What is the difference between Medicare an and Medicare B?

Sep 16, 2014 · What is Medicare Part B? Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are …

What is better than Medicare Part B?

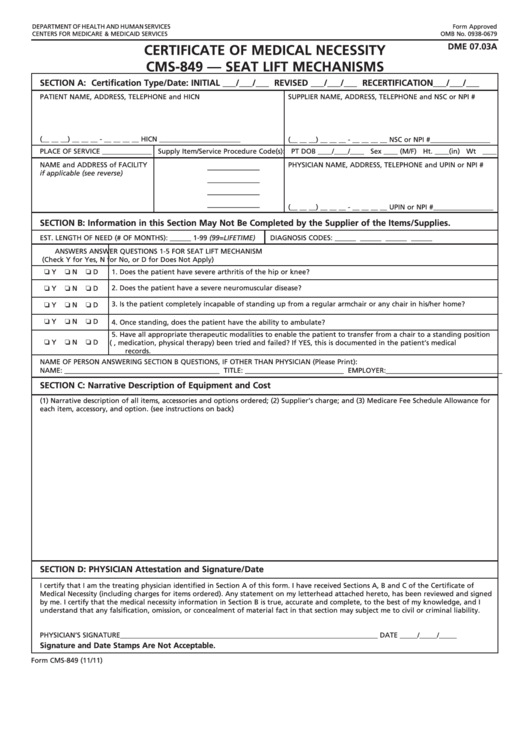

Nov 03, 2021 · Medicare Part B (medical insurance) is part of Original Medicare and covers medical services and supplies that are medically necessary to treat your health condition. This can include outpatient care, preventive services, ambulance services, and durable medical equipment. It also covers part-time or intermittent home health and rehabilitative services, …

What is Medicare Part B and what does it cover?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. benefits. Provides these benefits to people with Medicare who enroll in the plan. Medicare health plans include: Medicare Advantage Plans. Other Medicare health plans.

What does the B in Medicare number mean?

Jun 11, 2019 · What is Medicare Part B? Medicare Part B is medical insurance. It may cover a wide range of items and services. Here’s a partial list of what Part B may cover: Doctor visits; Preventive services, like annual checkups and flu shots; Medical supplies and durable medical equipment, such as walkers and wheelchairs; Certain lab tests and screenings

What is the difference between Medicare Part and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

What is the difference between Medicare Part B and Part F?

Those who have Medicare Plan F won't pay out-of-pocket costs for Medicare parts A and B. Policyholders would only pay the premiums, which start at $0 for Part A and $135.50 for Part B. Additionally, individuals would not have to pay the deductible, which is $1,364 for Part A and $185 for Part B.5 days ago

What does Part B mean in Medicare?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary.Sep 16, 2014

What does Medicare type A Type B and Type D cover?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

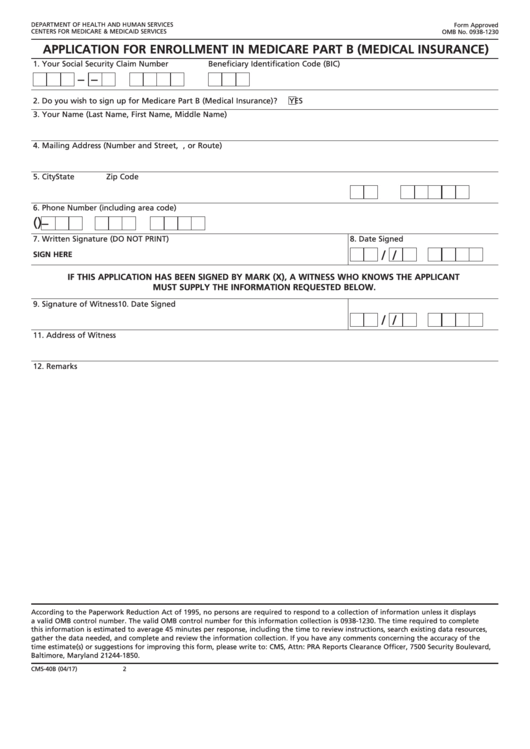

Are you automatically enrolled in Medicare Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

Eligibility For Medicare Part B

Anyone who is eligible for premium-free Medicare Part A is eligible for Medicare Part B by enrolling and paying a monthly premium. If you are not e...

When to Enroll in Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally you’re automatically enrolled in Medic...

Delaying Medicare Part B Enrollment

Some people may get Medicare Part A “premium-free,” but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B come...

Medicare Part B Deductible and Coinsurance Amounts

The annual deductible for Medicare Part B is $183 in 2018. You will also be responsible for a 20% coinsurance for many covered services. If your do...

What is Medicare Part B?

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Does Medicare cover long term care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it .

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

Do you have to pay Medicare Part B premium?

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, you’ll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

What does Medicare Part B cover?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, ...

What is Part B insurance?

Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

What is Medicare Part B?

Medicare Part B (medical insurance) is part of Original Medicare and covers medical services and supplies that are medically necessary to treat your health condition. This can include outpatient care, preventive services, ambulance services, and durable medical equipment. It also covers part-time or intermittent ...

How often is Medicare Part B deducted?

See below for more details about the Medicare Part B premium. If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill every three months.

What is the late enrollment penalty for Medicare?

A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didn’t enroll in Part B.

What is the deductible for Medicare Part B 2021?

The annual deductible for Medicare Part B is $203 in 2021. You will also be responsible for a 20% coinsurance for many covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

How long do you have to enroll in Medicare Part B?

You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends (whichever comes first), you have an eight-month special enrollment period to sign up for Part B without a late penalty.

How old do you have to be to qualify for Medicare?

You must be 65 years or older. You must be a U.S. citizen, or a permanent resident lawfully residing in the U.S for at least five continuous years. You may also qualify for automatic Medicare Part B enrollment through disability. If you are under 65 and receiving Social Security or Railroad Retirement Board (RRB) disability benefits, ...

How long does it take to get Medicare Part A and Part B?

If you are under 65 and receiving Social Security or Railroad Retirement Board (RRB) disability benefits, you will automatically be enrolled in Medicare Part A and Part B after 24 months of disability benefits.

How much does Medicare pay if you work for 10 years?

If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium. If you worked 30-39 quarters, you’ll generally pay $240 in 2019. If you worked fewer than 30 quarters, you’ll generally pay $437 in 2019. On the other hand, most people do pay a monthly premium for Medicare Part B.

How many Medicare Supplement Plans are there?

There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance. You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

What is Medicare Part A?

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as: You’re admitted to a hospital or mental hospital as an inpatient. You’re admitted to a skilled nursing facility and meet certain conditions. You qualify for hospice care.

What are preventive services?

Preventive services, like annual checkups and flu shots. Medical supplies and durable medical equipment, such as walkers and wheelchairs. Certain lab tests and screenings. Diabetes care, such as screenings, supplies, and a prevention program. Chemotherapy.

Do you have to pay Medicare Part A or B?

Although both Medicare Part A and Part B have monthly premiums, whether you’re likely to pay a premium – and how much – depends on the “part” of Medicare. Most people don’t have to pay a monthly premium for Medicare Part A. If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium.

Can you get hospice care with Medicare?

You qualify for hospice care. Your doctor orders home health care for you and you meet the Medicare criteria. Medicare Part A may cover part-time home health care for a limited time. Even when Medicare Part A covers your care: You may have to pay a deductible amount and/or coinsurance or copayment.

How long do you have to be on Medicare if you are 65?

For those younger than 65, you are only eligible to receive Medicare benefits if you: Have received Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months.

What is Medicare Advantage?

Medicare Advantage (Part C) is an alternative to Original Medicare. It allows you to receive Part A and Part B benefits — and in many cases, other benefits — from a private health insurance plan. At the very least, your Medicare Advantage plan must offer the same benefits as Original Medicare. The only exception is hospice care, which is still ...

What are the benefits of Medicare Advantage Plan?

Additional benefits that many Medicare Advantage plans include are: Vision coverage. Hearing coverage. Dental coverage. Medicare Part D prescription drug coverage. If you’re eligible for Medicare Part A and Part B, and do not have ESRD, you can join a Medicare Advantage Plan. Medicare beneficiaries have the option of receiving health care benefits ...

How many parts are there in Medicare?

There are four different parts of Medicare: Part A, Part B, Part C, and Part D — each part covering different services. Understanding how these parts and services work (together and separately) is the key to determining which ones fit your unique health care needs and budget. There are two main paths for Medicare coverage — enrolling in Original ...

When do you get Medicare for ALS?

If you’re under 65, it’s the 25th month you receive disability benefits. ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease (ESRD), you must manually enroll.

When do you get a disability if you are 65?

If you’re under 65, it’s the 25th month you receive disability benefits.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare Part B?

Medicare Part B is known as “medical insurance” because it covers doctor visits and medical care outside the hospital. Like with Medicare Part A, treatment must be determined as medically necessary or preventative to be covered by Medicare Part B. While Part A is required for some people on disability or those receiving other forms ...

How old do you have to be to get Medicare Part A?

To be eligible for Medicare Part A for free, you must be over age 65 and meet one of the following requirements: You or your spouse paid Medicare taxes while employed with the government. You are eligible for Social Security or Railroad Retirement Board benefits but haven’t started collecting them yet.

How much is the 2020 Medicare premium?

For 2020, the monthly premium is $458 (up from $437 in 2019). 1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 (up from $1,364 in 2019) to cover hospital inpatient care. 2.

How much does Medicare pay for covered services?

Medicare Part B pays 80% of costs for covered services, leaving beneficiaries to pay the remaining 20% of Part B expenses out of pocket.

What is nursing home care?

Hospital care, including long-term care facilities and inpatient rehab. Nursing home care, but only if the beneficiary requires more than custodial care. Skilled nursing facility care, including meals, supplies, and nurse-administered injections.

What is long term custodial care?

Most prescription drugs. Routine foot care. If you require any of these services, you may want to consider switching to a Medicare Advantage Plan that offers additional coverage beyond Original Medicare, which is a common term for Part A and Part B combined.

How long do you have to pay ESRD?

You have received Social Security or Railroad Retirement Board benefits for two years. You have End-Stage Renal Disease (ESRD). If you don’t meet any of the five requirements above, you’ll have to pay a premium for Part A.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).

Does Medicare cover wheelchair ramps?

In addition, in recent years the Centers for Medicare and Medicaid Services, which sets the rules for Medicare, has allowed Medicare Advantage plans to cover such extras as wheelchair ramps and shower grips for your home, meal delivery and transportation to and from doctors’ offices.

Does Medicare cover telehealth?

In response to the coronavirus outbreak, Medicare has temporarily expanded coverage of telehealth services . Beneficiaries can use a variety of devices — from phones to tablets to computers — to communicate with their providers.