What is covered under Medicare Part C?

Aug 03, 2021 · Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and …

What is Medicare Part C and how is it funded?

3 rows · About Medicare Part C. Medicare Advantage plans, or Medicare Part C plans, are ...

What are the benefits of Medicare Part C?

Medicare Part C, which is also called Medicare Advantage, is a combination of A and B with various extras depending on plan type. Part C is sold through private companies, but it’s also partially sponsored by the government.

How much does Medicare Part C cost per month?

Apr 15, 2020 · Medicare Part C is an alternative way to get your Original Medicare benefits. It is also referred to as a Medicare Advantage plan. In addition to your Original Medicare coverage, a Medicare Part C plan might offer additional benefits like vision and dental care.

What is the point of Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is Medicare Part C necessary?

Do you need Medicare Part C? These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you.

What is the difference between Medicare Advantage and Medicare Part C?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

What does plan C cover in Medicare?

Medicare Supplement insurance Plan C typically covers the following: Medicare Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits are exhausted. Medicare Part A hospice care coinsurance or copayments. Medicare Part B copayments and coinsurance.

Does Medicare Part C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.Oct 1, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What are the 4 types of Medicare?

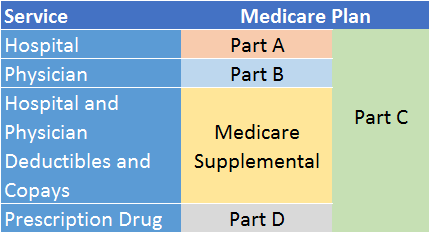

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is the difference between Medicare plan C and plan G?

The only difference between Plan C and Plan G is coverage for your Part B Deductible.Jan 26, 2022

Does plan C pay Medicare deductible?

Plan C is very popular because of how comprehensive it is. Many Medicare cost-sharing fees are covered under the plan. In addition to coverage for the Part B deductible, Plan C covers: Medicare Part A deductible.May 21, 2020

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is Medicare Part C?

Medicare Part C, which is also called Medicare Advantage, is a combination of A and B with various extras depending on plan type. Part C is sold through private companies, but it’s also partially sponsored by the government.

What changes did the Affordable Care Act make to Medicare?

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

How much is Medicare Part B 2020?

Medicare Part B has a standard monthly premium of $144.60 for new enrollees in 2020, with a yearly deductible of $198. These amounts increase to $148.50 and $203, respectively, in 2021.

When do you enroll in Medicare Advantage?

Enroll in a Medicare Advantage plan for the first time. Beginning 21 months after you start receiving SSI or Railroad Retirement benefits and ending the 28th month you get those benefits. Already enrolled in Medicare due to disability and you turn 65. Enroll in a Medicare Advantage plan for the first time -OR-.

How much does Medicare Advantage cost in 2021?

With Medicare Advantage, you pay a Part B premium and a premium for your Medicare Advantage plan. Premiums for Medicare Advantage average less than $30 in 2021. And as we said earlier, there are Medicare Advantage with zero dollar premiums, meaning you’ll pay nothing on top of your Part B premium for this coverage.

When is open enrollment for Medicare?

Each year, from October 15 to December 7 , open enrollment allows you to change, switch or initially enroll in a Medicare Advantage plan.

Does Medicare Advantage cover hospice?

Most Medicare Advantage plans do not offer hospice care, which is available under Original Medicare. The same goes with prescription drug coverage. While many plans will include this benefit, they do not have to include Part D in any plan. You can still purchase Part D separately if you want prescription drug coverage.

What is Medicare Advantage Part C?

Find Plans. Find Plans. Summary: Medicare Part C, also known as Medicare Advantage, is an alternative way to get your Original Medicare benefits. These plans often offer additional coverage for services like prescription drugs, vision and dental care. Plans vary in terms of both cost and benefits.

What are the parts of Medicare?

There are four basic parts to Medicare. Part A and Part B make up Original Medicare. Part A covers care you receive while you are in the hospital. Part B helps pay for expenses, like doctor visits and some medical equipment. Medicare Part C is an alternative way to get your Original Medicare coverage.

When do you enroll in Medicare?

This is the period when you first become eligible for Medicare. This enrollment period begins three months before the month you turn 65. It includes your birthday month and the three months following.

When can I switch Medicare Advantage plans?

This period runs annually from January 1 to March 31. During this time, you can switch from one Medicare Advantage plan to another.

What is a Silversneaker?

Wellness programs called SilverSneakers. Prescription medications. Medicare Part C plans can also offer additional benefits today, such as over-the-counter medications, transportation to and from doctor appointments, and adult daycare services.

Is Medicare Part D a stand alone plan?

Medicare Part D is prescription drug coverage. You can have a stand-alone prescription drug plan with Original Medicare, or you might have a Medicare Advantage plan that includes prescription medication benefits.

What is Medicare C?

Medicare C plans resemble group insurance benefits you may have had through former employers. Generally, there is a local network of providers that you will use. You will pay copays for many routine services like doctor’s visits, lab-work, ambulance, surgeries, hospital stays, urgent care and more.

How much is Medicare Part C in 2021?

Medicare sets the highest allowable amount for this OOP maximum each year. The Medicare Part C OOP in 2021 is $7,550. This means that the most you will spend on that plan for Part A and B services is $7,550. (Part D spending is separate.)

What is Medicare Advantage?

Instead, it is the official name for the program we now know as Medicare Advantage. Medicare Part C plans provide you an alternative to traditional Medicare. They are optional, so not everyone will feel like Part C is the best fit for them.

Does Medicare have an OOP cap?

Original Medicare does not have any OOP maximum to protect you. You could pay that 20% forever. So if you cannot afford the more comprehensive Medigap plans, then a Medicare Part C plan at least has an OOP cap to protect you.

How many parts does Medicare have?

Unlike traditional health insurance plans, Medicare is divided into four parts that each cover different services. If you’re already claiming Social Security benefits, then you will be automatically enrolled in Medicare Part A and Medicare Part B once you turn 65. These two parts are known as Original Medicare .

When is the open enrollment period for Medicare?

Outside of initial enrollment, these are the times you can purchase or make changes to a Medicare Advantage plan: Open enrollment for Medicare Part C and Medicare Part D, which runs from Oct. 15 to Dec. 7 each year. This is also called the annual election period (AEP).

What is Medicare for older people?

Medicare is a federal health insurance program that primarily serves Americans age 65 and older. It’s also available to younger individuals with certain disabilities or health conditions. Medicare consists of multiple parts, which each cover different types of health services.

Who runs Medicare Advantage?

The Medicare program is run by the Centers for Medicare & Medicaid Services (CMS), a federal agency, but Medicare Advantage plans are run by private insurers. For that reason, Medicare Advantage plans often look similar to traditional health insurance plans.

What is MSA in Medicare?

MSAs are a bit different from the types of plans above. An MSA works very similarly to a high-deductible health plan (HDHP) paired with a health savings account (HSA). With an MSA plan, Medicare will deposit money into an account that you can then use to pay for your health care services. Your insurance will not start to pay for your medical expenses until you spend enough to hit your deductible.

How much is Medicare Part B in 2021?

The Medicare Part B premium is typically $148.50 a month in 2021, but it may be higher if you earn a higher income. Beyond that, prices can vary greatly by plan. Medicare Advantage premiums average $33 in 2020, according to data from the CMS compiled by Policygenius. At the same time, premiums can reach up to $481.

Is Medicare Advantage a private insurance?

Medicare Advantage is run by private insurance companies, and even though prices may be lower than traditional private health insurance, a lot of the complexities from private plans exist in Medicare Part C. Medicare Advantage plans (sometimes called MA plans) also require you to use a local network of providers.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live. This guide shows the average cost of Medicare Part C plans in each state.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

What is Medicare Supplement Insurance Plan C?

Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive Medicare Supplement Insurance plans you can buy . If you only choose to see doctors who accept assignment, it provides the same amount of coverage as the most extensive plan, Medigap Plan F. Without Medigap Plan C, your costs under Medicare Part A in 2021 include:

How much is Medicare Part A 2021?

Without Medigap Plan C, your costs under Medicare Part A in 2021 include: $1,484 deductible during inpatient hospital stays (per benefit period) $371 coinsurance per day after day 60 in the hospital. $742 coinsurance per day for up to 60 “lifetime reserve days” after day 90 in the hospital. All costs for inpatient hospital care after day 150.

What is the difference between Medicare and Medicare Part B?

The difference between what Medicare pays for a certain medical service, and what your doctor or provider charges for it, is the Medicare Part B excess charge, which you’re responsible for paying out-of-pocket. In some cases, you may be charged up to 15% more than the Medicare-approved amount for a service.

How much is Medicare Part B deductible in 2021?

Without Medigap Plan C, your costs under Medicare Part B include: A $203 annual deductible in 2021. 20% coinsurance for most Medicare-approved services after the deductible is met. Up to 15% additional excess charges if your doctor does not accept assignment. All costs for foreign travel emergency coverage.

How much is Medicare Part B coinsurance?

With Medigap Plan C, your costs under Medicare Part B include: $0 for the Medicare Part B deductible. $0 in coinsurance for Medicare-approved services. Up to 15% additional excess charges if your doctor does not accept assignment. 20% of your medically necessary emergency care outside of the U.S. after you meet a $250 deductible.

What is the deductible for Medicare Supplement 2020?

Effective Jan. 1, 2020, Section 401 of the Medicare Access and CHIP Reauthorization Act (MACRA) stipulates that newly eligible Medicare beneficiaries are unable to sign up for a Medicare Supplement Insurance plan that covers the Medicare Part B deductible (which is $203 in 2021 ).