Full Answer

What medications are not covered by Part D?

Usually, Part D plans do not cover drugs for weight management, erectile dysfunction, or fertility. Part D plans cover two drugs in the most commonly prescribed categories. However, different...

What drugs are covered in Part D?

- Oral cancer drugs: Medicare helps pay for some oral cancer drugs you take by mouth if the same drug is available in injectable form or the drug is a prodrug ...

- Oral anti-nausea drugs: Medicare helps pay for oral anti-nausea drugs used as part of an anti-cancer chemotherapeutic regimen if they’re administered before, at, or within 48 hours of chemotherapy or ...

- Self-administered drugs in hospital outpatient settings: Medicare may pay for some self-administered drugs, like drugs given through an IV. ...

How does Medicare Part D cover prescription drugs?

- Monthly premiums

- Annual deductible (maximum of $445 in 2021)

- Copayments (flat fee you pay for each prescription)

- Coinsurance (percentage of the actual cost of the medication)

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

What is Medicare Part D and how does it work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What does Medicare Part D provide coverage for?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

Does Medicare Part D provide prescription coverage?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

What does Part D include?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the maximum out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

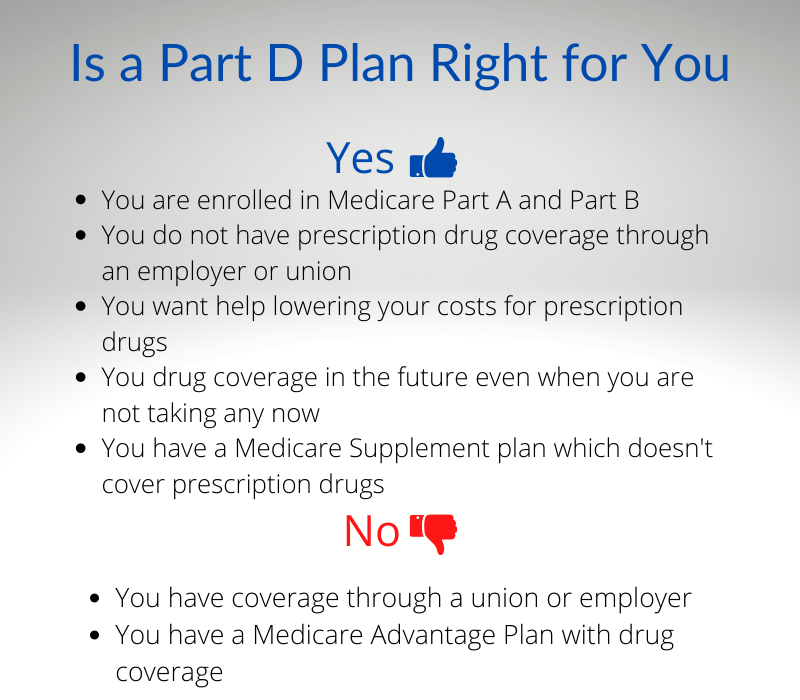

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

When did Medicare Part D become mandatory?

2006The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is a tier in prescription drug coverage?

Tiers. To lower costs, many plans offering prescription drug coverage place drugs into different “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” on their formularies. Each plan can divide its tiers in different ways.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What are the tiers of Medicare?

Here's an example of a Medicare drug plan's tiers (your plan’s tiers may be different): Tier 1—lowest. copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug.

What is Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications.

Why switch to a different Medicare Part D plan?

Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way. Part D drug plans also have changes from year to year.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

How does each drug plan work?

Each drug plan will separate its medications into tiers. Each tiers has a copy amount that you will pay. For example, a plan might assign a $7 copay for a Tier 1 generic medication. Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on.

What happens if you take a medication that is not on the formulary?

If you take a medication that is not on the formulary, such as a compound medication, you will have to file an exception to try to get that drug approved. Not all exceptions are approved, so be aware that you may pay out of pocket for any medication that is not covered by your plan or by Part D as a whole.

What are Part D restrictions?

Part D plan restrictions are common with pain medications, narcotics and opiates .

When does Medicare Part D change?

Part D drug plans also have changes from year to year. Your plan’s benefits, formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance may change on January 1st of each year. Medicare gives you an Annual Election Period during which you can change your plan if you desire to do so.

What is Medicare Part D?

Medicare Part D plans are offered by private companies to help cover the cost of prescription drugs. Everyone with Medicare can get this optional coverage to help lower their prescription drug costs. Medicare Part D generally covers both brand-name and generic prescription drugs at participating pharmacies.

What is the gap in Medicare?

The Medicare Prescription Drug Coverage Gap (the “Doughnut Hole”) Most Medicare Part D plans have a coverage gap, sometimes called the “Doughnut Hole.”. This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for the drugs, up to a yearly limit.

Is a discount card considered a prescription?

Note: Discount cards, doctor samples, free clinics, drug discount Web sites, and manufacturer’s pharmacy assistance programs are not considered prescription drug coverage and are not considered creditable coverage. Avoid the late-enrollment penalty. Join when you first become eligible.

Do you have to live in the service area of Medicare?

You must also live in the service area of the Medicare drug plan you want to join. Important Note for Medicare Beneficiaries with Employer or Union Coverage: If you have employer or union coverage, call your benefits administrator before you make any changes, or before you sign up for any other coverage.

Does Part D have a deductible?

Part D plans may have a monthly plan premium and a yearly deductible. These vary from plan to plan. You pay a portion of your drug costs, including a copayment or coinsurance. Costs vary depending on which drug plan you choose. Coverage options, including drug coverage, may vary from plan to plan.

Does Medicare cover generic drugs?

Whatever plan you choose, Medicare drug coverage will help you by covering brand-name and generic drugs at pharmacies that are convenient for you. Each Part D plan has a formulary – a list of medications the plan will cover. This list may also be referred to as a drug list, prescription drug list (PDL), or a covered medications list (CML).

What is Medicare Part D Prescription Drug Coverage?

Private companies that offer Part D coverage are allowed to design their own benefit plans, as long as the overall value of the plan is at least as good as the basic plan outlined in the 2003 Medicare Act. So, different plans offer different lists of medicines (called a formulary), and different costs.

How much does Part D cost?

How much you’ll pay for Medicare drug coverage depends on which plan you choose. But in general, here’s what you can expect to pay in 2018:

What is Medicare Part D?

Prescription Coverage is often referred to as Medicare Part D. Medicare coverage of prescription drugs is an optional benefit offered to everyone who has Medicare Part A or Part B, or both. Medicare Part D plans can help lower than the full market price of medicine. Automatic refill services through the mail may be a convenient option ...

What are the out-of-pocket costs of Medicare Part D?

Enrollees can authorize an automatic deduction from Social Security for Part D premiums. Out-of-pocket costs include deductibles, copays, and coinsurance. These vary by the plan chosen and the prescription needs a person has.

What does CMS mean for prescription drugs?

The Centers for Medicare and Medicaid Services (CMS) approves the drug formulary for each plan. As a rule, plans must include at least 2 drugs in the most commonly prescribed categories or classes of drugs. This effectively helps people with different medical conditions to get the prescription drugs they need.

How long does it take to enroll in Medicare?

Ideally, the window to enroll in Medicare Prescription Drug coverage is the 7-month Initial Enrollment Period surrounding one’s 65th birthday. People younger than age 65 with eligibility for Medicare due to disability get a 7-month Initial Enrollment Period. This IEP runs from the 22nd month of receiving disability benefits, ...

How long can you go without prescription coverage?

Generally, the penalty applies to applicants who go without prescription medical coverage for more than 63 consecutive days. After the Initial Enrollment Period’s final date, the clock starts ticking.

How often can a drug be changed in CMS?

CMS allows for changes in the list of covered drugs up to twice each month, when drugs are removed or new drugs are added. Crucially, changes in the formulary may affect drug choices and coverage for the plan or members. Law requires plans to provide 60-day notice to customers in advance of dropping a drug.

How much is the penalty for Medicare Part D 2021?

As of 2021, the U.S. has $33.06 Part D average premium. Therefore, the penalty of 1% of this national average cost rounds to about $0.30 permanently added to Medicare Part D premiums. The penalty multiplies this additional 1% for every full month that the person was eligible, but did not have Medicare Part D coverage.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

Do you have to pay a penalty on Medicare?

After you join a Medicare drug plan, the plan will tell you if you owe a penalty and what your premium will be. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare pay late enrollment penalties?

, you don't pay the late enrollment penalty.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.