How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How much does Part B insurance cost?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

What was the monthly cost of Medicare in 2019?

$135.50 per monthThe standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.

What is the cost of Medicare Part B for 2021?

$148.50 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much does Medicare Part B normally cost?

$170.10 each monthCosts for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

What is the Medicare deduction from Social Security for 2019?

The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What income is used for Medicare Part B premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is the Medicare Part B premium for 2022?

$170.10In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

What is the Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

Can you write off Medicare Part B premiums from your taxes?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

What amount of Social Security is taxable in 2019?

Maximum Taxable Earnings Each YearYearAmount2016$118,5002017$127,2002018$128,4002019$132,9004 more rows

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare Part B deductible?

There are also deductibles and coinsurance amounts for Medicare Part B. In 2019, the Part B deductible is $185 per year. After you pay that amount out of pocket, Medicare starts providing coverage, and you'll only have to cover the 20% of your costs that Part B doesn't pay.

What is Medicare Part B?

Medicare Part B covers medically necessary outpatient services and treatments. Qualifying events include what's necessary to deal with a disease or medical condition, including diagnosis, cure, prevention, or detection. Doctor visits are covered under Medicare Part B, but you'll find a wide range of services that include diagnostic tests, ...

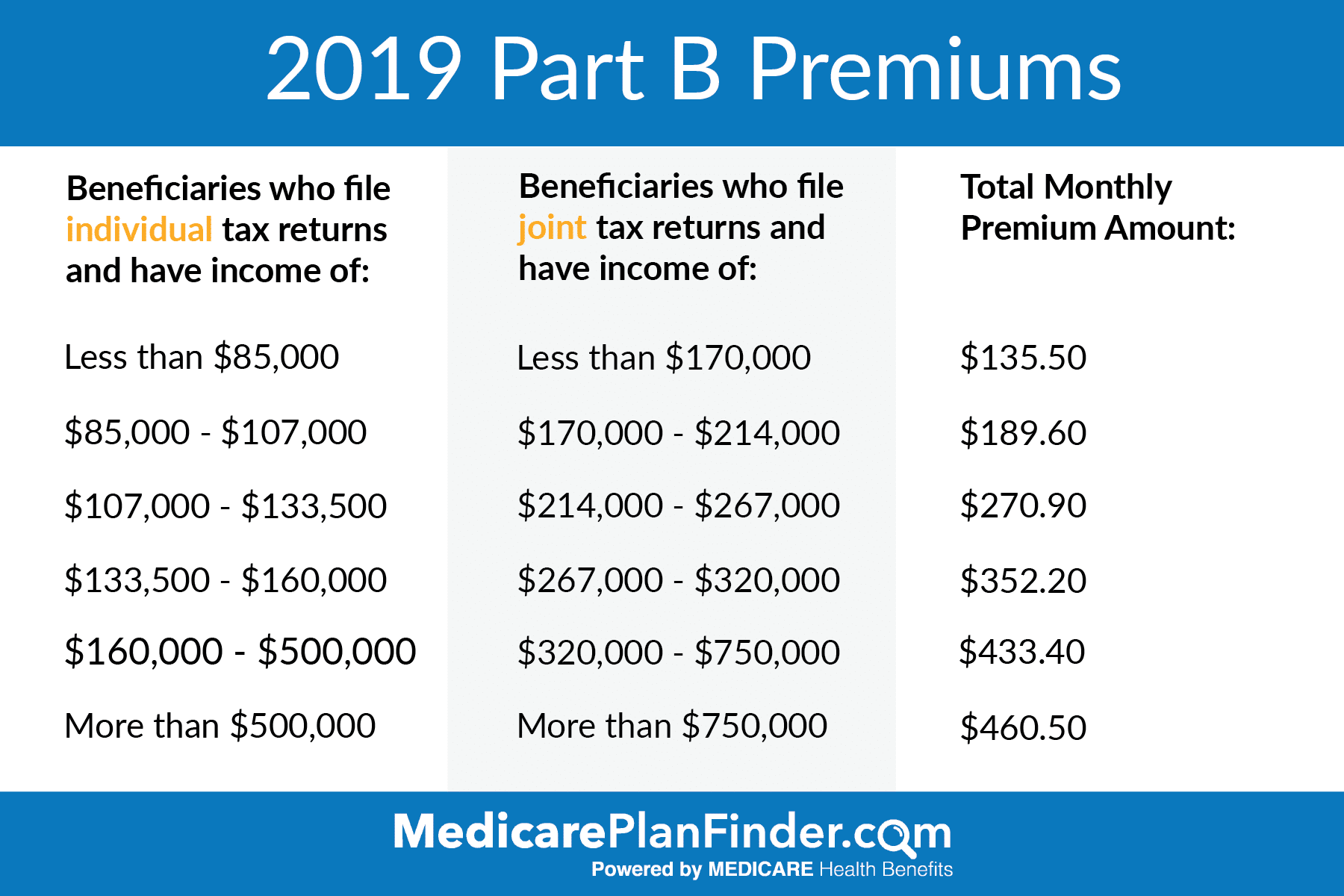

How much is the Medicare premium per month?

Depending on your income, premiums can be as much as $460.50 per month. For individuals with this income: Or joint filers with this income: Total monthly premium in 2019 will be: $85,000 to $107,000. $170,000 to $214,000. $189.60. $107,000 to $133,500. $214,000 to $267,000.

Is a doctor's visit covered by Medicare?

Doctor visits are covered under Medicare Part B, but you'll find a wide range of services that include diagnostic tests, ambulance services, clinical research, durable medical equipment, mental health services, and even second opinions about key issues like surgery. New Medicare participants get a one-time "Welcome to Medicare" preventive visit.

Does Part B pay for checkups?

After the first visit, you'll also qualify for annual checkups to maintain your wellness. However, there are some things that Part B doesn't pay for.

Is Medicare Part B a financial protection plan?

For doctor visits and other outpatient care, Medicare Part B is an essential part of your financial protection plan. Given the high costs of healthcare, having Part B can be a lifesaver both healthwise and financially.

How much is Medicare Part B 2019?

There are a few other out-of-pocket Part B costs that you may be required to pay in 2019. 2019 Part B deductible. The Medicare Part B deductible for 2019 is $185 for the year. Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in.

What are the costs of Medicare Part B?

What Are the Other 2019 Medicare Part B Costs? 1 2019 Part B deductible#N#The Medicare Part B deductible for 2019 is $185 for the year.#N#Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in. The deductible resets with each new year. 2 2019 Part B coinsurance or copayment#N#After you meet your Part B deductible, you are typically required to pay the Part B coinsurance or copayment for additional Part B services you receive in 2019.#N#Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 3 2019 Part B excess charges#N#If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.#N#These providers are allowed to charge you up to 15 percent more than the Medicare-approved amount for your care. This extra amount is called an “ excess charge ” and you will be responsible for paying it in full.

What is QMB in Medicare?

Qualified Beneficiary Medicare (QMB) Program. This program helps pay for the Medicare Part A and Part B premium, along with deductibles, copayments and coinsurance. Individuals can qualify with monthly incomes lower than $1,061 in 2019, and married couples may qualify with combined incomes of less than $1,430 in 2019.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is a type of private insurance that is used along with Original Medicare (Part A and Part B) to provide coverage for some of Original Medicare's out-of-pocket costs.

What is Part B coinsurance?

Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 2019 Part B excess charges. If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.

What happens if you don't sign up for Medicare Part B?

However, if you do not sign up for Medicare Part B during your Initial Enrollment Period (IEP) and decide you want to enroll in Part B later on, you will be charged a late enrollment penalty for the rest of the time that you have Part B.

How much does the penalty increase for Part B?

The penalty raises your Part B premium by up to 10 percent for each year that you were eligible for Part B but did not sign up. The penalty remains in force for as long as you continue to be enrolled in Part B.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

What happens if you don't receive your Part B?

If you don’t receive any of these benefit payments, you will simply get a bill in the mail for your Part B premium. How it changed from 2018. The 2019 Part B premiums rose by close to 1.1 percent from 2018 across all income levels.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the Medicare Part B deductible for 2019?

As mentioned above, the annual Medicare Part B deductible for 2019 is $185. So what exactly does that mean? You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019.

How much is Part B medical insurance?

This is the first medical care covered by Part B you have received in 2019. You will be responsible for the full $120 for your appointment since you have not yet satisfied your 2019 Part B deductible. In July, you injure your knee and schedule another appointment with your doctor.

What happens after you meet your Medicare Part B deductible?

What Happens After You Meet the Part B Deductible? After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019. On Jan. 1, 2020, your deductible will reset, and you will have to pay the 2020 Medicare Part B deductible before your Part B ...

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What is Part B insurance?

Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care. Some durable medical equipment (DME) Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2019 Part B deductible.