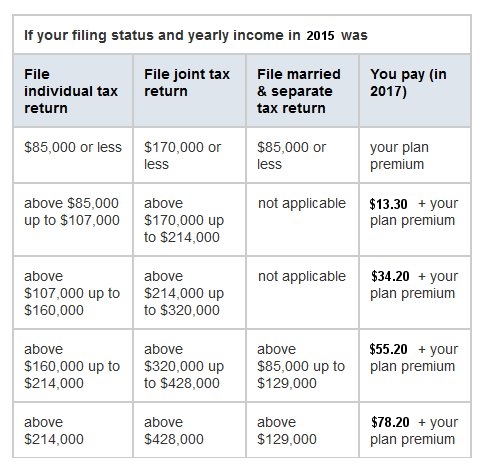

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

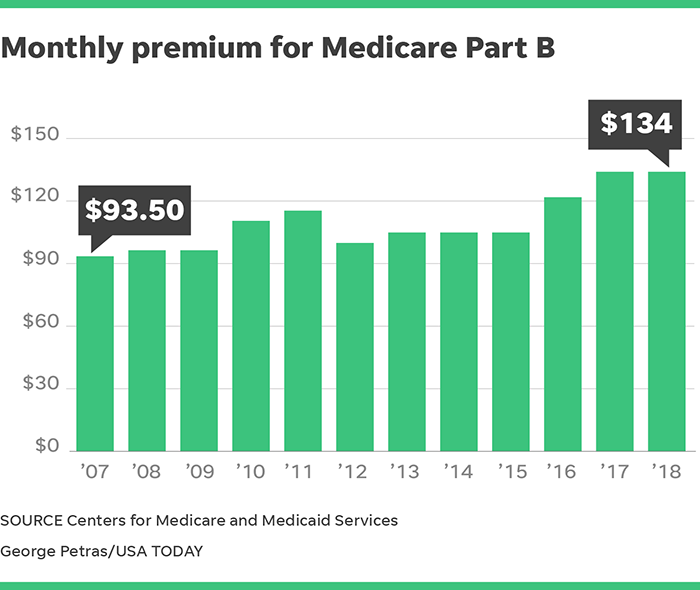

How much is Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

How to get help paying Medicare premium?

getting help paying for your Medicare premiums. TTY users can call 1-877-486-2048. • Call your State Medical Assistance (Medicaid) office. To get Medicare.gov/talk-to-someone, select your state, then select “Other insurance programs,” or call 1-800-MEDICARE. You have the right to get Medicare information in an accessible

What were Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What is the cost of Medicare Part B for 2019?

$135.50The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the cost of Medicare Part D for 2018?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred.

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.

What was the cost of Medicare Part B in 2015?

$104.90 per monthHow much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums.

How much do Medicare premiums increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

How much is Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How much will Medicare B go up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

Is there a penalty for late enrollment in Medicare Part A?

Note that beneficiaries who delay enrollment in Medicare Part A after they first become eligible may be subject to a late-enrollment penalty in the form of a higher premium. Medicare Part B has an annual deductible ($166 in 2016).

What is the Medicare premium for 2016?

The standard 2016 Medicare Part B premium will remain at $104.90 per month , the same rate as in 2015. Higher Part B premium rates for people with higher incomes will also remain at 2015 levels.

When did Medicare Part B and A changes take effect?

The Medicare administration has announced Medicare Part A and Part B rates for 2016, with changes taking effect Jan. 1, 2016.

What is Medicare Supplement Plan F?

An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out of pocket. Excess charges are the difference between what Medicare pays and what your medical provider charges—and they can add up fast without the protection Plan F provides! To learn more about how Medicare supplement plans can save you money, request a free Medigap quote from one of our licensed Medicare supplement insurance representatives or call MedicareMall toll-free at (877) 413-1556.

How much is Medicare deductible for 2016?

For 2016, that deductible is $1,288, which is up $28 from 2015. At that point, Medicare pays all of the allowed costs of hospital care for the first 60 days of your stay. From the 61st to the 90th day of your hospital stay, Medicare still covers most of the cost, but you'll have to pay a daily coinsurance amount.

What is Medicare Part A?

In particular, Medicare Part A coverage offers help with the expensive cost of care in hospitals and other inpatient facilities.

What does the SSI cover?

It covers semi-private rooms, meals, general nursing, drugs received as part of your inpatient treatment, and other hospital services. Coverage takes effect when a doctor officially orders that you need to stay overnight for at least two nights for medically necessary care that can be given only in a hospital.

Does Medicare cover skilled nursing?

Medicare covers all costs for the first 20 days of skilled nursing care, with no deductible because the required hospital stay related to the skilled nursing facility admission involved the hospital deductible.

Does Medicare Part A have a monthly premium?

For the vast majority of participants, Medicare Part A coverage comes with no monthly premium. Instead, Part A requires you to pay deductibles and coinsurance amounts when you actually use hospital services. The latest Medicare cost figures for 2016 just came out, and as you'd expect, costs are heading up next year.

Does Medicare pay for skilled nursing after 100th day?

After the 100th day, you're responsible for all costs, and there's no provision for lifetime reserve days for skilled nursing facilities. Image based on Medicare data. Hospital and skilled nursing facility charges can be astronomical, and Medicare pays the lion's share of costs for these expenses.

What is the Medicare deductible for 2016?

The Medicare Part A deductible for all Medicare beneficiaries is $1,288. If you aren’t eligible for premium-free Part A, you may be able to buy Part A if you meet one of the following conditions:

How much is Medicare Advantage 2016?

The 2016 Medicare Advantage plan premiums range from $0 to $388.

How much is the Social Security Part B deductible for 2016?

The annual deductible for all Part B beneficiaries is $166 for 2016, an increase of $19 from the 2015 Part B annual deductible of $147. As the Social Security Administration previously announced, there will no Social Security cost of living increase for 2016.

What age do you have to be to get Medicare Part B?

You’re 65 or older, and you have (or are enrolling in) Part B and meet the citizenship and residency requirements. You’re under 65, disabled, and your premium-free Part A coverage ended because you returned to work.

How much is the 2016 Part D premium?

The 2016 Part D plan premiums range from $6 to $175. The 2016 standard Part D plan deductible is $360, however the actual plan deductible can be anywhere from $0 to $360 . *If you pay a late-enrollment Penalty, this amount is higher.

Who will enroll in Medicare Part B in 2016?

those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and. beneficiaries who pay an additional income-related premium. These groups account for about 30 percent of the 52 million Americans expected to be enrolled in Medicare Part B in 2016.

Can I get Medicare Part D?

Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage (MAPD).

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.