What is the best supplement insurance for Medicare?

Mar 24, 2022 · Medicare Supplement Insurance, also known as Medigap insurance, was created to fill in the “gaps” in costs left behind by Medicare Part A and Part B. Medicare Part A and Part B sometimes require you to pay deductibles, copays, and coinsurances. A Medicare Supplement policy can help you cover these costs.

What are the top 5 Medicare supplement plans?

Jan 31, 2022 · The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly. Best For Special Needs: Cigna Cigna

How much does a Medicare supplemental insurance plan cost?

A Medicare Supplement insurance plan is healthcare insurance you can buy that may help pay for costs that Original Medicare doesn’t pay. Let’s explore how these plans work, what they cover and more. How does Medicare Supplement insurance work? Medicare Supplement insurance plans, also known as Medigap, help supplement Original Medicare.

What does supplemental health insurance usually cover?

Medicare supplement insurance is a type of insurance that is designed to cover the expenses that are not covered by Medicare. It is also referred to as Medigap. Many people who have Medicare are surprised to find out that Part B will only cover about 80 …

What is the purpose of Medicare supplemental insurance?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What is the cost of supplemental insurance for Medicare?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization. Several factors impact Medigap costs, including your age and where you live.

What is the difference between Medicare and Medicare supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is Medicare supplemental insurance based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

Is Medigap and supplemental insurance the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What does Medicare Part B cover?

Both plans also cover Medicare Part B coinsurances and copays, the first three pints of blood, Part A hospice care coinsurances or copays, skilled nursing facility care coinsurances, and the Part A deductible, but not at 100% like other plans. Plan K covers these benefits at 50% and Plan L covers them at 75%.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

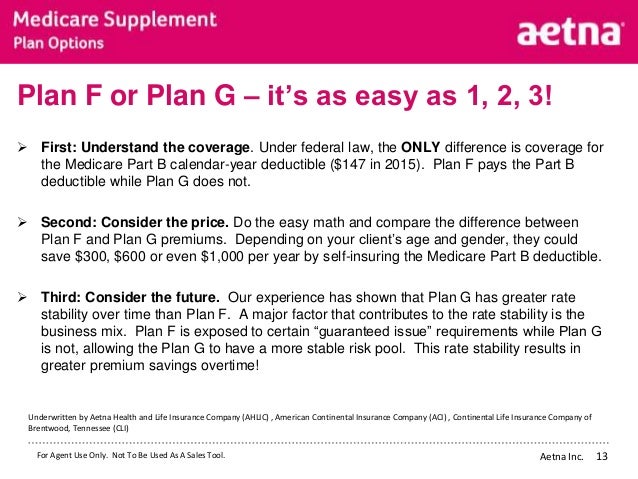

What is Plan F?

Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you travel outside of the country.

How does Medicare Supplement insurance work?

Medicare Supplement insurance plans, also known as Medigap, help supplement Original Medicare. They may help pay some of the healthcare costs that Original Medicare does pay like copayments, coinsurance and deductibles.

What do Medicare Supplement insurance plans cover? 1

All Medicare Supplement insurance plans offer the same basic benefits but some offer additional benefits. A list of basic benefits includes:

Important things to know about Medicare Supplement insurance plans 2

Medicare Supplement insurance plans are not the same as Medicare Advantage plans.

How to pick the best Medicare Supplement insurance plan for you

Everyone has unique healthcare needs. If you’re thinking about adding extra insurance to Original Medicare, check out how to pick the best Medicare Supplement insurance plan for you.

How can we help?

Licensed Humana sales agents are available Monday - Friday, 8 a.m. to 8 p.m., local time.

What is Medicare Supplement Insurance?

Medicare supplement insurance is a type of insurance that is designed to cover the expenses that are not covered by Medicare. It is also referred to as Medigap. Many people who have Medicare are surprised to find out that Part B will only cover about 80 percent of their medical expenses. If you are living on a tight budget, ...

How many people does Medigap cover?

You will have a premium that you will have to pay each month. You will have to buy from a company in your state. A Medigap plan will only cover one person.

How does Medigap work?

How a Medigap Plan Works. Your doctor will send you a bill for the services that have been provided. Medicare will pay their portion. Medigap will pay the remaining balance. The Benefits of Using a Medicare Supplement Plan. You are free to choose your own hospitals and doctors.

Do I need a referral to see a specialist?

You won’t have to get a referral to see a specialist. Your out-of-pocket expenses will be more predictable. You will be able to use it anywhere in the United States. You won’t have to worry about getting your coverage dropped if you develop a health condition.

Does Medigap cover long term care?

Medigap will cover your hospital expenses, doctor’s bills and medications. However, there are some things that will not be covered. This includes long-term care, such as assisted living, nursing home and home care. Vision care, dental care and hearing aids also aren’t covered. The Cost of Medicare Supplemental Insurance.

Is hearing aid covered by Medicare?

Vision care, dental care and hearing aids also aren’t covered. The Cost of Medicare Supplemental Insurance. Because you get Medicare supplemental insurance through a private company, the cost of it can vary. You may have to shop around to find a premium that fits your budget.

Can I change my health insurance plan?

You can make a change to your plan any time. However, it is a good idea for you to wait until the enrollment period. You will have to answer any questions about your health if you attempt to change the plan outside of the enrollment period. The company can choose to accept or decline you.

How to collect Medicare Supplement Insurance?

The easiest way to collect Medicare Supplement Insurance plan costs is to contact a licensed insurance agent who can gather up price quotes for multiple carriers selling Medigap plans in your location . You can also compare plans for free online.

What happens if you apply for Medicare Supplement?

If you apply for a Medicare Supplement Insurance plan during your Medigap Open Enrollment Period, you will have guaranteed issue rights. That means an insurance company is not allowed to use medical underwriting to charge you a higher rate for your coverage.

Does Medicare Supplement Insurance offer discounts?

It’s not uncommon for insurance companies to offer discounts on Medicare Supplement Insurance plans. Discounts are often available for non-smokers, married couples and other criteria. Be sure to ask your insurance agent or insurance carrier about any potential discounts that may be available.

Is it uncommon for a product to cost more in a large city than it does in a more rural

The cost of living can be significantly different in one market compared to another. It’s not uncommon for a product to cost more in a large city than it does in a more rural setting, and the same can be said for Medicare Supplement Insurance plans.

What is senior supplement?

Senior Supplements. Supplemental health insurance for seniors, which is sold by private health insurance companies, is an addition to existing healthcare coverage that’s designed specifically to meet seniors’ needs.

Does Medicare Supplement cover dental?

Like Medicare’s “parts,” each plan offers different benefits and has a different premium amount. These plans cover healthcare expenses that Medicare doesn ’t pay for such as coinsurance and deductibles. But, Medigap plans do not cover dental, vision, or any other supplemental health insurance benefits.