What is the maximum premium for Medicare Part B?

Nov 24, 2021 · The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits.

How much are Medicare Part B premiums?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What determines your Medicare Part B premium?

Nov 06, 2020 · The standard monthly premium for Medicare Part B enrollees will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020. Recent legislation signed by President Trump significantly dampens the 2021 Medicare Part B premium increase that would have occurred given the estimated growth in Medicare spending next year.

Who pays for Medicare Part B premiums?

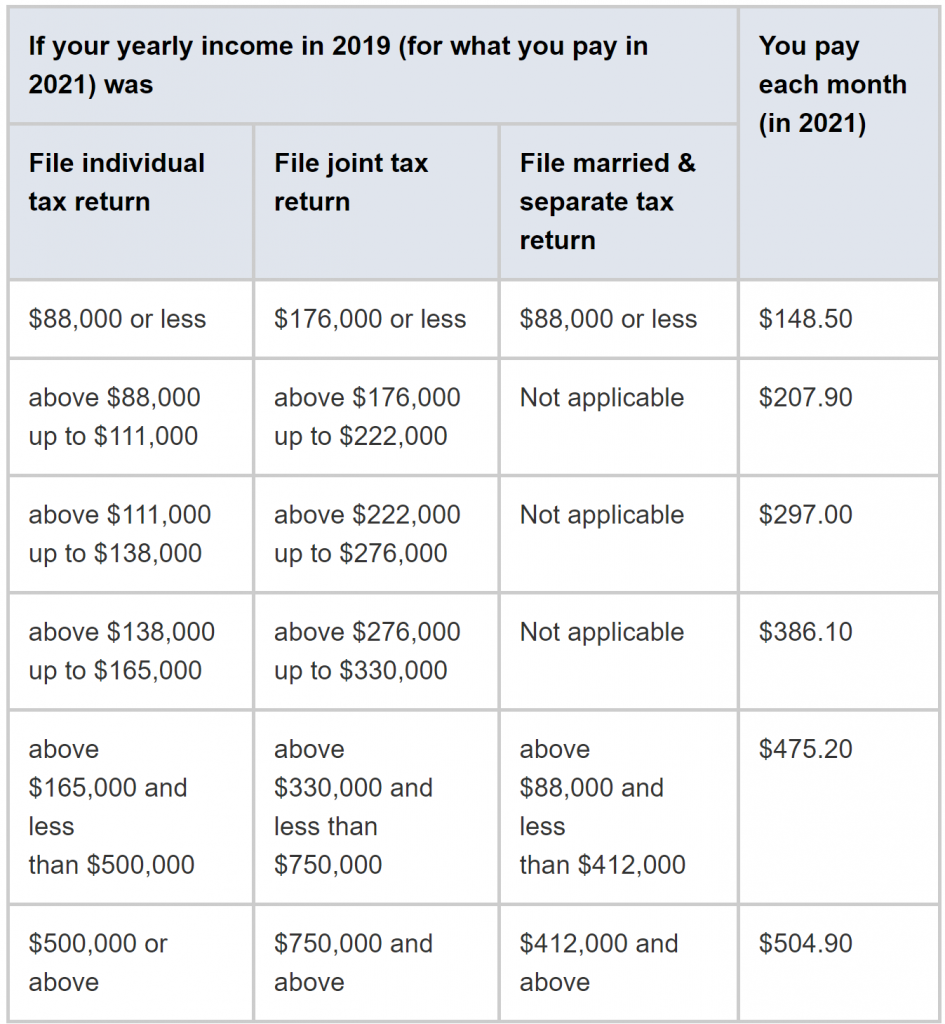

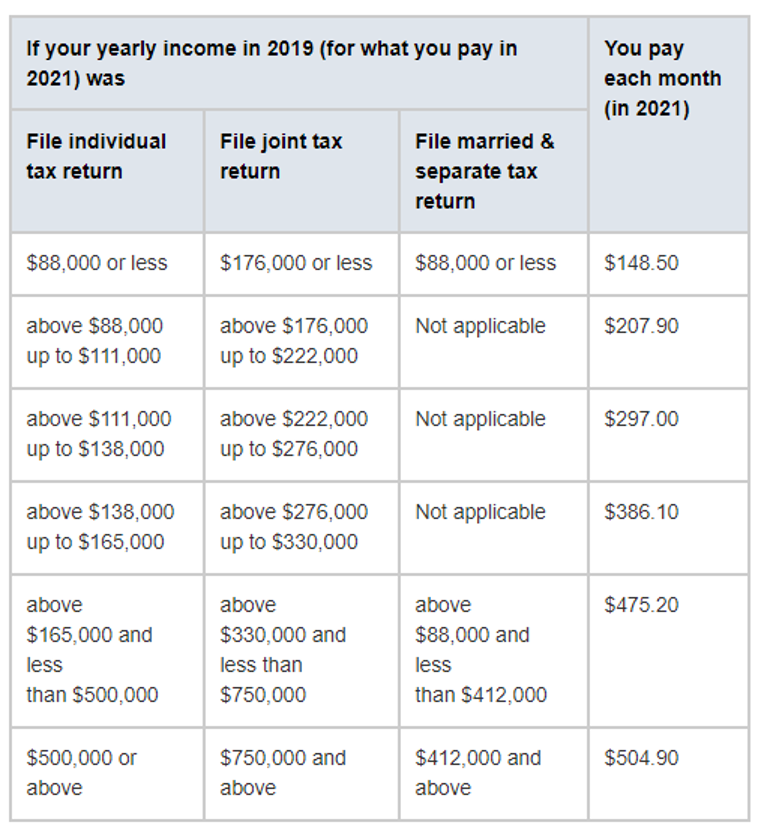

The Part B premium for 2021 is around $148.50. However, it can increase with your income. If your reported income is in a different bracket, you might have to pay more. The following are the Medicare Part B premium for 2021 for different income limits: If your income is $88,000 or less, you will have to pay the standard amount of $148.50.

What is the 2021 Part B monthly premium?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020.Nov 6, 2020

What was the monthly cost of Medicare in 2021?

$148.50In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020.Dec 16, 2020

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How much will the premium be for Medicare Part B in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Will Medicare Part B premium go up in 2022?

California Health Advocates > Prescription Drugs - Blog > Why Did Medicare's Part B Premium Rise 14.5% in 2022? If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022.Jan 26, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

How can I reduce my Medicare Part B premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

How often are Medicare Part B premiums adjusted?

If you buy only Part B, you'll get a "Medicare Premium Bill" (Form CMS-500) every 3 months. If you buy Part A or if you owe Part D IRMAA, you'll get a “Medicare Premium Bill” every month.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much does Medicare pay for inpatient care in 2021?

About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,484 in 2021, an increase of $76 from $1,408 in 2020.

How much is Medicare Part B deductible in 2021?

CMS also announced that the annual deductible for Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from $198 in 2020.

How much has Medicare Advantage decreased?

A 34 percent decrease in average monthly premiums for Medicare Advantage plans since 2017. This is the lowest average monthly premium since 2007. Beneficiaries in some states, including Alabama, Nevada, Michigan, and Kentucky, will see decreases of over 50 percent in average Medicare Advantage premiums. More than 4,800 Medicare Advantage plans are ...

When will Medicare Part D end?

During the ongoing Medicare Open Enrollment – which began on October 15, 2020 and ends December 7, 2020, more than 60 million Medicare beneficiaries can compare coverage options like ...

When will Medicare open enrollment start in 2021?

This news comes as Medicare Open Enrollment started on October 15, 2020 running through December 7, 2020, and follows the announcement that Medicare Advantage (or private Medicare health plans) and Part D prescription drug plan premiums are at historic lows, with hundreds of Medicare Advantage and Part D plans now offering $35 monthly co-pays for insulin starting in January 2021.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Can Medicare plan costs change year to year?

Medicare health and drug plan costs and covered benefits can change from year-to-year. CMS urges Medicare beneficiaries to review their coverage choices and decide on the options that best meet their health needs. Over the past three years, CMS has made it easier for seniors to compare and enroll in Medicare coverage.

Medicare Part B Deductible

For 2021, your part B deductible will be around $203. Your deductible will count towards the following cost:

Coverage of Medicare Part B Premium 2021

Part B of your Medicare covers preventive services and medically necessary services. These are services that can prevent your illness and the devices that will diagnose the disease. Part B holistically covers the following services:

Reimbursement of Medicare Part B Premium 2021

If you’re retired or are a state beneficiary, you can even get Medicare part B coverage reimbursement. Anyone who has a part B premium health plan can apply for a reimbursement program. If you have a sick leave balance, you are also eligible for Medicare Part B premium reimbursement.

Final Comments!

Among several Medicare parts, Part B of Medicare is the most important because it covers essential services. For the same reason, the premium for Medicare part B is also the highest. Nevertheless, do you want to save yourself from trouble and avoid procrastinating matters to the end? New Medicare is your go-to solution.

Medicare Part B Premiums For 2021

CMS, the Centers for Medicare & Medicaid Services, has just announced the Medicare Part B Premiums for 2021.

Medicare Costs For 2021

For 2021 the Medicare Part A premium for most people will be $0. If you have to buy part A then the premium will be up to $471 per month, compared to $458 in 2020.

How much is Medicare Part B?

Medicare Part B premiums increased from $134 in 2018 to $135.50 in 2019 for most beneficiaries. That led many people to expect a modest increase from 2019 to 2021. However, 2021 Medicare Part B premiums are expected to take a much bigger jump to $144.30 for most people. While this is expected to be the standard premium amount, premiums are based on income levels.

How much will Medicare premiums be in 2021?

The federal government looks at the modified adjusted gross income when determining premiums. Individuals who make $85,000-$107,000 are expected to pay $202.00 a month in 2021. The same is true for married couples who make $170,000-$214,000. In 2019, individuals and couples who met these income thresholds only paid $189.60 a month.

Will Medicare Part B increase in 2021?

That means they have not been adjusted for inflation, so more people are reaching the thresholds and paying surcharges. That means you are more likely to end up paying more for your Medicare Part B premium in 2021.

How Does Medicare Part B Work?

Before getting into the weeds of Medicare Part B premiums, let’s do a quick review of Medicare Part B and its role in federal retirement health insurance.

Medicare Part B Premiums

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How to Apply for Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

The Bottom Line

Once you turn 65, the government agrees to cover the majority of your health insurance costs. But Medicare is not free. The Medicare Part B premium alone—irrespective of other Medicare out-of-pocket costs—is an important line-item expense you will want to plan for in retirement.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

What are the factors that affect the cost of a Medigap plan?

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates. Medigap premiums can increase over time due to inflation and other factors, so you can typically expect Medigap plan premiums to be higher in 2022 than they will be in 2021.

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

How much is the 2021 deductible?

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible. The Part A deductible amount may increase each year, and it will likely be higher in 2022.

Is Medigap 2021 higher than 2021?

This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above. Some 2021 Medigap plan premiums may also be higher. Each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Changing Rates

The prices on Medicare plans will change all the time. What you pay one year will likely be less than what you pay next year. Medicare gets to decide what the prices will be, and only Medicare will sell these plans. The prices tend to increase, though, and you will want to track those rates before you sign up for one of these plans.

Other Part B Costs

The monthly premium is your biggest expense for Part B, but it is not the only cost. Right now, there is an annual deductible you need to pay for Part B services. This costs $198 a year. The cost could change for this deductible for 2020, and we expect it to go up by just a few dollars. That has been the trend for rates the last few years.

How to Get Part B

Are you interested in signing up for Part B? It’s available to most seniors at age 65. Those who have end-stage renal disease won’t qualify for Medigap plans to cover some Part B costs, but they can still qualify for Medicare parts A and B. You can typically get Part A and Part B at the same time.