The coverage offered through Medigap Plan F includes:

| Medicare Benefits | BCBSTX Plan F |

| Medicare Part A coinsurance & hospital c ... | 100% |

| Medicare Part B Coinsurance or copayment | 100% |

| Blood (first 3 pints) | 100% |

| Part A hospice care coinsurance or copay ... | 100% |

Full Answer

What does Blue Cross Medicare supplement plan F cover?

6 rows · Plan F . Plan F is the most popular BlueCross BlueShield of Texas Medicare Supplement ...

What is the difference between Blue Cross Plan G and plan F?

9 rows · Apr 23, 2019 · Blue Cross and Blue Shield of Texas Medicare Supplement Plan F. Medicare Supplement Plan ...

What is Medicare supplement plan F (Medigap)?

Medicare Supplement Insurance Plans are offered by Blue Cross and Blue Shield of Texas, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association.

Does plan F have a high deductible?

Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in each state. Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

What is Medicare Plan F coverage?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

Who is eligible for Medicare Plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.Oct 1, 2021

Does Plan F have prescription coverage?

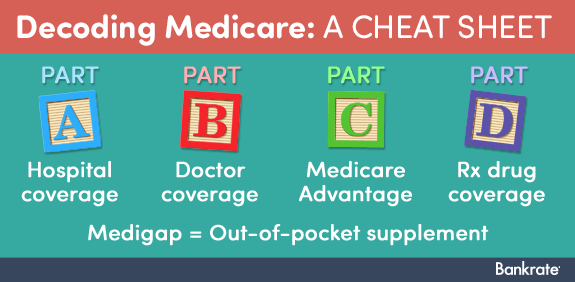

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.Dec 15, 2020

Why are they doing away with Medicare Plan F?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What are the benefits of Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.Aug 26, 2021

When did plan f go away?

Medicare Supplement Plan F is off the market for those newly eligible for Medicare Part A and Part B as of January 1, 2020 and thereafter. Medicare Supplement Plan F is still available to those who buy it before that date.Dec 17, 2021

Does Plan F have a deductible?

You may purchase this plan directly from health insurance providers during the Medicare open enrollment period. Like other health insurance policies, premiums for Plan F are tax-deductible.Apr 8, 2022

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Does Medicare Plan F cover deductible?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What's the difference between Plan F and Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Can you switch from Plan F to Plan G in 2021?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch.Jan 14, 2022

Has Medicare Plan F been discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

What is Medicare Supplement Insurance Plan F?

That means Medicare Supplement Insurance Plan F pays the 20 percent remaining costs for you to receive semi-private room and board, general nursing and miscellaneous services and supplies as well as outpatient medical services, supplies and treatment, physician services, physical and speech therapy, diagnostic tests and durable medical equipment.

Can you cancel your Blue Cross and Blue Shield policy in Texas?

Blue Cross and Blue Shield of Texas will never terminate or refuse to renew your policy because of the condition of your health. And for seniors looking for protection backed by a company with a solid reputation. * Network restrictions apply.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is one of the more popular Medigap options. This is due in large part to its comprehensive array of benefits. The coverage offered through Medigap Plan F includes:

How much is Medicare Part B 2021?

Other costs with this plan that you would need to pay for out-of-pocket include: • Medicare Part B deductible of $203 in 2021. • Medicare Part B excess charges. • Up to a $20 copayment for each visit to the doctor. • Up to a $50 copayment for each visit to the emergency room.

What is BCBStx insurance?

BCBSTX is an independent licensee of the Blue Cross Blue Shield Association. In addition to Medicare Supplement insurance, this company provides access to life insurance, as well as dental, vision and hearing coverage options.

How to contact Medicare Supplement?

If you would like a quote and/or you have any additional questions regarding the right Medicare Supplement coverage for you, reach out to us at (800) 208-4974, or you can use our view rates instantly online with our comparison tool. Free Quotes.

Is it good to work with a medicare specialist?

Making sure that you go with the best Medicare coverage can be somewhat overwhelming. Because of that, it is beneficial to work with a Medicare specialist that can guide you in terms of what coverage is available, as well as by providing you with quotes to compare from a wide variety of insurance carriers.

Is there a Medicare Advantage plan in Texas?

With a Medicare Advantage plan through Blue Cross and Blue Shield of Texas, you will have the same coverage that is available via Original Medicare. However, you may also have added benefits, such as vision, dental, and/or hearing coverage.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance Plans. A Medicare Supplement Insurance Plan* (also known as a Medigap policy) works with Original Medicare. While Medicare Parts A and B cover a lot of health care cost, they don’t cover all cost. A Medicare Supplement Insurance Plan offered by a private health insurance company like Blue Cross and Blue Shield ...

Does Medicare Supplement cover prescriptions?

The plan gives you the freedom to choose your own doctors, specialists and hospitals. Medicare Supplement insurance plans do not include prescription drug coverage. You can't have a Medicare Supplement Insurance Plan and a Medicare Advantage Plan at the same time, ...

Does Medicare cover vision?

Each plan covers a different set of costs. Some plans only cover basic benefits. Other plans cover a wider range of health care costs. Medicare Supplement Insurance Plans do not cover hearing, dental or vision care, or prescription drugs. However, any plan can be paired with a prescription drug plan. Some Medicare Supplement Insurance Plans cover ...

What is Medicare Plan F?

Medicare Plan F provides the most benefits out of all the supplemental Medicare plans available and can help reduce your out-of-pocket expenses. The policy is designed to address most of the coverage gaps in Medicare parts A and B. For this reason, many people covered by the standard Medicare policies are willing to pay ...

What is a plan F?

Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender. For this reason, it is vital to compare rates for ...

Is Medicare Plan F deductible?

When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out-of-pocket can also be deducted on your taxes. You would need to itemize these medical expenses, but the tax deductions could provide valuable additional returns.

What is a high deductible Medicare plan?

What is a high-deductible Medicare Plan F? The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits.

Does Medigap Plan G cover Medicare Part B?

As you can see, Medigap Plan G would not provide coverage for the Medicare Part B deductible. This means if you were to purchase Plan G, you would have to pay the deductible for Part B, which is $185 for 2019, as you receive health services.

Does Medicare cover injectables?

Medicare Plan F does provide coverage for injectable or infusion drugs given in a clinical setting but does not pay for other prescription drugs. The ideal coverage package would include Medicare parts A and B, along with the Part D prescription drug plan and a supplemental Medigap policy such as Plan F.

Help me Choose a Plan

Not sure what plan you need? Answer a few questions to help you decide.

Forms & Documents

Do you need to submit a prescription claim form, search a drug list or find a provider directory? Find the forms and documents you need in our Tools and Resources section.

Find an In-Network Provider

Search to find network doctors, specialists, hospitals and other health care providers.

Prescription Drug Estimator & Pharmacy Finder

Use this tool to choose the right plan that covers your prescription drugs and pharmacy, estimate annual cost savings when you enroll, and find an in-network pharmacy near you.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is not only the most comprehensive plan for lowering out-of-pocket costs, it is also the most popular.

How long is the open enrollment period for Medicare?

Although Medicare has an annual Open Enrollment Period, there is only one Medigap Open Enrollment Period. This six-month period starts when you enroll in Medicare Part B. Signing up after that time will allow companies to increase your rates or deny you coverage based on preexisting conditions.

When did Humana start selling health insurance?

Founded in 1961, Humana started out as a nursing home company and began selling health insurance in the 1980s. It offers Plan F in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan F is available in all of those states except Georgia and Kentucky.

What is Mutual of Omaha?

Founded in 1909, Mutual of Omaha offers a wide range of products from accident and life insurance to financial planning. As one of the first carriers to service Medicare in 1966, it has also built a solid reputation for high-quality Medicare products, offering Plan F in all 47 states where traditional Medicare Supplement Plans are available. If you are looking for High-Deductible Plan F, this company offers it in the majority of states with the exception of Georgia, Hawaii, Maine, Mississippi, New Mexico, New York, Ohio, Tennessee, Texas, Virginia, Wyoming.

What is the difference between regular and high deductible insurance?

Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away. High-Deductible Plan F, on the other hand, offers lower monthly premiums but requires you to pay an annual deductible, set at $2,370 for 2021, before it will pay toward out-of-pocket costs. 4

Is Aetna a subsidiary of CVS?

Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 41 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, Minnesota, New York, Washington, and Wisconsin.

Is Plan F still available?

Starting on January 1, 2020, Plan F is not available to people newly enrolled in Medicare. Plan F is still an option if you were eligible for Medicare before that date, whether based on age (65 years or older) or qualifying disability (regardless of age).

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

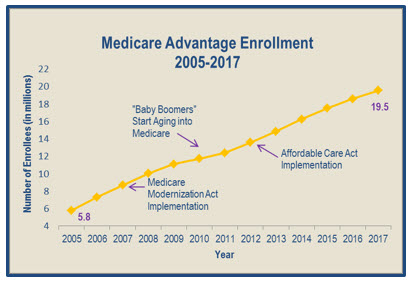

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

Is Medicare Supplement Plan F still available?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What is the Medicare deductible?

The Medicare deductibles, coinsurance and copays listed are based on the 2019 numbers approved by the Centers for Medicare and Medicaid Services. You can go to any hospital, doctor or other health care provider in the U.S. or its territories that accepts Medicare.

Is Blue Cross Medicare endorsed by the government?

This is a solicitation of insurance. We may contact you about buying insurance. Blue Cross Medicare Supplement plans aren't connected with or endorsed by the U.S. government or the federal Medicare program. If you're currently enrolled in Plan A or Plan C, you can stay with your plan as long as you pay your premium.

Does Medicare cover Part B?

The new MACRA law doesn’t allow Medicare supplement plans to cover the Part B deductible for people who are eligible for Medicare on or after Jan. 1, 2020. Because Plans C, F and high-deductible F cover the Part B deductible, they will no longer be available for beneficiaries who become eligible for Medicare on or after Jan. 1, 2020.