Special Low Income Medicare Beneficiaries (SLMBs) are Medicare recipients with income between 100% - 120% of the federal poverty level. Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

Does Medicaid replace Medicare Part B?

More than 8 million people have both Medicare and Medicaid. In this situation, Medicare becomes your primary insurance and settles your medical bills first; and Medicaid become secondary, paying for services that Medicare doesn’t cover and also paying most of your out-of-pocket expenses in Medicare (premiums, deductibles and copays).

Does Medicaid pay for Medicare Part B?

You have full Medicaid coverage. You get help from your state Medicaid program paying your Part B premiums (in a Medicare Savings Program). You get Supplemental Security Income (SSI) benefits. Drug costs in 2021 for people who qualify for Extra Help will be no more than $3.70 for each generic drug and $9.20 for each brand-name drug.

How much does Medicare Part B cover?

Medicare Part B covers the cost of outpatient services, including injectable and infused drugs such as cortisone injections that are given by a licensed medical provider. If a doctor confirms that cortisone shots are medically necessary, Part B covers 80% of the cost.

Is SLMB the same as QMB?

QMB: Net countable income at or below 100% of the Federal Poverty Level (FPL) (at or below $908* for a single person, or $1,226* for a couple). SLMB: Net countable income below 120% of the FPL (below $1,089* for a single person, or $1,471* for a couple).

Does SLMB pay deductible?

Specifically, the program pays for: your Medicare Part A deductible. your Medicare Part B deductible and monthly premiums. other coinsurance and copay costs associated with Medicare Part A and Part B coverage.

What is QMB Medicaid in Georgia?

The Qualified Medicare Beneficiary (QMB) program was designed to fill the gaps in Medicare coverage by eliminating out-of-pocket expenses for Medicare covered services. The QMB program helps low–income Medicare beneficiaries by paying Medicare premiums, deductibles and coinsurance.

What does MC QMB mean?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and deductibles, coinsurance, and copayments. …

What does SLMB mean?

Specified Low-Income Medicare BeneficiaryThe Specified Low-Income Medicare Beneficiary (SLMB) program is a Medicare Savings Program (MSP) that pays for an enrollee's Medicare Part B premiums. MSPs are federal programs that are administered by Medicaid in each state. As of 2020, most Medicare beneficiaries pay $144.90 a month for Part B.

What's the difference between Qi and SLMB?

Specified Low-income Medicare Beneficiary (SLMB): Pays for Medicare Part B premium. Qualifying Individual (QI) Program: Pays for Medicare Part B premium.

What does QMB Medicaid pay for?

The Qualified Medicare Beneficiary (QMB) program helps District residents who are eligible for Medicare pay for their Medicare costs. This means that Medicaid will pay for the Medicare premiums, co-insurance and deductibles for Medicare covered services.

Does Social Security count as income for QMB?

An individual making $1,000 per month from Social Security is under the income limit. However, if that individual has $10,000 in savings, they are over the QMB asset limit of $8,400.

What is the income limit for QMB in Georgia?

$1,064 a monthQualified Medicare Beneficiary (QMB): The income limit is $1,064 a month if single or $1,437 a month if married.

What is Part A insurance?

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

How do I check my Medicare payments?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

What part of Medicare pays for physician services and outpatient hospital care?

Medicare Part BLearn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care. Part B also covers durable medical equipment, home health care, and some preventive services.

What is SLMB in Medicare?

The Specified Low-Income Medicare Beneficiary (SLMB) program is a Medicare Savings Program (MSP) that pays for an enrollee’s Medicare Part B premiums. MSPs are federal programs that are administered by Medicaid in each state. As of 2020, most Medicare beneficiaries pay $144.90 a month for Part B.

How much does Medicare pay in 2020?

As of 2020, most Medicare beneficiaries pay $144.90 a month for Part B. SLMB enrollees no longer have this amount deducted from their Social Security benefit – amounting to an annual increase of over $1,738. Individuals who are approved for SLMB will receive three months of retroactive benefits.

Does SLMB pay for Part A?

Unlike the Qualified Medicare Beneficiary (QMB) program, SLMB does not pay for Parts A and B cost sharing (e.g. deductibles, co-pays and coinsurance) or for Part A premiums (if an enrollee owes them).

How to apply for a low income medicaid?

You can apply for the Specified Low Income Medicare Beneficiary Program online, by phone, in person at your agency, or by mail. If you are eligible for the Specified Low Income Medicare Beneficiary Program, Medicaid will start paying for your Medicare Part B premiums up to three months before your application date.

What is a SLMB?

The Specified Low Income Medicare Beneficiary (SLMB) Program is a Medicare Savings Program that helps pay for Medicare Part B premiums. Have countable assets at or below the program limit*. If there is one person in your family, the asset limit is $7,970.

When are Social Security assets limits effective?

*The asset limits are effective January 1, 2021, and the income limits are effective February 1, 2021. The limits are based on federal guidelines, which may change each year. ...

Does medicaid pay Medicare Part B?

Medicaid should already be paying your Medicare Part B premiums (meaning you do not need to apply for Specified Low Income Medicare Beneficiary Program benefits) if you receive Medicare and Medicaid and either of the following apply to you: You are enrolled in the Supplemental Security Income (SSI) program. You were enrolled in SSI but lost it ...

What is a Medicare notice?

A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare. It explains what the doctor, other health care provider, or supplier billed for, the Medicare-approved amount, how much Medicare paid, and what you must pay.

What is the number to call for Medicare?

If your provider won't stop billing you, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

How to stop Medicare charges?

If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

Can you get help paying Medicare premiums?

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay

Can you be charged for Medicare deductibles?

If you get a bill for Medicare charges: Tell your provider or the debt collector that you’re in the QMB Program and can’t be charged for Medicare deductibles, coinsurance, and copayments.

What is a SLMB?

Specified low-income Medicare beneficiary (SLMB) The SLMB plan helps pay for Medicare Part B premiums. To qualify for this type of financial help, you must be enrolled in Medicare Part A. You also must meet certain income and assets requirements. You can find the income requirements on the Medicare website.

How to apply for SLMB?

To apply for the SLMB program, contact your state Medicaid office . If you qualify for the SLMB program, you automatically qualify to get Extra Help paying for Medicare prescription drug coverage.

What is the income limit for Medicare?

The income limits in most states require that an individual’s monthly income falls under $1,456 or a married couple’s monthly income falls under $1,960.

What is a qualified individual program?

Qualified Individual program. The QI program helps people pay Medicare Part B premiums if they have Medicare Part A, and their income and resources meet the requirements. A person must apply every year for the benefits. When approving applications, Medicare gives priority to someone who had QI the previous year.

What is a SLMB?

The Specified Low-Income Medicare Beneficiary (SLMB) program helps people with Medicare Part A pay for their Medicare Part B monthly premiums or out-of-pocket costs. A person is eligible for SLMB if they have income and resources that fall below certain limits. While most states have the same income and resource criteria, there are a few exceptions.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Which states have income and resources limits?

Some states vary the income and resources limits. States with higher income limits include Hawaii, Alaska, District of Columbia (DC), and Connecticut. States that do not have resource limits include Maine, Arizona, Alabama, Mississippi, Connecticut, New York, Delaware, DC, and Vermont.

Does Medicare have a resource limit?

The income requirements for each program are generally consistent across the country. However, some states have higher income limits, and some states do not have resource limits.

Is Medicare Part A an Advantage Plan?

This means that someone with the alternative to original Medicare, which is an Advantage plan, is not eligible.

What is this program?

The Specified Low-Income Medicare Beneficiary (SLMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums.

Who is eligible for this program?

In order to qualify for SLMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page:

Didn't find what you were looking for?

Take our Benefit Finder questionnaire to view a list of benefits you may be eligible to receive.

How much does Medicare Part B cost?

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

What is Medicare and Medicaid?

Differentiating Medicare and Medicaid. Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program ...

What is the CMS?

The Centers for Medicare and Medicaid Services, abbreviated as CMS, oversees both the Medicare and Medicaid programs. For the Medicaid program, CMS works with state agencies to administer the program in each state, and for the Medicare program, the Social Security Administration (SSA) is the agency through which persons apply.

What is dual eligible?

Definition: Dual Eligible. To be considered dually eligible, persons must be enrolled in Medicare Part A, which is hospital insurance, and / or Medicare Part B, which is medical insurance. As an alternative to Original Medicare (Part A and Part B), persons may opt for Medicare Part C, which is also known as Medicare Advantage.

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

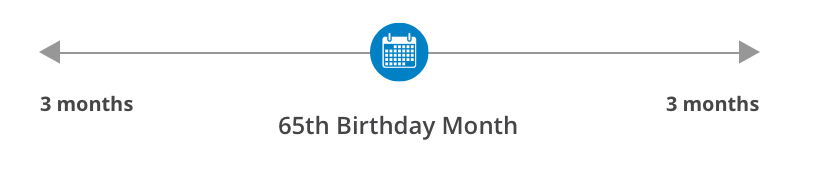

How old do you have to be to apply for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old.

What are home modifications?

Home Modifications (widening of doorways, installation of ramps, addition of pedestal sinks to allow wheelchair access, etc.)

How much is Medicare Part B premium for 2021?

For 2021, the lowest premium amount is $148.50 per month . However, an SLMB program will cover these expenses and lower your overall healthcare costs. If you or a loved one qualifies for an SLMB program, ...

What is SLMB in Medicare?

A Specified Low-Income Medicare Beneficiary (SLMB) program is a state-sponsored program that provides financial assistance in paying for Medicare Part B premiums. To qualify, you or your spouse must have limited income and resources.

What is the eligibility for SLMB?

SLMB eligibility. To be eligible for a SLMB program, you must also be eligible for Medicare Part A and meet certain income or resource requirements to qualify. To be eligible for Medicare Part A, you must be 65 years or older or have a qualifying disability, end stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS).

What documents are needed to get Medicaid?

These typically include your Medicare card, Social Security card, birth certificate or other proof of citizenship, proof of address, proof of income, and a bank statement that outlines your assets .

What is the eligibility for a spouse's health insurance?

To qualify, you or your spouse must have limited income and resources. This program can help make healthcare more affordable if you have difficulty paying your medical bills.

Which states have higher income limits?

Income limits are slightly higher in Alaska and Hawaii. You should contact your state’s Medicaid office to find out the current limits if you live in these states.

Can I apply for SLMB?

If you need assistance or think you might qualify for an SLMB plan, you should apply for the program. Some states have flexibility in their income qualifications (especially in Alaska and Hawaii) and income limits can change every year.