Best for size of network: UnitedHealthcare Medicare Advantage. Best for extra perks: Aetna Medicare Advantage. Best for member satisfaction: Kaiser Permanente Medicare Advantage.

Full Answer

What is the best Medicare Advantage plan for me?

Humana is one of the top Medicare Advantage plan companies for all states (except Alaska, Connecticut, Rhode Island, and Wyoming). Aetna is one of the top Medicare Advantage plan companies for all states (except Alaska, Hawaii, Minnesota, Montana, Vermont) and Washington, DC.

Which state has the best Medicare Part D drug plan?

1 California 2 Florida. CarePlus Health Plans, Inc. HealthSun Health Plans, Inc. Optimum HealthCare, Inc. 3 New York. U.S. News analyzed insurance companies’ Medicare Part D Prescription Drug plan offerings in each state based on their 2021 CMS star rating.

What are the different ways to get Medicare?

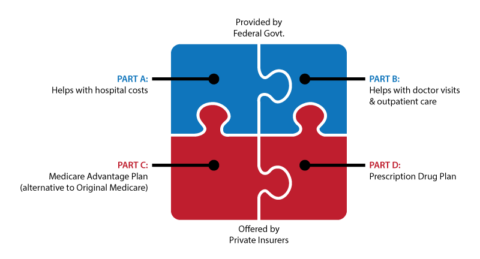

There are 4 main ways - Original Medicare, Original Medicare + Prescription Drugs, Original Medicare + Medicare Supplement Insurance (Medigap), or Medicare Advantage. Medicare Part A is essentially hospital insurance.

When is the best time to Change my Medicare plan?

The annual open enrollment period — from October 15 to December 7 — is the one time that most people can make changes to their Medicare coverage. But you don’t need to wait for October to roll around before you start investigating plan options. "Get started early,” says Murdoch. “It's always better to have enough time to do the research you need."

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

Which Medicare supplement plan has the highest level of coverage?

Medicare Supplement Plan F: The Premium-Only Plan Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Which health insurance is best for Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingBlue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.8Aetna3.53.61 more row•Jun 8, 2022

Which Medicare plan is best for low income seniors?

The Best Medicare Supplement Plans for Low-Income SeniorsCigna Medicare Supplement Insurance Plans : Best Overall Plans.Aetna Medicare Supplement Plans : Widest Range of Coverage.Mutual of Omaha Medigap Plans : Best Customer Service.State Farm Medicare Supplement Insurance : Best Bundled Discounts.More items...•

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Are there disadvantages to a Medicare Advantage plan?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

Which is the cheapest health insurance for senior citizens?

Read on to learn more about the best insurance policies for senior citizens with the lowest premiums.Star Health Red Carpet: ... National Insurance Varistha Mediclaim: ... Oriental Insurance HOPE: ... Bajaj Allianz Silver Health: ... New India Assurance Health Insurance:

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

Who qualifies for free Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the most comprehensive Medicare Supplement?

About 57% of all people with a Medicare Supplement Insurance plan have Plan F, which is the most comprehensive plan available. It covers 100% of all nine of the basic benefits Medigap plans offer (excluding for foreign travel emergency coverage, which it covers at 80%, like other Medigap plans). The monthly premium for Plan F will likely be the most expensive, but if all-inclusive coverage is what you’re after, this plan may be for you.

Is Medigap available in every state?

As previously mentioned, not every Medigap plan is available in every state. Needless to say, the best plan for you will be one that is offered in the area in which you live. Our licensed agents can help you determine which plans are available in your state.

Is Medicare Supplement Insurance standardized?

While Original Medicare costs are standardized by the government, Medicare Supplement Insurance is sold by private insurance companies and the cost of plans is dictated by the market. When deciding which plan may be best for you, shop around for different quotes to see which option might be the best fit for your budget.

g2017 Medigap Policies

Most states offer up to 10 standardized Medigap plan types to choose from, labeled A, B, C, D, F, G, K, L, M and N. Every insurance company that sells Medigap policies must offer Medigap Plan A and either Plan C or Plan F.

When to Buy Medigap

The best time to buy a Medigap policy is during your six-month Medigap open enrollment period. During this period, you can buy a Medigap policy regardless of your health status. Your open enrollment period automatically starts the day you are both 65 years or older and enrolled in Medicare Part B.

What is the best health insurance for retirees?

Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.

What is the Medicare program for retirees?

Your Medicare Coverage. Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan: