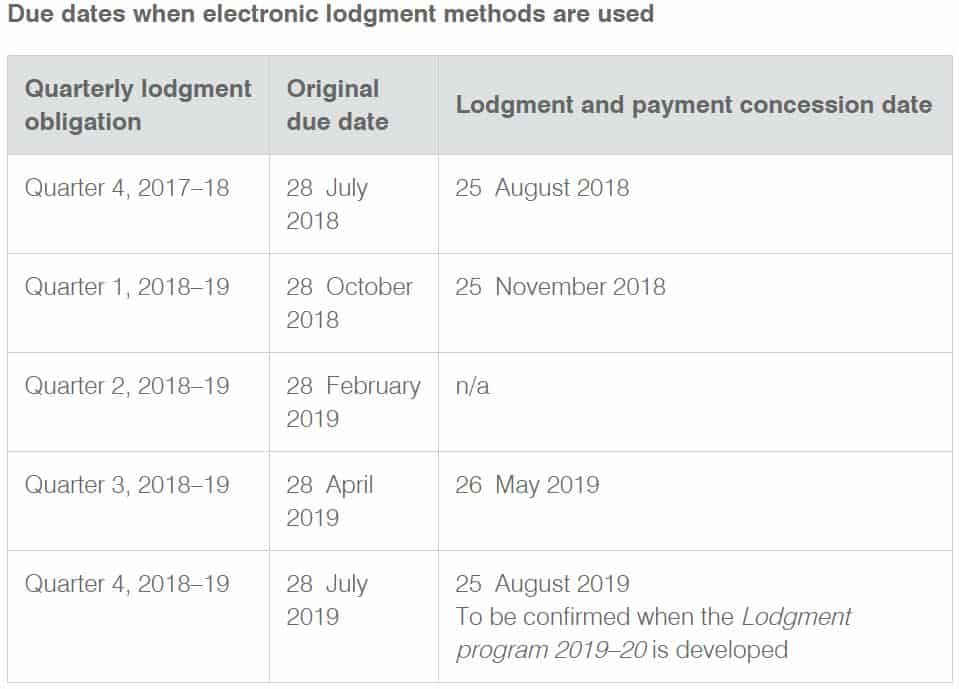

2016 Social Security and Medicare Tax Withholding Rates and Limits

| Tax | 2015 Limit | 2016 Limit |

| Social Security Gross | $118,500.00 | $118,500.00 |

| Social Security Liability | $7,347.00 | $7,347.00 |

| Medicare Gross | No Limit | No Limit |

| Medicare Liability | No Limit | No Limit |

What is the current Medicare tax rate?

The thresholds are as follows:

- For two married individuals filing jointly, the threshold is $250 000.

- For a married individual filing separately, $125 000.

- The threshold for a single person is $200 000.

- For the head of a household, with a qualifying person – $200 000.

- For a widow (er) with dependent child/ren – $200 000.

How much Medicare tax do I pay?

Social Security and Medicare taxes together are commonly referred to as the “FICA” tax. This is a 7.65% tax both employees and employers pay into the FICA system. Your FICA tax gets automatically taken out of each paycheck, normally by your employer, and is reflected as such on your paystubs.

How much is Medicare tax rate?

You will pay more tax than normally as you are not paying a subsidised rate for Social Security and Medicare. When you are someone else's employee, you share that cost with your employer when paying your FICA (Federal Insurance Contributions Act).

How to calculate additional Medicare tax properly?

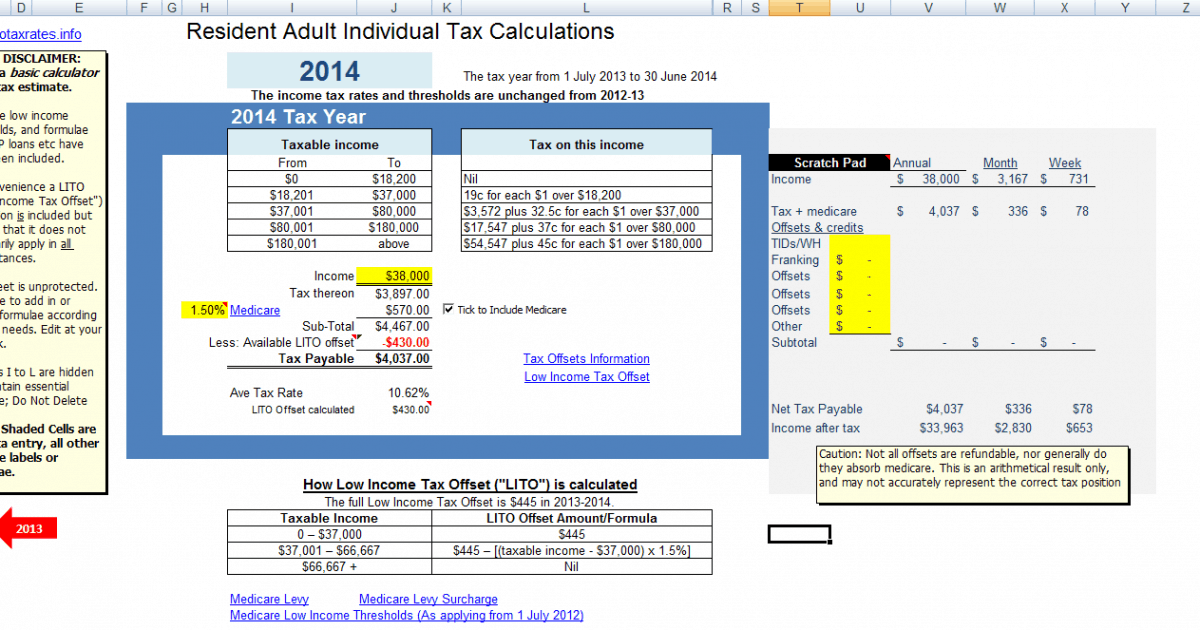

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

What was the Medicare tax rate in 2016?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings.

What is the Medicare tax rate for 2017?

1.45 percentFor employers and employees, the Medicare payroll tax rate is a matching 1.45 percent on all earnings, bringing the total Social Security and Medicare payroll withholding rate for employers and employees to 7.65 percent each—with only the Social Security portion (6.2 percent) limited to the $127,200 taxable-maximum ...

How much is Medicare tax per year?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How do you calculate your Medicare tax?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

What is the Medicare tax rate for 2018?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax. 1.

Does everyone pay Medicare tax?

There is no minimum income limit, and all individuals who work in the United States must pay the Medicare tax on their earnings.

Can I opt out of paying Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

How much Social Security and Medicare tax do I pay?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

Who pays for Medicare tax?

The Medicare tax rate is 2.9% of your income. If you work for an employer, you pay half of it, and your employer pays the other half — 1.45% of your wages each. If you are self-employed, you are responsible for the full 2.9%.

Why do I pay for Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

Do I get Medicare tax back?

You are entitled to a refund of the excess amount if you overpay your FICA taxes. You might overpay if: You aren't subject to these taxes, but they were withheld from your pay.

What is the Medicare tax rate?

What your Medicare tax rate is. Medicare taxes get taken directly out of the paychecks of most workers. The tax rate for employees is 1.45%, which is withheld under the provisions of FICA, or the Federal Insurance Contributions Act. Your employer also has to pay an additional 1.45% of your earnings to Medicare.

What is the Medicare tax rate for single filers?

The rate of the Additional Medicare Tax is 0.9% , and so the total tax rate that employees pay is 2.35%.

How does Medicare withholding work?

How Medicare withholding works. For most individuals, withholding for Medicare tax is simple. The complications that sometimes arise with Social Security withholding when someone has two or more jobs don't come up with Medicare, because there's no income limit on when Medicare tax is imposed.

Why do people feel entitled to Medicare?

Medicare provides basic medical coverage for Americans over the age of 65, and most people rely on the promise of Medicare being there when they retire. Part of the reason why people feel entitled to Medicare is that they pay taxes over the course of their careers.

Does demographic shift affect Medicare?

The problem, though, is that demographic shifts will reduce the number of younger workers per retired Medicare beneficiary, and that could pose difficulties for Medicare in providing the necessary funding from payroll taxes.

Do you pay Medicare taxes backwards?

Many people feel that they've earned their Medicare benefit because of the taxes that they've paid into the system. However, in reality, the tax revenue that you pay in Medicare taxes doesn't go toward covering your own benefit.

Is there a maximum Medicare tax?

Therefore, there is no theoretical maximum Medicare tax for any given individual. In addition to the standard Medicare tax rate, certain high-income individuals also have to pay what has become known as the Additional Medicare Tax.

Find out how much your paycheck will suffer

One of the first things you notice when you get your first paycheck is that your take-home pay is less than your wage or salary would suggest. That's because part of your earnings gets withheld to cover taxes, and a big part of that withholding goes toward Social Security and Medicare taxes.

Social Security, Medicare, and FICA

Tax withholding can appear on your paycheck in different ways depending on how your employer handles its payroll. Some employers break out Social Security taxes separately from Medicare taxes. Others lump them into one big category called FICA, which stands for the Federal Insurance Contributions Act.

Are changes coming to payroll tax withholding?

Tax increases are rarely popular. However, when it comes to Social Security and Medicare taxes, some policymakers believe that there's an opportunity to change the payroll tax withholding system in a way that will generate more tax revenue.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Is Medicare a part of self employment?

Medicare as Part of the Self-Employment Tax. You'll take something of a double hit on the Medicare tax if you're self-employed. You must pay both halves of the tax because you're the employee and the employer.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

How much is withheld from a full retirement?

In the year an employee reaches full retirement age, $1 in benefits will be withheld for each $3 they earn above $41,880 until the month the employee reaches full retirement age. Once an employee reaches full retirement age or older, their benefits are not reduced regardless of how much they earn.

Where to include aggregate cost of employer sponsored health benefits on 2014 W-2?

Employers are required to include the aggregate cost of employer sponsored health benefits on the 2014 W-2’s in Box 12 with code DD. It is for informational purposes only and will not be included in taxable income. Please contact us regarding the specific types of health benefits to be recorded.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings. Source: Social Security Administration.

What is the Medicare payroll tax rate?

For employees, the Medicare payroll tax rate is 1.45 percent on all earnings, bringing the combined Social Security and Medicare payroll tax for employees to 7.65 percent—with only the Social Security portion limited to the $118,500 earned-income threshold.

What is the Social Security earnings limit for 2016?

Earnings Limit Unchanged. The annual earnings limit for those who both work and claim Social Security benefits will stay at $15,720 in 2016 for individuals who opt to receive benefits early (ages 62 through 65). For those who turn 66 in 2016, the earning limit remains at $41,880.

When was Revenue Procedure 2015-53 issued?

The IRS issued Revenue Procedure 2015-53 at the end of October 2015, with annual inflation adjustments for income tax provisions including 2016 taxable income ranges for singles, married (filing jointly), married (filing separately), and heads of households. While there was no statutory increase in tax rates for 2016, ...

Will HR adjust payroll taxes in 2016?

HR professionals won’t have to adjust their payroll tax systems in 2016 for a Social Security FICA increase, as the amount of earned income subject to Social Security taxes won’t change, given the absence of inflation and tepid wage increases over the past year. But the modest amount of inflation this year was enough to cause small upward ...

Is there a Social Security increase for 2016?

On Oct. 15, 2015, the Social Security Administration (SSA) announced that there will be no increase in monthly Social Security benefits in 2016, and that the maximum amount of wages subject to Social Security taxes will also remain unchanged at $118,500. Earnings above this amount are not subject to the Social Security portion ...

Did the CPI increase in 2016?

While there was no statutory increase in tax rates for 2016, the modest CPI increase did nudge income tax brackets slightly upward, which could mean lower taxes for employees whose income stayed flat. (For a look back at 2015 tax brackets, see 2015 Income Tax Rates and Ranges .) 2016 Tax Rates: Single Filing Individual Return.