When will Medicare increase?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

Will Medicare increase this year?

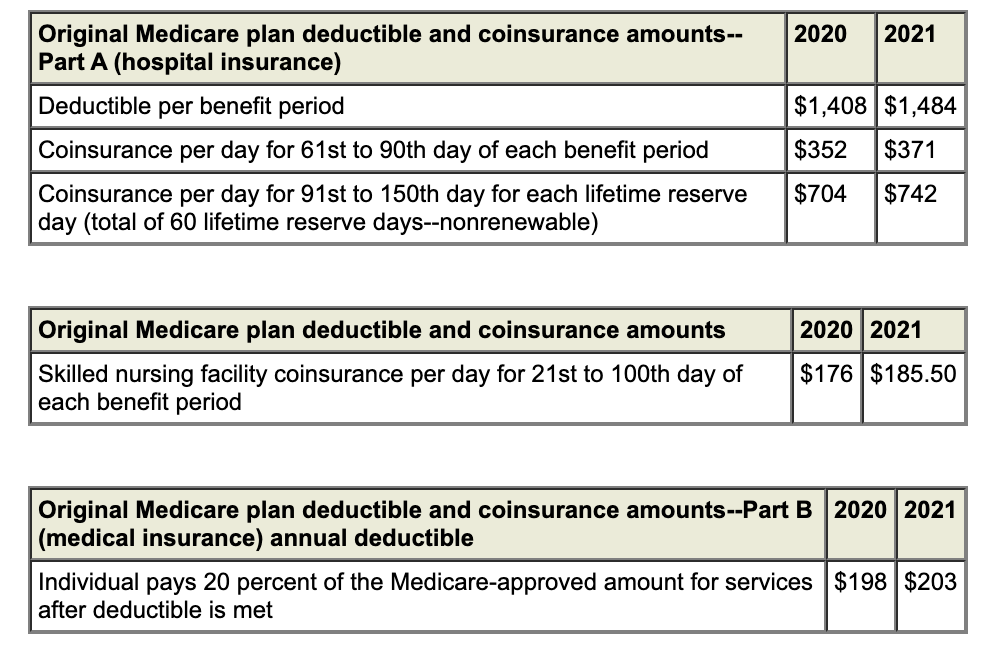

Nov 12, 2021 · The annual deductible for Medicare Part B beneficiaries grows with the Part B financing and is increasing from $203 in 2021 to $233 in 2022. The Administration is taking action to address the rapidly increasing drug costs that are posing a threat to the future of the Medicare program and that place a burden on people with Medicare.

How much is Medicare increasing?

Dec 07, 2021 · Medicare Premiums to Increase Dramatically in 2022. Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month. The Centers for Medicare and Medicaid Services (CMS) announced the premium and other …

How much will my Medicare premiums be?

Jan 03, 2022 · The monthly premium for Part B, which covers doctor visits and other outpatient services, such as diagnostic screenings and lab tests, will be $170.10 in 2022, up $21.60 from the 2021 monthly charge. Centers for Medicare & Medicaid Services (CMS) officials say this largest-ever dollar increase was necessary because of three factors:

Will Medicare premiums go up in 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).Jan 4, 2022

What will Medicare rates go up 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Will 2022 Medicare premium be reduced?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.Jan 25, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What will the COLA be for 2022?

5.9 percentIn October the Social Security Administration announced a historic cost-of-living adjustment (COLA) of 5.9 percent that will be applied to benefits for 2022.Dec 3, 2021

What will be the cost of Part B Medicare in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What will the Medicare Part B deductible be in 2022?

$233The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

What is deducted from your Social Security check?

Federal Income Taxes Up to 25 percent of their Social Security checks can be deducted to pay taxes on a quarterly basis. If they owe federal taxes from previous years, the U.S. Treasury will levy their Social Security checks until the back taxes are paid up.

Medicare Part A and Part B Premiums Increase in 2022

Medicare Part A premiums will remain at $0 for most beneficiaries. That’s because most beneficiaries haver premium-free Part A because they paid Medicare taxes for at least 40 quarters (10 years of work), which is a benchmark that remains unchanged for 2022.

What Is the 2022 Medicare Part B deductible?

The estimated rate for the 2022 Part B deductible is $217 per year (up from $203 in 2021). This is an increase of $14 per year from the 2021 Part B deductible

Questions About Medicare Rate Increases?

If you have any questions about Medicare premiums, deductibles or other costs, call 1-800-MEDICARE (1-800-633-4227) to speak with a representative.