mailed to you or applying over the phone. Social Security representatives are available by phone Monday through Friday, from 7AM to 7PM. 3 Applying in person at your local Social Security office.

Is my annual income higher than the eligibility limit for Medicare?

The Medicare Extra Help program eligibility limits may change from year to year. For the most up-to-date levels, visit Medicare.gov. Your annual income is higher than the eligibility limit, but you support other family members who also live in the same household;

Does Medicare count as a home?

When calculating eligibility for the low-income subsidy, Medicare does not count resources such as your home (or primary residence); insurance policies; or a car. Many people qualify for Medicare Extra Help savings and do not know it. The best way to find out if you qualify is to go ahead and apply.

What's the Low Income Subsidy (LIS)?

The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage.

How can I help people get the LIS?

We work with our partners to find and enroll people who may qualify for the LIS, and we encourage local organizations to tell people in their communities about it.

Who might need help with their LIS?

There are 4 groups of people who already have the LIS, but may need some help to keep it or to understand that their LIS is changing. We send them targeted notices on colored paper when there are changes to their LIS.