What does Medicare supplement plan C cover?

Aug 03, 2021 · Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and …

How much does Medicare Part C plan cost?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the best Medicare plan?

Dec 01, 2021 · Medicare Part C is an insurance option for people who want more Medicare coverage. Also known as Medicare Advantage plans, Part C plans give you the opportunity to choose your plan type, coverage,...

What does Part C cover in Medicare?

Dec 01, 2021 · Medicare Part C is a type of insurance option that offers traditional Medicare coverage plus more. It’s also known as Medicare Advantage. Some Medicare Part C plans offer health coverage benefits such as gym memberships and transportation services.

What does plan C cover in Medicare?

Medicare Supplement insurance Plan C typically covers the following: Medicare Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits are exhausted. Medicare Part A hospice care coinsurance or copayments. Medicare Part B copayments and coinsurance.

What is the point of Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is Medicare Part C necessary?

Do you need Medicare Part C? These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you.

Does Medicare C cover prescriptions?

What is Medicare Part C coverage for extra benefits? Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

Is Medicare C the same as Medicare Advantage?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is the difference between Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

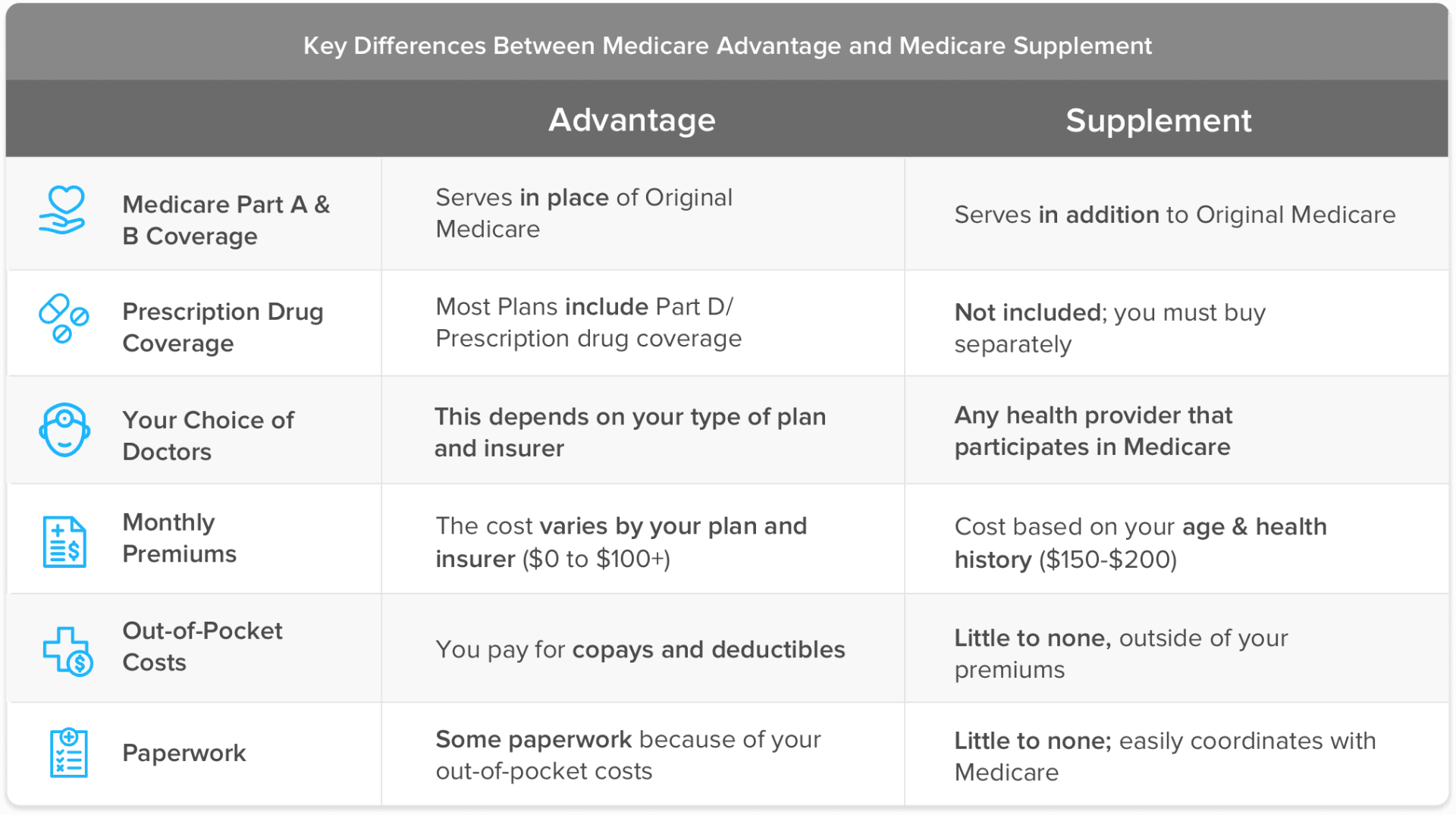

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.Oct 1, 2021

How much do Medicare Part C plans cost?

What's the average cost of Medicare Part C?Medicare Part C plan type# of plans offeredAverage monthly costHMO-POS202$47Cost plan13$53PFFS19$77Regional PPO29$802 more rows•Jan 24, 2022

How much does it cost for Medicare Part C?

While the average cost for Medicare Part C is $25 per month, it's possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.Sep 30, 2021

Which of the following is another name for Medicare C?

Medicare Part C is an alternative name for Medicare Advantage. Medicare Part C is another way to get your Medicare Part A and Part B benefits from a private insurance company. According to the National Institutes of Health (NIH) Medicare Part C gives Medicare beneficiaries a choice of health insurance plans.

What are the 4 phases of Medicare Part D coverage?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage. Select a stage to learn more about the differences between them.Oct 1, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What Does Medicare Part C Cover?

Medicare Advantage (Part C) has more coverage for routine healthcare that you use every day.

What Does Medicare Part C Cover Compared To Original Medicare?

Medicare Part C plans cover Part A and Part B, and many also include prescription drug coverage (Part D) and other benefits not available with Original Medicare. That’s why, of the approximately 64 million people who applied for Medicare, nearly 22 million of them opted for Medicare Advantage plans. 1

What Are Medicare Part C (Medicare Advantage) Costs?

It’s pretty easy to find a Medicare Advantage plan that fits your budget. Medicare Part C premiums, deductibles, and copays vary from plan to plan and state to state. Anthem has many options, and there are money-saving programs for those with low incomes.

Should I Enroll In A Medicare Advantage Plan?

Review your coverage needs when you apply for Medicare. If Original Medicare isn’t enough, you may want to consider Medicare Part C — just know all the pros and cons.

How To Enroll In A Medicare Part C Plan?

If you are applying for Medicare for the first time, you can choose a Medicare Advantage plan during the Initial Enrollment Period (IEP). This is the seven-month period that includes:

What Is The Difference Between Medicare Part C And Part D?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined.

What is Medicare Part A deductible?

At its most basic level, this plan specifically covers the following costs and benefits: Medicare Part A deductible. Part A hospital and coinsurance costs (up to an additional 365 days after Medicare benefits are exhausted) Part A hospice care copayment or coinsurance. Part B deductible. Part B copayments and coinsurance.

What is Medigap Plan C?

Medigap Plan C is designed to provide enrollees with fewer out-of-pocket expenses because it covers a portion of the remaining balance of hospital or doctor bills not covered by Original Medicare (Parts A and B), such as Medicare deductibles, copayments, and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is a policy designed to help pay some of the health care costs that Original Medicare doesn’t cover. Medigap Plan C is one such option, and (considering it covers all but one of the available Medicare Supplement benefits) it happens to be one of the most comprehensive.

When to buy Medigap insurance?

The ideal time to purchase any Medigap policy is during your open enrollment period, which is a six-month period that begins the month you turn 65 and enroll in Medicare Part B. During this time period, insurance companies cannot decline coverage, even if you have pre-existing conditions or are in poor health.

What is excess charge in Medicare?

If you have Original Medicare, and the amount a health care provider is legally allowed to charge is greater than the Medicare-approved amount, the difference is called an excess charge. With Plan F, excess charges will be taken care of, while with Plan C they become the beneficiary’s responsibility.

Is Medigap Plan C still available?

Medigap Plan C policies are still available to Medicare beneficiaries who were eligible for Medicare before January 1, 2020. If you frequently need medical attention, travel outside the United States, or are interested in lowering your out-of-pocket costs, then Medigap Plan C could be the ideal solution.

Does Medigap Plan C make a difference?

Medigap Plan C can make a substantial difference in out-of-pocket costs and coverage. If any of the following scenarios apply to you, it’s worth considering Plan C supplemental coverage:

What is the deductible for Medicare Supplement 2020?

Effective Jan. 1, 2020, Section 401 of the Medicare Access and CHIP Reauthorization Act (MACRA) stipulates that newly eligible Medicare beneficiaries are unable to sign up for a Medicare Supplement Insurance plan that covers the Medicare Part B deductible (which is $203 in 2021 ).

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive Medicare Supplement Insurance plans you can buy . If you only choose to see doctors who accept assignment, it provides the same amount of coverage as the most extensive plan, Medigap Plan F. Without Medigap Plan C, your costs under Medicare Part A in 2021 include:

How much is Medicare Part B deductible in 2021?

Without Medigap Plan C, your costs under Medicare Part B include: A $203 annual deductible in 2021. 20% coinsurance for most Medicare-approved services after the deductible is met. Up to 15% additional excess charges if your doctor does not accept assignment. All costs for foreign travel emergency coverage.

How much is Medicare Part A 2021?

Without Medigap Plan C, your costs under Medicare Part A in 2021 include: $1,484 deductible during inpatient hospital stays (per benefit period) $371 coinsurance per day after day 60 in the hospital. $742 coinsurance per day for up to 60 “lifetime reserve days” after day 90 in the hospital. All costs for inpatient hospital care after day 150.

What is Medicare Supplement Insurance Plan C?

Medicare Supplement Insurance Plan C is among the more comprehensive Medigap plans available in most states. Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to cover some of the program’s out-of-pocket costs, like coinsurance, copayments and deductibles.

What is not included in Medigap Plan C?

The only benefit not included in Medigap Plan C is coverage for Medicare Part B excess charges. Excess charges are additional expenses you may have to pay for if the doctor or provider you use doesn’t accept assignment — meaning they won’t accept the Medicare-approved amount as full payment for covered services.

How much is Medicare Part B coinsurance?

With Medigap Plan C, your costs under Medicare Part B include: $0 for the Medicare Part B deductible. $0 in coinsurance for Medicare-approved services. Up to 15% additional excess charges if your doctor does not accept assignment. 20% of your medically necessary emergency care outside of the U.S. after you meet a $250 deductible.

Is Medicare Part C the same as Medigap?

Please note that Medigap Plan C is not the same as Medicare Part C ( Medicare Advantage), despite their names that sound somewhat alike. Medicare Supplement insurance Plan C typically covers the following: Medicare Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits are exhausted.

Is Medicare Supplement Plan C phased out?

Medigap Plan C covers most Medicare-approved out-of-pocket expenses. However, Medicare Supplement Plan C is being phased out, along with Plan F. Be aware that if you become eligible for Medicare on or after January 1, 2020, you won’t be able to buy Plan C.

Do you have to live within the service area of Medigap?

You must live within the plan’s service area. If you apply for Medigap Plan C outside your Medigap OEP, the insurance company may require you to undergo medical underwriting and doesn’t have to accept you as a member. However, in some situations you might have a guaranteed issue right to enroll in a Medigap plan.

What Is Covered by Medicare Part C?

Traditional Medicare Advantage plans may include any or some of the following:

What Separates Medicare Part C from A and B Regarding Coverage?

Medicare Part C plans cover A and B and may also cover prescriptions, which is part D. Nearly half of all applicants for Medicare end up applying for Medicare Advantage, or Part C, because of the additional coverage provided, and the fact that it’s all-inclusive.

What are the benefits of Medicare Advantage?

Some of those benefits might include: Medicare Part C plans can also offer additional benefits today, such as over-the-counter medications, transportation to and from doctor appointments, and adult daycare services.

What is Medicare Advantage Part C?

Find Plans. Find Plans. Summary: Medicare Part C, also known as Medicare Advantage, is an alternative way to get your Original Medicare benefits. These plans often offer additional coverage for services like prescription drugs, vision and dental care. Plans vary in terms of both cost and benefits.

What are the parts of Medicare?

There are four basic parts to Medicare. Part A and Part B make up Original Medicare. Part A covers care you receive while you are in the hospital. Part B helps pay for expenses, like doctor visits and some medical equipment. Medicare Part C is an alternative way to get your Original Medicare coverage.

When can I switch Medicare Advantage plans?

This period runs annually from January 1 to March 31. During this time, you can switch from one Medicare Advantage plan to another.

Is Medicare Part D a stand alone plan?

Medicare Part D is prescription drug coverage. You can have a stand-alone prescription drug plan with Original Medicare, or you might have a Medicare Advantage plan that includes prescription medication benefits.

When do you enroll in Medicare?

This is the period when you first become eligible for Medicare. This enrollment period begins three months before the month you turn 65. It includes your birthday month and the three months following.

Do I need to see a doctor to get PFFS?

Private Fee-for-Service plans (PFFS) Some plans may require you to see doctors within their network in order to qualify for coverage . Others might let you see providers outside the network, but the coverage may be less. If you choose one of these plans, make sure your doctor is in the network before you enroll.