A Medicare premium is a monthly fee you pay for coverage. You must pay your premium or you risk being uncovered. Premiums for Part A Part A is premium-free for beneficiaries who work and contribute to Medicare for at least 40 quarters. If you work between seven and a half years to ten years, you’ll need to pay a reduced premium.

How to calculate Medicare premiums?

A health insurance premium is the amount – typically billed monthly – that policyholders pay for health coverage. Policyholders must pay their premiums each month regardless of whether they visit a doctor or use any other healthcare service. Health insurance through Medicare, the health insurance marketplace, or an employer will almost ...

What are Medicare premiums based on?

Aug 23, 2021 · Premiums for Part A. Part A is premium-free for beneficiaries who work and contribute to Medicare for at least 40 quarters. If you work between seven and a half years to ten years, you’ll need to pay a reduced premium. However, those who work fewer than 30 quarters will need to pay the full Part A premium.

How to pay your Medicare premium?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $274. Learn more about Part A premiums.

What is the average monthly premium for Medicare?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A …

What is the difference between Medicare and Medicare premium?

The plan pays the full cost of your care after you reach the limit. Definitions: Premium: The monthly fee you pay to have Medicare or your health plan. Deductible: What you must pay before Medicare or your health plan starts paying for your care.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Who pays premium for Medicare?

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Did Medicare premiums go up for 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Why is my Medicare premium so high?

CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system. Some of the higher health care spending is being attributed to COVID-19 care.Nov 15, 2021

How can I avoid paying Medicare premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Who qualifies for Medicare premium refund?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

What is Medicare Part B premium reduction?

The Part B give back benefit helps those on Medicare lower their monthly health care spending by reducing the amount of their Medicare Part B premium. When you enroll in a Medicare Advantage Plan that offers this benefit, the carrier pays either a part of or the entire premium for your outpatient coverage each month.

What is a health insurance premium?

A health insurance premium is the amount – typically billed monthly – that policyholders pay for health coverage. Policyholders must pay their prem...

How can I find out what my premium will be?

Health plan websites and printed marketing materials provide premium and other cost information. Don’t sign up for a plan without carefully reviewi...

What is a typical premium?

Premiums vary significantly from plan to plan. For people who buy their own coverage in the marketplace, the average full-price premium (ie, before...

How can I lower my premiums?

If you switch to a plan with fewer benefits, a smaller provider network, or more restrictive managed care rules (an HMO with no out-of-network bene...

How does the Affordable Care Act help lower premiums?

The premium subsidies are a direct result of the ACA, and they’re the primary means of keeping premiums affordable. But the ACA also ensures that s...

How does the American Rescue Plan (2021 COVID relief) help lower premiums?

The American Rescue Plan eliminates the “subsidy cliff” by ensuring that nobody has to pay more than 8.5% of their income for the benchmark marketp...

How do carriers set their health insurance premiums?

Insurers set premiums based on the overall claims experience of their entire risk pool, and projected costs for the coming year. In the individual...

What factors affect my health insurance premium?

If you’re purchasing individual/family coverage, your premiums depend on your age, zip code, and tobacco use, as well as the insurer that you selec...

Do health insurance premiums increase as policyholders age?

In general, yes. In the individual/family market, premiums in nearly every state are three times higher for a 64-year-old applicant than they would...

Are health insurance premiums tax-deductible?

It depends. If you have employer-sponsored coverage, you’re almost certainly already paying your premiums with pre-tax dollars. If you purchase you...

What is a Medicare Deductible?

Simply, a deductible is an amount you pay upfront before your plan covers your health care expenses. For example, if your plan has a $3,000 yearly deductible, you must pay the full $3,000 for services Medicare approves BEFORE your insurance plan covers the remaining costs.

What is a Medicare Copay?

A Medicare copay is a fixed dollar amount that you pay each time you see a health care provider or receive health care services. With drug plans, you’re required to pay out-of-pocket until you reach your deductible/initial coverage phase if your plan has one. Additionally, it’s important to note that copays have nothing to do with the premium.

What is a Medicare Premium?

A Medicare premium is a monthly fee you pay for coverage. You must pay your premium or you risk being uncovered.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is Medicare Advantage?

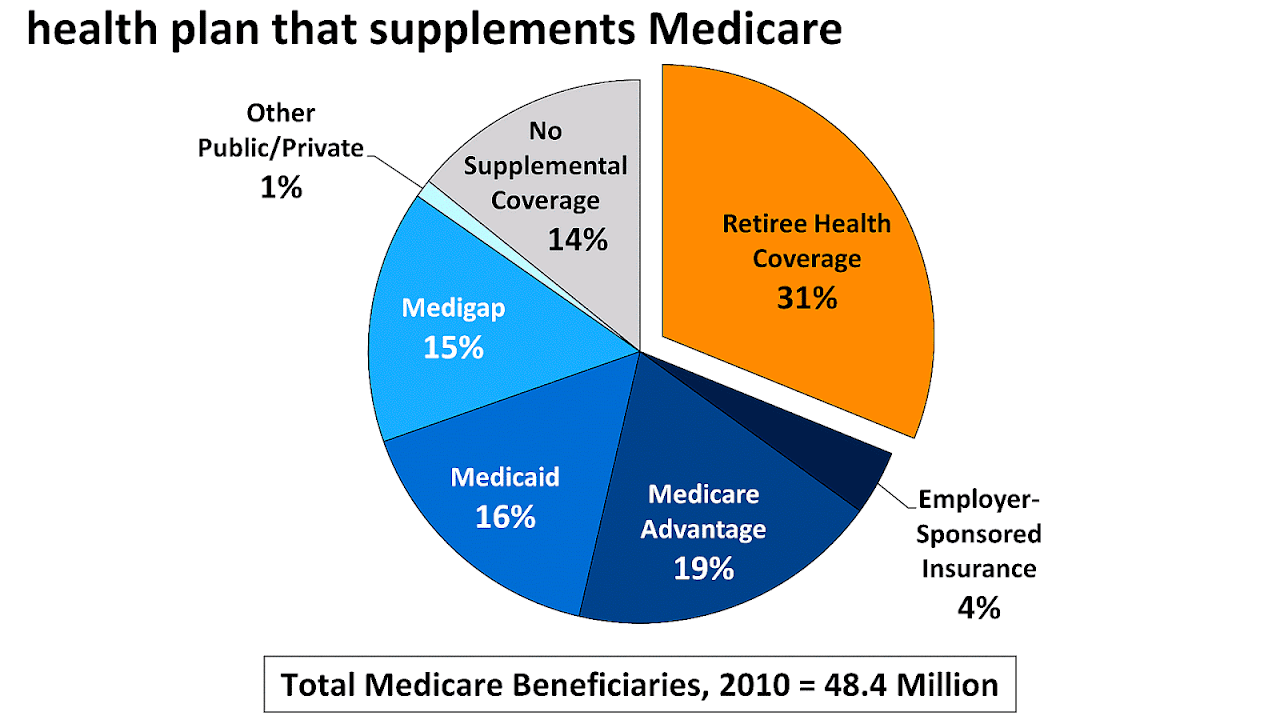

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What determines the premium of an insurance policy?

An insurance premium is usually determined by four key factors: 1. Type of Coverage. Insurance companies offer different options when you purchase an insurance policy. The more coverage you get, or the more comprehensive coverage you choose, the higher your insurance premium may be.

How to get the lowest insurance premium?

The trick to getting the lowest insurance premium is finding the insurance company that is most interested in insuring you. When an insurance company's rates go too high all of a sudden, it is always worth asking your representative if there is anything that can be done to reduce the premium.

What is the role of actuaries in underwriting?

The information from the actuaries helps shape underwriting. Underwriters are given guidelines to underwrite the risk, and a part of this is determining the premium. The insurance company decides how much money they will charge for the insurance contract they are selling you.

Why do insurance companies deviate rates?

If an insurance company decides they want to aggressively pursue a market segment, they may deviate rates to attract new business. This is an interesting facet of insurance premium because it may drastically alter rates on a temporary basis, or more permanent basis if the insurance company is having success and getting good results in the market.

Is insurance paid monthly or annual?

The insurance premium is sometimes paid on an annual basis, semi-annual, or monthly basis. If the insurance company decides they want the insurance premium upfront, they may also require that. This is often the case when a person has had their insurance policy canceled for non-payment in the past.

Do you pay more for life insurance?

Amount of Coverage and Your Insurance Premium Cost. Whether you are purchasing life insurance, car insurance, health insurance, or any other insurance, you will always pay more premium (more money) for higher amounts of coverage.

Do insurance companies need to increase premiums?

In profitable years, an insurance company may not need to increase insurance premiums. In less profitable years, if an insurance company sustains more claims and losses than anticipated, then they may have to review their insurance premium structure and re-assess the risk factors in what they are insuring.

What is Medicare Part B?

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

Does Medicare cover long term care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it .

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

Do you have to pay Medicare Part B premium?

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, you’ll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

What is Medicare Premium Payment Program?

The Medicare Savings Program is an overarching name for the following four programs: Medicare operates under the Centers for Medicare & Medicaid Services (CMS).

What is Medicare buy in?

Medicare buy-in programs were developed to lower out-of-pocket expenses of recipients with modest income and assets. To assess income eligibility, the buy-in model uses the same resource limits but with different thresholds. People who have Medicare benefits plus Medicaid are said to have dual benefits.

What does "buy in" mean in Medicare?

What Does Medicare “Buy-in” Mean? Medicare addresses the issue of medical insurance for the senior population, and some individuals under the age of 65 due to disability. Many Medicare recipients face difficulty paying their healthcare costs and need support.

What is the equivalent of Medicaid in California?

California’s equivalent of Medicaid is Medi-Cal. Only available in certain states is PACE, which stands for Programs of All-Inclusive Care for the Elderly.

What is the Medicaid program?

Assistance with medical coverage. Medicaid is a program jointly held by federal and state governments designed for low-income individuals.

Is Medicare buy in good?

While Medicare buy-in offers a solution to healthcare access, coverage continuity, better health in the community and potentially lower healthcare spending in the long-term, there are challenges, mostly in terms of financing. However, access to affordable and quality medical care is critical for optimum health and cost efficiency.

Does Medicaid cover nursing home care?

Medicaid not only supports people with limited means but also offers benefits not typically covered by Medicare. Some additional benefits that may be offered by Medicaid include care in a nursing home and assistance in personal care. Rules and eligibility vary by state.

What is Medicare for people over 65?

If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure). People with Medicare have the option of paying a monthly premium for outpatient prescription drug coverage.

How does Medicare Part D work in 2010?

In 2010, basic Medicare Part D coverage works like this: You pay out-of-pocket for monthly Part D premiums all year. You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your ...

Does Medicare Extra Help cover out-of-pocket costs?

These plans also may charge a higher monthly premium.) For those that qualify, there is also a program called Medicare Extra Help that helps you pay your premiums and have reduced or no out-of-pocket costs for your drugs.

Does Medicare Part D cover prescriptions?

Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan. If you would like more information on the one-time rebate check, feel free to call 1-800-MEDICARE.

What is creditable coverage?

The most common type of creditable coverage is a large employer group plan. Meaning, a company that employs 20 or more people. When working for an employer, you likely receive health coverage through the company. If the company you work for has more than 20 employees, you have creditable coverage for Medicare.

How does a notice of creditable coverage work?

The Notice of Creditable Coverage works as proof that you obtained coverage elsewhere when you first became eligible for Medicare. Your Notice of Creditable Coverage comes in the mail each year for those who obtain drug coverage through an employer or union.

What is small group insurance?

An employer with small group insurance is a company with less than 20 employees and may not be creditable coverage under Medicare. Further, a variety of government programs are also considered creditable coverage. Examples of other types of coverage are individual, group, and student health plans.

Is Part D a creditable plan?

A plan is creditable for Part D as long as it meets four qualifications. Pays at least 60% of the prescription cost. Covers both brand-name and generic medications. Offers a variety of pharmacies. Does not have an annual benefit cap amount, or has a low deductible.

Is Medicare coverage good for 2021?

Updated on July 12, 2021. Coverage that’s as good as Medicare is creditable coverage, meaning the plan benefits are up to the same standards as Medicare. When a person has creditable coverage, they may postpone enrollment in Medicare. Creditable coverage allows beneficiaries to delay enrolling without worrying about being late enrollment penalties.

How much is Part B premium?

Still, those on Advantage plans must continue to pay their Part B premium. The standard Part B premium is $148.50. Those with lower incomes can get help paying this premium, while higher-income earners are subject to premium adjustment.

What is an Advantage Plan?

Advantage plans enable participants to receive multiple benefits from one plan, but all Advantage plans must also include the same coverage as Original Medicare (Parts A and B). When you have an Advantage plan and receive care, the insurance company pays instead of Medicare. Advantage plans are often HMOs or PPOs, ...

Can you see a doctor with Medicare?

With or without secondary Medigap insurance, Original Medicare coverage enables you to see any doctor accepting Medicare assignment. As of 2020, only 1% of physicians treating adults had formally opted out of Medicare assignment, so this is similar to having an unlimited "network."

Do you have to pay Medicare premiums for both Part A and Part B?

People who have paid Medicare taxes for 40 or more quarters receive Part A premium-free. You must enroll in both Part A and Part B to obtain an Advantage plan. So, while an Advantage plan stands in for your Medicare and might come without a monthly premium, you'll still be responsible for your Original Medicare costs.