In Ohio, beneficiaries qualify for Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

| Household Size* | Maximum Income Level (Per Year) |

|---|---|

| 1 | $18,075 |

| 2 | $24,353 |

| 3 | $30,630 |

| 4 | $36,908 |

What is the monthly income limit for Medicaid in Ohio?

Feb 02, 2021 · guidelines MUST apply. Family Size Monthly Income* 1 $1,699 2 $2,289 3 $2,879 4 $3,469 5 $4,059 6 $4,649 7 $5,239 8 $5,829 9 $6,419 10 $7,009 Families with monthly incomes higher than the amount in the first column, but lower than the amount in the second column MUST apply if they do not have private health insurance. Family Size Monthly Income* 1 $1,699 $2,265

What is the poverty level for Medicaid in Ohio?

Oct 04, 2020 · In Ohio, beneficiaries qualify for Medicaid benefits for the aged, blind and disabled with monthly incomes up to $783 (single) and $1,175 (married). Medicare enrollees with limited incomes may qualify for assistance with prescription drug expenses in Ohio.

How to verify eligibility of Medicaid plan members in Ohio?

10 rows · May 01, 2021 · Additionally, to be eligible for Medicaid, you cannot make more than the income guidelines ...

What are the requirements for Medicaid in Ohio?

2020 income guidelines for Ohio Medicaid * For families/households with more than 8 persons, add $4,480 for each additional person. ** Income levels reflect the (1) conversion to MAGI eligibility and (2) addition of the 5 percentage point disregard. 2/10/2020 Adults (ages 19 – 64)

What is the monthly income limit for Ohio Medicaid?

Income & Asset Limits for Eligibility2022 Ohio Medicaid Long Term Care Eligibility for SeniorsType of MedicaidSingleMarried (both spouses applying)Medicaid Waivers / Home and Community Based Services$2,523 / month$5,046 / monthRegular Medicaid / Aged Blind and Disabled$841 / month$1,261 / month2 more rows•Dec 16, 2021

How much can you make and still qualify for Medicaid in Ohio?

If your family's income is at or under 138% of the Federal Poverty Guidelines (FPG) ($18,754 per year for an individual; $38,295 for a family of four), you may qualify. If you are 18 or younger and your family's income is at or under 211% of FPG ($58,553 per year for a family of four), you may qualify.

Who can qualify for Medicare in Ohio?

Who Qualifies for Medicare in Ohio?You are 65 or older.You have been on Social Security Disability Insurance (SSDI) for two years.You have end-stage renal disease (ESRD) or Lou Gehrig's disease.

What is the highest income to qualify for Medicaid?

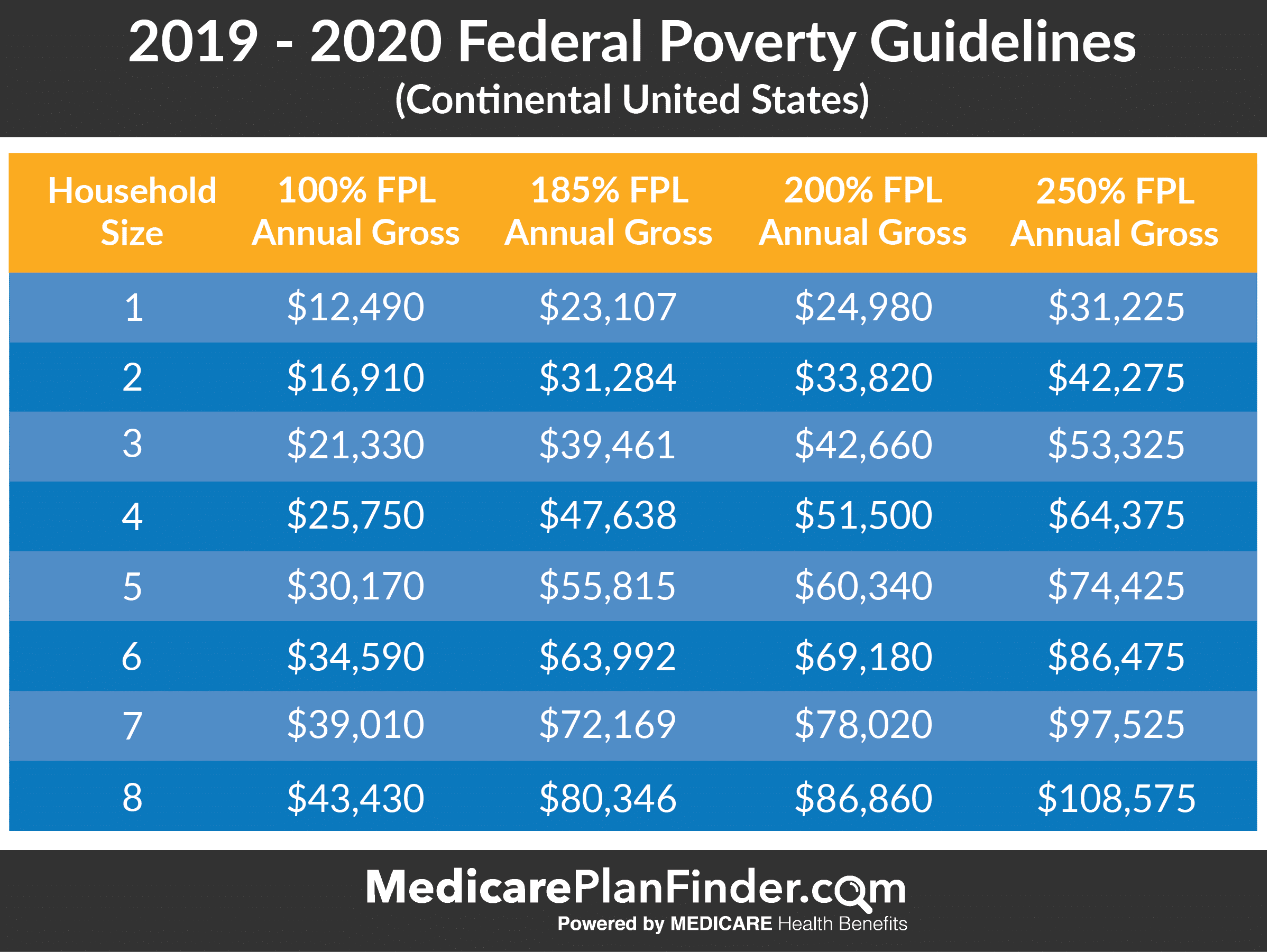

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.Mar 26, 2022

What is the monthly income limit for food stamps in Ohio?

SNAP Max Income for Food Stamps Oct. 1, 2019, through Sept. 30, 2020Household SizeGross Monthly Income Limits (130% of poverty)Max Food Assistance Benefit Monthly1$1,354$1942$1,832$3553$2,311$5094$2,790$6465 more rows

Do I qualify for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

How does Medicaid check income?

Documentation of income might include any of the following: Most current pay stubs, award letter for Social Security, SSI, Railroad Retirement, or VA, pension statement, alimony checks, dividend checks, a written statement from one's employer or from a family member who is providing support, or an income tax return.Mar 14, 2022

When can you apply for Medicare in Ohio?

65You're first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig's disease).

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

What are the Medicare income limits for 2022?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

How are Medicare premiums calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How do you qualify for Medicaid and Medicare?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).Feb 11, 2022

Does Ohio help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who's eligible for Medicaid for the aged, blind and disabled in Ohio?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cov...

Where can Medicare beneficiaries get help in Ohio?

Ohio Senior Health Insurance Information Program (OSHIIP) You can access free counseling about Medicare benefits through the Ohio Senior Health Ins...

Where can I apply for Medicaid in Ohio?

Medicaid is administered by the State Department of Medicaid in Ohio. You can apply for Medicaid or an MSP using this website or by visiting a coun...

What is the income limit for Medicaid in Ohio?

Income eligibility: The income limit is $783 a month if single and $1,175 a month if married.

Who administers Medicaid in Ohio?

Medicaid is administered by the State Department of Medicaid in Ohio. You can apply for Medicaid or an MSP using this website or by visiting a county Job and Family Services office. Josh Schultz has a strong background in Medicare and the Affordable Care Act.

What is the maximum amount of money you can get with Medicare?

Medicare beneficiaries who have limited incomes and assets can apply for Extra Help – a federal program that lowers prescription drug expenses under Medicare Part D. The income limit is $1,615 a month for singles and $2,175 a month for couples, and the asset limit is $14,610 for individuals and $29,160 for spouses.

Does Medicare cover dental insurance?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cover important services like vision and dental benefits. [mro_survey align ="right"]Medicare can also leave its enrollees with large co-pays, coinsurances and deductibles.

Does Medicare cover long term care?

Medicare beneficiaries increasingly rely on long-term services and supports (LTSS) – or long-term care – which is mostly not covered by Medicare. In fact, 20 percent of Medicare beneficiaries who lived at home received some assistance with LTSS in 2015.

How much can a spouse keep on medicaid?

If only one spouse has Medicaid, federal rules allow the other spouse to keep up to $128,640. Certain assets are never counted, including many household effects, family heirlooms, certain prepaid burial arrangements, and one car. Applicants are also not allowed to have more than $595,000 in home equity. Back to top.

When does Medicaid have to recover from an enrollee's estate?

Medicaid has to try to recover from an enrollee’s estate what it paid for long-term care related costs beginning at age 55. States can choose to also pursue estate recovery for all other Medicaid benefits, and for enrollees who did not receive LTSS.

What is Medicaid in Ohio?

Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. However, this page is strictly focused on Medicaid eligibility, for Ohio residents who are 65 years of age and over, and specifically for long term care, whether that be at home, in a nursing home, or in assisted living.

What is MCOP in Ohio?

3) MyCare Ohio Plan (MCOP) – the name of the state managed care Medicaid program for persons dually eligible for Medicaid and Medicare. Under MCOP, a variety of in-home supports are provided, like PASSPORT, though MyCare does not have limited enrollment.

What are countable assets for Medicaid?

Countable assets include cash, stocks, bonds, investments, credit union, savings, and checking accounts, and real estate in which one does not reside . However, for Medicaid eligibility, there are many assets that are considered exempt (non-countable).

What is a QIT trust?

1) Qualified Income Trusts (QIT’s) – QIT’s, also commonly referred to as Miller Trusts, offer a way for individuals over the Medicaid income limit to still qualify for long-term care Medicaid, as money deposited into a QIT does not count towards Medicaid’s income limit.

Is a stimulus check counted as income?

Coronavirus stimulus checks (previous and subsequent) are not counted as income and have no impact Medicaid eligibility. In the case when only one spouse of a married couple is applying for nursing home Medicaid or a Medicaid waiver, only the income of the applicant is counted.

How many people are covered by Medicaid in Ohio?

As of 2020, the program, along with the Children’s Health Insurance Program (CHIP) covered 2.9 million people. This includes 1.25 million children as shown by the image below.

How many Ohio residents are on medicaid?

As of June 2019, there were 526,100 Ohio residents enrolled in expanded Medicaid. Additionally, during the 2015 legislative session, lawmakers agreed to allow Medicaid expansion to continue as a part of a budget agreement. Therefore, there was no separate legislation on Medicaid expansion.

What are the income requirements for medicaid?

Additionally, to be eligible for Medicaid, you cannot make more than the income guidelines outlined below: 1 Children up to age 1 with family income up to 206 percent of FPL 2 Any child age 1-5 with a family income up to 206 percent of FPL 3 Children ages 6- 18 with family income up to 206 percent of FPL 4 CHIP for children with family income up to 206 percent of FPL 5 Pregnant women with family income up to 200 percent of FPL 6 Parents of minor children with family income up to 90 percent of FPL 7 Individuals who are elderly, blind, and disabled with family income up to 74% of the FPL 8 Adults without dependents under Medicaid expansion with income up to 133% of the FPL

What is Medicaid insurance?

What is Medicaid? Medicaid is a federal and state health insurance program for people with a low income. It provides free or low-cost health coverage to millions of Americans, including families and children, pregnant women, the elderly, and people with disabilities.

How many people are on medicaid in 2020?

According to the Centers for Medicare & Medicaid Services, as of November 2020, here are the number of people enrolled in Medicaid and Chip in the entire United States: 78,521,263 individuals were enrolled in Medicaid and CHIP. 72,204,587 individuals were enrolled in Medicaid. 6,695,834 individuals were enrolled in CHIP.

Did Ohio expand Medicaid?

Ohio Medicaid Expansion Update. Governor Kasich announced in early 2013 that Ohio would expand Medicaid under the ACA. Ohio lawmakers who were opposed to Medicaid expansion brought a lawsuit against the Kasich administration in an effort to block expansion.

How much is Medicare Part B in 2021?

All deductibles and coinsurance that Medicare does not pay. Medicare Part B premium: $148.50/month for most people in 2021. Medicaid Eligibility.

What if I don't qualify for medicaid?

If you do not qualify for full Medicaid, you may qualify for other assistance programs. There are four kinds of Medicare Savings Programs that help those with low income and asset levels pay for health care coverage. Note: You must meet certain income and asset limits to qualify for these programs. QMB, SLMB, QI and QDWI programs are not subject ...

What is a QDWI?

Qualified Disabled and Working Individuals (QDWI) If you are under age 65, disabled, and no longer entitled to free Medicare Hospital Insurance Part A solely because you. successfully returned to work, you may be eligible for a program that helps pay your Medicare Part A monthly premium.

What is Medicare Supplement?

Medicare Supplement (secondary insurance): Sold by private insurance companies to fill “gaps” in Original Medicare coverage. Others may have coverage through a retirement health plan or Medicaid. Prescription Drug Coverage: Sold by private insurance companies to fill “gaps” in Original Medicare coverage. Others may have coverage through ...

What is Medicare Part D?

Part D is Medicare’s comprehensive prescription drug coverage benefit and is available to anyone eligible for Medicare Part A or Part B. People with Medicare may enroll in Part D coverage through either a stand-alone plan or a Medicare Advantage plan.

What is extra help?

Extra Help is a Medicare program that helps people with limited income and resources pay Medicare prescription drug costs. You may qualify for Extra Help, also called low-income subsidy (LIS), if your annual income and total resources are below these limits this year: prescription medications are included: Single Person:

Does Medicare pay for extra help?

If you qualify for Extra Help, Medicare will pay: All or most of the monthly premium. All or most of the annual deductible. Most of your copayments/co-insurance. Full coverage during the donut hole.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

Summary

- Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. However, this page is strictly focused on Medicaid eligibility, for Ohio residents who are 65 years of age and over, and specifically for long term care, whether that be at home, in a nursing home, or in assisted living. Make not...

Healthcare

- There are several different Medicaid long-term care programs for which Ohio seniors may be eligible. These programs have slightly different eligibility requirements and benefits. Further complicating eligibility are the facts that the criteria vary with marital status and that Ohio offers multiple pathways towards eligibility.

Participants

- 2) Medicaid Waivers / Home and Community Based Services (HCBS) Limited number of participants. Provided at home, adult day care, or in assisted living.

Programs

- Eligibility for these programs is complicated by the facts that the criteria vary with marital status and that Ohio offers multiple pathways towards eligibility. The table below provides a quick reference to allow seniors to determine if they could be immediately eligible for long term care from a Medicaid program. Alternatively, one can take the Medicaid Eligibility Test. IMPORTANT, …

Components

- Countable assets include cash, stocks, bonds, investments, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for Medicaid eligibility, there are many assets that are considered exempt (non-countable). Exemptions include personal belongings, household furnishings, an automobile, irrevocable burial trusts, and ones primary ho…

Qualification

- For Ohio residents, 65 and over who do not meet the eligibility requirements in the table above, there are other ways to qualify for Medicaid.

Issues

- Unfortunately, Qualified Income Trusts do not assist one with extra assets in qualifying for Medicaid. Said another way, if one meets the income requirements for Medicaid eligibility, but not the asset requirement, the above option cannot assist one in reducing their extra assets. However, one can spend down assets by spending excess assets on ones that are non-countable, such a…