Is Medicare Plan G better than Plan F?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $233 in 2022.

How much does Medicare Plan G cost?

Dec 03, 2021 · Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans. The big four are:

Which is better Medicare Plan F or G?

Medicare Part G – Known as Medicare Plan G – is now the most popular Medigap Plan Available. Medicare Supplement Plan G covers 100% of the gaps in Medicare Part A & B with only one small deductible to pay. More people will enroll in Medicare Plan …

Does plan G cover Medicare deductible?

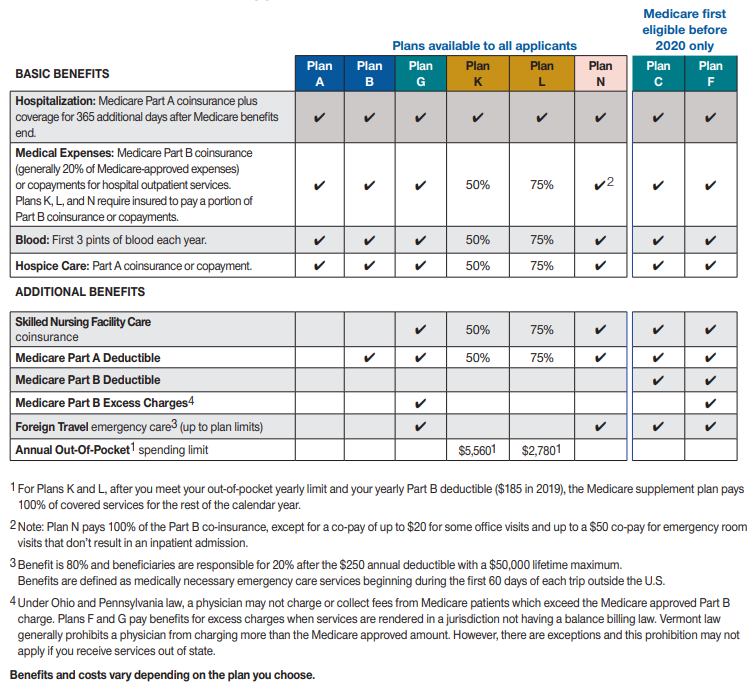

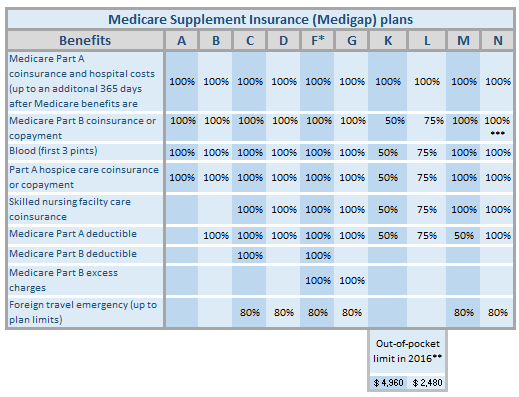

Summary: Medicare Supplement Plan G is one of the most popular Medicare Supplement plans. This plan covers: Medicare Part A coinsurance and hospital costs; Medicare Part B coinsurance or copayment; Blood (first 3 pints) Part A hospice care coinsurance or copayment; Skilled nursing facility care coinsurance; Part A deductible; Part B excess charges

What does plan G include?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Does Medicare Plan G include prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

What is the difference between Medicare Plan D and Plan G?

Medigap Plan D It is very similar to Medigap Plan G, with only one benefit difference. Just like the difference in Plans F and C, the only difference in Plans G and D is the coverage of the Medicare Part B Excess charges. Whereas Plan G covers those at 100%, Plan D does not cover them at all.

What is the 2021 deductible for Medicare Plan G?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does plan G have a deductible?

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you don't have Plan G, then you'll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.Jan 24, 2022

Does Medicare Plan G have a deductible?

Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end. Part A hospice care coinsurance or copayment.Nov 11, 2020

What is the most comprehensive Medicare supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Are all Medicare Plan G the same?

All Medicare Supplement plans, including Plan G, are standardized in the following ways: Benefits – You don't have to worry about which company offers the best or most benefits. The benefits of a Plan G will be the same regardless of the company you select.

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

Is Plan G high deductible a good idea?

Who typically should consider a high-deductible plan? Plans F and G are the most popular Medigap plans because they take away ugly healthcare billing surprises. High-deductible F and G Medigap plans do the same thing, but choosing these plans means you have to have enough savings to pay the annual deductible upfront.Nov 18, 2021

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

The Medicare Supplement Plan G is a Medigap insurance policy. Medigap plans can fill in the gaps in Original Medicare coverage. For example, when y...

What Is Medigap insurance?

Medigap, or Medicare supplement plans, are additional policies that can cover some or all of the gaps in Original Medicare. This includes copayment...

Is it Medicare Part G or Plan G?

The correct name is “Plan G.”

What Does Plan G Not Cover?

Medicare Plan G coverage is robust, but it doesn’t cover everything. The most notable thing Plan G doesn’t cover is the Part B deductible.

What is the Difference Between Medicare Supplement Plan F and Plan G?

Plan F and Plan G are the most comprehensive Medigap policies. Both plans will cover most of the gaps in your Medicare coverage, but you can’t purc...

How Much is the Monthly Premium for Plan G?

Medigap plans like Plan G are offered by private insurance agencies. Unlike Original Medicare, there’s not a federally mandated price tag. Instead,...

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

What is a Part D plan?

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

What is the deductible for diabetes without Plan G?

Without Plan G, your yearly cost for all that care would be the Part B deductible of $203 plus all the copays and coinsurance required for your diabetes supplies and care. With Plan G, once you pay the deductible, you are 100% covered for those costs; you never pay another dollar that year.

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

What is a Part B coinsurance?

Part B coinsurance or copayment. Part B excess charges. Blood (the first three pints needed for a transfusion) Skilled nursing facility coinsurance. Foreign travel emergency care (up to plan limits of $50,000) The only thing that Plan G does not cover that Plan F does is the Part B deductible.

Medicare Plan G Coverage

Probably the easiest way to explain what Medicare Plan G covers, is to simply explain what it doesn’t cover. Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible.

Medicare Supplement Plan G – What it Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Plan G vs Plan F

Medicare plan F used to be the plan with the highest coverage. It paid 100% of all your medical bills for you, including the Medicare Part B deductible.

Medicare Part G Cost

Medicare Plan G varies in cost based on where you live, your age, gender, tobacco use, and if you qualify for a household discount or not. The cost for Plan G Medicare ranges from $85 – $120 per month.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

Does Medicare pay your portion?

It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

Key Takeaways

If you’re enrolled in Original Medicare, a Medicare Plan G policy lowers out-of-pocket costs.

What is Medicare Plan G?

The Medicare Supplement Plan G is a Medigap Insurance policy. Medigap plans can fill in the gaps in Original Medicare coverage. For example, when you access healthcare, Medicare Part B steps in and covers 80% of the cost. However, you’re left with 20% of the bill. That’s where Medicare Plan G coverage comes in handy.

Medicare Plan G Coverage

Plan G is one of the most comprehensive Medigap plans you’ll find. If you’re enrolled in a Plan G, most of your healthcare services will be completely covered.

What is the Difference Between Medicare Supplement Plan F and Plan G?

Medicare Plan F and Plan G are the most comprehensive Medigap policies. Both plans will cover most of the gaps in your Medicare coverage. Let’s take a closer look.

How Much is the Monthly Premium for Plan G?

Medigap plans like Plan G are offered by private insurance agencies. Unlike Original Medicare, there’s not a federally mandated price tag. Instead, each insurance agency can set their own monthly premiums. Your monthly costs vary depending on your state, your provider, and the policy you choose.

How Does Medicare Plan G Compare to Medicare Advantage

You can’t have Medicare Plan G and a Medicare Advantage plan, so choose wisely.

What is Medicare Supplement Plan G?

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance . Medigap Plan G is a Medicare supplement plan that offers eight of the nine benefits available. This makes it one the most comprehensive Medigap plan offered.

What factors go into what an insurance company charges for Plan G?

There are lots of factors that go into what an insurance company charges for Plan G. These include: your age. your overall health.

What is the most comprehensive Medicare supplement plan?

Formerly, Medigap Plan F was the most comprehensive and popular Medicare supplement plan. Now, Plan G is the most comprehensive plan insurance companies offer.

What are the letters in a Medigap plan?

Exceptions exist for Massachusetts, Minnesota, and Wisconsin, who standardize their plans differently. Most companies name the plans by uppercase letters A, B, C, D, F, G, K, L, M, and N.

Why is it so hard to change Medigap plan?

However, some people find it hard to change their coverage because they get older (and premiums are more likely to be higher) and they may find switching plans costs them more. Because Medigap Plan G is one of the most comprehensive plans, it’s likely that health insurance companies may increase the costs over time.

How long does Medicare coinsurance last?

Medicare Part A coinsurance and hospital costs up to 365 days after your Medicare benefits are used up. Medicare Part B coinsurance or copayments. first 3 pints of blood for transfusions. Medicare Part A hospice care coinsurance or copayments. skilled nursing care facility coinsurance.

Does Medicare supplement plan increase deductible?

Once you choose a Medicare supplement plan, the deductibles can increase on a yearly basis.

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

What is the second most comprehensive Medicare supplement plan?

The plans are named by letter, ranging from A to N. Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity. 1.

Why do people call Medicare Supplement Plans “Medigap”?

Some people call Medicare supplement plans “Medigap” because they “fill in the gaps” that exist in Medicare. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. The plans are named by letter, ranging from A to N.

How to contact Debra from Medicare?

Call a Licensed Agent: 833-271-5571. Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesn’t accept Medicare assignment.

Does Debra have a Medigap Plan G?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.