2015 Social Security and Medicare Tax Withholding Rates and Limits

| Tax | 2014 Limit | 2015 Limit |

| Social Security Gross | $117,000.00 | $118,500.00 |

| Social Security Liability | $7,254.00 | $7,347.00 |

| Medicare Gross | No Limit | No Limit |

| Medicare Liability | No Limit | No Limit |

How much Medicare tax do I have to withhold?

Additional Medicare Tax withholding. In addition to withholding Medicare tax at 1.45%, you must withhold a 0.9% Additional Medicare Tax from wages you pay to an employee in excess of $200,000 in a calendar year.

What is Social Security and Medicare payroll withholding?

Social Security and Medicare payroll withholding are collected together as the Federal Insurance Contributions Act (FICA) tax. • Adjust their payroll systems to account for the higher taxable maximum under the Social Security portion of FICA. • Notify affected employees that more of their paychecks will be subject to FICA.

When does an employer have to start withholding Medicare tax?

An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There's no employer match for Additional Medicare Tax.

Who is responsible for withholding additional Medicare tax?

Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess...

What is Medicare withholding on my paycheck?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How is Medicare tax calculated example?

For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40. Their Medicare contribution would be: $700.00 x 1.45%= $10.15. These are also the amounts the employer would pay.

What is Medicare tax withheld on w2?

Box 6: Medicare Tax Withheld. This amount represents the total amount withheld from your paycheck for Medicare taxes. The Medicare tax rate is 1.45%, and a matching amount of 1.45% is paid by W&M. Once you earn $200,000 annually, there is an additional . 9% that the employee pays which makes a total of 2.35%.

Does everyone pay Medicare tax?

There is no minimum income limit, and all individuals who work in the United States must pay the Medicare tax on their earnings.

Can I opt out of Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

Do I get Medicare tax back?

You are entitled to a refund of the excess amount if you overpay your FICA taxes. You might overpay if: You aren't subject to these taxes, but they were withheld from your pay.

How is Medicare calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Where does Medicare tax withheld go on 1040?

Line 5a in Part I of Form 1040-SS. Line 5a in Part I of Form 1040-PR. Use Part V to figure the amount of Additional Medicare Tax on wages and RRTA compensation withheld by your employer.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What worksheet do you use to file taxes for 2015?

Age 65 or older or blind. If you are 65 or older or blind, use Worksheet 1-3 or Worksheet 1-4, to help you de- cide whether you can claim exemption from withholding. Do not use either worksheet if you will itemize deductions, claim exemptions for dependents, or claim tax credits on your 2015 return.

When are 2015 estimated taxes due?

If your first estimated tax payment is due April 15, 2015, you can figure your required payment for each period by dividing your annual estima- ted tax due (line 16a of the 2015 Estimated Tax Worksheet (Worksheet 2-1)) by 4. Enter this amount on line 17.

Who can file a 940?

Aggregate Forms 940 can be filed by agents act- ing on behalf of home care service recipients who receive home care services through a program administered by a federal, state, or local government. To request approval to act as an agent on behalf of home care service recipients, the agent files Form 2678 with the IRS.

Do you have to file a 941 if you have no wages?

If you have not filed a “final” Form 941 or Form 944, or are not a “seasonal” employer, you must continue to file a Form 941 or Form 944, even for periods during which you paid no wages. The IRS encourages you to file your “Zero Wage” Forms 941 or 944 electronically using IRS e-file at www.irs.gov/efile.

How many people will pay Social Security taxes in 2015?

Of the estimated 168 million workers who will pay Social Security taxes in 2015, about 10 million will pay higher taxes because of the increase in the taxable maximum, the SSA said. Social Security and Medicare payroll withholding are collected together as the Federal Insurance Contributions Act (FICA) tax.

How much is Medicare tax?

For most Americans, the Medicare portion of the FICA tax remains at 2.9 percent, of which half ( 1.45 percent) is paid by employees and half by employers. Unlike Social Security, there is no limit on the amount of earnings (which includes salary and bonus income) subject to the Medicare portion of the tax. This results, for most American wage ...

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings.

What is the FICA tax rate?

This results, for most American wage earners, in a total FICA tax of 15.3 percent (Social Security plus Medicare), half of which is paid by employees and half by employers. Again, self-employed individuals are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security plus 2.9 percent Medicare).

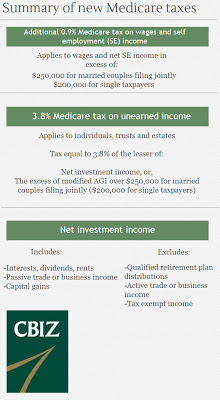

What is the additional Medicare tax?

The Additional Medicare Tax raises the wage earner’s portion on compensation above the threshold amounts to 2.35 percent ; the employer-paid portion of the Medicare tax on these amounts remains at 1.45 percent. The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax.

Will Social Security increase in 2016?

On Oct. 15, 2015, the Social Security Administration announced that there will be no increase in monthly Social Security benefit payments in 2016, and that the amount of wages subject to Social Security taxes will also remain unchanged at $118,500 in 2016. See the SHRM Online article Social Security Payroll Tax Threshold Unchanged for 2016.

Is Medicare a payroll tax?

The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax. Net Investment Income Tax. Although it is not a payroll tax, HR professionals also should be aware of the net investment income tax (NIIT) that high earners must pay when they file their income tax returns.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.