2016 Medicare Premiums and Deductibles (article)

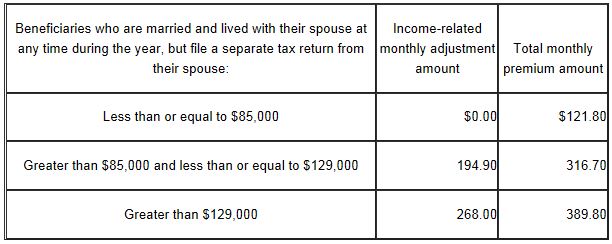

| Beneficiaries who are married and lived ... | Income-related monthly adjustment amount | Total monthly premium amount |

| ≤ $85,000 | $0.00 | $121.80 |

| > $85,000 and ≤ $129,000 | 194.90 | 316.70 |

| > $129,000 | 268.00 | 389.80 |

How much does Medicare Part a cost in 2016?

4 rows · Nov 10, 2015 · The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will ...

Will Medicare premiums and deductibles increase in 2016?

Aug 25, 2016 · Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What is the Medicare Part B Part B deductible for 2016?

4 rows · Part A deductibles in 2016 will be $1,288 for first 60 days of inpatient care; an additional ...

How much will Medicare premium mitigation Save you in 2016?

Nov 19, 2015 · In 2016, the standard Part B premium amount will be $121.80 (or higher depending on your income). Most people who get Social Security benefits will continue to pay a Part B premium of $104.90 each month. You'll pay a different premium amount in 2016 if: You enroll in Part B for the first time in 2016. You don't get Social Security benefits.

What was the cost of Medicare in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What is the annual medical deductible for Medicare?

You pay: $1,556 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $389 coinsurance per day of each benefit period.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the annual deductible for Medicare Part B for 2018?

$183 for 2018The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

What is the annual deductible for Medicare Part B?

$233Alongside the premium, Medicare Part B includes an annual deductible and 20% coinsurance for which you are responsible to pay out-of-pocket. In 2022, the Medicare Part B deductible is $233. Once you meet the annual deductible, Medicare will cover 80% of your Medicare Part B expenses.Feb 14, 2022

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What was the Medicare deductible in 2017?

$183 inCMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.Nov 10, 2016

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.

What changes to Medicare benefits were made in 2017?

Premiums are on the rise The maximum cost for coverage is set to rise to $413 in 2017, up slightly from $411 in 2016. Premiums for Part B coverage, which covers the costs of services and supplies needed to diagnose and treat diseases, are also set to move higher in 2017.Dec 12, 2016

What is the 2019 Medicare Part B deductible?

Medicare Part B Premiums/Deductibles The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.Oct 12, 2018

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the Medicare Part B deductible for 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.Nov 8, 2019

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

Is there a penalty for late enrollment in Medicare Part A?

Note that beneficiaries who delay enrollment in Medicare Part A after they first become eligible may be subject to a late-enrollment penalty in the form of a higher premium. Medicare Part B has an annual deductible ($166 in 2016).

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Will Social Security increase in 2016?

As the Social Security Administration previously announced, there will be no Social Security cost of living increase for 2016. As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

How much more Medicare Advantage premiums were there in 2016?

There are 6 percent more $0 Medicare Advantage premiums in 2016, after the number of $0 Medicare Advantage premiums dropped 19 percent from 2014 to 2015. However, average Medicare Advantage premiums in 2016 are up 4 percent from 2015.

When does Medicare change plans?

Every year between October 15 and December 7, Medicare beneficiaries can change their Medicare health plans and prescription drug coverage to better align with their personal needs. Since plans may change their costs and coverage every year, the least expensive plan options for Medicare beneficiaries may also change from year to year.

Is Alaska included in Medicare Advantage?

Premiums and deductibles for Medicare health and drug plans were obtained from the 2016 MA and PDP landscape source files available at cms.gov on September 21, 2015. Alaska was not included in the Medicare Advantage data.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.