What is the cost of Medicare Part B in 2019?

Part B premiums. The standard Part B premium amount in 2019 is $135.50. Most people will pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How does my Magi affect my Medicare Part B premiums?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is a Medicare Part B premium?

Part B premiums. Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the standard Medicare Part B premium amount for 2020?

The standard Part B premium amount in 2020 is $144.60. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the Magi for Medicare for 2019?

The base Medicare premium for 2019 is $135.50 per month. Surcharges are imposed on beneficiaries with higher income: single taxpayers with modified adjusted gross income (MAGI) in excess of $85,000 and married couples with MAGI greater than $170,000.

What are the magi limits for Medicare premiums?

Monthly Medicare Premiums for 2022Modified Adjusted Gross Income (MAGI)Part B monthly premium amountIndividuals with a MAGI above $170,000 and less than $500,000 Married couples with a MAGI above $340,000 and less than $750,000Standard premium + $374.205 more rows

What is the Medicare Part B Irmaa for 2019?

2019 Medicare Part B premium The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium. This higher Part B premium is called the Income-Related Monthly Adjusted Amount (IRMAA).

Are Medicare premiums based on AGI or magi?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How is Medicare Part B Magi calculated?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

How do I calculate Magi?

To calculate your MAGI:Add up your gross income from all sources.Check the list of “adjustments” to your gross income and subtract those for which you qualify from your gross income. ... The resulting number is your AGI.More items...

How do you calculate modified adjusted gross income for Irmaa?

That means your 2021 premiums and IRMAA determinations are calculated based on MAGI from your 2019 federal tax return. MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

Is Irmaa based on AGI or taxable income?

The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it.

What is difference between AGI and Magi?

According to the IRS, your MAGI is your AGI with the addition of the appropriate deductions, potentially including: Student loan interest. One-half of self-employment tax. Qualified tuition expenses.

Is Social Security income included in MAGI for Medicare?

Social Security income includes retirement, survivor benefits, and disability payments. For the most part, only taxable sources of income count in determining household MAGI-based income. However, all Social Security income of tax filers is counted, regardless of whether it is taxable or not.

Are Medicare Part B premiums recalculated each year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How much is Medicare Part B?

I won't keep you in suspense. The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium.

Is Medicare Part B rising?

The Centers for Medicare and Medicaid Services just announced the 2019 Medicare Part B premiums. You might not be surprised to learn that premiums are rising, but you might be pleasantly surprised to learn that they aren't rising by very much.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

How much is Medicare Part B 2019?

I won't keep you in suspense. The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium. In addition, the annual Medicare Part B deductible will increase, but by just $2, to $185.

What is Medicare Part B?

Medicare Part B is the medical insurance component of the Medicare program. It pays for costs like doctor's office visits, medical equipment, and outpatient procedures.

How much is the cost of living adjustment for 2019?

Since many beneficiaries were already paying lower-than-standard premiums because of this rule, the 2.8% cost-of-living adjustment that kicks in for 2019 won't be enough to cover the increase to $135.50 per month. So, beneficiaries whom this applies to will pay a lower premium than $135.50.

Is Medicare Part B rising?

The Centers for Medicare and Medicaid Services just announced the 2019 Medicare Part B premiums. You might not be surprised to learn that premiums are rising, but you might be pleasantly surprised to learn that they aren't rising by very much.

Is Medicare Part A premium free?

Meanwhile, Medicare Part A, which mainly covers hospital stays, remains premium-free for most American seniors, although the Part A deductible is rising from $1,340 in 2018 to $1,364 in 2019.

Do Medicare beneficiaries pay less than the premium?

Some beneficiaries will pay less than the standard premium. In contrast to the high-earner discussion, some Medicare beneficiaries will actually pay less than the standard monthly premium.

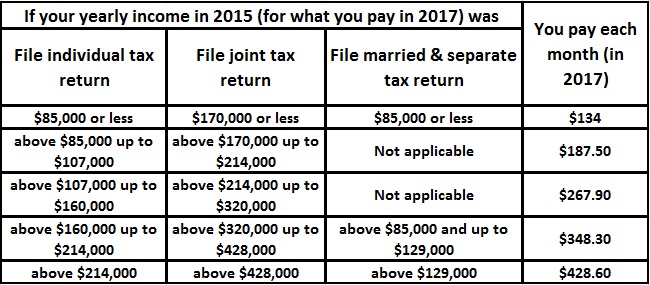

Does Medicare use adjusted gross income?

To be clear, Medicare uses your modified adjusted gross income ( MAGI) from your tax return from two years ago to determine your premiums. In other words, for 2019, they'll consider your MAGI from 2017. With that in mind, here's the high-earner premium table for 2019 by tax filing status and MAGI: Individual Tax Filers. Joint Return Filers.

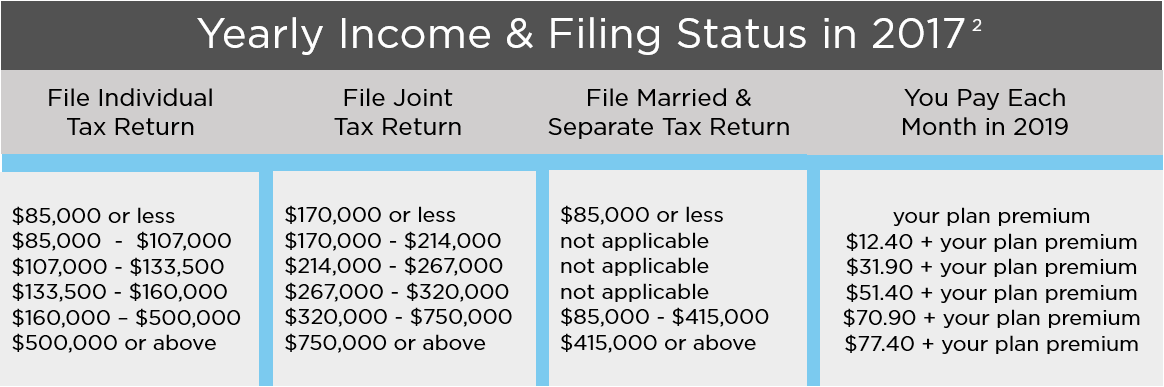

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

What is the MAGI for health insurance?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest.

Does MAGI include SSI?

For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn’t include Supplemental Security Income (SSI). MAGI does not appear as a line on your tax return.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How Does Medicare Part B Work?

Before getting into the weeds of Medicare Part B premiums, let’s do a quick review of Medicare Part B and its role in federal retirement health insurance.

Medicare Part B Premiums

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How to Apply for Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

The Bottom Line

Once you turn 65, the government agrees to cover the majority of your health insurance costs. But Medicare is not free. The Medicare Part B premium alone—irrespective of other Medicare out-of-pocket costs—is an important line-item expense you will want to plan for in retirement.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

What is the income used to determine IRMAA?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA. As if it’s not complicated enough for not moving the needle much, ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.