What does PDP stand for in prescription?

Mar 07, 2022 · Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B) doesn't provide prescription drug coverage.

What is the full meaning of PDP?

A Part D prescription drug plan (PDP) – or “stand-alone prescription drug plan” – is one of two main ways Medicare beneficiaries can enroll in Medicare coverage for prescription drugs. The Medicare Part D benefit is offered through private insurers, either as a stand-alone Part D plan (PDP) or a Medicare Advantage plan that has prescription drug benefits (MAPD).

What is Medicare, and what does it cover?

Mar 12, 2022 · Medicare prescription drug coverage is an optional benefit available to anyone who has Medicare. If you dont sign up for Part D when youre first eligible, you may have to pay a Part D late enrollment penalty. You may enroll in a Medicare Part D Prescription Drug plan: during your Initial Enrollment Period

What is the difference between a Medicare PDP and MAPD?

A Medicare Part D PDP is a stand-alone Medicare Part D prescription drug plan that provides insurance coverage for your out-patient prescription drugs. (Prescription drugs you receive in the hospital or a doctor's office may be covered by your Medicare Part A or Medicare Part B.) So like any insurance, you will pay a monthly premium (unless you ...

What does PDP stand for in Medicare?

Medicare Prescription Drug PlanMedicare Cost Plan Join a Medicare Prescription Drug Plan (PDP). These plans add coverage to Original Medicare, and can be added to one of these: • A Medicare Savings Account (MSA) Plan.

Is PDP the same as Part D?

A Medicare Prescription Drug plan (PDP) is an insurance policy that covers take-home drugs prescribed by a doctor. Out-of-pocket costs usually apply. PDPs are also known as Medicare Part D. Private insurance companies sell these plans, following approval by Medicare.

What is the PDP plan?

What is a PDP (Prescription Drug Plan)? Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too.

Why do Medicare Part D plans have different premiums?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

What is the difference between a PDP and an MA PD?

A "PDP" is the abbreviation used for a stand-alone Medicare Part D "prescription drug plan". A PDP provides coverage of your out-patient prescription drugs that are found on the plan's formulary. An "MAPD" is the abbreviation for a "Medicare Advantage plan that offers prescription drug coverage".

What is the difference between Medicare Advantage and PDP?

Once you enroll in an Advantage plan, a private insurance company handles your claims instead of Medicare. In other words, it pays instead of Original Medicare. In contrast, Prescription Drug Plans (PDP) are stand-alone plans that only provide prescription drug coverage through Part D of Medicare.Feb 18, 2022

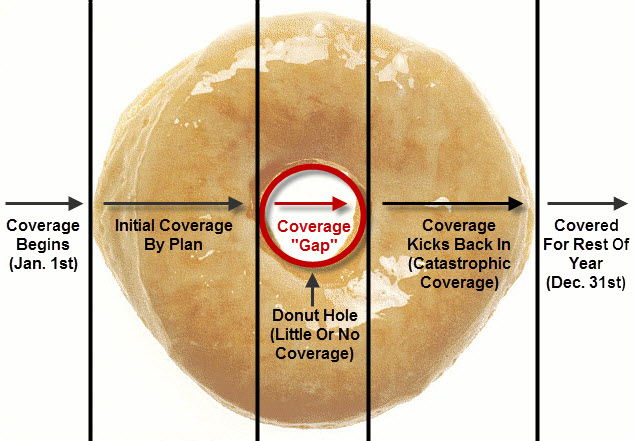

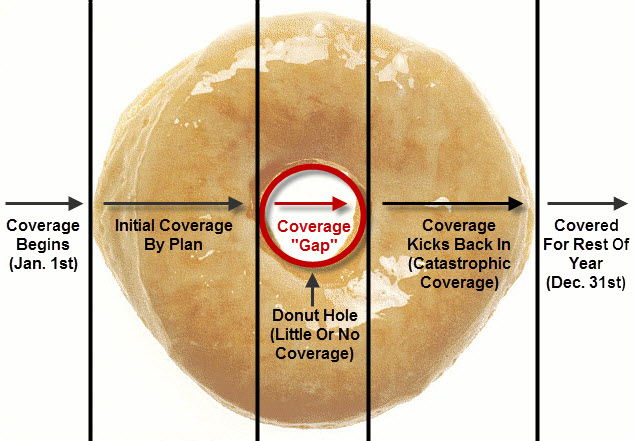

What is the deductible of a PDP plan?

Your ZIP Code allows us to filter for Medicare plans in your area. Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Is Medicare Part D optional?

While Part D is technically optional, there are steep and permanent penalties if you don't sign up on time. The program is designed primarily for those enrolled in Original Medicare (Parts A and B). You can sign up during your initial enrollment period — a seven-month window with your 65th birthday month in the middle.Jan 5, 2022

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is a PDP plan?

A Part D prescription drug plan (PDP) – or “stand-alone prescription drug plan” – is one of two main ways Medicare beneficiaries can enroll in Medicare coverage for prescription drugs. The Medicare Part D benefit is offered through private insurers, either as a stand-alone Part D plan (PDP) or a Medicare Advantage plan that has prescription drug ...

Can you get PDP with Medicare?

A PDP can be purchased by beneficiaries with Original Medicare coverage (with or without a Medigap plan) and – in some cases –by Medicare Advantage (MA) beneficiaries who don’t have a prescription drug benefit included in their MA plan.