Get details on Medicare Supplement Insurance options

| Coverage | Medigap Plan |

| Basic benefits | Medigap Plan A. |

| Basics plus some extras | Medigap Plan B. Medigap Plan M. |

| Highest coverage | Medigap Plan D. Medigap Plan G. |

Which Medicare supplement plan should I Choose?

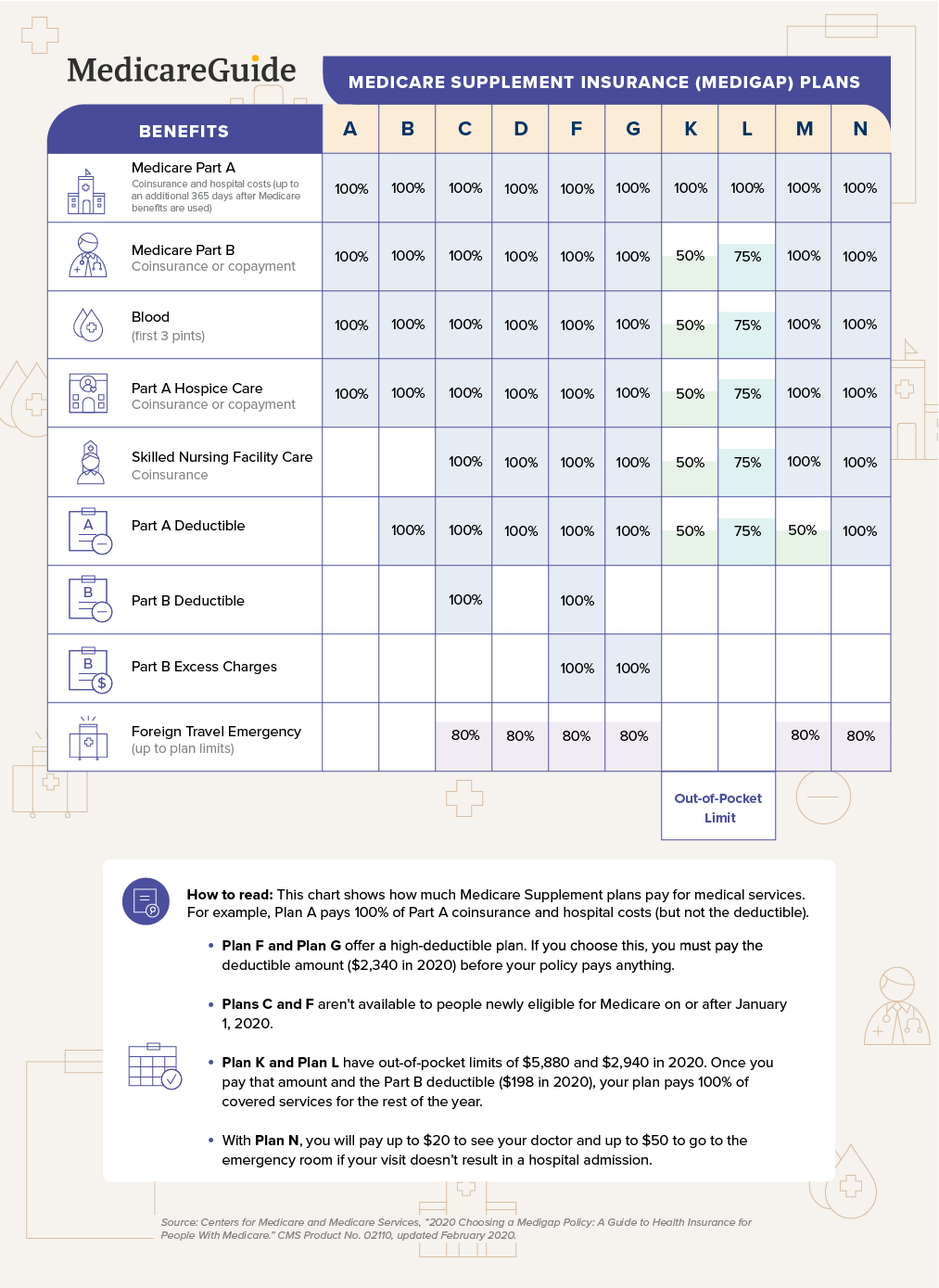

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Is a Medicare supplement insurance plan worth it?

Medicare Supplement plans would help cover the 20% you’re responsible for paying. Medicare Supplement plans, or Medigap policies, are insurance plans sold by private insurance companies. You pay the insurance company a monthly premium for your Medigap plan, in addition to the Part B premium you pay to Medicare.

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Insurance Cost Factors

- Plan Coverage. One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided.

- Carrier. Medicare Supplement Insurance is sold by private insurance companies that set their own plan prices.

- Location. ...

- Enrollment Time. ...

- Pricing Structure. ...

- Discounts. ...

- Gender. ...

Which Medicare supplement plan is the most popular?

Medicare supplement Plan G is one of the most popular Medigap plans available today. More people will enroll in Plan G than any other Medigap plan, and for good reason. Medicare Plan G pays 100% of the gaps in Medicare Part A and B after you simply pay a small annual deductible. Keep reading to learn why Plan G might be the best option for you.

What is a Medicare supplement plan g?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What is the difference between Plan G and an Advantage plan?

Costs for a Medicare Advantage plan and a Medicare Supplement Plan G differ substantially in both premium costs and potential out-of-pocket costs. A Medicare Advantage plan often has no monthly premium, while a Medicare Supplement Plan G always has a monthly premium.

What is the difference between Plan D and Plan G?

Medigap Plan D Just like the difference in Plans F and C, the only difference in Plans G and D is the coverage of the Medicare Part B Excess charges. Whereas Plan G covers those at 100%, Plan D does not cover them at all.

What is the difference between Medicare Plan B and Plan G?

The main difference between them is Plan F covers your Medicare Part B deductible while Plan G doesn't. Some of the other Medicare Supplement plans available today are only slightly different from F and G while a few are quite different.

Is Medicare Part C or G better?

If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.

Is Medicare Part G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Does Medicare Plan G have a deductible?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Does plan G cover prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

What is the deductible for plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Does AARP Offer plan G?

AARP also offers a high-deductible version of Plan G. This option will require you to pay a deductible of $2,340 before the plan begins to assist with costs. Once you've met your deductible, the plan will pay 100% of covered costs for the remainder of the year. This plan does not cover your Part B deductible.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

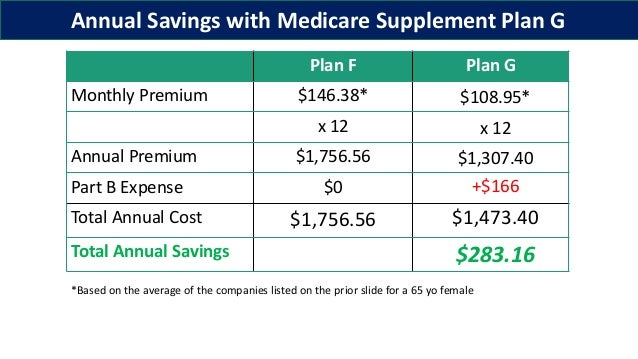

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

What is a Part D plan?

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

What is the deductible for diabetes without Plan G?

Without Plan G, your yearly cost for all that care would be the Part B deductible of $203 plus all the copays and coinsurance required for your diabetes supplies and care. With Plan G, once you pay the deductible, you are 100% covered for those costs; you never pay another dollar that year.

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

What is a Part B coinsurance?

Part B coinsurance or copayment. Part B excess charges. Blood (the first three pints needed for a transfusion) Skilled nursing facility coinsurance. Foreign travel emergency care (up to plan limits of $50,000) The only thing that Plan G does not cover that Plan F does is the Part B deductible.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

Is there such a thing as Medicare Part G?

Only Original Medicare itself has Parts and there are only four parts – A, B, C and D. So there is no such thing as Medicare Part G! All Supplement insurances, on the other hand, are called Plans. So instead of saying Medicare Part G say Plan G, and you’ll be using the correct wording. Hope that helps you!

What is Medicare Supplement Plan G?

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance . Medigap Plan G is a Medicare supplement plan that offers eight of the nine benefits available. This makes it one the most comprehensive Medigap plan offered.

What factors go into what an insurance company charges for Plan G?

There are lots of factors that go into what an insurance company charges for Plan G. These include: your age. your overall health.

What is the most comprehensive Medicare supplement plan?

Formerly, Medigap Plan F was the most comprehensive and popular Medicare supplement plan. Now, Plan G is the most comprehensive plan insurance companies offer.

What are the letters in a Medigap plan?

Exceptions exist for Massachusetts, Minnesota, and Wisconsin, who standardize their plans differently. Most companies name the plans by uppercase letters A, B, C, D, F, G, K, L, M, and N.

Why is it so hard to change Medigap plan?

However, some people find it hard to change their coverage because they get older (and premiums are more likely to be higher) and they may find switching plans costs them more. Because Medigap Plan G is one of the most comprehensive plans, it’s likely that health insurance companies may increase the costs over time.

How long does Medicare coinsurance last?

Medicare Part A coinsurance and hospital costs up to 365 days after your Medicare benefits are used up. Medicare Part B coinsurance or copayments. first 3 pints of blood for transfusions. Medicare Part A hospice care coinsurance or copayments. skilled nursing care facility coinsurance.

Does Medicare supplement plan increase deductible?

Once you choose a Medicare supplement plan, the deductibles can increase on a yearly basis.

A Quick Look at Medicare

Medicare is a federal health insurance for people 65 or older, certain people under 65 with disabilities and people of any age with End-Stage Renal Disease (ESRD).

What Are Medicare Supplement Insurance Plans?

A Medicare Supplement Plan (also known as Medigap) is health insurance that you can buy from private companies.

What Does Medicare Plan G Cover?

Due to the phasing out of Medicare Plan F in 2020, Plan G (also known as Medigap Plan G) has become a popular choice among seniors to lower Medicare’s out-of-pocket expenses.

How Much Does Medicare Supplement Plan G Cost?

All of these amounts can be slightly confusing. Here is a breakdown to show you how much you could potentially pay for Medicare Plan G:

How Do I Enroll in Medicare Plan G?

To qualify for Medicare Plan G, you must first have Medicare Parts A and B.

Where Do I Find Out More about Medicare Supplement Insurance?

We know that making sense of all the different Medicare Supplement Insurance Plans and benefits can be challenging.

How it works

After Medicare pays its approved portion of medical costs, Medigap Plan G helps pay for remaining out-of-pocket expenses. You must pay a separate monthly premium for Medigap coverage.

Compare alternative plans

For those who are eligible, Plan F covers everything in Plan G, plus the Part B deductible; however, plans covering the Part B deductible can’t be sold to most new Medicare members anymore.

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

What is the second most comprehensive Medicare supplement plan?

The plans are named by letter, ranging from A to N. Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity. 1.

Why do people call Medicare Supplement Plans “Medigap”?

Some people call Medicare supplement plans “Medigap” because they “fill in the gaps” that exist in Medicare. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. The plans are named by letter, ranging from A to N.

How to contact Debra from Medicare?

Call a Licensed Agent: 833-271-5571. Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesn’t accept Medicare assignment.

Does Debra have a Medigap Plan G?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

What Does Plan G Cover?

Medigap Plan G covers many costs not covered by traditional Medicare coverage such as outpatient services like lab tests and physical therapy visits. It also covers the cost of copays, coinsurance or deductibles for many other types of health care providers

Medicare Part A

Medicare Part A is a program that helps pay for hospital stays. You can consider Part A your “room and board” in the hospital, including things such as a semi-private room, meals, medications, and nursing care.

What Does Medicare Part A Cover?

Part A covers health care in the hospital, skilled nursing facility, hospice and some home health services. It also includes some coverage for these types of providers after being discharged from a hospital.

What Part A Does Not Cover

Part A does not cover services that are considered “outpatient.” These services would fall under Medicare Part B. Medicare Part A also does not cover all costs associated with hospitalization. This includes the deductible, which is per benefit period (not annual) and the copayments or coinsurances.

Medicare Part B

Medicare Part B is the counterpart to Medicare Part A under Original Medicare. This part of Medicare is considered your outpatient coverage. Part B covers outpatient care like lab work, x-rays and visits with your primary physician. It also includes coverage for these types of providers after being discharged from a hospital.

What Does Medicare Part B Cover?

Medicare Part B covers services that are considered either medically necessary or preventive.

What Does Medicare Part B Not Cover?

Medicare Part B does not cover some cost-share, such as an annual deductible of $203 in 2021, or the 20% coinsurance for all medically necessary services. Medigap plans, like Medicare Supplement Plan G, are designed to pick up the 20% coinsurance in order to significantly lower your out-of-pocket expenses.