What are the best Medicare supplement plans for individuals under 65?

Medicare Advantage plan options for people under 65 with a disability. A Special Needs Plan is a type of Medicare Advantage plan (Medicare Part C) that is designed for the specific needs of someone with a specific disability or medical condition.

When can someone under 65 get Medicare benefits?

Pursuant to a grant from the U.S. Department of Health and Human Services, Administration for Community Living, the Center for Medicare Advocacy is undertaking an innovative, model project to assist State Health Insurance Assistance Programs (SHIPs) and Senior Medicare Patrol Programs (SMPs) to reach and serve Medicare Beneficiaries under 65 years old. While people …

Is it hard to find an affordable Medigap plan under 65?

· Federal law doesn’t require insurance companies to sell Medicare Supplement Insurance for disabled people under age 65, but some state laws do. If you’re enrolled in Medicare under 65 due to a disability and/or end-stage renal disease (or ESRD), your eligibility for Medicare Supplement Insurance will depend on the state you live in. The following states require that …

What is the best Medicare Advantage plan for You?

· Around 15% of all Medicare enrollees are under the age of 65 and have qualified for Medicare because of a disability. If you’re under 65 and are eligible for Original Medicare (Part A and Part B), then you are most likely also eligible to enroll in a Medicare Advantage (Part C) plan, which covers everything Original Medicare covers and can also cover additional things …

Medicare Eligibility Before Age 65

If you’re under 65 years old, you might be eligible for Medicare: 1. If you receive disability benefits from Social Security or certain disability...

How to Apply For Medicare Part A and Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If you’ve been receiving disability benefits from Social Security or the Railroad Reti...

Medicare Eligibility For Medicare Advantage (Part C) Before 65

After you’re enrolled in Original Medicare, you may choose to remain with Original Medicare (Medicare Part A and Part B) or consider enrollment in...

What is covered by Medicare?

Coverage includes certain hospital, nursing home, home health, physician, and community-based services. The health care services do not have to be related to the individual’s disability in order to be covered.

How long can disabled people receive Medicare?

Even after the eight-and-one-half year period of extended Medicare coverage has ended, working individuals with disabilities can continue to receive benefits as long as the individual remains medically disabled. At this point the individual – who must be under age 65 – will have to pay the premium for Part A as well as the premium for Part B. The amount of the Part A premium will depend on the number of quarters of work in which the individual or his spouse have paid into Social Security. Individuals whose income is low, and who have resources under $4,000 ($6,000 for a couple), can get help with payment of these premiums under a state run buy-in program for Qualified Disabled and Working Individuals.

How long can I get Medicare after a disability?

Individuals who still have the disabling impairment but have earned income that meets or exceeds the “Substantial Gainful Activity” level can continue to receive Medicare health insurance after successfully completing a trial work period. The Substantial Gainful Activity level for 2014 is $1070 a month, or $1,800 for the blind. This new period of eligibility can continue for as long as 93 months after the trial work period has ended, for a total of eight-and-one-half years including the 9 month trial work period. During this time, though SSDI cash benefits may cease, the beneficiary pays no premium for the hospital insurance portion of Medicare (Part A). Premiums are due for the supplemental medical insurance portion (Part B). If the individual’s employer has more than 100 employees, it is required to offer health insurance to individuals and spouses with disabilities, and Medicare will be the secondary payer. For smaller employers who offer health insurance to persons with disabilities, Medicare will remain the primary payer.

How long does Medicare cover disabled people?

Medicare eligibility for working people with disabilities falls into three distinct time frames. The first is the trial work period, which extends for 9 months after a disabled individual obtains a job.

What are the conditions that are at risk for being unfairly denied access to Medicare?

People with these and other long-term conditions are entitled to coverage if the care ordered by their doctors meets Medicare criteria: Alzheimer’s Disease. Mental Illness.

Why should Medicare not be denied?

Coverage should NOT be denied simply because services are “maintenance only” or because the patient has a particular illness or condition (See the Jimmo v. Sebelius Summary, below).

Can you get Medicare for mental illness?

People with Dementia, Mental Illness, and Other Long-Term and Chronic Conditions CAN Obtain Coverage. There are no illnesses or underlying conditions that disqualify people for Medicare coverage. Beneficiaries are entitled to an individualized assessment of whether they meet coverage criteria.

When do you get Medicare Part B?

If you get Medicare Part B before you turn 65, your OEP automatically begins the month you turn 65. Some states have Medigap open enrollment periods for people under 65. If that’s the case, you’ll still get a Medigap OEP when you turn 65, and you'll be able to buy any policy sold in your state. Before making a purchase, find out what rights you ...

Can you buy Medigap plans?

The availability of Medigap plans you can choose from and your qualification to buy them will vary based on a few factors, including what state you live in.

Does Delaware require Medigap coverage for disabled people?

This requirement does not include those under 65 with ESRD. **Delaware requires that insurance carriers offer at least one Medigap policy to those under 65 who have ESRD. This requirement does not include those under 65 who are disabled. Even if your state isn't listed above, you may be able to get coverage. Some insurance companies voluntarily ...

What is Medicare Advantage?

Medicare Advantage plans are sold by private insurance companies and are required by law to provide all of the same benefits as Original Medicare (Part A and Part B). On top of those basic benefits, these plans typically offer additional coverage not found in Original Medicare for things like prescription drugs and other benefits.

When do you get Medicare if you collect Social Security?

If you have collected disability benefits from Social Security or the Railroad Retirement Board for 24 months, you will become eligible for Medicare enrollment beginning with your 25th month of receiving benefits .

Can an under 65 person get Medicare?

Under a previous law, beneficiaries under 65 who qualified for Medicare because of ESRD were only allowed to enroll in a Medicare Advantage plan if it was a Special Needs Plan. But a 2020 rule change granted these beneficiaries the same freedom as other under-65 beneficiaries to enroll in any type of Medicare Advantage plan. And additional 2020 legislation promotes more use of home dialysis and other coverage improvements for those with ESRD.

How old do you have to be to get Medicare?

As you might know, the Medicare eligibility age is 65, and to be eligible you have to be an American citizen or legal permanent resident of at least five continuous years.

When do you get Medicare if you have Social Security?

If you’ve been receiving disability benefits from Social Security or the Railroad Retirement Board (RRB) for 24 months in a row, you will be automatically enrolled in Original Medicare, Part A and Part B, when you reach the 25th month.

How to enroll in Medicare Part A and Part B?

If you have end-stage renal disease (ESRD), and you would like to enroll in Medicare Part A and Part B, you will need to sign up by visiting your local Social Security Office or calling Social Security at 1-800-772-1213 (TTY users 1-800-772-1213). If you worked for a railroad, please contact the RRB to enroll by calling 1-877-772-5772 ...

Do you have to be on Medicare if you have ALS?

If you have ALS or Lou Gehrig’s disease, you’re automatically enrolled in Medicare the month you begin receiving your Social Security disability benefits.

What is ESRD in Medicare?

ESRD is permanent damage to the kidneys that requires regular dialysis or a kidney transplant. If you’re eligible for Medicare because of any of these circumstances, you may receive health insurance through Medicare Part A (hospital insurance) and Medicare Part B (medical insurance), which make up Original Medicare.

Does Medicare cover vision?

For example, Original Medicare doesn’t include prescription drug coverage or routine dental/vision care, but a Medica re Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans. Hopefully, you now have a better idea how Medicare eligibility works if you’re under 65.

How long do you have to be on Medicare if you are 65?

When you’re under 65, you become eligible for Medicare if: You’ve received Social Security Disability Insurance (SSDI) checks for at least 24 months. At the end of the 24 months, you’ll automatically enroll in Parts A and B. You have End-Stage Renal Disease (ESRD) and need dialysis or a kidney transplant. You can get benefits with no waiting period ...

What is Medicare Advantage?

Medicare Advantage Plans for Disabled Under 65. Most Social Security Disability Advantage plans combine Medicare coverage with other benefits like prescription drugs, vision, and dental coverage. Medicare Advantage can be either HMOs or PPOs. You may have to pay a monthly premium, an annual deductible, and copays or coinsurance for each healthcare ...

Can I get Medicare if I have SSDI?

Yes, you can get Medicare if you are receiving SSDI for 24 or more months or if you have ESRD or ALS.

Is Medicare available to people under 65?

Medicare is available to people under 65 who have a disability and meet other requirements. If you have a disability and you’re over age 65, you’re automatically eligible because of age.

Can I get medicaid if my child is disabled?

In the case that your child was disabled before turning 22, is unmarried, and one parent receives Social Security retirement benefits, no work history is required for SSDI. Children 19 years of age or older who don’t qualify for Medicare may qualify for Medicaid.

Can a disabled child get medicare?

Medicare for Disabled Youth. Children under the age of 20 with ESRD can qualify for Medicare if they need regular dialysis treatment and at least one of their parents is eligible for or receives Social Security retirement benefits. If your child is over the age of 20, they qualify for Medicare after receiving SSDI benefits for at least 24 months.

Do you have to have Medicare to get Part D?

If you choose Medicare, you’ll need a Part D drug plan. You’ll pay a premium, and a copay or coinsurance. Many people on Social Security Disability qualify for Extra Help with Part D costs. Eligibility for Extra Help is based on income and assets. If you’re on Medicaid, you automatically qualify for Extra Help.

What percentage of seniors get medicaid?

About 25 percent of seniors enrolled in original Medicare get Medigap insurance, according to the Kaiser Family Foundation. Others forego supplemental plans altogether, while some turn to employer-sponsored plans and Medicaid. You buy Medigap plans through private insurance companies such as these listed below.

How much is the household discount for Medicare?

Household discount of up to 12 percent if you reside with your spouse or have resided with an adult 60 or older for at least one year, and that person has Medigap/will get a Medigap plan along with yours. Ninety-eight percent of Medicare claims paid within 12 hours, according to company.

Which insurance company offers Medigap coverage?

It’s also possible to find supplemental coverage from a union or a former employer. Cigna - Cigna is a huge company that offers Medigap coverage in most states at competitive rates. Aetna - It is fairly easy to get quotes online from this big-name insurer, and you can get prescription drug plans as well.

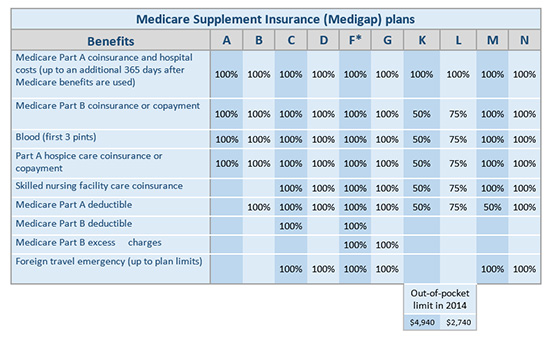

How long does Medicare cover coinsurance?

All of the Medigap insurance plans 100 percent cover Medicare Part A coinsurance and hospital costs for up to 365 days after you use Medicare benefits. They cover Medicare B copayments up to varying levels.

Is Medigap a Medicare Advantage?

Medigap plans are not Medicare Advantage plans, and they do not include dental, vision or hearing insurance nor prescription drug coverage. In 2021, there are 10 Medigap insurance plans, each designated by a letter (Wisconsin, Minnesota, and Massachusetts do things slightly differently).

Does Medigap cover dental?

The purpose of Medigap plans is to help with costs original Medicare does not cover, and each Medigap plan applies to only one person. That said, spouses may be able to get household discounts of five to 12 percent with many insurers. Medigap plans are not Medicare Advantage plans, and they do not include dental, vision or hearing insurance nor prescription drug coverage.

What to do if you don't have a Medigap plan?

On the Humana website, you key in your ZIP code and see what plans, including Medicare Advantage and prescription drug, are available in your area. If there are no Medigap plans, you see a note to call a licensed sales agent.

What is the best Medicare plan?

The best Medicare plan is one that covers all your necessary medical and financial needs. There are advantages and disadvantages to each Medicare plan option, ranging from cost-effectiveness to provider limitations, and more.

What to consider when choosing a Medicare plan?

Here are some important things to consider when choosing the best Medicare plan for you: The type of coverage you already have.

When is open enrollment for Medicare?

October 15 to December 7. This is the open enrollment period. During this time, you can enroll in, drop, or change your Medicare Part C or Part D plan.

When is the enrollment period for Medicare?

January 1 to March 31. This is the enrollment period for anyone who didn’t sign up for a Medicare plan when first eligible (although there are penalties for waiting). You can also sign up for a Medicare Advantage plan during this period.

How long after your 65th birthday can you enroll in Medicare?

To ensure that you enroll on time to avoid coverage gaps and late penalties, pay close attention to the following Medicare enrollment periods: Your 65th birthday. You can enroll in Medicare any time within the 3 months before or after your 65 th birthday. Six months following your 65th birthday.

What is Medigap insurance?

Medigap is a supplemental private insurance option that can help pay for Medicare costs , such as deductibles, copays, and coinsurance.

What is Medicare Part D?

Medicare Part D. Part D offers additional prescription drug coverage for any medications that aren’t included under original Medicare. A Medicare Advantage plan can take the place of Part D. If you don’t want Medicare Advantage, Part D is a great alternative.

When is Medicare available for older adults?

Medicare is available when a person turns 65 and in some other specific circumstances. However, older adults have different health concerns and conditions, so finding the right plan is an individual choice. A key benefit of traditional Medicare — which ...

What is Medicare Advantage?

Medicare Advantage, or Medicare Part C, is an alternative to traditional Medicare. Private companies offer an array of health plans that contract with Medicare to provide all of a person’s Part A and Part B benefits. Most Medicare Advantage plans also cover prescription drugs.

Which is more expensive, Medicare or Medigap?

Traditional Medicare with Medigap likely offers the most coverage, but it may be the most expensive. A person can consider their income and how much they are able to spend before choosing a Medicare plan. Traditional Medicare with Medigap also offers a lot of flexibility when choosing a doctor or specialist.

What are the disadvantages of Medicare Advantage?

The main disadvantage of Medicare Advantage plans is that a person’s choice of providers is more restricted than with traditional Medicare. A person must choose doctors and hospitals that are within the plan’s network. If they pick out-of-network providers, they face higher costs.

What are the advantages and disadvantages of Medicare?

The primary disadvantage associated with traditional Medicare is that it may cost more than Medicare Advantage.

How does Medigap differ from Medicare Advantage?

Medigap differs from Medicare Advantage in a key way. Medicare Advantage plans are an alternative to traditional Medicare, while Medigap is a supplement to traditional Medicare. To enroll in Medigap, a person must be enrolled in traditional Medicare.

What is Medigap insurance?

Medigap is Medicare supplemental insurance that private companies offer. It provides coverage of healthcare that traditional Medicare does not include.

What is the best health insurance for low income seniors?

Best for Low-Income Seniors : Medicaid. Get a Quote. If you are a low-income senior, the best way to get health insurance is through Medicaid, a federal insurance program. With Medicaid, you can get free or low-cost coverage. Pros. Low or $0 premiums for low-income seniors. Covers services that Medicare doesn’t.

Which is the best insurance for retirees?

Best Overall : UnitedHealthcare. Our choice for the best overall insurance provider for retirees is UnitedHealthcare because of its comprehensive coverage options that go above and beyond the limits of Medicare. With UnitedHealthcare, you can get worldwide coverage and vision, dental, and chiropractic care.

Does Cigna offer Medicare?

If you retire before you turn 65 and become eligible for Medicare, Cigna offers affordable policies through the Health Insurance Marketplace, with free virtual care and financial assistance programs available . It is the best choice for people younger than 65 because of its comprehensive coverage options for people with pre-existing conditions.

What is the best short term insurance for retirees?

The top pick for short-term insurance for retirees is the Golden Rule Insurance Company . Offering low monthly premiums, the Golden Rule Insurance Company is ideal for people who retire early and need to bridge the gap until they’re eligible for Medicare.

Is Medicare free for retirement?

However, Medicare isn’t free healthcare. In fact, a 65-year-old couple that retired in 2019 can expect to pay $285,000 in healthcare and medical expenses during their retirement. 4. A Medigap policy can help cover your health costs, such as your Medicare deductibles, coinsurance, or copayments.

Does Medicare cover prescriptions?

There may be location limitations. While Medicare is a valuable insurance option, it has limitations. It doesn’t include prescription drug coverage, medical care received outside of the United States, or dental or vision care.

How much does cancer treatment cost without insurance?

For example, the average cost per hospital stay is $11,700, while treatment for cancer can cost hundreds of thousands of dollars. 1.